Binance Futures Trading Tutorial: Step-by-Step Beginner’s Guide

Written by Michael Hayes

Michael Hayes, a seasoned finance professional, enhanced his expertise by attending executive education programs in Finance at the prestigious Wharton School of the University of Pennsylvania. With a career spanning over 20 years, Michael has gained extensive experience in financial analysis, investment management, and strategic financial planning. His deep understanding of financial markets, coupled with his passion for continuous learning, has made him a trusted advisor in the field

Expert Reviewed

This article has been reviewed by crypto market experts at SCM to ensure all the content, sources, and claims adhere to the highest standards of accuracy and reliability.

Last Updated on June 23, 2025

Established in 2017 and based in Malta, Binance has quickly become the world’s largest crypto exchange, with over 90 million users and a daily trading volume of over $30 billion.

Binance Futures offers low fees, high leverage, and multiple contract options, allowing you to profit whether the market rises or falls by taking long or short positions.

Advanced features like Hedge Mode enable holding both long and short positions simultaneously, supporting diverse strategies. Automated tools like Grid Trading help manage buy and sell orders within set ranges.

This tutorial will guide you through Binance Futures, showing you how to set up your account, understand order types, and use key features effectively. Unlock the potential of futures trading on Binance.

How to Trade Crypto Futures on Binance

Trading crypto futures on Binance involves several crucial steps and concepts for successful trading.

Leverage allows you to control a more prominent position with less capital. For example, if you use 10x leverage, you can control $10,000 of a position with just $1,000 of your funds.

Margin is the collateral you need to maintain your leveraged positions. There are two types of margin modes on Binance: cross-margin mode and isolated margin mode. Cross-margin mode shares your entire margin balance across all open positions, while isolated margin mode restricts the margin to the position you are entering.

Liquidation happens when your position is closed automatically because the market moves against you, and you cannot meet the margin requirements. To minimize risks, monitor your positions regularly.

The index price represents the average price of the crypto asset across significant exchanges, ensuring a fair reference.

Fair prices prevent market manipulation and ensure that positions are marked correctly.

The funding rate is a periodic payment between long and short positions to ensure that the futures price converges to the index price.

Start by selecting the type of futures contracts: USD-M or Coin-M. Choose your leverage carefully, as higher leverage increases potential gains and risks. Next, determine your order type: market, limit, or stop.

Using the Binance order calculator to estimate your potential profits and losses before entering a trade is highly recommended. This tool helps you set realistic targets and stop-loss levels, ensuring a disciplined trading approach.

By understanding these concepts and using the tools provided by Binance, you can trade crypto futures more effectively and manage your risks.

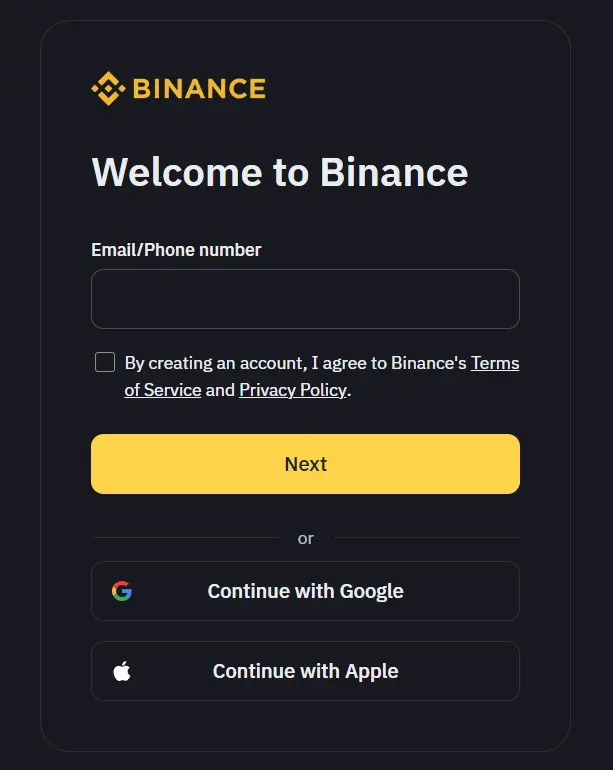

How to Create an Account on Binance

To start trading crypto futures on Binance, you must first create a free account. This can be done via the Binance website or app.

Via Website:

- Navigate to Binance’s homepage.

- Click on “Register” at the top right corner.

- Choose to sign up with either your phone number or email.

- Enter your details and complete the verification steps.

Via Mobile App:

- Download the Binance app from your device’s app store.

- Open the app and tap on “Sign Up”.

- Choose to register using your phone number or email.

- Fill in the required fields and follow the verification process.

Verification Process and Security Measures

After registering, you need to verify your identity. This involves providing a government-issued ID and sometimes a selfie for facial recognition. Binance uses these steps to enhance account security and comply with regulations.

- ID Verification: Upload your ID and a photo.

- Facial Recognition: Follow on-screen instructions for a quick selfie.

Binance employs two-factor authentication (2FA) for additional security. Enabling this feature is recommended to keep your account secure.

Referral Program and New User Bonus

When creating your account, you can use a referral code. This may grant you and the referrer a bonus. These bonuses can include trading fee discounts or other perks.

- Enter Referral Code: During the signup process.

- Claim Bonus: Bonuses will be credited after completing your first trade or deposit.

Creating an account on Binance is straightforward, ensuring you can start trading crypto futures efficiently.

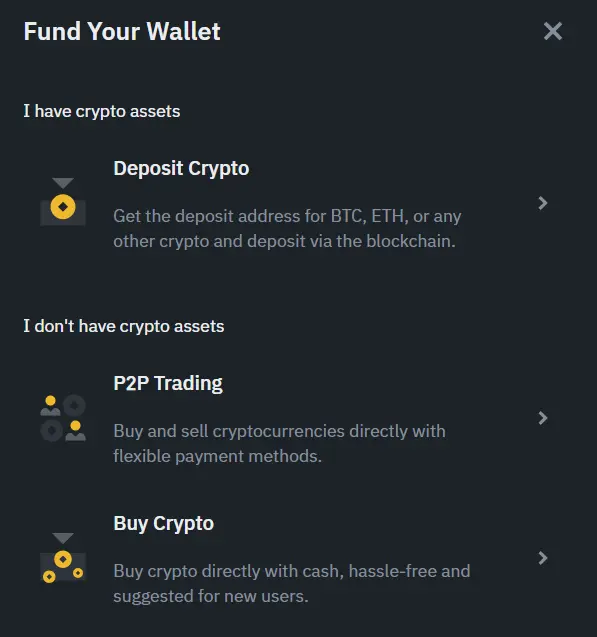

How to Deposit and Withdraw Funds on Binance

You can use crypto and fiat currencies to deposit funds on Binance. Navigate to the “Wallet > Fiat and Spot” section for crypto deposits.

Click “Deposit” and choose the crypto you want to deposit, and Binance will generate a deposit address. Ensure you use the correct network to avoid losing funds.

Supported fiat payment methods include bank transfers, credit/debit cards, and third-party services like Simplex. Select “Deposit Fiat,” choose your currency, and follow the prompts.

Here’s a table summarizing the payment methods:

| Currency | Methods | Minimum Deposit | Maximum Deposit | Fees | Processing Time |

|---|---|---|---|---|---|

| Crypto | Blockchain transfer | None | Varies by coin | Free | Up to 1 hour |

| Fiat | Bank transfer | $10 | Varies by method | Varies | 1-3 business days |

| Fiat | Credit/Debit card | $10 | Varies by method | Varies | Minutes |

| Fiat | Simplex | $50 | Varies by method | 3.5% or $10 | Minutes |

For withdrawals, go to “Wallet > Fiat and Spot” and select “Withdraw.” For crypto withdrawals, enter the recipient’s address and the amount and confirm the network.

For fiat withdrawals, click “Withdraw Fiat,” choose your currency, and select the preferred payment method. Follow the instructions to complete the process.

Here’s a table summarizing fiat withdrawal details:

| Method | Minimum Withdrawal | Maximum Withdrawal | Fees | Processing Time |

|---|---|---|---|---|

| Bank transfer | $50 | Varies by method | Varies | 1-5 business days |

| Credit/Debit card | $50 | Varies by method | Varies | Minutes |

| Simplex | $50 | Varies by method | 1% or $10 | Minutes |

Always confirm the fees and limits on Binance’s platform, as they may change.

How to Transfer Funds to the Futures Wallet

The Futures Wallet on Binance differs from your Main Wallet (Spot Wallet). The Main Wallet is where you store your non-leveraged assets, handling regular buy and sell trades. On the other hand, the Futures Wallet is specifically for leveraged trading in the futures market.

To transfer funds from your Main Wallet to your Futures Wallet, follow these steps:

- Open the Binance app and log in to your account.

- Navigate to [Wallet] at the bottom of the homepage.

- Select [Transfer] next to the USDⓈ-M Futures wallet.

Next, you’ll need to choose the type of assets to transfer and the amount:

- Select Asset: Pick the asset, such as USDT.

- Enter Amount: Specify the amount to transfer.

- Confirm: Click on Confirm Transfer.

Supported currencies include USDT, BUSD, and several other stablecoins. The minimum and maximum transfer amounts might vary based on the asset and your account status. Always check the current Binance guidelines for the most up-to-date information.

For a smooth experience, ensure that your asset selection and entered amounts meet Binance’s criteria. Following these steps, you can seamlessly move your funds and begin trading on Binance Futures.

How to Choose Between USDⓈ-M and COIN-M Futures

When trading futures on Binance, selecting between USDⓈ-M and COIN-M Futures depends on your trading preferences and strategies.

USDⓈ-M Futures

USDⓈ-Margined futures use stablecoins as collateral.

Characteristics:

- Settlement in USDT/BUSD: All trades settle in stablecoins like USDT or BUSD.

- Lower volatility: Holding stablecoins can reduce exposure to crypto price fluctuations.

- Versatility: Suitable for traders wanting to minimize risk and maintain stable collateral value.

Examples:

- BTC/USDT

- ETH/USDT

- BNB/USDT

Advantages:

- Stability of collateral

- It is a more straightforward profit calculation since gains are in fiat equivalent

Disadvantages:

- Potentially lower returns if stablecoins devalue against crypto assets

COIN-M Futures

COIN-M Futures are settled in the underlying cryptocurrency itself.

Characteristics:

- Settlement in Crypto: Contracts are settled in the specific cryptocurrency being traded.

- Higher potential returns: Gains are in crypto, benefiting from asset appreciation.

- Increased volatility: Higher risk due to price fluctuations of the crypto used as collateral.

Examples:

- BTC/USD

- ETH/USD

- BNB/USD

Advantages:

- Potential for higher returns with appreciating crypto assets

- Maintains crypto exposure

Disadvantages:

- Higher risk from crypto price volatility

- Complex profit calculation due to fluctuating crypto values

Choose USDⓈ-M futures for stability and predictable returns. Opt for COIN-M futures if you prefer potential higher gains and can manage the associated risks.

How to Understand the Futures Trading Interface on Binance

Navigating the Binance Futures Trading interface is essential for successful trading. The interface is designed to provide all the necessary tools and information.

The chart area is where you can view the price movements of your selected contract. It includes various time frames and drawing tools that help you analyze market trends.

The order book displays real-time buy and sell orders. The left side typically shows buy orders, and the right side shows sell orders. This helps you understand the market depth and liquidity.

In the order panel, you place your orders. You can choose from different order types: limit, market, and stop-limit. Enter the quantity and price before confirming your order.

The position panel shows your open positions and their PnL (profit and loss). Here, you can monitor your current trades and decide whether to hold or close them.

Customization options allow you to adjust the interface according to your preferences. You can rearrange panels, change themes, and set up alerts.

Trading tools like leverage settings and risk management features enhance your trading experience. You can select leverage up to 125x, but remember that higher leverage increases risk.

Understanding each component and utilizing the customization options will help you make informed decisions on Binance Futures.

How to Place and Manage Orders on Binance Futures

To begin trading on Binance Futures, choose a trading pair. For instance, let’s use the USDT/BTC pair. This pair involves trading Bitcoin against Tether (USDT).

Next, select a contract type. You can opt for perpetual contracts, which have no expiration date and are settled daily.

To maximize your potential returns, you can adjust your leverage level. Binance Futures allows you to choose to leverage up to 125x. Remember, higher leverage increases both possible profit and risk.

Order Types

- Limit Orders: Set a specific price you want to buy or sell. The trade executes only when the market hits your price.

- Market Orders: Execute trades immediately at the current market price. Valid for quick entry or exit.

- Stop Orders: Trigger a buy or sell order once a specified price is reached.

Placing an Order

- Navigate to the Binance Futures interface.

- Select your trading pair, such as USDT/BTC.

- Choose your order type: limit, market, or stop.

- Enter the details, including price and quantity.

- Click Buy/Long or Sell/Short to place your order.

Leverage and Margin System

In Binance Futures, you can use leverage to control a more prominent position size with a smaller initial margin. For example, using 10x leverage means you only need $100 to maintain a $1,000 position. Adjust your leverage using the slider before placing an order.

Managing and Closing Positions

To manage your open positions, go to the Positions tab. You can monitor your P&L (Profit and Loss), margin balance, and leverage here.

To close a position:

- Locate your open position in the Positions tab.

- Choose Market to close at the current price or Limit to set a specific price.

- Confirm the close to finalize the trade.

Funding Rate and Settlement

The funding rate is a periodic payment between traders to ensure the price of perpetual contracts aligns with the cryptocurrency spot trading price. Favorable funding rates mean longs pay shorts and vice versa. Binance calculates and applies funding every eight hours.

How to Use the Binance Order Calculator

The Binance order calculator is valuable for futures trading, providing vital insights before placing any order.

To access the calculator, click the [Calculator] icon on the Order Entry Panel on the right side of the futures trading interface.

Parameters of the Calculator

- Initial Margin: This is the amount you need to open a position.

- Profit & Loss (PnL): Calculates potential gains or losses based on input values.

- Return on Investment (ROI): Determines the expected return percentage.

- Liquidation Price: Identifies the price at which your position will be liquidated.

Using the Calculator

- Initial Margin: Input the entry price, target price, and leverage. The calculator will display the required margin.

- PnL and ROI: Add the entry and exit prices and quantity. You’ll see the potential PnL and ROI.

- Liquidation Price: Enter your leverage, entry price, and wallet balance to determine the liquidation price.

Example Scenarios

- Calculating Initial Margin:

- Entry Price: $10,000

- Target Price: $12,000

- Leverage: 10x

- The required margin will be shown based on these inputs.

- Determining ROI and PnL:

- Entry Price: $8,000

- Exit Price: $9,500

- Quantity: 5 BTC

- The calculator will display PnL and ROI.

- Finding Liquidation Price:

- Entry Price: $9,000

- Leverage: 20x

- Wallet Balance: $1,000

- The calculator will provide the liquidation price.

Using the Binance order calculator ensures you make informed decisions in futures trading, enhancing your trading strategy and potentially minimizing risks.

How to Use the Binance Copy Trading Feature

The Binance copy trading feature allows you to follow and replicate the trades of professional traders automatically. This feature is a great way to learn from experienced traders and potentially increase your returns.

To access the Binance copy trading platform, log in to your Binance account. Navigate to [Trade], then select [Copy Trading]. Ensure you’re on the [Futures] tab.

Steps to Get Started

- Choose a Trader: Browse through the list of lead traders. Review performance metrics like ROI, PNL, and Sharpe Ratio.

- Allocate Funds: Select the capital you wish to allocate for copy trading. Note that your copy trading account balance is separate from your regular Binance account.

- Start Copying: Click [Copy] to replicate the chosen trader’s trades.

Benefits of Copy Trading

- Ease of Use: Automates trading based on professional traders’ strategies.

- Learning Opportunity: Helps you understand market movements by watching experienced traders.

- Potential for Higher Returns: Leverages the expertise of successful traders.

Risks of Copy Trading

- Market Volatility: As with all trading, market conditions can lead to losses.

- Dependence on Trader Performance: Your success is tied to the selected trader’s performance.

Tips for Choosing the Best Copy Traders

- Review Metrics: Focus on traders with a high ROI, consistent performance, and a favorable Sharpe Ratio.

- Monitor Regularly: Even automated trades must ensure they align with your investing goals.

- Diversify: Consider following multiple traders to spread out risk.

By leveraging Binance’s copy trading feature, you can potentially enhance your futures trading experience by learning directly from seasoned traders.

Frequently Asked Questions

This section covers essential aspects of Binance Futures trading, including rules to follow, ways to profit, permissibility within Islamic finance, and strategic guides.

Are there any specific rules to follow when trading futures on Binance?

Yes, traders must adhere to several rules when trading futures on Binance. Always ensure you meet the margin requirements to avoid liquidation. Use leverage cautiously and be aware of the associated risks. Identity verification may be necessary to unlock all features.

Can you profit from Binance futures trading, and if so, how?

You can profit from Binance futures trading by speculating on the price movement of cryptocurrencies. You can benefit from both rising and falling markets by taking long or short positions. Employ stop-loss orders and other risk management tools to protect your investments.

Is futures trading on Binance considered halal in Islamic finance?

The permissibility of futures trading in Islamic finance is a debated topic. Some scholars argue that the speculative nature of futures trading conflicts with Islamic principles. It’s recommended to consult with a knowledgeable Islamic finance advisor to determine whether this form of trading aligns with your beliefs.

Can you provide a guide for employing a Binance Futures trading strategy?

First, I thoroughly understand the mechanics of future contracts and associated risks. Establish a strategy that includes entry and exit points, risk management techniques, and continuous learning. Use tools like limit orders, stop-loss orders, and leverage settings to enhance your strategy, ensuring you are well-prepared for the market’s volatility.

Conclusion

You now have a solid understanding of how to start trading futures on Binance. You can maximize your trading potential with features like up to 125X leverage. Remember, though, that with high reward comes high risk.

Keep in mind the following points:

- Start with small trades to get comfortable.

- Use risk management strategies effectively.

To further enhance your knowledge, consider exploring additional resources:

- Binance Futures Beginner’s Guide

- Binance Academy’s in-depth articles on futures trading

For support, Binance offers various community resources and customer service:

- Binance Support Center

- Binance’s official Telegram and Reddit groups

Embark on your futures trading journey today and leverage the tools and resources Binance provides to achieve your trading goals.

Browse Other Useful Guides