In finance, few things have defied traditional expectations more than the rise of memecoins—cryptocurrencies born from internet humor and online communities.

From Dogecoin to Shiba Inu, these internet memes have rapidly climbed the ranks in market capitalization, sometimes eclipsing well-established Nasdaq-listed corporations in the process.

What started as a joke is now commanding billions of dollars and reshaping conversations about the future of investing, attracting attention from both retail investors and financial heavyweights.

Key Insights & Stats:

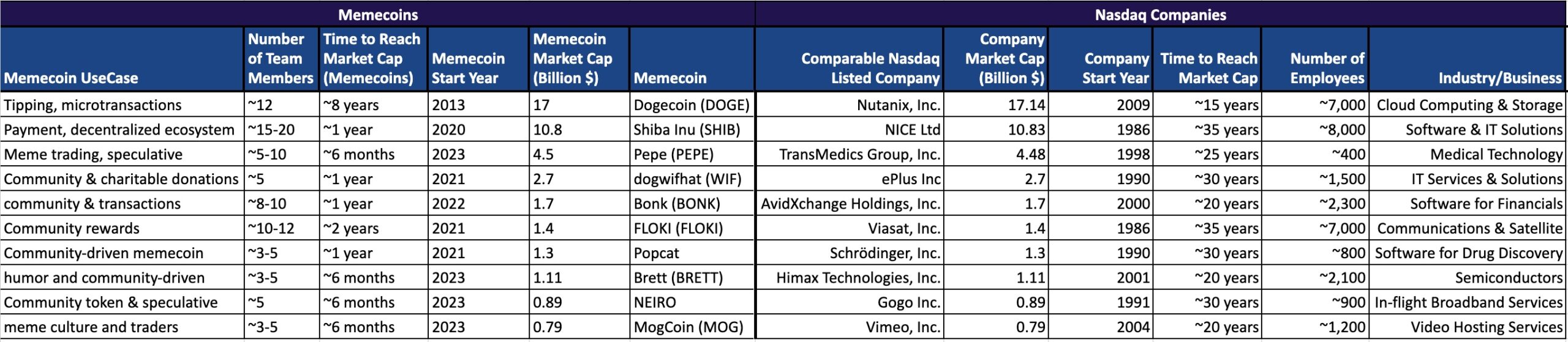

- Dogecoin [DOGE] vs Nasdaq Comparison: Dogecoin’s market cap of $17 billion is on par with Nutanix’s $17.14 billion in just 8 years with a team of around 12 members, competing with Nutanix Inc., which took 15 years and employs 6,000 people to reach a similar valuation.

- Shiba Inu (SHIB) achieved a market cap of $10.8 billion in just 1 year, while NICE Ltd., founded in 1986, took 35 years to reach a comparable market cap.

- Pepe Coin (PEPE) hit a market cap of $4.5 billion in 6 months, outpacing TransMedics Group, Inc., which took 25 years to reach a similar valuation.

- The number of people involved in dogwifhat (WIF) project is approximately 5, yet it reached a $2.7 billion market cap, rivalling ePlus Inc., which employs over 1,500 people.

- Popcat reached a market cap of $1.3 billion in just 1 year with a team of 3-5 members, rivaling ePlus Inc., which took 30 years to achieve the same with thousands of employees.

- Brett (BRETT), humor and community-driven memecoin hit $1.11 billion in 6 months, with a small team of 3-5 members, outpacing companies like TransMedics, which needed 25 years for comparable growth but with 400 employees working day & night for them.

- NEIRO, with a market cap of $0.89 billion in 6 months with a team of only 5 members, dwarfs companies like NICE Ltd, which took 35 years to reach a similar valuation.

- MogCoin (MOG) reached $0.79 billion in 6 months, with a lean team of 3-5 members, challenging companies like NICE Ltd., established in 1986.

- Traditional companies took an average of 25-35 years to reach billion-dollar valuations, while memecoins like Shiba Inu and Pepe achieved similar valuations in less than a year.

Memecoins vs Nasdaq Companies: How Memecoins Compete with Corporate America

Take Dogecoin, for example, which started as a satirical cryptocurrency in 2013.

With a market cap of $17 billion, it rivals the valuation of Nutanix, a cloud computing and storage company founded in 2009, which has a similar market cap of $17.14 billion.

However, while Nutanix took over 15 years to achieve this value, Dogecoin peaked in just eight years—primarily driven by a viral online culture and celebrity endorsements.

Even more extreme, Shiba Inu, another memecoin launched in 2020, reached a market cap of $10.8 billion within a year. In contrast, NICE Ltd, an IT and software solutions company founded in 1986, took over 35 years to reach a comparable valuation.

These rapid rises highlight a stark difference between traditional business growth and the explosive, speculative nature of cryptocurrencies.

Top 5 Reasons For The Rise of Memecoins

- The Power of Community

- New Generation, New Investments

- The Role of Speculation and Hype

- A New Financial Paradigm?

- A Cultural Shift in Financial Markets

#1. The Power of Community

One key reason for the rapid rise of memecoins is the collective power of online communities. Platforms like Reddit, Twitter, and TikTok have allowed memecoins to gain viral momentum in ways that traditional stocks rarely experience.

Investors are drawn to memecoins not because of their utility or underlying technology but because they represent a cultural movement that disrupts the conventional rules of investing.

These communities foster a sense of belonging and shared belief, allowing these digital tokens to reach valuations previously reserved for well-established companies.

#2. New Generation, New Investments

Memecoins have attracted a younger generation of investors who view digital assets as a way to bypass traditional financial institutions.

Many of these investors have grown up immersed in social media and internet memes, making the leap into memecoin investing a natural extension of their online culture. This movement aligns with a broader trend of younger investors favoring digital assets over traditional stocks and bonds.

Additionally, memecoins’ low barrier to entry allows anyone with a smartphone and a small amount of capital to participate in this speculative market.

#3. The Role of Speculation and Hype

The power of speculation and viral hype is another driving force behind memecoins’ explosive rise.

Unlike traditional stocks, whose value is often tied to financial performance, memecoins’ value can skyrocket based on influencer endorsements, viral posts, or even a meme going viral.

A single tweet from a celebrity like Elon Musk can soar prices, only to plummet just as quickly as the buzz fades. This unpredictability adds to the allure for many, even as it amplifies the risks.

#4. A New Financial Paradigm?

Memecoins represent a departure from traditional financial norms, where value is typically tied to tangible assets, earnings, and broader market conditions.

In the case of memecoins, value is derived almost entirely from collective belief, virality, and the engagement of the communities behind them. While highly speculative, this ability to create value through decentralized community support is a hallmark of the shift toward decentralized finance.

Memecoins may not adhere to traditional investment paths, but their rise signals a broader trend toward democratized markets and alternative forms of value creation.

#5. A Cultural Shift in Financial Markets

The rise of memecoins signals more than just a speculative frenzy. It speaks to a broader cultural movement where the democratization of finance, powered by social media and online communities, is challenging traditional institutions.

Investors once locked out of early-stage opportunities in traditional markets can now participate in the explosive growth of digital assets with just a smartphone and an internet connection.

The Future of Memecoins and Corporate America

As memecoins continue to challenge the norms of traditional finance, questions remain about their sustainability. Will the next decade see them evolve into more sophisticated financial products, or will they remain speculative assets driven by internet culture?

What’s clear is that their rapid rise is forcing a re-evaluation of how value is created in modern markets.

Corporate America, with its centuries-old institutions, may not be going anywhere, but it’s being challenged in ways that were unimaginable just a few years ago.

Memecoins, born from internet jokes and Reddit threads, have shown that market value isn’t always tied to traditional metrics like earnings reports or product roadmaps. Sometimes, it’s simply a matter of being in the right meme at the right time.

Memecoins, with their playful branding and community-driven ethos, have achieved valuations that rival long-established corporate giants. While speculative and volatile, their rise is a testament to community power and modern finance’s shifting dynamics.

The comparison between memecoins and Nasdaq-listed companies shows that value in the digital age is no longer solely determined by traditional metrics. Instead, it is increasingly shaped by the collective belief of online communities, with memecoins leading the charge in this new financial paradigm.

Whether they are a temporary phenomenon or a lasting fixture in the financial landscape, their impact is undeniable.

Methodology

We selected the top 10 memecoins from CoinMarketCap, ranked by market capitalization, and identified 10 Nasdaq-listed American companies with comparable market capitalizations with a cut-off time of data collection at 15th October 2024 by 7:00 am, Eastern Time (ET)

The analysis focused on the contrasting trajectories of these two categories, examining factors such as the number of individuals involved, the time taken to reach their current market caps, and their primary use cases or business operations. These parameters form the basis of the findings presented here.