MEXC Futures Trading Tutorial: A Step-by-Step Guide 2025

Written by Larry Jones

Hi, I'm Larry Jones, an Financial Management graduate from Franklin University, where I focused on Finance. With a deep passion for trading and investing, I've immersed myself in the dynamic world of financial markets. Currently, I dedicate my time to trading while also educating others about the exciting opportunities in cryptocurrencies. Through my experience and expertise, I aim to make complex financial concepts accessible to everyone. Whether you're a seasoned trader or new to the world of investing, my goal is to provide you with valuable insights and practical knowledge to help you navigate the world of cryptocurrencies with confidence.

Expert Reviewed

This article has been reviewed by crypto market experts at SCM to ensure all the content, sources, and claims adhere to the highest standards of accuracy and reliability.

Last Updated on June 24, 2025

MEXC, founded in 2018 and headquartered in Singapore, stands out as a premier cryptocurrency exchange platform.

Known for its reliability and comprehensive range of offerings, MEXC has garnered trust from over 6 million users globally.

The exchange boasts an impressive average daily trading volume surpassing $500 million, underlining its significance in the crypto trading ecosystem.

When it comes to futures trading, MEXC offers several competitive advantages.

You can enjoy low fees, trade with high leverage, and choose from various contract options.

Whether you’re a novice or an experienced trader, MEXC’s intuitive platform makes navigating the complexities of futures trading easy, ensuring a seamless trading experience.

Understanding the basics and setting up your account to start futures trading on MEXC can pave the way for potentially lucrative opportunities.

In this tutorial, you’ll learn essential steps such as transferring funds to your futures account, making your first trade, and utilizing MEXC’s robust tools to manage and optimize your trades effectively.

How to Trade Crypto Futures on MEXC: MEXC Futures Trading Strategy & Basics

Trading crypto futures on MEXC involves understanding key concepts and strategies.

Start by accessing the Futures section on the MEXC platform and transferring assets from your spot account into your futures account.

- Leverage allows you to control a more prominent position with less capital. For example, with 10x leverage, you can trade $10,000 using just $1,000 of your funds.

- Margin is the funds required to open and maintain a leveraged position. An initial margin is required to open a position, while a maintenance margin is the minimum balance to keep the position open.

- Liquidation occurs when your account balance falls below the maintenance margin. To avoid liquidation, monitor your margin level and adjust your leverage accordingly.

MEXC offers two margin modes: Cross Margin and Isolated Margin:

- In Cross Margin Mode, your entire account balance can be used to prevent liquidation. It’s helpful if you want to spread risk across multiple positions.

- In Isolated Margin Mode, only the margin assigned to that position is at risk. This is ideal if you prefer to limit your risk to individual trades.

The Index Price is based on the asset’s average price across several significant exchanges. Fair Price prevents market manipulation and limits liquidations based on this price.

Funding Rate is a periodic payment between traders to keep future prices aligned with spot prices. Favorable funding means longs pay shorts, and negative funding means shorts pay longs.

For efficient trading, use the MEXC Order Calculator. It helps estimate potential profits and losses, considering leverage and entry price factors.

Understanding these basics allows you to make informed decisions and manage risk effectively while trading on MEXC.

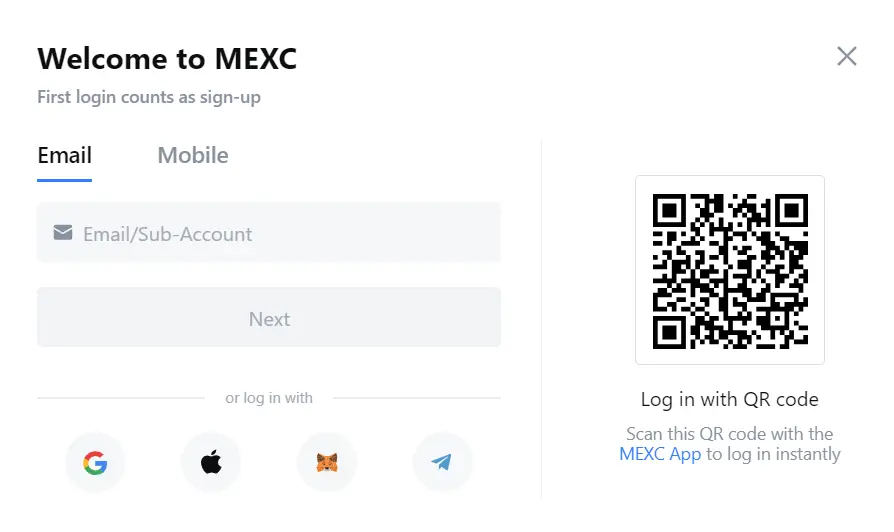

How to Create an Account on MEXC

Creating an account on MEXC is straightforward. You can choose to register via the website or the app.

- Access the MEXC Website or Download the App

- Visit the MEXC website or download the MEXC App from your app store.

- Register for a New Account

- On the website, click the Sign Up button.

- On the app, tap Sign Up.

- Fill in your email address or phone number.

- Create a strong password.

- Email/Phone Verification

- You’ll receive a verification code if you sign up with an email.

- For phone registrations, you’ll get a verification SMS.

- Enter the code to verify your account.

- Secure Your Account

- Set up Two-Factor Authentication (2FA) using Google Authenticator or SMS.

- This adds an extra layer of security to protect your assets.

- Complete KYC Verification

- Go to the Account Settings.

- Upload the necessary documents (e.g., ID card, passport) for KYC verification.

- This step is essential to unlock advanced features and withdrawal options.

Referral Program and Welcome Bonus

MEXC offers a referral program. Share your referral link with friends. You and your friends can earn a bonus when they sign up.

- Find Referral Link

- Access the Referral section in Account Settings.

- Share your unique referral link.

- Earn Bonuses

- Complete the sign-up through the referral link.

- Qualify for bonuses upon meeting certain conditions.

Creating an account on MEXC is simple. Ensure to follow security protocols to safeguard your investments. Enjoy trading with the benefits provided by the referral program.

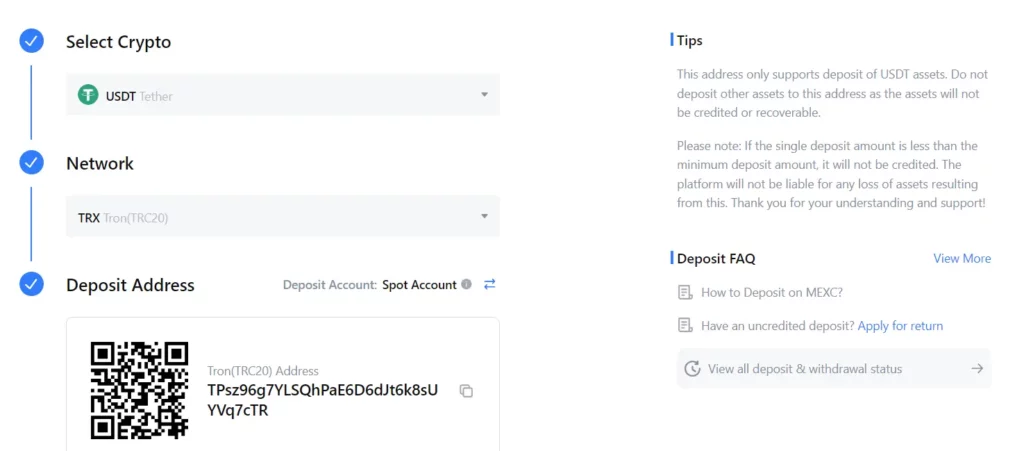

How to Deposit and Withdraw Funds on MEXC

To start trading on MEXC, you must deposit funds into your account. This process is straightforward:

- Access Your Wallet:

- Open the MEXC app and tap the Wallets icon at the bottom right corner.

- Initiate a Deposit:

- Press the Deposit button at the top left.

- Select the Token:

- Either search for the specific tokens you wish to deposit or manually select them from the list provided.

Supported Payment Methods:

- Cryptocurrencies: You can deposit and withdraw various cryptocurrencies, including USDT, BTC, ETH, etc.

- Fiat Currencies: Supported fiat options vary depending on your region and the available payment processors.

Minimum and Maximum Limits:

- Cryptocurrency Deposits: Vary depending on the token. Generally, there’s no minimum amount for deposits, but withdrawal limits may apply.

- Fiat Currencies: Limits depend on the payment method and the user’s verification status. Some methods may require a minimum deposit of around $10.

Processing Fees and Time:

- Deposits:

- Cryptocurrency: Usually free, but network fees may apply.

- Fiat: Fees depend on the payment method (e.g., bank transfer, credit card).

- Withdrawals:

- Cryptocurrency: Each token has a different fee, which you can find on the platform’s fee structure page.

- Fiat: Fees vary by payment method.

- Processing Time:

- Cryptocurrencies: Instant for deposits. Depending on network congestion, withdrawal may take a few minutes to several hours.

- Fiat: Deposits may take 1-5 business days. Withdrawal processing times depend on the payment method, ranging from 1-7 business days.

Double-check the address and details before confirming any transactions to avoid errors. This ensures that your funds will be transferred successfully.

How to Transfer Funds to the Futures Wallet

On MEXC, your funds are typically held in the main wallet by default.

This wallet is used for spot trading and storing assets. For futures trading, you need to transfer funds to the futures wallet. This ensures that your assets are correctly allocated for derivatives trading.

To start the transfer:

- Open the MEXC App: Launch the app and navigate to the [Wallets] section at the bottom right.

- Initiate the Transfer:

- Tap on the [Transfer] button.

- In the transfer screen, set the source as [Spot] and the destination as [Futures].

- Select the Currency:

- Choose the currency you want to transfer, such as USDT or BTC. Ensure the currency is supported for futures trading on MEXC.

- Set the Amount:

- Enter the amount you wish to transfer. MEXC usually specifies a minimum transfer amount; ensure your transfer meets this requirement.

- Check for maximum limits on the amount you can transfer for your security and leverage planning.

- Confirm the Transfer:

- Review your transfer details and confirm the action.

- The funds should instantly appear in your futures wallet, ready for trading.

Supported currencies typically include popular assets like USDT, BTC, ETH, and XRP. For accurate details on supported currencies and any specific transfer limits, refer to MEXC’s official resources.

Transferring funds between wallets ensures efficient trading capital management, ensuring you are set up for spot or futures trading as required.

How to Choose Between Coin-Margined and USDT-Margined Futures

Choosing between coin-margined and USDT-margined futures on MEXC depends on your trading preferences and strategies.

Coin-margined futures are settled and collateralized with cryptocurrencies like Bitcoin (BTC) or Ethereum (ETH).

This type is ideal if you prefer to hold and accumulate more cryptocurrencies. It allows you to benefit from cryptocurrency price increases when trading in a bull market.

USDT-Margined Futures are quoted and settled in Tether (USDT), a stablecoin pegged to the US Dollar.

These futures offer more excellent stability because their value is closely tied to USD. They are easier to manage and calculate potential profits, appealing to traders who want simplicity.

Advantages and Disadvantages

| Type | Advantages | Disadvantages |

|---|---|---|

| Coin-Margined | It allows holding underlying assets, is beneficial in bull markets, and has the potential for higher gains with crypto value increase. | Susceptible to crypto market volatility, requires holding crypto as collateral. |

| USDT-Margined | Stable pricing, easy profit calculation, lower volatility risk. | You might miss out on potential crypto gains without direct exposure to cryptocurrency price increases. |

Examples of Contracts

Coin-Margined Futures Contracts:

- BTC/USD

- ETH/USD

USDT-Margined Futures Contracts:

- BTC/USDT

- ETH/USDT

When deciding, consider your risk tolerance and whether you prefer holding cryptocurrencies or stable assets like USDT. This choice will influence your trading experience and potential profit opportunities.

How to Understand the Futures Trading Interface on MEXC

Navigating the futures trading interface on MEXC can initially seem complex, but understanding its components can help you trade efficiently.

Main Elements

- Chart: The chart displays the price movement of futures contracts. You can customize time intervals and apply various technical indicators.

- Order Book: The order book lists current buy (bids) and sell (asks) orders. It helps you gauge market depth and momentum.

- Order Panel: This is where you place your orders. You can select order types like limit, market, or stop orders. Adjust quantities and prices as needed.

- Position Panel: This shows your open positions and profit/loss status. It helps you manage and monitor your trades.

Customization Options

MEXC’s interface allows for customization with features such as:

- Different Chart Styles: Candlestick, Line, and OHLC.

- Technical Indicators: Moving Averages, RSI, MACD, etc.

- Layout Adjustments: Resize or move panels to your preference.

Trading Tools

MEXC provides several trading tools to enhance your trading experience:

- Trading View Integration: Advanced charting tools and technical analysis.

- Risk Management Tools: Set stop-loss and take-profit levels directly from the order panel.

- Leverage Settings: Adjust your leverage according to your risk tolerance.

Understanding these components will enhance your trading efficiency on MEXC’s futures platform.

How to Place and Manage Orders on MEXC Futures

Select a trading pair and contract type by navigating to the [Futures] tab on the MEXC platform.

For example, choose the USDT/BTC pair and the USDT-M perpetual contract. Next, decide on the leverage level. Leverage can amplify gains and losses, so choose wisely based on your risk tolerance.

Types of Orders:

- Limit Order: Set a specific price you wish to buy or sell. The order will only be executed when the market reaches this price.

- Market Order: Buy or sell immediately at the current market price.

- Stop Order: Execute a buy or sell order when the market hits a pre-defined trigger price.

To place a limit order, go to the order placement area on the right side of the trading page. Enter the desired price and quantity for a USDT/BTC pair, then click [Buy/Long] or [Sell/Short]. Your order will appear in the [Open Order] section below.

When placing a market order, enter the quantity and click [Buy/Long] or [Sell/Short]. The order will be executed at the best available price.

- Leverage and Margin: Leverage allows you to control a more prominent position with less capital. For instance, with 10x leverage, you need only 10% of the position’s value as collateral. Adjust your leverage in the leverage settings.

- Managing Positions: Monitor your open positions in the [Positions] section. Here, you can close a position by clicking [Close] and setting the desired price or opting for a market close.

- Funding Rate and Settlement: The funding rate is a periodic payment exchanged between buyers and sellers to keep futures prices in line with spot prices. Settlement occurs periodically, ensuring that profit and loss calculations are accurate.

By following these steps, you can confidently place and manage orders on MEXC futures, optimizing your trading strategy.

How to Use the MEXC Order Calculator

The MEXC order calculator is valuable for futures trading, enabling you to assess potential outcomes before executing trades.

Accessing the order calculator is straightforward. Start by navigating to the MEXC futures trading platform. You’ll find the order calculator at the top right corner of the page.

Once there, it would be best if you input several parameters. These include:

- Entry Price: The price at which you plan to enter the trade.

- Exit Price: The price at which you plan to exit the trade.

- Quantity: The number of contracts you intend to trade.

- Leverage: The leverage ratio you plan to use.

Example Usage

Scenario 1: Determining Potential Profit

- Entry Price: $50,000

- Exit Price: $52,000

- Quantity: 10

- Leverage: 10x

The order calculator will provide you with the potential profit by inputting these details. For instance, in this case, if the price moves from $50,000 to $52,000, your potential profit calculations are based on the leverage and quantity specified.

Example Usage

Scenario 2: Assessing Potential Loss

- Entry Price: $50,000

- Exit Price: $48,000

- Quantity: 10

- Leverage: 5x

Here, the calculator determines the potential loss if the price drops from $50,000 to $48,000. This highlights how crucial the calculator is for risk management.

The MEXC order calculator equips you with vital insights, allowing you to make informed decisions.

Frequently Asked Questions

In this section, you’ll find answers to common questions about trading futures on MEXC. These questions address fees, beginner steps, short selling, and automated trading.

What are the fees associated with trading MEXC futures?

MEXC charges trading fees on futures contracts, typically between 0.02% and 0.075% per transaction. Fees are applied differently for makers and takers, with makers paying less. To stay updated, checking the latest fee schedule on the MEXC website is essential.

What steps should beginners take to start trading futures on MEXC?

First, you need to register an account on the MEXC platform. Then, deposit funds into your future account. Open the MEXC App or website, go to [Wallets], and transfer funds from [Spot] to [Futures]. Ensure you have enough USDT or other supported assets.

Can I engage in short selling on the MEXC platform, and if so, how?

Yes, MEXC allows short selling. To short sell, select a futures contract and choose a sell order. This involves borrowing an asset to sell it at the current price, hoping to repurchase it at a lower price in the future. Be sure to manage your risk and understand the market conditions.

How does one use the MEXC Futures API for automated trading?

MEXC offers an API for automated trading. You need to generate API keys through your MEXC account settings. You can connect to the API and integrate these keys with your trading bots or algorithms. Detailed API documentation is available on the MEXC website to help you get started.

Conclusion

Embarking on futures trading with MEXC offers a dynamic opportunity in the cryptocurrency trading market. This platform facilitates a seamless trading experience with some of the lowest fees available.

Before diving in, ensure you have adequate funds in your future account. Transfers from your spot account to your futures account are straightforward and essential for starting.

Steps to Get Started:

- Create an Account: Register on the MEXC official website.

- Funds Transfer: Move funds from [Spot] to [Futures] in the MEXC App.

- Select Trading Pairs: Browse and select the trading pairs that suit your strategy.

Leverage the available resources to enhance your trading knowledge:

Take advantage of MX Tokens for an additional 10% discount on trading fees. This incentive is beneficial for managing costs and maximizing profits.

For further support, MEXC provides detailed guides and tutorials. You can always seek additional help through their customer support and educational materials.

Browse Other Useful Guides