While platforms like TikTok and Instagram are often associated with viral dance trends and influencer updates, many young people, particularly those between 18 and 41, are using them for something far more severe—investment advice.

A Forbes report revealed that nearly 80% of young adults now turn to social media platforms like TikTok, YouTube, and Instagram for financial advice.

With hashtags like #StockTok and videos promising the next big stock pick, social media has quickly become the go-to place for financial guidance.

Intrigued by this report and trend, the Social Capital Markets team sought to investigate how much of this advice is genuinely helpful and credible.

But is it reliable? Our investigation suggests otherwise, revealing that much of the online advice may not be as helpful as it seems.

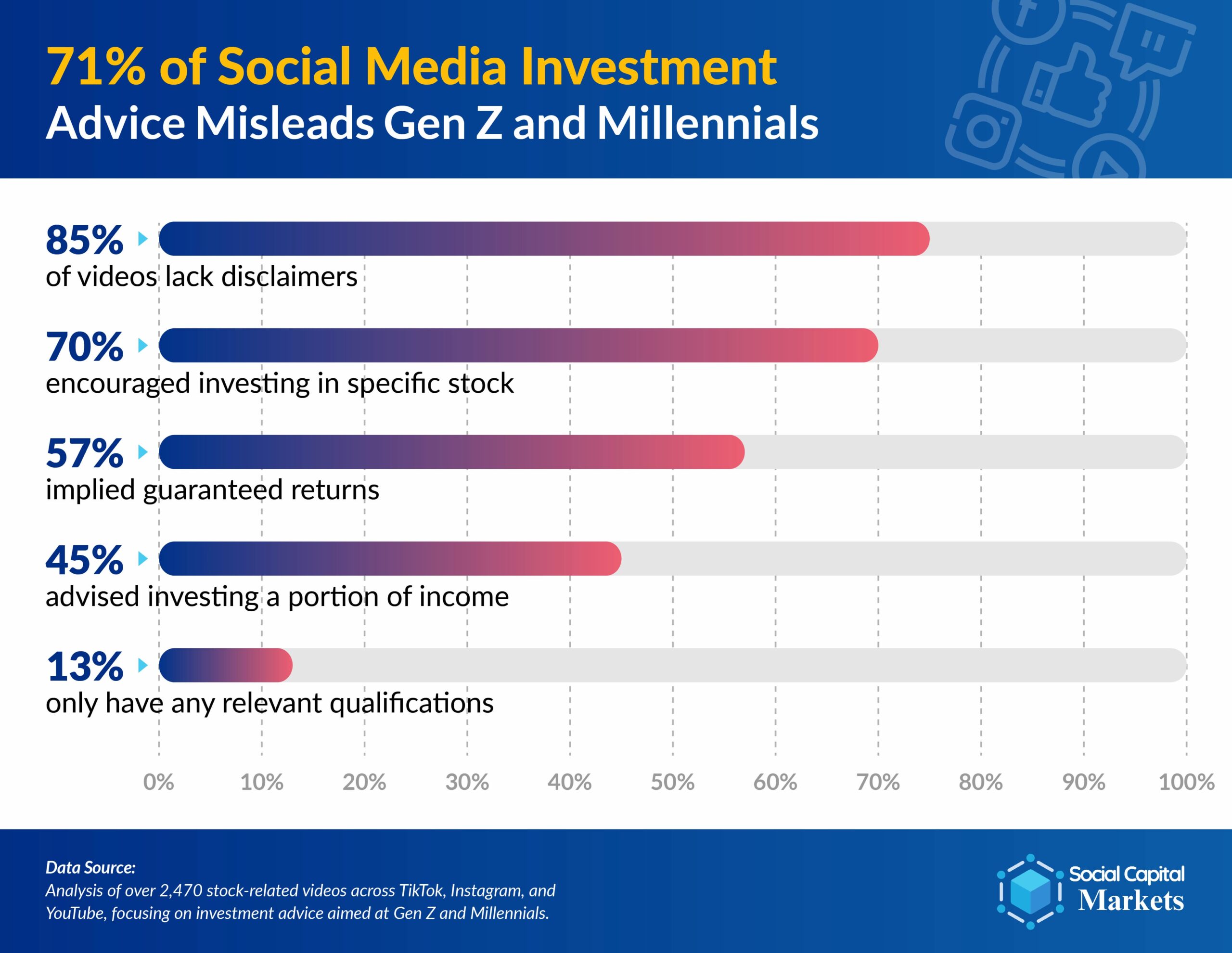

A comprehensive analysis of over 2,470 stock-related videos across these platforms found that 71% of the financial advice young adults consume is misleading.

This raises significant concerns about whether social media is a trustworthy source of financial guidance or a potential minefield leading younger generations toward costly mistakes.

Key Insights from the Study

- 83% of videos lack disclaimers: Most videos analyzed did not adequately warn about the risks associated with investing, leaving viewers with a one-sided picture of financial decisions.

- 70% encouraged stock-specific investments: Many videos actively promoted specific stock picks without offering adequate context or addressing risks.

- 57% implied guaranteed returns: Many videos implied that following their investment advice would guarantee wealth or returns, a highly misleading notion given the volatile nature of stock markets.

- 45% encouraged viewers to invest a specific proportion of income: A concerning number of videos suggested how much of their income viewers should invest, a highly personal decision that should be made based on individual financial situations.

- 13% only have relevant qualifications or credentials to speak about anything in financial matters.

#1. TikTok: The Wild West of Financial Advice

Among the platforms analyzed, TikTok emerged as the most problematic, with 91% of videos lacking disclaimers and 70% encouraging stock purchases.

TikTok’s short, fast-paced nature makes it a breeding ground for viral financial advice that’s often boiled down to quick tips rather than well-rounded insights.

TikTok also led the platforms in implying guaranteed returns (65%) and encouraging viewers to invest specific portions of their income (50%). This could be risky for novice investors, especially Gen Zers, who may still grapple with student loans and low starting salaries.

#2. Instagram: The Visual Appeal of Quick Wealth

Instagram, though visually appealing, also had troubling statistics. 88% of Instagram videos lacked disclaimers, and 65% encouraged specific stock investments.

The platform had the lowest rate of content implying guaranteed returns (50%) and pushing specific income-based investments (40%), but these numbers still indicate a widespread issue with misleading advice.

#3. YouTube: More Depth, But Transparency Issues

While 76% of YouTube videos failed to include disclaimers, the platform was still more aggressive in pushing specific stock picks, with 75% of the content analyzed promoting particular investments.

Although YouTube’s longer-form video format allows for deeper discussion, a significant portion of the videos lacked the necessary transparency to help users make informed financial decisions.

55% of the YouTube videos implied guaranteed returns, while 45% suggested viewers invest specific amounts of their income, adding to the concern that many viewers are receiving potentially harmful advice.

Riskiest Platform Overall for Financial Advice

Based on our data, TikTok is the riskiest platform overall for financial advice. Here’s why:

- 91% of TikTok videos lack disclaimers, meaning that most content doesn’t adequately inform viewers of potential risks or conflicts of interest.

- 70% of TikTok videos actively encourage viewers to invest in specific stock assets, which is highly risky for novice investors, mainly if these stock picks aren’t backed by thorough analysis.

- 65% of TikTok videos imply guaranteed returns, creating a false sense of security and promising unrealistic outcomes from stock investments.

- 50% of TikTok videos encourage viewers to invest a particular proportion of their income, which can be financially irresponsible without considering individual circumstances.

What Are Crypto Influencers Focusing On?

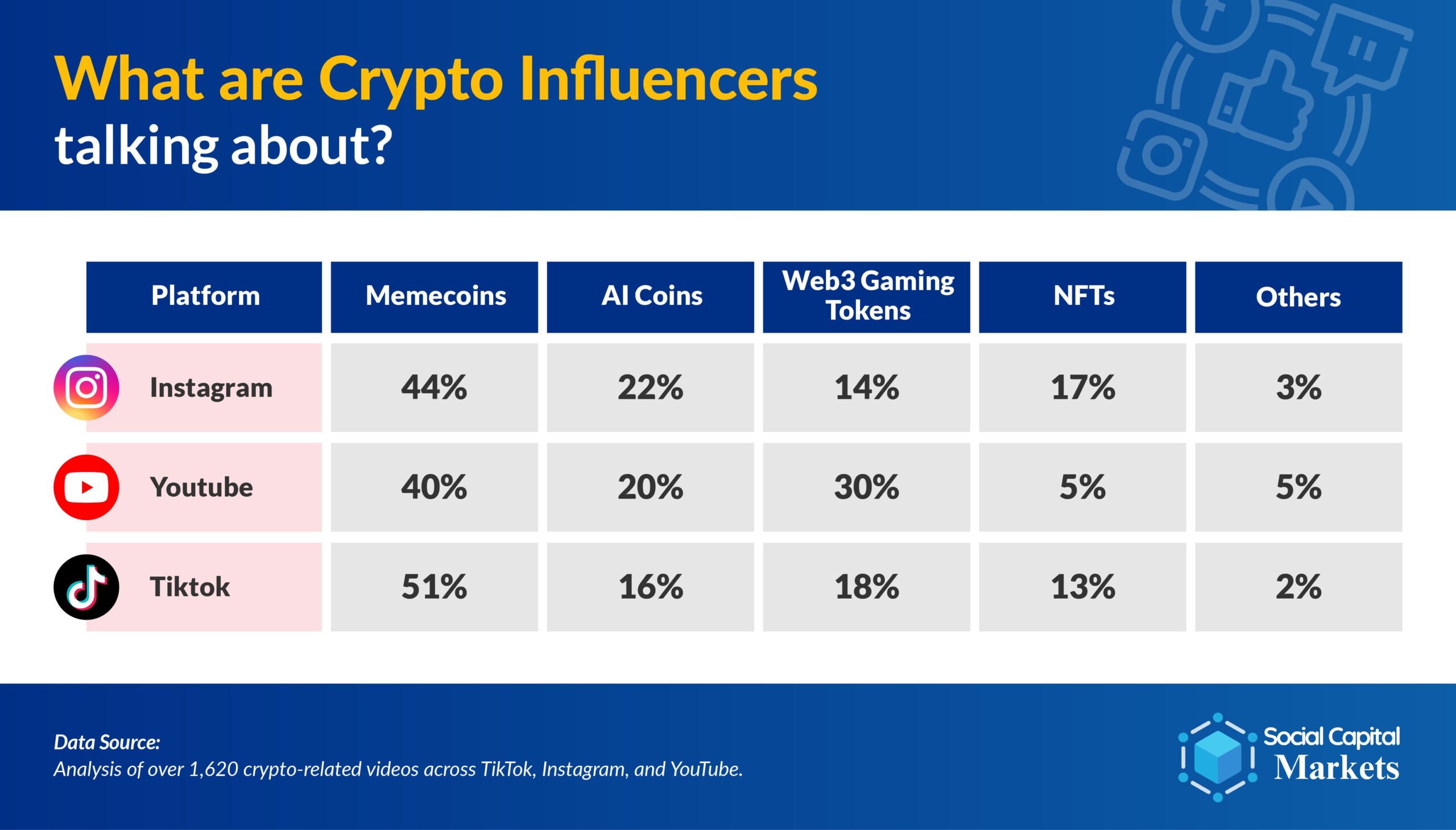

Continuing our analysis of crypto influencers on TikTok, YouTube, and Instagram, we found similar trends in the content predominantly consumed by Gen Z & Gen Y.

- Memecoins Lead the Conversation: Memecoins like Dogecoin and Shiba Inu are the most talked-about assets across all platforms.

- 51% of TikTok influencers discuss memecoins, making it the leading platform for these speculative investments.

- Instagram isn’t far behind, with 44% of influencers focusing on memecoins, followed by 40% on YouTube.

- AI Coins Gain Traction: AI coins, or cryptocurrencies focused on artificial intelligence technologies, are gaining popularity.

- 22% of Instagram influencers discuss AI coins, while YouTube and TikTok feature 20% and 16% respectively.

- Web3 Gaming Tokens: These tokens, often associated with decentralized games and virtual worlds, are most prominent on YouTube, where 30% of influencers cover this niche.

- 18% of TikTok influencers and 14% of Instagram influencers also talk about Web3 gaming tokens, highlighting the cross-platform interest in this emerging sector.

- NFTs Losing Steam?: While once a hot topic, NFTs (non-fungible tokens) are seeing lower engagement in other crypto categories.

- 17% of Instagram influencers still cover NFTs, with 13% on TikTok and only 5% on YouTube discussing them regularly.

- Other Cryptocurrencies: A small percentage of influencers focus on different cryptocurrencies, such as more traditional assets like Bitcoin or Ethereum, but these numbers are comparatively low—5% on YouTube and 3% on Instagram.

Should You Trust Social Media Financial Advice?

The lack of clear regulations around financial advice on platforms like TikTok and Instagram means that influencers with little or no financial background can offer recommendations with little accountability.

As a result, many young investors rely on tips that may not suit their financial situation.

Given the volatility and the rapidly evolving nature of the crypto market, these trends point to an even more hazardous environment for young investors, especially those who turn to social media for quick and easy advice.

However, being skeptical and not taking everything at face value can be a good strategy if you rely entirely on social media’s financial advice.

Methodology

Our research analyzed 2,470 TikTok, YouTube, and Instagram videos, focusing on popular finance-related accounts. We sourced videos by searching relevant hashtags like #StockTok, #Investing, and #Stocktips, ensuring each account had substantial viewership and engagement.

We reviewed the scripts of these videos, assessing whether they included disclaimers and evaluating if they encouraged viewers to invest in specific assets, implied guaranteed returns, or recommended a specific proportion of income to invest. A video was deemed “misleading” if it lacked a disclaimer and met one or more of the above criteria, indicating a potential risk to viewers, particularly inexperienced investors.

We also studied 1,620 crypto-related videos to identify the trend of “What Are Crypto Influencers Focusing On?” across memecoins, AI coins, Web3 gaming tokens, and NFTs