OKX vs KuCoin: Analysis of Features, Fees, and Security

Written by Stephen Wedge

Stephen Wedge, with over 15 years of experience in finance, holds a Master of Science in Finance from Vanderbilt University's Owen Graduate School of Management. He specializes in financial analysis, strategic investment planning, and has a keen interest in the world of cryptocurrencies. With a deep understanding of both traditional and digital financial markets, Stephen offers valuable expertise to investors seeking to navigate the complexities of crypto investments.

Expert Reviewed

This article has been reviewed by crypto market experts at SCM to ensure all the content, sources, and claims adhere to the highest standards of accuracy and reliability.

Last Updated on December 5, 2025

The debate between OKX and KuCoin is a hot topic among cryptocurrency enthusiasts seeking the best trading experience.

In this article, I’ll analyze both exchanges in-depth, drawing from my extensive use of their platforms. We’ll compare their trading volumes, security features, user interfaces, and the variety of cryptocurrencies they offer.

By dissecting the unique advantages and potential drawbacks of OKX and KuCoin, I aim to uncover which exchange might be the superior choice for traders.

Whether you prioritize a user-friendly experience or a wide array of trading pairs, this comparison will help illuminate which platform could better serve your crypto trading needs.

Let’s dive into the details and see which exchange is on top.

OKX vs KuCoin: Comparative Table

When choosing a crypto exchange, you’d typically consider factors such as reputation, fees, available tokens, and the platform’s additional services.

Below is a comparison of OKX and KuCoin to aid you in making an informed decision.

| Feature | OKX | KuCoin |

|---|---|---|

| Founded | 2017 | 2017 |

| Founder(s) | Star Xu | Michael Gan, Eric Don |

| Supported Coins | Over 400 | Large variety, including less-known altcoins |

| Spot Trading Fees | 0.10% standard fee | 0.10% standard fee; 20% discount if using KCS token |

| Futures Trading Fees | Maker: -0.015% to 0.02%; Taker: 0.02% to 0.05% | Maker: -0.015%; Taker: 0.03% to 0.06% |

| Products Offered | Spot, Futures, Options, Margin Trading, Mining Pools, NFTs | Spot, Futures, Margin Trading, Staking, Lending, NFTs |

| Max Leverage | Up to 100x | Up to 100x |

| Security Measures | Industry-leading security standards | Advanced security features |

| Deposit Methods | Cryptocurrency, Bank Transfer, Credit/Debit Card | Cryptocurrency, Bank Transfer, Credit/Debit Card |

| Additional Services | Developer tools, dynamic charts, OTC trading | Additional discount on fees with KCS token, KCS Bonus Plan |

Both exchanges have their strengths: OKX has a suite of developer tools and is known for its dynamic charts, while KuCoin offers trading fee discounts for users who hold and use their native KCS token to pay fees.

Your choice depends on which features align more closely with your trading needs and preferences.

OKX vs KuCoin: Products and Services

When choosing between OKX and KuCoin, you’ll find that both exchanges offer an extensive list of products and services catering to various trading and investment preferences.

OKX:

- Spot Trading: You can access a broad range of cryptocurrencies for direct trading.

- Futures & Perpetual Swaps: OKX enables leveraged trading with futures and perpetual swap contracts.

- Options Trading: It offers crypto options trading, adding to the diversity of its financial products.

- Staking Services: Users can stake specific cryptocurrencies to earn interest.

- NFT Marketplace: OKX provides a platform for NFT trading and participation.

KuCoin:

- Spot Trading: KuCoin supports many tokens, giving you significant choices.

- Futures Trading: Like OKX, KuCoin offers futures trading to leverage positions.

- Leveraged Tokens: These tokens allow magnified exposure to cryptocurrency markets without needing direct margin trading.

- Staking and Lending: KuCoin users can stake and lend their crypto to earn interest.

While both platforms deliver a full suite of services and prudently address user safety and experience, differences emerge in their approach to trading products and user interface.

OKX is often recognized for its robust technical tools, which are suited for advanced traders. KuCoin, on the other hand, attracts users with a more intuitive interface and a more comprehensive range of altcoins.

Deciding between the two might determine what services align best with your trading style or investment goals.

OKX vs KuCoin: Contract Types

When exploring contract types on both OKX and KuCoin, you’ll find various products tailored to different trading styles and risk tolerances.

Understanding each contract type will help you determine which platform best suits your needs.

- Inverse Perpetual Contracts: On OKX, you can engage in inverse perpetual contracts, where the contract is quoted in cryptocurrency rather than a fiat currency, meaning your margin is also in that cryptocurrency. Conversely, on KuCoin, these contracts allow you to hold positions indefinitely without a settlement date, providing flexibility in your trading strategy.

- Linear Perpetual Contracts: OKX and KuCoin provide linear perpetual contracts quoted and settled in USDT or another stablecoin. This is beneficial for you if you prefer to calculate your profits, losses, and margins directly in a stablecoin without converting them from the cryptocurrency asset.

- Inverse Futures Contracts: OKX supports inverse futures contracts, akin to their perpetual counterparts, but with fixed settlement dates. While KuCoin also offers these, they might differ in the variety and settlement options available.

- COIN-M Futures: KuCoin shines with its COIN-M futures, where the contracts are quoted in the cryptocurrency, and margin and PnL are also calculated in the coin. This can be an advantage if you’re looking to trade with the actual cryptocurrency asset.

- USD-M Futures: You’ll find USD-M futures on both exchanges, which are margin and profit/loss calculated in USDT or another stable currency, making them straightforward to track and manage.

- Options: For more advanced trading needs, OKX presents a range of options contracts, giving you the flexibility to hedge or take advantage of market movements in various scenarios. KuCoin’s options offerings may vary, and it’s worth checking their platform for the latest details.

When deciding between OKX and KuCoin, assess the contract types against your trading strategies, desired currency handling, and risk management preferences.

Each platform’s offerings cater to different aspects of cryptocurrency trading, and your choice will depend on which aligns best with your trading goals.

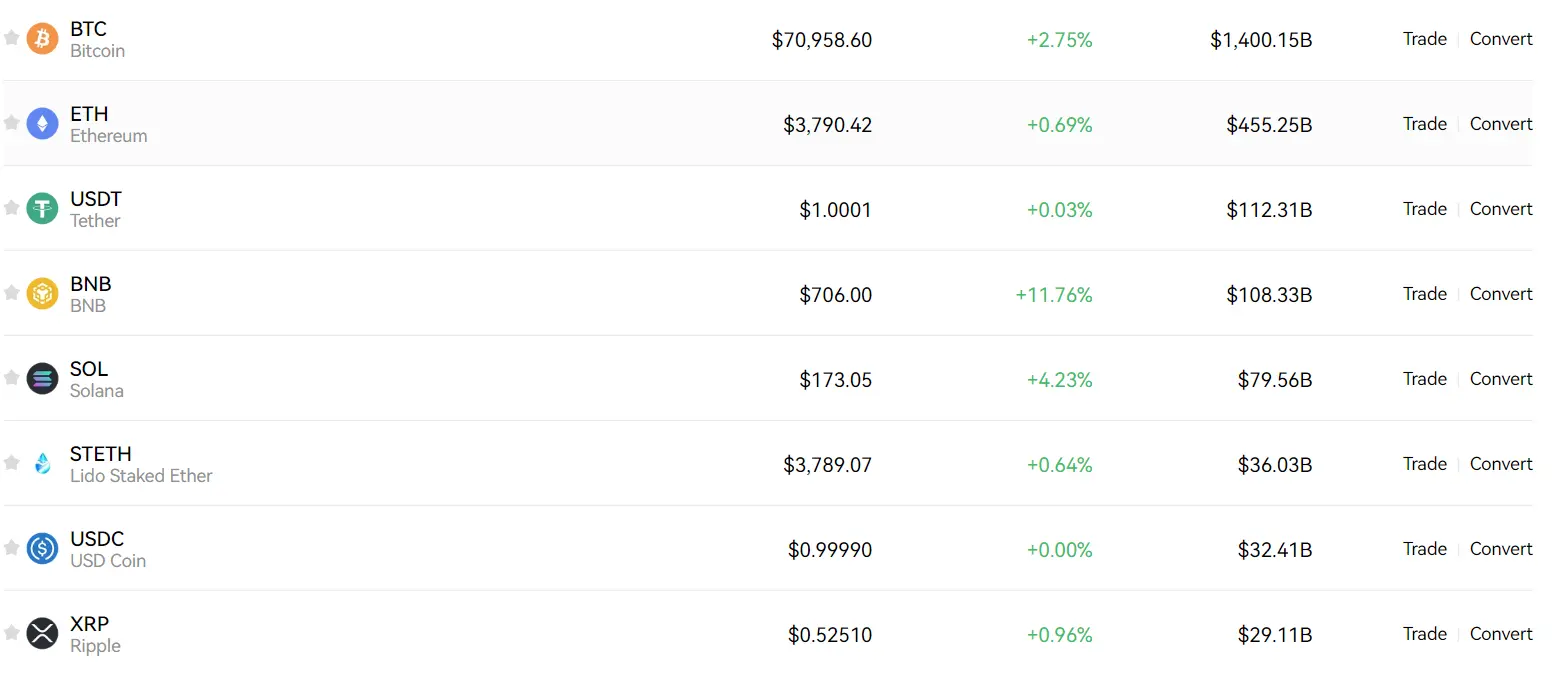

OKX vs KuCoin: Supported Cryptocurrencies

When you’re analyzing the variety of cryptocurrencies supported by OKX and KuCoin, it’s apparent that both platforms have strengths that cater to different preferences in the crypto community.

OKX:

- Spot Trading: Offers a curated list of cryptocurrencies, with more than 350 tokens available for trading.

- Futures and Leverage Trading: Focuses on providing popular and liquid futures pairs. OKX supports various futures contracts with competitive fees, attracting seasoned and novice traders.

KuCoin:

- Spot Trading: Features an extensive collection of cryptocurrencies, boasting over 750 tokens. This range makes KuCoin one of the industry leaders in terms of asset support.

- Futures and Leverage Trading: Alongside spot markets, KuCoin provides diverse futures contracts. The platform has many USDT-M and Coin-M tradable contracts, which positions it ahead of many competitors regarding futures trading options.

Regarding the most popular futures trading crypto pairs, both exchanges offer pairs that generally include significant cryptocurrencies like Bitcoin (BTC) and Ethereum (ETH) due to their high liquidity and trading volume.

Here is a breakdown of futures trading options:

- OKX: Primarily focuses on high-liquidity pairs like BTC/USD and ETH/USD, making it suitable for traders who prefer established cryptocurrencies.

- KuCoin: Offers a broader range of futures trading pairs, which may include both popular and more niche cryptocurrencies.

When you decide on an exchange for futures trading, consider the number of cryptocurrencies available, the specific pairs, and the trading volume, as these factors can significantly affect your trading experience.

OKX vs KuCoin: Leverage and Margin Trading

When you engage in margin trading on either OKX or KuCoin, you’re offered the ability to borrow funds, augmenting your trading position beyond what your current capital allows.

This practice notably increases the potential returns and associated risks, including the possibility of liquidation if the market turns against you.

OKX Margin Trading:

- Maximum Leverage: You can leverage up to 100x on futures trading, amplifying your position extensively.

- Spot Margin: Offers a maximum of 5x leverage.

- Liquidation: OKX implements a tiered margin system to optimize liquidation processes and reduce market impact.

- Funding Rates: These are updated regularly to reflect the market conditions and are visible within the trading interface.

KuCoin Margin Trading:

- Available Cryptocurrencies: Supports margin trading with over 15 cryptocurrencies, including KCS, ETH, and BTC.

- Fee Reduction: If you pay fees with KuCoin’s KCS token, you enjoy a discount, thereby slightly reducing the cost compared to OKX.

- Maximum Leverage: Generally offers lower leverage than OKX, making it a more conservative choice for margin and futures trading.

Both platforms require careful consideration of margin requirements and liquidation risks.

Your positions are subject to liquidation if they fall below the maintenance margin, with KuCoin offering a platform-specific risk level management system to help you identify potential liquidation risks.

You must monitor the funding rates closely, as they impact the cost of holding leveraged positions.

Differences between the two exchanges’ rates can influence your decision on where to trade, depending on market conditions and your trading strategy.

OKX vs KuCoin: Trading Volume

When assessing trading volume on OKX and KuCoin, you should consider how volume can influence your trading experience.

The trading volume of an exchange directly affects liquidity – the ease of buying and selling without causing a significant price movement.

OKX Trading Volume:

- Known for a consistently high trading volume.

- Often ranks in the top tier on coin market ranking sites.

- A high volume here means more efficient trade execution and typically less slippage.

KuCoin Trading Volume:

- Also recognized for substantial trading volumes.

- It competes closely with OKX, ensuring a healthy liquidity pool.

- While smaller in volume than OKX, KuCoin maintains a robust trading environment.

Data on trading volume and liquidity could be sourced from platforms like CoinMarketCap, where these exchanges are typically listed in the top 20.

Read More: Crypto Futures Open Interest Explained

Financial exchanges are evaluated based on the volume of trades in the derivatives and spot markets.

This information indicates the trading community has confidence in these platforms and the ability to fulfill large orders without impacting the market too drastically.

Remember, a higher trading volume suggests a reduced risk of slippage, where there’s a difference between the expected price of a trade and the price at which the trade is executed.

With OKX and KuCoin, you’re part of some of the most lively trading ecosystems, ensuring that your trades are more likely to be executed promptly and at predictable prices.

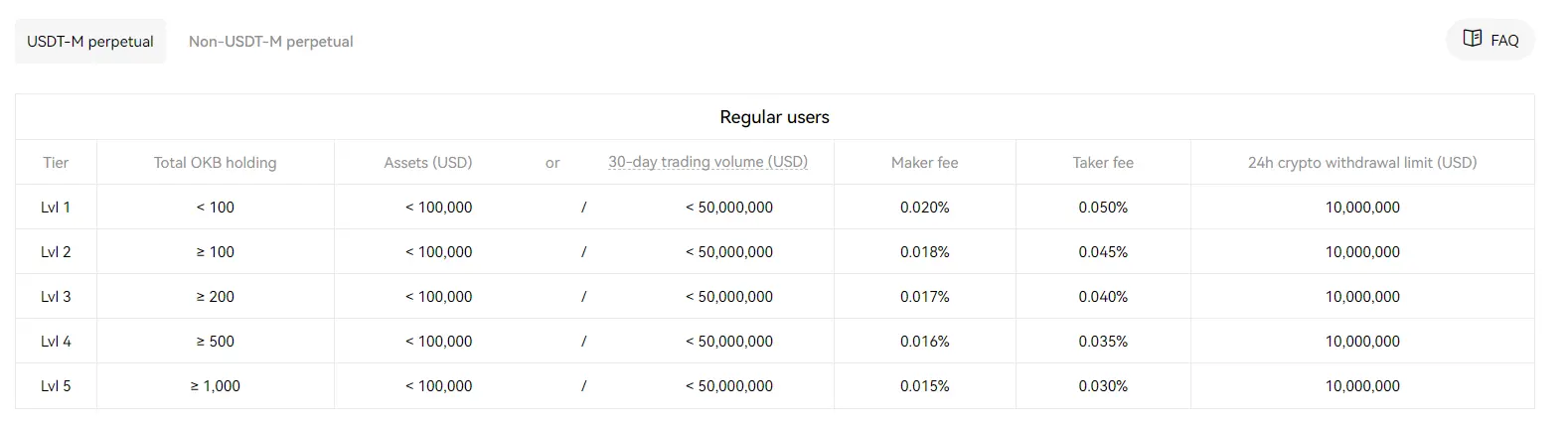

OKX vs KuCoin: Futures Trading Fees and Rewards

When trading futures on OKX, you’re looking at a maker fee that can be as low as -0.015% and a taker fee of up to 0.05%.

Conversely, KuCoin charges a maker fee of 0.02% and a taker fee of 0.06% for the same futures trading. Notably, the precise fees you incur may vary based on your trading volume and level within the exchanges’ tiered fee structures.

Fee Discounts & Rewards: Both platforms offer the opportunity to significantly reduce fees by using their native tokens—OKB for OKX and KCS for KuCoin—granting you up to 20% off on trading fees. Your fee rate could further benefit from any additional promotions or rewards programs these exchanges may have active.

Fee Calculation: To illustrate, if you were to execute a futures trade valued at $10,000 as a maker at OKX, your fee could be harmful, which means you could receive a rebate of $1.50. In contrast, as a taker, you might pay a cost of $5. On KuCoin, the maker would incur a $2 fee while the taker would pay $6.

Deposits and Withdrawals: It’s crucial to factor in the costs of depositing and withdrawing funds. Typically, deposit fees are minimal or non-existent, but withdrawal fees can vary and should be checked directly on the exchanges’ fee schedules. These fees can fluctuate with the changing values of cryptocurrencies.

By considering these factors, you tailor your trading strategy not just to market conditions but also to optimize for the cost-efficiency of your chosen platform. Use the exchanges’ fee calculators to estimate your specific scenarios precisely.

OKX vs KuCoin: Deposits & Withdrawal Options

When considering the ease of moving funds on OKX and KuCoin, you’ll find both exchanges offer a range of options suited to diverse user preferences.

OKX Deposits & Withdrawals:

- Currencies: Supports cryptocurrency deposits.

- Payment Methods: Exclusively allows crypto deposits; fiat deposits are not permitted.

- Fees:There is noo charge for crypto deposits; however, withdrawal fees vary depending on the asset.

- Processing Times: Typically fast, though it depends on the network congestion.

- Limits: They have minimum and maximum limit,s which can varydepending ony the specific cryptocurrency.

KuCoin Deposits & Withdrawals:

- Currencies: Accepts cryptocurrency; fiat transactions are facilitated via third parties.

- Payment Methods: Offers credit/debit card transactions via third parties with varying fees, often up to 6%.

- Fees: Crypto deposit fees are absent, but third-party services for fiat transactions may impose fees. Withdrawal fees are applicable and are asset-dependent.

- Processing Times: Crypto transactions are usually quick, subject to network speed.

- Limits: Varies by currency and by user’s verification level.

For both platforms, the actual withdrawal fees and processing times can fluctuate with market conditions and network activity.

Your verification level may also influence your deposit and withdrawal limits, allowing for a larger volume of funds to be moved as your level increases.

When using KuCoin, paying for trading fees with KCS tokens or using OKB tokens on OKX can provide additional discounts, thus affecting the overall cost of transactions.

Remember that while third-party payment processors facilitate fiat transactions, these can come with higher costs.

OKX vs KuCoin: Native Token Usage

OKX and KuCoin offer native tokens, OKB and KCS (KuCoin Token), respectively. These tokens enhance your trading experience by providing various benefits and utilities within their ecosystems.

OKX’s OKB Token:

- Trading Fee Discounts: Holders of OKB can receive discounts on trading fees, making your transactions more cost-effective.

- Use Cases: The token can be utilized in several ways, including participating in token sales and earning interest.

KuCoin’s KCS Token:

- Trading Fee Discounts: As a KCS holder, you have the perk of paying lower trading fees. You can obtain an additional discount by using KCS to cover your costs.

- Rewards: Holding KCS also makes you eligible for dividend-like rewards.

- Other Utilities: KCS can be utilized to participate in new token sales on KuCoin’s Spotlight platform and earn passive income.

| Token | Discount on Trading Fees | Other Utilities |

|---|---|---|

| OKB (OKX) | Yes | Token sales, Earning interest |

| KCS (KuCoin) | Yes | Token sales, Dividend rewards |

By strategically using OKB or KCS, you can take advantage of the financial incentives and contribute to the respective exchange’s ecosystem activities.

Remember that the benefits associated with these tokens might evolve, so staying informed about the latest updates from both exchanges is advisable to maximize advantages.

OKX vs KuCoin: KYC Requirements & KYC Limits

When comparing KYC (Know Your Customer) requirements between OKX and KuCoin, you’ll discover that both exchanges have structured verification processes to enhance security and comply with regulatory standards.

Your verification level affects your access to certain features and limits your deposits, withdrawals, and trading capabilities.

OKX KYC Requirements:

- Level 1 Verification: Basic personal information.

- Level 2 Verification: Government-issued ID and a selfie.

- Level 3 Verification: Address verification.

KuCoin KYC Requirements:

- Unverified:You cann use the exchange with limited functionality.

- Verified: Requires a government-issued ID and a selfie.

- Verified Plus: Additional information may be required for higher limits.

KYC verification at OKX aims to provide you with a secure environment and mitigate risks like fraud and money laundering. Once verified, you enjoy increased limits for cryptocurrency withdrawals.

For instance, on OKX, verified users can withdraw a higher amount than unverified users.

Meanwhile, KuCoin offers unverified users the opportunity to perform limited trading. However, KYC verification significantly increases your 24-hour withdrawal limit and overall platform functionality.

| Verification Level | OKX Withdrawal Limit | KuCoin Withdrawal Limit |

|---|---|---|

| Unverified | Limited | Limited |

| Verified | Higher | Higher |

| Verified Plus | Highest | Highest |

You need to consider how these KYC requirements and limits align with your privacy preferences and trading needs. Both exchanges have put these procedures in place to balance user privacy and the necessity of complying with financial regulations.

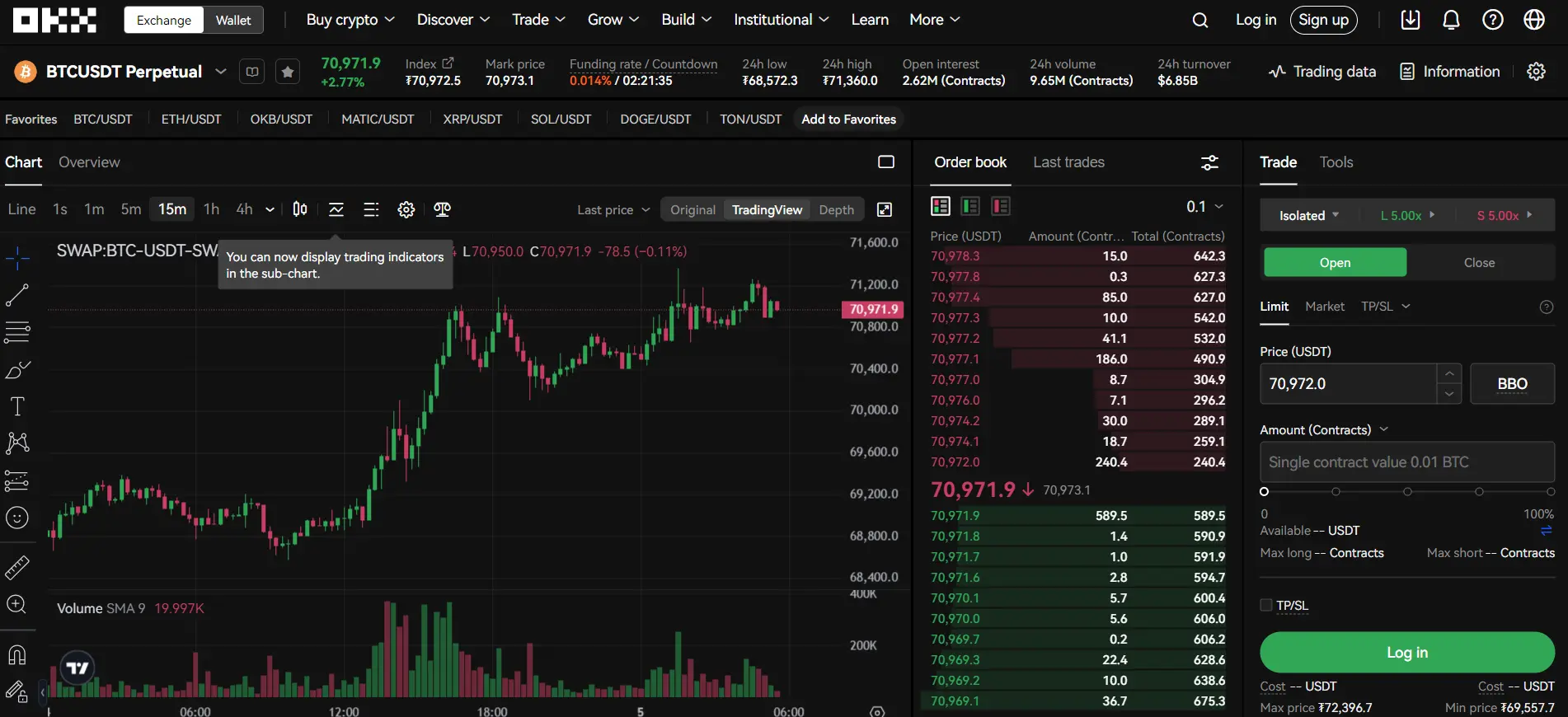

OKX vs KuCoin: User Experience

When evaluating the user experience of OKX and KuCoin, it’s clear that both exchanges prioritize a seamless interface.

OKX offers a cutting-edge platform featuring a dark mode option that users find visually appealing and comfortable for long trading sessions.

The exchange is designed to cater to novice and seasoned traders, with an interface that facilitates easy navigation despite its wide array of services.

- Ease of Use: OKX has structured its platform to ensure that functions are readily accessible. The intuitive menu allows you to find various trading options without hassle.

- Speed: OKX’s engine is optimized for quick and efficient trades, critical in the fast-moving crypto market. To more about the exchange, check this OKX futures trading tutorial.

KuCoin, on the other hand, is acclaimed for its user-friendly platform tailored for a diverse trading audience. It boasts over a thousand tokens for trading, appealing to traders looking for a wide selection.

- Design and Functionality: KuCoin’s platform support for trading bots is particularly noteworthy for those who prefer automated trading solutions. To know more about it, check this KuCoin tutorial.

Both exchanges have mobile apps, extending their trading platforms’ functionality to the convenience of your smartphone. These apps encapsulate the core attributes of their web counterparts, aiming for:

- Accessibility: Manage your portfolio and trade anytime, anywhere.

- Consistency: A user experience that reflects the web platform optimized for touch interaction.

While OKX and KuCoin offer wholesome experiences overall, individual preferences on design elements, such as theme options and layout structure, will influence your choice.

Both platforms are committed to providing a comprehensive and user-friendly trading environment, but you may prefer one over the other based on personal comfort with their interfaces.

OKX vs KuCoin: Order Types

When you trade on OKX or KuCoin, you have access to various order types that enable you to implement your trading strategies effectively and manage your risks.

OKX:

- Market Orders: Execute trades immediately at the best available current price.

- Limit Orders: Set the maximum or minimum price you are willing to buy or sell.

- Stop Orders: Trigger a sell or buy order when the price crosses a specified threshold; useful for risk management.

- Conditional Orders: Carry out buy or sell orders when certain pre-set conditions are met.

- Post-Only Orders: Ensure the order is added to the order book but not immediately executed, allowing traders to pay only the maker fees.

- Reduce-Only Orders: Ensure that an order can only reduce your position, not increase it. It is ideal for managing positions while trading futures.

KuCoin:

- Market Orders: Allow immediate buy or sell at the current market price.

- Limit Orders: Provide control over the price you are willing to execute a trade.

- Stop Orders: Stop-Limit orders let you specify the price point at which the order should activate.

- Conditional Orders: Similar to OKX, they enable you to set conditions for the trade.

- Post-Only Orders: This guarantees you will pay the maker fee, not the taker fee.

- Hidden Orders: Keep your order invisible to other traders to prevent market price influences.

Both platforms cater to traders’ different styles and preferences by providing these diverse order types. Understanding and utilizing these order types allows you to tailor your trade execution to align with your trading goals and risk profile.

OKX vs KuCoin: Security Measures & Reliability

When evaluating the security of OKX and KuCoin, it’s essential to recognize that both platforms have experienced security incidents.

OKX had a hacking incident 2017, whereas KuCoin encountered a hack in 2020. Since these events, both exchanges have significantly increased their security measures.

OKX Security:

- Past Incident: Hack in 2017

- Resolution: OKX has fortified its security infrastructure.

- Current Measures:

- Two-factor authentication (2FA)

- Cold Storage for the majority of funds

- Regular internal and external security audits.

KuCoin Security:

- Past Incident: Hack in 2020

- Resolution: KuCoin responded by enhancing security protocols.

- Current Measures:

- Multi-layer encryption

- 2FA and additional safety measures for withdrawal

- Micro-withdrawal wallets for extra protection

- Cutting-edge security technology for asset protection

Both platforms acknowledge the gravity of security threats and proactively work to improve their systems to prevent future breaches.

Your assets on either exchange are secured with industry-standard practices, including encryption, 2FA, and cold storage solutions.

Given cryptocurrency exchanges’ competitive and ever-evolving nature, OKX and KuCoin continuously strive to offer a reliable trading environment.

They both have sizable user bases, and their responsiveness to past issues elucidates their commitment to your security and trust as a trader. It is, however, vital to perform personal due diligence when assessing the security of any exchange.

OKX vs KuCoin: Insurance Fund

When you choose a cryptocurrency exchange, one of the crucial factors you consider is the security of your funds. Both OKX and KuCoin understand this concern and have taken steps to safeguard your assets.

OKX maintains what they refer to as the Risk Reserve Fund. It is designed to protect and compensate users in case of unforeseeable losses arising from trading activities. The fund grows over time as a small percentage of trading fees bolsters its resources.

KuCoin, on the other hand, has implemented the Insurance Fund. This fund serves a similar purpose and is intended to protect against various risks, ensuring users’ interests are preserved during adverse situations.

If you face a financial loss due to a system or trading glitch on either platform, these funds are in place to potentially reimburse you, subject to the terms each exchange has specified. You need to review these terms to understand the extent of the protection afforded.

| Exchange | Type of Fund | Purpose |

|---|---|---|

| OKX | Risk Reserve Fund | Protects users against trading-related losses |

| KuCoin | Insurance Fund | Safeguards users’ assets against various risks |

Neither insurance fund protects against all forms of loss, such as user error or unauthorized access to your account due to compromised personal security measures.

Therefore, you should always exercise prudent security practices while relying on the safety netsexchanges provides.

OKX vs KuCoin: Customer Support

When choosing a cryptocurrency exchange, the quality of customer support is critical. KuCoin and OKX offer different approaches to help you with your trading needs.

- KuCoin:

- Comprehensive support: They’ve structured their service into several layers to ensure you can find help when needed.

- Communication channels: Your options include a help center, tickets, email, and live chat for timely assistance.

- Availability: Their teams work round-the-clock to resolve your queries, aiming for constant availability.

- OKX:

- Responsive assistance: OKX prioritizes quick and actionable responses to customer questions.

- Help options: You have access to support through various methods, which typically include a helpdesk, a ticketing system, and a direct line of communication for urgent matters.

- Educational resources: Beyond direct support, OKX provides educational materials to help you become more self-sufficient in solving issues.

You’re encouraged to use customer service interactions to gauge the responsiveness and effectiveness of each exchange. Feedback from existing users can also be a valuable source of insight into the support quality you can expect.

Should you encounter an issue, both KuCoin, and OKX understand the importance of swift resolution and aim to equip you with the necessary tools to trade confidently and with peace of mind.

OKX vs KuCoin: Regulatory Compliance

When comparing OKX and KuCoinregardingf regulatory compliance, you’ll find differences in how each platform navigates the complex world of cryptocurrency regulation.

OKX has faced specific regulatory challenges. For instance, jurisdictions such as the United States, United Kingdom, and Canada have previously imposed restrictions on the use of OKX, mainly stemming from the stringent regulatory frameworks in these countries.

In contrast, KuCoin has also encountered its share of regulatory scrutiny. While the platform offers a wide range of services globally, it operates under the regulatory radar in some countries due to the absence of a formal licensing regime for cryptocurrency exchanges.

Despite these challenges, both exchanges function and serve a global audience.

It is critical for you as a user to remain aware of the regulatory environment in your jurisdiction and to understand how it might affect your interaction with these platforms.

Moreover, always ensure that your services comply with local regulations to avoid any future legal complications.

| Exchange | Known Regulatory Issues | Compliance Efforts |

|---|---|---|

| OKX | Banned in some regions | Adheres to local laws where it operates |

| KuCoin | Regulatory scrutiny | Currently unlicensed but operational |

Your due diligence is a crucial aspect of engaging with cryptocurrency trading platforms, and it’s advisable to periodically check for updates regarding the regulatory status of OKX and KuCoin in your region.

Remember, the landscape of crypto regulation is continuously evolving, so staying informed is critical to ensuring compliance on your part.

Conclusion

When considering KuCoin and OKX as your go-to cryptocurrency exchange platforms, your choice hinges on your trading preferences and requirements.

- For Traders Seeking Fee Discounts and Gamification: If you appreciate trading contests and gamified trading experiences, you might find KuCoin appealing due to its promotional activities. Moreover, KuCoin offers a 0% maker fee, which can be particularly advantageous if you’re frequently creating market liquidity.

- For Users Prioritizing Lower Fees Across Various Tiers: OKX users benefit from a 0.06% maker and taker fee at level 5, which is competitive in the market. Additionally, using OKX’s native OKB tokens or KuCoin’s KCS tokens can yield a 20% discount on fees, which is particularly beneficial if you prefer paying fees with native exchange tokens.

- For Investors Interested in Futures Trading: Both platforms set a base futures trading maker fee at 0.02%, positioning them equally for users interested in this type of trading.

- Security-Minded Users: If security is a paramount concern, remember KuCoin’s historical security incident. However, this should be balanced with recognizing that both exchanges have taken steps to enhance security measures and customer support.

- Volume and Variety Seekers: KuCoin and OKX are known for their wide array of trading pairs and volume, placing them among the top choices for users looking for variety and high liquidity.

Your choice should align with your trading strategy, desired fee structure, security considerations, and various available trading options. As a trader or investor, aligning platform features with your goals is crucial in cryptocurrency trading.

Compare OKX and KuCoin with other major exchanges