How To Leverage Trade Crypto On Binance !?

Written by Sudhir Khatwani

Sudhir Khatwani holds a bachelor's degree from Vellore Institute of Technology and has made significant contributions as a Programmer Analyst at Cognizant, where he worked on critical projects for leading financial institutions like MUFG and CITI Bank. His technical expertise and analytical skills have been instrumental in delivering high-impact solutions within the financial sector. His expertise in digital assets and blockchain technology was further honed through his previous role as a content strategist for the prominent cryptocurrency exchange, CoinSwitch.

Expert Reviewed

This article has been reviewed by crypto market experts at SCM to ensure all the content, sources, and claims adhere to the highest standards of accuracy and reliability.

Last Updated on June 30, 2025

Leverage trading can dramatically enhance your crypto trading experience on Binance by allowing you to engage with more significant positions than your original capital.

Using borrowed funds can amplify your buying or selling power, providing the opportunity for potentially higher profits. However, this increased power also comes with increased risk.

You’ll need to understand the basic concepts of leverage and margin to get started. Leverage refers to using borrowed funds to increase the size of your trades.

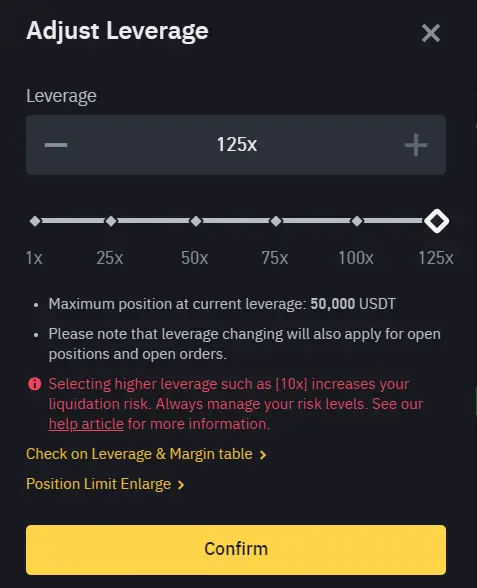

For example, if you have $1,000 and use 10x leverage, you can control a position worth $10,000. On Binance, you can choose leverage ranging from 1x up to 125x, making it a flexible platform for traders at all experience levels.

Navigating the Binance interface is straightforward, but setting your leverage correctly is crucial.

You can adjust your leverage by clicking on the [20x] icon in your futures trading interface, where a pop-up will allow you to change the leverage settings according to your strategy.

Understanding how to manage these settings and the associated risks is critical to successfully leveraging your trades on Binance.

Setting Up For Leverage Trading On Binance

Choosing the proper cryptocurrency exchange is crucial. Binance offers a robust platform for leverage trading with features designed to cater to beginners and experienced traders.

When selecting an exchange, consider fees, security, user interface, and available leverage ratios.

Binance typically offers up to 125x leverage on some futures contracts, making it a competitive option. Other exchanges like BitMEX, Bybit, Kraken, and MEXC also provide leverage trading but may vary in fees and features.

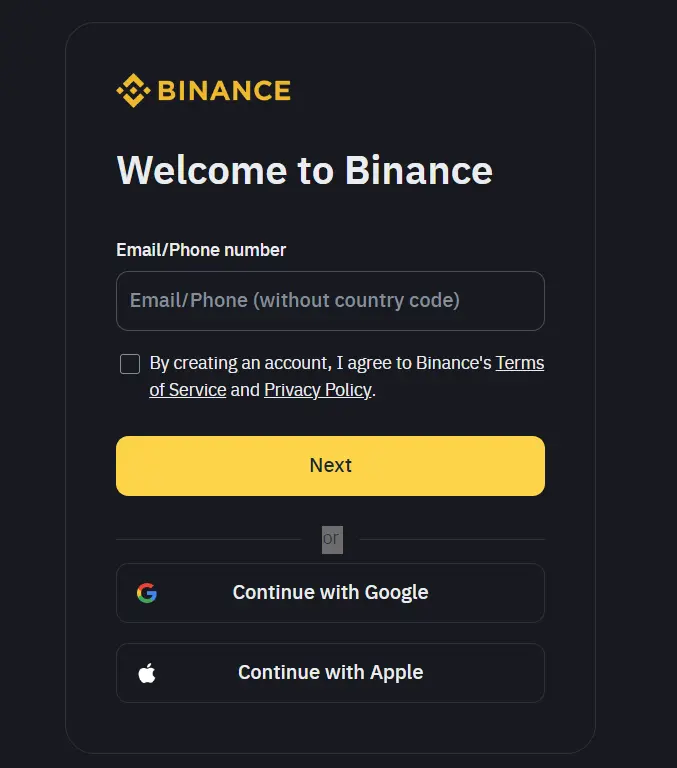

Creating and Funding Your Account:

- Registration: Start by visiting the Binance website and clicking the “Register” button. Fill out the required information, including your email and password.

- Identity Verification (KYC): To comply with regulations, you must complete identity verification. This involves providing personal information and uploading identification documents. Navigate to the “Verification” section to begin this process.

- Funding Your Account:

- Fiat Deposits: Transfer funds directly from your bank account.

- Crypto Deposits: Send cryptocurrencies to your Binance wallet.

- Credit/Debit Card: Use your card for instant deposits.

Leverage trading on Binance requires transferring funds to your Margin or Futures account.

Navigate to the desired account and select “Transfer” to move your funds. This setup ensures that you are ready to start leverage trading efficiently.

How To Leverage Trade Crypto On Binance

Step 1: Select the Trading Pair

First, choose the cryptocurrency pair you want to trade, such as BTC/USDT. Ensure the selected pair has good liquidity and manageable volatility to avoid excessive price slippage.

Step 2: Choose Leverage Ratio

Decide the leverage ratio you wish to use, such as 10x or 20x. Remember, higher leverage increases potential profit but also increases risk. Example: With 10x leverage, a 1% move in the asset price can lead to a 10% change in your position.

Step 3: Enter the Trade

- Long Position: Buy if you expect the asset price to rise.

- Short Position: Sell if you expect the asset price to fall.

Example: Using 10x leverage, you can buy $1,000 worth of BTC with only $100 of your capital.

Step 4: Set Stop Loss and Take Profit Orders

Set stop loss and take profit orders to manage risk and secure profits. These orders allow you to automate exit points based on predefined profit or loss levels. On Binance, you can easily set these orders in the trading interface.

Step 5: Monitor and Adjust the Trade

Regularly monitor the market conditions, adjust your stop loss, and take profit orders accordingly. This helps you respond to market changes and optimize your trade outcomes.

Managing Risk in Leverage Trading on Binance

Initial Margin and Maintenance Margin

When you start a leveraged trade, the initial margin is the upfront capital you need to open a position. For instance, to control a $10,000 position with 10x leverage, you need to put up $1,000.

The maintenance margin is the minimum equity required to maintain your position. Falling below this can result in liquidation. Suppose your maintenance margin is $500; if your account value drops to $400, your position may be liquidated.

Example Calculation:

| Margin Type | Amount Needed |

|---|---|

| Initial Margin | $1,000 |

| Maintenance Margin | $500 |

Importance: Keeping your account value above the maintenance margin is crucial to avoid liquidation.

Monitoring Account Value

Binance offers several tools and features to help you stay on top of your positions.

Regularly check the Margin Account Balance and use the Risk Ratio tool to assess your current leverage and risk levels. Implement strategies like setting stop-loss orders and using alerts to manage your risk better.

Tools and Features on Binance

- Risk Ratio: Indicates the health of your margin account.

- Stop-loss orders: Automatically sell your asset if it hits a specific price.

- Alerts and Notifications: Inform you of critical changes in your positions.

By using these tools and maintaining disciplined trading strategies, you can better manage the risks associated with leverage trading on Binance.

Practical Examples and Case Studies

Example: Successful Leverage Trade

Imagine you decide to leverage trade Bitcoin on Binance using 10x leverage.

You buy BTC when the price is $30,000. With leverage, you can control $300,000 worth of BTC using only $30,000 of your funds.

When the price rises to $33,000, the value of your position increases to $330,000. This yields a 100% profit on your initial margin.

| Scenario | Position Value | Profit/Loss |

|---|---|---|

| Initial Purchase | $300,000 | N/A |

| BTC Price at $33,000 | $330,000 | $30,000 |

Case Study: Risk Management Failure

A trader uses 20x leverage on a BTC trade without setting a stop loss. The initial price of BTC is $50,000.

Due to market volatility, BTC drops by 5% to $47,500. Given the high leverage, this translates to a 100% loss of the initial margin, resulting in the liquidation of the position and a total loss of your funds.

| Scenario | Position Value | Profit/Loss |

|---|---|---|

| Initial Purchase | $1,000,000 | N/A |

| BTC Price Drops 5% | $950,000 | -$50,000 |

| Liquidation | $0 | -$50,000 |

In both examples, leverage’s role in amplifying gains and losses is clear.

Trading with leverage provides opportunities for significant profits but also increases risks, especially without proper risk management strategies like stop-loss orders.

How To Leverage Trade Crypto Through Leveraged Tokens & DeFi Platforms On Binance

Leveraged tokens allow you to gain exposure to an asset with higher potential returns without managing collateral, margin, and liquidation risks.

These tokens represent positions in a leveraged asset, magnifying your gains from price movements.

Examples of Popular Leveraged Tokens on Binance:

- BTCUP: Provides 3x leveraged exposure to Bitcoin prices.

- BTCDOWN: Offers -3x leverage, profiting from a decline in Bitcoin prices.

- ETHUP: Delivers 3x leverage on Ethereum price movements.

- ETHDOWN: Gives -3x leverage, capitalizing on Ethereum price drops.

Benefits of Using Leveraged Tokens:

- Hassle-Free: Avoid the complications of margin trading, such as monitoring collateral levels.

- Managed Risk: Built-in mechanisms to reduce the risk of liquidation.

- Easy Access: Trade these tokens directly on Binance without a separate margin account.

Please search for the leveraged token you want on Binance and trade it like a regular spot asset. This approach offers a more straightforward and less risky way to gain leveraged exposure to the crypto market.

Conclusion

Leverage trading on Binance offers the potential to amplify your gains. You can navigate this complex trading environment with the right strategies and an f of technical and fundamental anal grasps.

Key Points to Remember:

- Always calculate leverage carefully. Understand how much margin you’re using relative to your position size.

- Start small if you’re new to this type of trading. It’s advisable to gain experience before increasing your leverage ratios.

- Stay updated with market trends and news. Being informed can mitigate some risks associated with leverage trading.

A disciplined approach to managing your trades and constant learning and adaptation can enhance your trading outcomes on Binance.

Leverage responsibly and use the tools available to you effectively for a successful trading experience.