How to Short Crypto on Bybit in 2025: A Step-by-Step Guide

Written by Larry Jones

Hi, I'm Larry Jones, an Financial Management graduate from Franklin University, where I focused on Finance. With a deep passion for trading and investing, I've immersed myself in the dynamic world of financial markets. Currently, I dedicate my time to trading while also educating others about the exciting opportunities in cryptocurrencies. Through my experience and expertise, I aim to make complex financial concepts accessible to everyone. Whether you're a seasoned trader or new to the world of investing, my goal is to provide you with valuable insights and practical knowledge to help you navigate the world of cryptocurrencies with confidence.

Expert Reviewed

This article has been reviewed by crypto market experts at SCM to ensure all the content, sources, and claims adhere to the highest standards of accuracy and reliability.

Last Updated on June 25, 2025

Bybit has quickly become a popular platform for shorting cryptocurrency, offering tools that cater to both beginner and experienced traders.

With up to 100x leverage on futures trading, Bybit allows traders to profit even in bearish markets.

Whether you’re hedging or taking advantage of market downturns, this guide will help you short crypto successfully on Bybit.

Short-selling on Bybit lets you turn price declines into potential gains. This article covers how to initiate short positions, set up margin trading, and manage risk effectively, providing you with the knowledge to confidently short crypto.

To maximize Bybit’s platform, understanding key strategies like Perpetual Contracts and crypto put options is crucial for optimizing your trading decisions.

How to Set Up Your Bybit Account For Shorting Crypto?

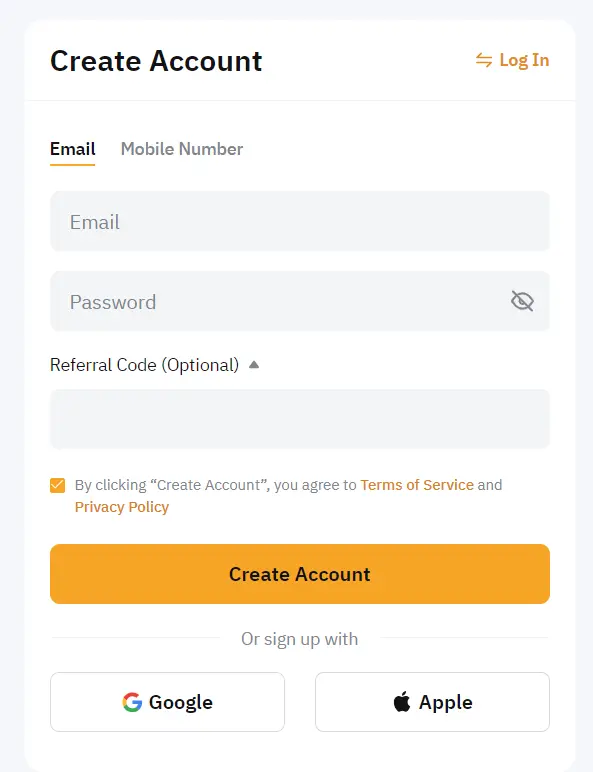

Step 1: Create a Bybit Account

First, visit the Bybit website or download the mobile app.

Choose to sign up with an email address or mobile number. Fill in your details and check the consent box. Click the “Sign Up” button.

Be sure to verify your email to complete the registration process.

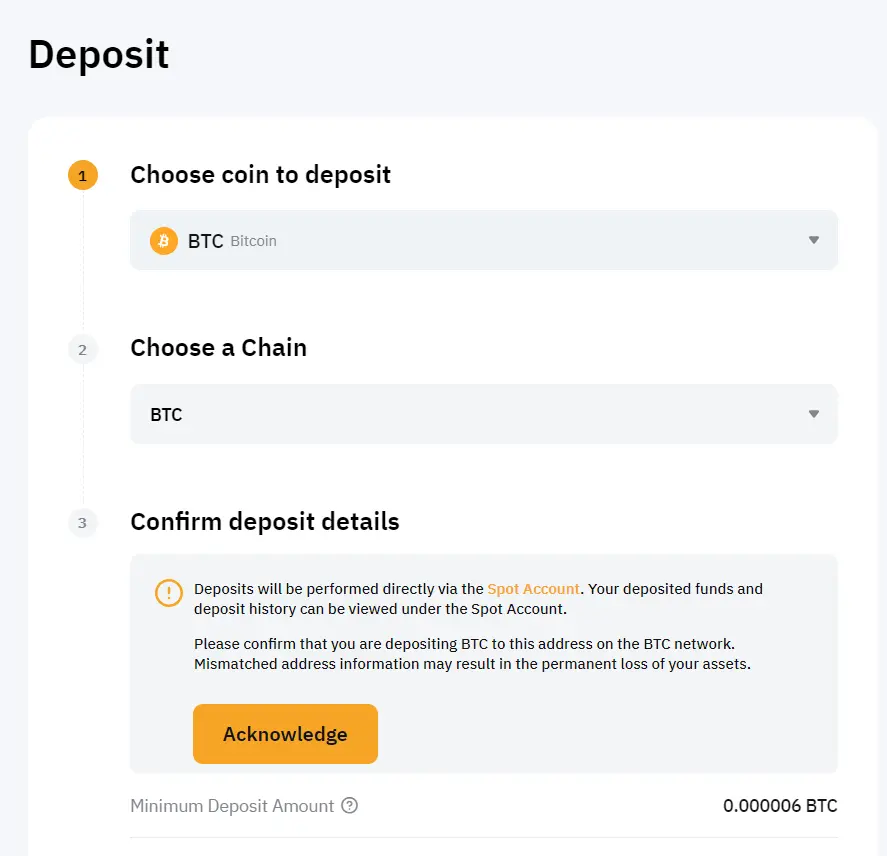

Step 2: Deposit Funds

After registering, you need to deposit funds into your Bybit account. You can deposit cryptocurrencies like BTC, ETH, or USDT, or use fiat via credit/debit card.

Funds are credited to your spot wallet, making them available for trading.

How to Short on Bybit Using Margin Trading

Step 1: Activate Margin Trading

Navigate to “Trade” and select “Margin Trading” to enable margin trading on the Bybit platform.

Step 2: Transfer Funds to Margin Wallet

Transfer funds from your spot wallet to the margin wallet using the “Transfer” button.

Step 3: Borrow Funds

Click “Borrow” and select the asset to borrow, such as BTC or USDT. Enter the amount and confirm the loan. Bybit offers up to 5x leverage for margin trading.

Step 4: Enter a Short Position

Select the trading pair, for example, BTC/USDT. Choose the order type: limit, market, or stop limit. Set the leverage amount and execute the short sell order by clicking “Sell/Short.”

Step 5: Manage the Position

Use take profit and stop loss orders to manage your risk.

Step 6: Repay Borrowed Funds

After closing your trade, repay the borrowed amount plus interest by clicking the “Repay” button.

Following these steps ensures you can efficiently short on Bybit using margin trading.

How to Short on Bybit Using Futures Trading

Step 1: Open a Bybit Futures Account

To start, create a Bybit account following the standard registration steps for margin trading. You can sign up on their website or mobile app.

Step 2: Deposit Funds to Bybit

Deposit funds into your spot wallet. Afterward, transfer the funds to your futures account using the “Transfer” button. You’ll need sufficient funds to cover your positions and potential losses.

Step 3: Choose the Futures Contract

Select the futures contract you wish to trade. For instance, you can choose the BTC/USDT Perpetual contract.

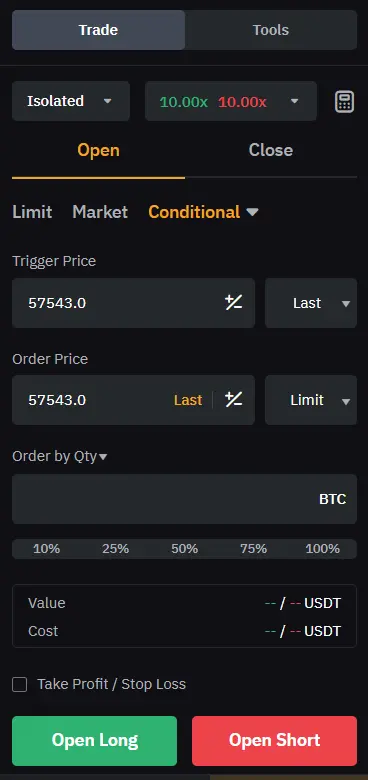

Step 4: Place a Short Order

You have several order types to choose from:

- Market Order: Executes immediately at the best available price.

- Limit Order: Executes at your specified price.

- Conditional Order: Activates when a trigger price is reached.

Example: Place a limit short order for BTC at $20,970.9 with 5x leverage. Use the leverage to amplify your position.

Step 5: Manage the Position

Monitor your open positions continuously. Adjust your take profit and stop loss orders to manage risk. Be proactive in managing your trades to minimize potential losses.

Step 6: Close the Position

Close your position using either a market or limit order once your target is met. Example: Close the position at $18,000 to secure your profit. Remember to repay any borrowed funds and interest promptly to avoid additional costs.

Practical Examples and Case Studies

Example: Successful Short Trade

Consider you borrow 1 BTC at $35,000. You sell it immediately, expecting the price to drop.

When the price reaches $30,000, you buy back the 1 BTC and return it. Your profit from this transaction is the difference between the selling and buying prices, which is $5,000.

Case Study: Risk Management

Assume you short 0.5 BTC at $40,000 with a target repurchase price of $35,000. In this scenario, using a stop-loss order at $42,000 can help manage your risk.

Goal: Avoiding substantial losses during unexpected market volatility.

| Step | Action | Rationale |

|---|---|---|

| 1 | Short 0.5 BTC @ $40K | Initiate the short-selling action |

| 2 | Set Stop-Loss @ $42K | Protect your position from adverse movement |

| 3 | Target Buy @ $35K | Realize profit if market moves as expected |

Practical Example: Leveraged Short

You opt for a 5x leverage to short 0.8 BTC when BTC price is $50,000. This increases your exposure to $4,000.

If the price drops to $45,000, your effective exposure translates to $35,000 (excluding fees and interest), producing significant gains from a smaller initial margin.

Case Study: Using Crypto Put Options

Instead of directly borrowing and selling, you use crypto put options. Purchase a put option with a strike price of $35,000, expiring in one month.

If BTC’s price falls below this strike price, you exercise the option to sell BTC at $35,000, even if the market price is lower, securing profits.

Using a balanced approach with practical examples and calculated risk management strategies can enhance your shorting experience on Bybit.

Frequently Asked Questions

Gain insights into initiating a short position on Bybit, the potential for simultaneous long and short positions, using Bybit’s mobile app for shorting, and more.

What are the steps to initiate a short position on the Bybit platform?

To start shorting crypto on Bybit, create an account, deposit funds, and navigate to the trading interface. Choose the BTC/USD trading pair, select Isolated Margin or Cross Margin, transfer your collateral, and initiate the short position.

Is it possible to engage in both long and short positions simultaneously on Bybit?

Yes, Bybit allows traders to open both long and short positions at the same time. This can be done using different orders and managing each position separately on the trading interface.

What is the process for shorting cryptocurrencies using Bybit’s mobile application?

To short cryptocurrencies using the Bybit mobile app, first, download the app and log in to your account. Navigate to the relevant trading pair, transfer collateral, and set up your short position by choosing the appropriate margin type and order.

Does Bybit support short selling, and if so, what are the prerequisites?

Bybit supports short selling through margin trading. You need to create an account, verify your identity, deposit funds, and choose the appropriate margin type for your short trade. Ensure you understand the leverage options and margin requirements before proceeding.

How can one manage risk when shorting on Bybit?

Managing risk when shorting on Bybit involves setting stop-loss orders, using proper leverage, and continuously monitoring market conditions. It’s crucial to have a clear risk management strategy to minimize potential losses.

Can you provide guidance on executing a short trade for altcoins like Solana on Bybit?

To short altcoins like Solana on Bybit, log in to your account, select the Solana trading pair, transfer your collateral, and choose the margin type. Place a short order, monitor the trade, and set stop-loss levels to manage risk.

Conclusion

Shorting on Bybit allows you to profit from market downturns. Begin by selecting your trading pair and choosing between Isolated Margin or Cross Margin. Transfer your collateral to the exchange and start automatic borrowing.

Key Steps:

- Select Trading Pair: Choose the BTC/USD interface.

- Transfer Collateral: Use the “Transfer” feature.

- Short/Sell: Enter your short position.

Each step is crucial, so ensure you understand the process before committing real funds.

It’s highly recommended to practice using a demo account. This will help you grasp the mechanics of shorting without risking your capital.