Gen Z, born between 1996 and 2010, is the second youngest generation, fitting between millennials and Generation Alpha. These young individuals are rapidly entering the investing space, often starting investing before turning 18.

Reports indicate that Gen Z invests in various assets, from hedge funds and stocks to digital assets. We’ve gathered data and statistics to highlight Gen Z’s investing trends and how they lead the charge in the investment world.

Gen Z Investing Age

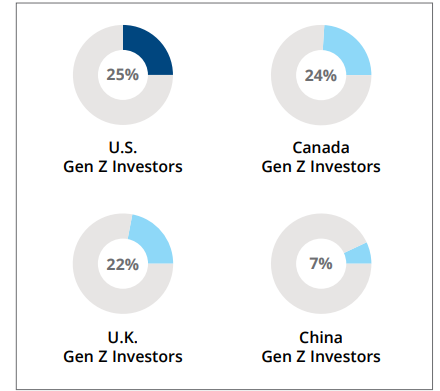

Gen Z begins investing at an early age, with studies showing the average starting age is 19. Although comprehensive global data is unavailable, recent research reveals that 25% of Gen Z in the U.S. start investing before turning 18.

This trend is not unique to the U.S.; in CU.S.ada, 24% of Gen Z investors begin before 18, while in China and the U.K., the U.K.gures are 7% and 22%, respectively.

Gen Z Investment Preferences

Gen Z is increasingly involved in investing. A survey revealed that 43% of US Gen Z credits their interest and confidence in investing to early exposure to the industry.

According to a CAMS study, Gen Z comprises 54% of first-time mutual fund investors, with 41% investing in individual stocks.

Beyond individual stocks, Gen Z shows a strong preference for mutual funds, with 35% investing in them. Additionally, 25% of Gen Z invest in nonfungible tokens, and 23% prefer exchange-traded funds.

From all of Gen Z’s investment preference data, it’s clear that Gen Z is more interested in mutual funds.

Gen Z Crypto Investment

Gen Z views crypto as the second riskiest investment option, but the perceptions are shifting; at least, that’s what data suggests.

In 2024, Gen Z and millennials make up 94% of crypto buyers, with Gen Z representing 17.4% of these investors. On average, a Gen Z investor spends about $6,120 on cryptocurrency.

A survey of Gen Z in the U.S. found that Gen Z chose crypto as their primary investment. About 55% of the investment is in crypto, followed by individual stocks and mutual funds.

Another survey shows that Gen Z and Millennials worldwide are almost as likely to own cryptocurrency (21%) as they are to own real estate (20%).”

The data suggests a strong preference for cryptocurrency investments among younger generations, with a significant portion of Gen Z and millennials prioritizing crypto over traditional assets like real estate.

Gen Z Stocks & Mutual Fund Figures

From 2024, in the last five years, almost 1.6 billion new mutual fund investors have emerged, including 8.5 million Gen Z investors.

In 2022, 73% of Gen Z owned stocks. However, as of 2024, only 41% of Gen Z hold stocks. This shift indicates a notable change in investment preferences among younger generations.

Gen Z Usage Statistics Of Financial Websites & Apps

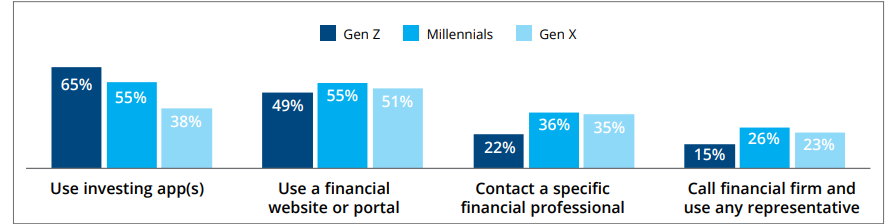

Gen Z prefers financial websites and investing apps for their investment purposes over professional agents.

A study of the US Gen Z population reveals that 65% use investment apps, while 49% turn to financial websites or portals. In contrast, only 22% seek help from financial professionals, and just 15% rely on financial firms.

In Canada, 55% of the Gen Z population depends on investing apps and 50% on financial websites or portals for investing.

Gen Z Investing Statistics

- In a 2024 survey, 71% of Gen Z Americans showed confidence in their investment strategies. (Source – Charles Schwab Modern Wealth Survey 2024)

- In a survey of 2,000 adult investors, 59% of Gen Z and 63% of millennial respondents said a high-performing portfolio should include more than five different companies or funds. (Source – The Motley Fool Survey)

- According to a survey, in 2024, technology stocks are the top investment choice for Gen Z, with 53% of respondents owning stocks in this sector. (Source – The Motley Fool Survey)

- Gen Z and millennials trade much more frequently than Gen X and boomers. (Source – The Motley Fool Survey)

- According to the data, around 70% of Gen Z and millennial respondents report making at least one trade per month. (Source – The Motley Fool Survey)

- For financial advice, 70% of US Gen Z relies on family and friends. (Source – Charles Schwab Modern Wealth Survey 2024)

- 31% of US Gen Z avoid financial planning because they believe they don’t have enough money to warrant a plan. (Source – Charles Schwab Modern Wealth Survey 2024)

- Financial advisors recommend allocating only 1% to 3% of an investor’s folio to cryptocurrency. (Source – cnbc.com)

- Aside from investments, 62% of millennials and Gen Zers also try trending financial hacks, often popularized on social media. (Source – fortune.com)

- Reports suggest that 28% of Gen Z investors have learned about investing in school. (Source – valuewalk.com)

- Studies show that 48% of Gen Z invest in fractional shares. (Source – valuewalk.com)

- According to 2024 studies, 43% of Gen Z and 45% of Millennials identify as socially responsible investors. (Source – valuewalk.com)

- A survey of Gen Z investors and non-investors in the U.S. found that their top challenge in meeting financial goals is the rising cost of living and inflation. (Source – CFA Institute Report )

- 50% of U.S. Gen Z investors admit to making investment decisions driven by FOMO (fear of missing out). (Source – CFA Institute Report )

- A 2022 report found that Gen Z art collectors spent over 30% of their net worth on art, driven mainly by platforms like Instagram and TikTok. (Source – businesslive.co.za)

- Canadian Gen Zs are highly active in investments, with 57 percent owning crypto, 45 percent investing in mutual funds, and 41 percent holding individual stocks. (Source – CFA Institute Report )

- Gen Z has a spending power of approximately $140 billion in the United States. (Source – techfunnel.com)

- Gen Z investors in the U.K. areU.K.ably focused on crypto, with 50% owning digital assets. (Source – CFA Institute Report )

- As per the 2024 survey, 26% of UK Gen Z investors expect to retire after age 70. In China, Canada, and the U.S., the percentage of Gen Z investors who expect to retire at 70 are 4%, 7%, and 10%, respectively. (Source – CFA Institute Report )

- In China, 54% of Gen Z investors prefer mutual funds, 41% choose wealth management products from commercial banks, and 32% invest in individual stocks. (Source – CFA Institute Report )