KuCoin Futures Trading Tutorial 2025: A Step-by-Step Guide

Written by Stephen Wedge

Stephen Wedge, with over 15 years of experience in finance, holds a Master of Science in Finance from Vanderbilt University's Owen Graduate School of Management. He specializes in financial analysis, strategic investment planning, and has a keen interest in the world of cryptocurrencies. With a deep understanding of both traditional and digital financial markets, Stephen offers valuable expertise to investors seeking to navigate the complexities of crypto investments.

Expert Reviewed

This article has been reviewed by crypto market experts at SCM to ensure all the content, sources, and claims adhere to the highest standards of accuracy and reliability.

Last Updated on June 23, 2025

KuCoin, launched in 2017, has made significant strides in cryptocurrency trading. With over 10 million users and impressive daily trading volumes, it stands out among its competitors.

One of the features that you should explore on KuCoin is futures trading, which is known for its low fees, high leverage, and diverse contract options.

In the ever-volatile crypto market, futures trading on KuCoin allows you to go long or short on various assets, offering opportunities regardless of market direction.

The platform is designed to be user-friendly, making it accessible even if you’re new to this form of trading.

Understanding how to trade futures on KuCoin effectively can enhance your trading strategy and maximize your profits.

Futures trading on KuCoin involves transferring funds, selecting leverage, and choosing the proper contracts. Each step is crucial for a successful trading experience.

This tutorial will guide you through these steps, ensuring that you can navigate KuCoin’s futures trading with confidence and precision.

By the end of this guide, you’ll be well-equipped to take full advantage of what KuCoin Futures has to offer.

How to Trade Crypto Futures on KuCoin: KuCoin Futures Trading Strategy & Basics

To trade crypto futures on KuCoin, follow these key steps and strategies to navigate the platform effectively.

Setting Up and Funding Your Account

- Log in to your KuCoin account

- Navigate to the USDⓈ-M or COIN-M Futures trading page.

- Transfer funds to your future wallet. Use USDT or USDC for USDⓈ-M or cryptocurrencies like BTC for COIN-M futures.

Choosing Leverage and Margin

- Leverage: Control more prominent positions with smaller capital. Select your preferred leverage on the trading interface.

- Margin Types:

- Cross Margin Mode: Uses your entire margin balance to prevent liquidation.

- Isolated Margin Mode: Limits margin to a specific position, reducing overall risk.

Key Concepts

- Leverage: Amplifies potential profits and losses.

- Margin: Collateral needed to open and maintain a leveraged position.

- Liquidation: Automatic closure of your position if your margin falls below the required levels.

Important Prices and Funding Rates

- Index Price: Weighted average of prices from major exchanges, prevents manipulation.

- Fair Price: Used for liquidation and mark prices, ensuring stability.

- Funding Rate: Regular payments between long and short positions to align futures prices with spot prices.

Using the KuCoin Order Calculator

Utilize KuCoin’s order calculator to:

- Estimate potential profits and losses.

- Input leverage, entry price, and exit price scenarios.

By managing your leverage and margin and knowing essential pricing mechanisms and funding rates, you can better navigate crypto futures trading on KuCoin. Happy trading!

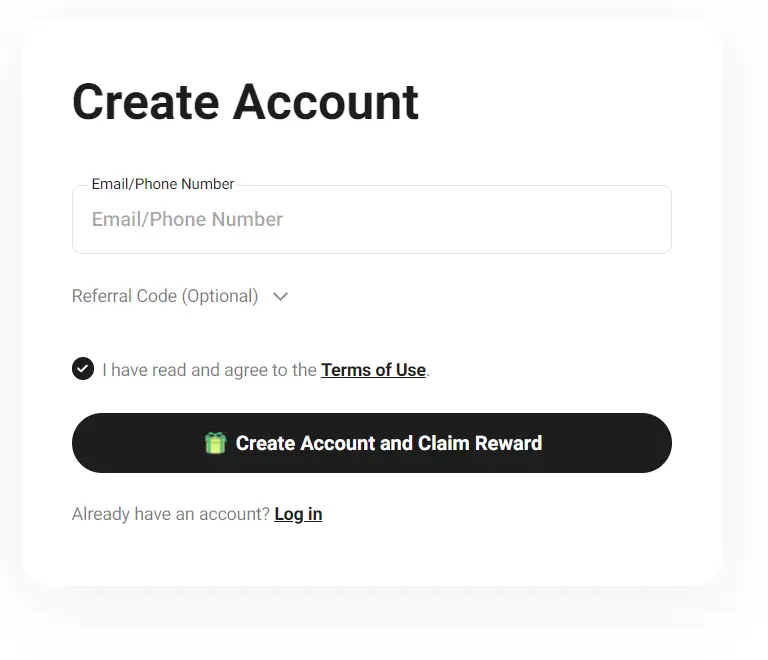

How to Create an Account on KuCoin

Creating an account on KuCoin is straightforward. Here’s a step-by-step guide to get you started:

Visit the KuCoin Website or Download the App:

Navigate to the KuCoin website or download the KuCoin app from the App Store or Google Play.

Register:

- Click the “Sign Up“ button.

- Choose to register using either your email or phone number.

- Create a strong password.

Verification:

- Complete the KYC (Know Your Customer) process.

- Submit the required identification documents as prompted.

- This step is essential to unlock higher leverage and trading limits.

Security Measures:

- Enable Two-Factor Authentication (2FA) for enhanced security.

- This will add an extra layer of protection to your account.

Referral Program:

Take advantage of KuCoin’s referral program. By inviting friends using your referral link, you can earn bonuses.

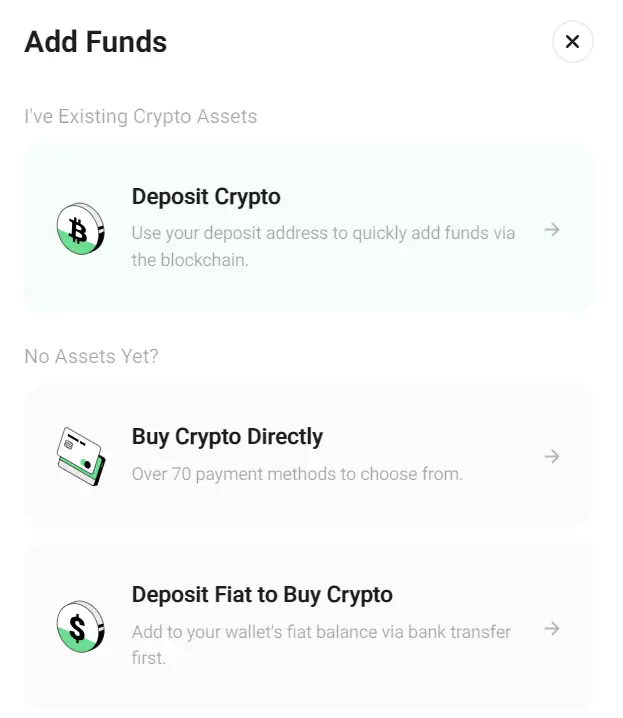

How to Deposit and Withdraw Funds on KuCoin

Depositing and withdrawing funds on KuCoin is a straightforward process.

Deposit Funds

- Navigate to the “Assets” Section:

- After logging into your account, go to the Assets section.

- Select “Deposit”:

- Click on the Deposit button.

- Choose Currency:

- Pick the cryptocurrency or fiat currency you want to deposit.

- Follow the Instructions:

- Follow the on-screen instructions to complete the deposit.

Withdraw Funds

- Go to the “Assets” Section:

- In your account, go to the Assets section.

- Select “Withdraw”:

- Click on the Withdraw button.

- Choose Currency:

- Select the currency you wish to withdraw.

- Enter Withdrawal Details:

- Input the Wallet Address and Withdrawal Amount, and choose the correct Network.

Supported Payment Methods

KuCoin supports various payment methods, such as:

- Bank Transfers

- Credit/Debit Cards

- Third-Party Payment Processors

Fees and Processing Time

- Deposit Fees:

- Generally free.

- Withdrawal Fees and Times:

- Fees and processing times vary depending on the selected currency.

Explore these features to manage your funds efficiently on KuCoin.

How to Transfer Funds to the Futures Wallet

Before starting trading futures on KuCoin, you must transfer funds from your main wallet to your futures wallet.

To begin, log in to your KuCoin account. Go to Assets, and then select Transfer. This option allows you to move funds between your wallets.

When the transfer interface appears, you must choose the currency you want to transfer. KuCoin supports multiple currencies for futures trading, such as USDT, USDC, and BTC.

Specify the amount of currency you want to transfer. Remember that each currency may have its minimum and maximum transfer limits.

Steps to Transfer Funds:

- Log in to your KuCoin account

- Navigate to Assets.

- Select Transfer.

- Choose the currency (e.g., USDT, USDC, BTC).

- Enter the amount to transfer.

- Confirm the transfer.

Your funds will now be available in your future wallet and ready for trading. The straightforward process ensures your funds are appropriately allocated for futures trading.

How to Choose Between Coin-Margined and USDT-Margined Futures

A few key factors should be considered when selecting between coin-margined and USDT-margined futures on KuCoin.

Coin-Margined Futures

- Collateral: Use the underlying cryptocurrency as collateral (e.g., BTC-margined futures).

- Potential Benefits: May benefit from the price appreciation of the underlying asset.

- Volatility: Suits traders who expect the cryptocurrency value to rise.

USDT-Margined Futures

- Collateral: Use USDT as collateral, offering stability and simplicity.

- Stability: Provides more stability in volatile markets.

- Intuitive for Fiat Calculations: It is easier to calculate returns directly in USD.

Advantages and Disadvantages

- Coin-Margined Futures:

- Advantage: Potential gains from the appreciating value of the collateral.

- Disadvantage: Exposure to volatility in cryptocurrency value.

- USDT-Margined Futures:

- Advantage: Stability in collateral value, easier risk management.

- Disadvantage: No additional gains from cryptocurrency price appreciation.

Examples

- USDT-Margined Contracts: BTC/USDT, ETH/USDT.

- Coin-Margined Contracts: BTC/USD.

Choosing the right type depends on your risk tolerance and market outlook. If you expect a bull market and want to capitalize on rising crypto values, coin-margined futures may be more appealing.

In contrast, USDT-margined futures might be the better option if you prefer stable, predictable returns.

How to Understand the Futures Trading Interface on KuCoin

The KuCoin Futures trading interface is designed to be intuitive and user-friendly, even for beginners.

- Price Chart: This is the centerpiece of the interface, displaying the price movements of the selected futures contract. You can perform technical analysis using various charting tools and indicators.

- Order Book: Located next to the chart, the order book shows the current buy and sell orders. The green side represents buy orders, while the red shows sell orders.

- Order Panel: This is where you place your buy or sell orders. You can choose from market orders, limit orders, and stop orders and specify the amount and leverage.

- Position Panel: This section displays all your open positions, including the size, entry price, and unrealized profit or loss. You can modify or close your positions directly from this panel.

- Customization Options: KuCoin allows you to customize the interface. You can adjust the layout, choose which panels to display, and use various trading tools to suit your preferences. This flexibility helps in creating an environment tailored to your trading style.

How to Place and Manage Orders on KuCoin Futures

Choose the desired trading pair and contract type (e.g., BTC/USDT perpetual contract) from the KuCoin Futures interface. This is the first step before proceeding with any trading activity.

Next, adjust the leverage level. High leverage can amplify potential gains and losses, so set it according to your risk tolerance. KuCoin offers various leverage options for flexibility.

KuCoin supports multiple order types. These include:

- Limit Order: Set a specific price at which you want to execute the trade.

- Market Order: Execute the trade immediately at the current market price.

- Stop Order: Trigger a buy or sell order once the asset reaches a predetermined price.

To place an order, enter the order details such as amount and price for limit orders, and confirm to execute. Proper placement ensures effective management of your trading strategy.

After placing an order, monitor your open positions regularly. Use the platform’s tools to adjust positions as needed. This may involve increasing or decreasing your exposure based on market conditions.

Understanding the Funding Rate and Settlement Mechanism is crucial.

Read More: What Is Crypto P2P Trading?

The funding rate can affect your positions depending on whether you hold a long or short contract. Settlement occurs periodically and involves the transfer of gains or losses to your account.

Managing orders and positions effectively involves staying informed and using the tools available on KuCoin Futures. Doing so allows you to navigate the complexities of futures trading with greater confidence and control.

How to Use the KuCoin Order Calculator

To access the KuCoin order calculator, navigate to the futures trading interface.

The calculator icon is in the upper right corner of the “Place Order” section.

Parameters

Start by selecting your position direction: Buy/Long or Sell/Short.

Input the following details:

- Entry Price: The price at which you plan to enter the trade.

- Exit Price: The price at which you plan to exit the trade.

- Leverage: The multiplier you intend to use.

- Position Size: The amount of the asset you wish to trade.

Results

Once you enter these parameters, the calculator provides several critical pieces of information:

- Estimated Profit/Loss: This shows your potential earnings or losses based on the input prices.

- Required Margin: This indicates the collateral needed to open the position.

- Potential Liquidation Price: This calculates the price level at which your position may be liquidated.

Examples

Use the calculator with different scenarios to effectively plan your trades.

For instance:

- If your entry price is $10,000, exit price $12,000, leverage 10x, and position size 1 BTC, the calculator will show potential profits, required margin, and liquidation price.

- Adjusting the leverage to 20x will reflect changes in potential profits and risks.

Experiment with these variables to balance risk and reward that suits your trading strategy.

Frequently Asked Questions

These FAQs cover essential information about getting started with KuCoin Futures, trading fees, leverage, and other pertinent details to help you trade confidently.

How can beginners get started with KuCoin Futures trading?

To start trading on KuCoin Futures, log in to your KuCoin account and navigate to the Futures trading page. Transfer USDT or other supported cryptocurrencies to your Futures Wallet. Select a trading pair, set your leverage, and place your order. Remember to start with smaller trades to understand the platform better.

In which countries are KuCoin Futures trading services restricted?

KuCoin Futures services are restricted in certain countries due to regulatory concerns. Countries like the United States, Canada, Japan, and others may not allow access to KuCoin Futures trading. Always check the latest information on kucoin’s official website for updates on restricted regions.

How can one utilize the KuCoin Futures API for automated trading?

KuCoin provides a robust API that allows you to automate your trading strategies. Access the KuCoin API documentation on their website, register for an API key, and set up your trading bot. Be sure to follow the security protocols, including IP allowlisting and setting API permissions.

What are the trading fees associated with KuCoin Futures?

KuCoin Futures trading fees include a maker fee and a taker fee. The standard fee is 0.02% for makers and 0.06% for takers. These fees can be reduced by holding KuCoin Shares (KCS) or through various fee discount programs provided by KuCoin.

What are the steps to executing a trade in KuCoin Futures?

Log in and go to the Futures trading page to execute a trade. Choose your trading pair and leverage. Transfer funds to your Futures wallet if not already done. Specify the order type—market or limit—enter the quantity, set your price (for limit orders), and confirm your trade.

How does utilizing 20x leverage on KuCoin affect a Futures position?

Using 20x leverage means you can control a position much more significant than your initial margin. For instance, with $100, you can take a position worth $2,000. While this amplifies potential profits, it also significantly increases the risk. Small market movements against your position can lead to liquidation and loss of your initial margin.

Conclusion

KuCoin offers a robust platform for futures trading with various features and tools to enhance your trading experience.

Whether you are a beginner or an experienced trader, KuCoin provides the resources and support needed to succeed in futures trading.

Start your trading journey on KuCoin today and explore the extensive resources available for further learning and support.

Browse Other Useful Guides