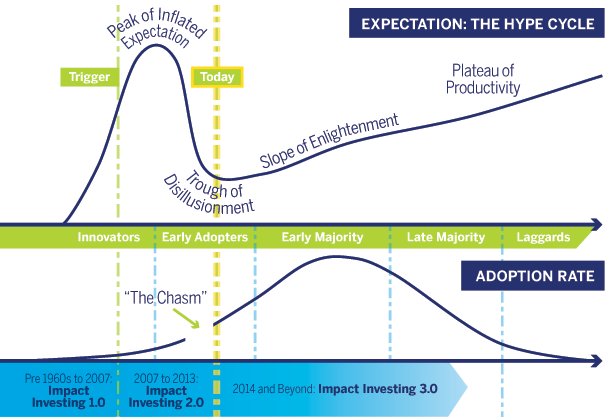

Impact IQ — Emerging technologies follow a path to market adoption so well worn that it is known simply as “the hype cycle.” A hot new product category reaches the “peak of inflated expectations” only to inevitably crash in the “trough of disillusionment.” After a reset, the survivors climb the “slope of enlightenment” to the “plateau of productivity.”

Impact IQ — Emerging technologies follow a path to market adoption so well worn that it is known simply as “the hype cycle.” A hot new product category reaches the “peak of inflated expectations” only to inevitably crash in the “trough of disillusionment.” After a reset, the survivors climb the “slope of enlightenment” to the “plateau of productivity.”

“Impact investing” is an emerging set of financial practices more than a new technology, but it has also suffered a backlash of disillusionment after exciting sky-high expectations. Where are the deals? There’s no track record of exits or returns. Social impact is too tough to measure. Impact investing is just dressed-up philanthropy. And so on.

But just as some early champions of impact investing have begun to feel fatigued by the challenge of adequately explaining its potential, new institutions and individual investors are stepping forward to adopt a range of impactful approaches.

At the risk of again inflating expectations, impact investing’s climb up the slope of enlightenment stands to catalyze hundreds of billions of dollars over the next decade for investments in smallholder agriculture and food security; access to basic services such as water, electricity and sanitation; small business and economic development in both developing countries and U.S. inner cities; businesses led by and serving women and girls; sustainable real assets such as timber, energy efficiency and wastewater treatment; and many other sectors.

As global population approaches nine billion, the emerging global middle class is creating unstoppable demand for food, water, energy, education, healthcare, financial services, housing and sanitation. Resource constraints and climate change demand disruptive innovation and radical efficiency.

That makes impact a signal for long-term outperformance. And makes impact investors pioneers in a new global economy.

Call it impact investing 3.0…

The growth of dedicated impact venture-capital or private equity funds won’t be enough. To really climb that slope of enlightenment, impact investing will have to attract the mass market of smaller “retail” investors and the “real money” of major pension funds, insurance companies and sovereign wealth funds. That shift has barely begun — but it has begun.

The frontier for impact investing, then, is to match different kinds of investors with the deals that give them the kind of returns they are looking for, in terms of upside opportunities, downside risks and social and environmental benefits. David Chen of Equilibrium Capital Partners suggests that represents an opportunity for the financial industry to rebuild its reputation through financial innovation aligned with environmental sustainability and economic inclusion.

Just as financiers in recent decades have learned to dissect and repackage risky assets — say, turning subprime mortgages into investment-grade instruments — so too can they dissect and repackage benefits, so that positive social and environmental impacts can be valued and priced and sold to investors with those expectations for their portfolios.

“When the economics are aligned, when the incentives are aligned, when the language is aligned,” Chen says, “the capital markets can react at a blindingly fast speed.”

Read the full story in Freshwater, the magazine of the Freshwater Trust.

Author’s note:

Impact industry insiders will notice that putting “3.0” in the headline represents a rapid acceleration of the field, given that the impact investing industry’s leading trio of researchers last month released another excellent report ushering in the new era of impact investing, 2.0.

I’m not trying to incite an arms race, nor a debate on fine points of nomenclature. I have already saluted Cathy Clark, Ben Thornley and Jed Emerson for crisply laying out the successes and challenges of a dozen impact funds that are plowing the hard ground of actual practice in these early years. (See “Impact Investment Performance: Tiptoeing Toward Transparency.”)

There’s no disagreement: a new stage is coming — must come — when capital at scale flows to compelling investments in the sustainable and inclusive future. At that tipping point, nobody will care about the version number.

We all do care about the flow of capital. Impact IQ, and our sister site ImpactSpace.org is tracking that flow through the companies, the investors and the deals that are creating value in this emerging era. So I accepted eagerly when Joe Whitworth, Adrian McCarthy and their team at Freshwater Trust invited me to do a kind of year-end look-ahead for Freshwater, their fresh and appealing magazine.

The evolution of Freshwater Trust itself is a microcosm of the industry’s. Freshwater’s innovative water quality trading mechanism finances water-cooling stream restoration projects through “credits” bought by industrial users. (Full disclosure, Impact IQ and Freshwater share a board member, David Chen, co-founder and principal of Equilibrium Capital Partners in Portland, where Freshwater is also based.) In the coming year, Impact IQ will be tracking that kind of shift from philanthropic or government funding to commercial financing for conservation projects, a major Impact 3.0 trend.

The full issue of Freshwater is well worth reading, with an excellent feature by Julia Bond on high-tech solutions in water, deforestation and energy efficiency, and Brad Kahn’s good description of the Bullitt Foundation’s new “net zero” headquarters building in Seattle, which itself pioneered an innovative new kind of project financing (see “MEETS: Generating ‘Non-Energy’ to Drive Revenues from Efficiency.”)

Impact IQ provides original reporting and analysis for investors and entrepreneurs pursing social, environmental and financial returns.