In the fast-evolving world of cryptocurrency trading, selecting the right exchange can significantly impact a trader’s profitability, experience, and security. Among the rising contenders in the global crypto exchange arena are Weex and BingX—two platforms that have rapidly expanded their user bases through distinct offerings tailored to both novice and experienced traders.

While Weex positions itself as a low-fee, pro-trader derivatives platform with a focus on ultra-fast order execution and security, BingX leans into social trading, offering features that allow users to copy professional traders’ strategies and engage with community-driven trading insights.

This comparison aims to provide a detailed, side-by-side breakdown of both exchanges—from trading fees and leverage options to security protocols, product offerings, and overall usability. Whether you’re an active day trader, a long-term investor, or a beginner exploring the crypto market, this guide will help you determine which platform aligns best with your goals and risk profile.

Quick Feature Comparison: Weex vs BingX

| Feature | Weex | BingX |

|---|---|---|

| Founded | 2018 | 2018 |

| Founders | Team from Wall Street, Silicon Valley, Citibank, and Google; led by CEO “Peter” | Founder details not publicly disclosed; known as a global social trading platform |

| Supported Coins & Pairs | 600+ coins and 1,500+ trading pairs including major and altcoins | Wide range including BTC, ETH, LTC, ADA, DOT, and hundreds of altcoins |

| 24h Trading Volume | ~$3.7 Billion | ~$1.09 Billion |

| Trading Fees | Spot: 0%Futures: Maker 0.02%, Taker 0.06% | Spot: ~0.1%Futures: Maker 0.02%, Taker 0.05% |

| Leverage Offered | Up to 200× for perpetual and futures trading | Up to 125× for futures contracts |

| Deposit & Withdrawal Methods | Crypto deposits, fiat via OTC, instant crypto withdrawals, withdrawal whitelisting | Supports crypto and fiat methods including bank transfer, credit/debit cards, Apple/Google Pay, and P2P |

| Security Measures | 1,000 BTC protection fund, cold wallet storage, 2FA, withdrawal address whitelisting, multisig wallets, proof of reserves | 100% asset reserves certified, cold wallet system, 2FA, passkey authentication, and regular audits |

Weex vs BingX: Key Differences at a Glance

Weex and BingX serve different types of crypto traders through their unique features. Weex stands out with zero spot trading fees and up to 200× leverage, making it ideal for professional and high-frequency traders. BingX, while slightly more expensive on spot trades (~0.1%), offers slightly lower futures fees and a more beginner-friendly approach.

In terms of coin offerings, Weex supports over 600 cryptocurrencies and 1,500+ pairs, catering to those who want access to a wide range of assets. BingX offers fewer pairs but focuses on high-liquidity, mainstream tokens.

Where BingX shines is its social trading ecosystem, allowing users to copy experienced traders—perfect for beginners or passive investors. Weex, in contrast, is built for speed, execution, and professional-grade tools, suiting more advanced users.

In short, Weex is better for traders seeking deep markets and low costs, while BingX is ideal for those who value simplicity and community-driven trading.

Weex vs BingX: Platform Products and Services Overview

Weex provides a comprehensive suite of products tailored for both casual users and professional traders. It offers spot trading, high-leverage futures contracts (up to 400×), and an OTC desk for large fiat conversions. A standout feature is its copy trading platform, which allows users to follow experienced traders. Additional tools include demo trading for beginners, fiat payment options via cards and bank transfers, and a 1,000 BTC insurance fund for added security. The platform is optimized for high-speed execution, making it attractive to high-frequency traders.

BingX, in contrast, focuses heavily on social trading features. It offers standard spot and perpetual futures markets with up to 125× leverage, but differentiates itself with advanced tools like copy trading, signal trading, grid bots, and dual investment products. The platform also includes lending services and automated trading strategies, making it a flexible choice for users with diverse risk appetites and strategy styles. Its interface and product lineup are beginner-friendly while still supporting more advanced needs.

Weex vs BingX: Range of Tradable Contracts

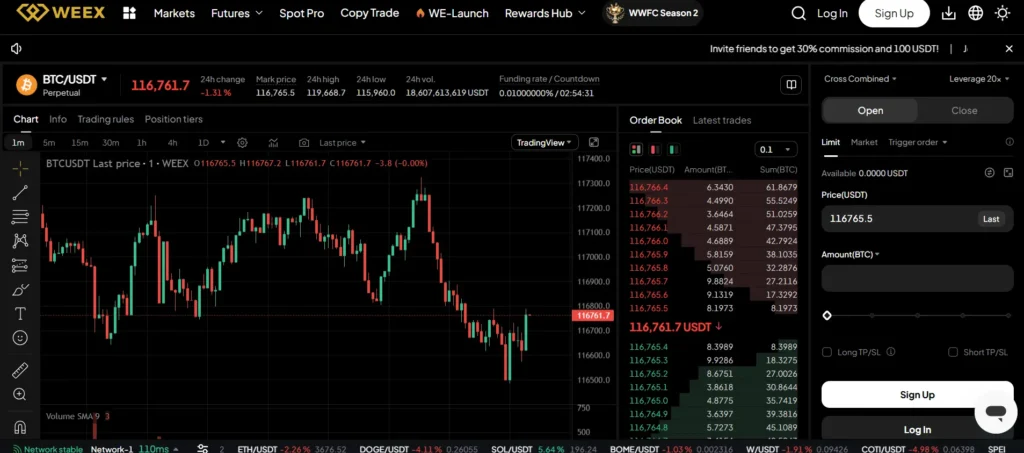

Weex offers a broad selection of derivative instruments, particularly perpetual futures with leverage up to 400× across hundreds of crypto assets. The platform is designed for aggressive futures trading, with fast execution speeds and minimal slippage. It also supports standard futures and spot trading to meet varied trader preferences.

BingX also provides a wide range of contract types, including perpetual and standard futures. While its maximum leverage tops out at 125×, it supports both USDT-margined and coin-margined contracts. These options provide flexibility for users who prefer to settle trades in crypto rather than stablecoins. BingX caters well to traders who want structured contracts with defined expiry terms as well as perpetual contracts for continuous exposure.

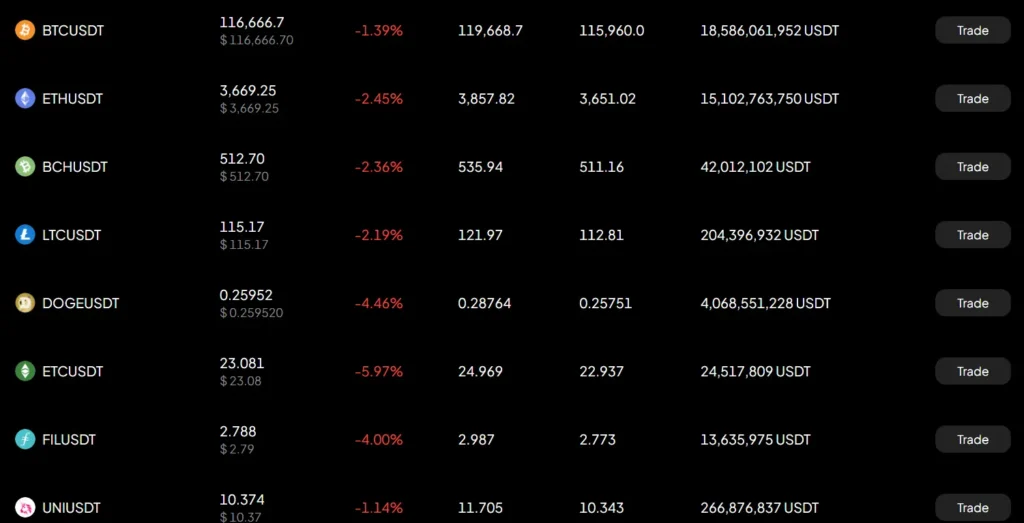

Weex vs BingX: Supported Cryptocurrencies and Trading Pairs

Weex excels in the diversity of its asset listings, offering over 600 cryptocurrencies and 1,500+ trading pairs. From major tokens like BTC and ETH to low-cap altcoins and trending meme coins, Weex’s wide coverage allows traders to explore a full range of market opportunities.

BingX also supports a strong variety of assets, with over 700 tokens available for spot trading and 500+ pairs for perpetual futures. While it doesn’t have as many exotic tokens as Weex, it provides a highly curated list focused on liquidity and performance. Core pairs like BTC/USDT and ETH/USDT are well-supported, making it ideal for users who trade high-volume markets.

Weex vs BingX: Leverage and Margin Trading

Weex stands out with its ultra-high leverage offering, going up to 400× on selected futures contracts. This makes it a go-to choice for experienced traders looking to maximize exposure with minimal capital. While such high leverage can amplify gains, it also significantly increases risk, so the platform includes real-time risk monitoring and position management tools.

BingX takes a more moderate approach, offering up to 125× leverage for major cryptocurrencies. The platform uses a tiered leverage model, reducing maximum leverage as position sizes increase. It also supports isolated margin, auto-deleveraging mechanisms, and lending-based margin trading, making it suitable for users who prefer managed risk strategies while still accessing leverage benefits.

Weex vs BingX: Trading Volume and Liquidity

When it comes to trading volume, Weex consistently ranks among the top global exchanges with daily volumes hovering around $3.8 billion. This high liquidity, especially in major trading pairs like BTC/USDT, ensures tight spreads and efficient order execution, which is crucial for high-frequency and institutional traders. The depth of the order book also supports large transactions without significant slippage, making Weex a strong option for serious traders.

BingX, although slightly behind in overall volume, still processes significant daily turnover, particularly in its futures and copy trading markets. Its focus on popular, high-volume assets ensures a stable and reliable trading experience. While liquidity in some low-cap altcoins may not be as deep as Weex, for most users trading mainstream assets, BingX offers more than adequate execution speed and consistency.

Weex vs BingX: Fee Structure Comparison

Weex adopts a competitive fee model aimed at attracting active traders. Spot trading fees are often waived entirely on promotional pairs, while standard futures trading fees are 0.02% for makers and 0.06–0.08% for takers. This positions Weex among the most cost-effective platforms for derivatives trading. Withdrawal fees vary depending on the asset and network congestion but are generally kept low to facilitate easy fund movement.

BingX charges around 0.1% on spot trades, with futures fees typically at 0.02% for makers and 0.05% for takers. It also provides a tiered VIP system where high-volume traders receive discounted rates. While deposit fees are zero for crypto, withdrawal fees are flat and depend on the coin—sometimes slightly higher than industry norms. However, BingX often compensates for this with promotional fee discounts and reward programs for active users.

Weex vs BingX: Deposits, Withdrawals, and Payment Methods

Weex supports a wide range of deposit and withdrawal options, making it accessible to both crypto-native and fiat users. It offers direct crypto deposits and withdrawals, with features like address whitelisting and two-factor authentication for added security. Fiat on-ramps are available through OTC trading and third-party partners, supporting methods like bank transfers and credit cards. Withdrawal speeds are generally fast, and the platform prioritizes fund security through cold wallet protocols.

BingX also provides multiple payment options, including crypto deposits, peer-to-peer (P2P) transfers, bank cards, and Apple or Google Pay. Fiat-to-crypto purchases are easy to complete, especially for beginners. However, fiat withdrawals are more limited, and users often need to convert assets back to crypto for full access. Processing times are reasonable, and the platform maintains transparent policies regarding transaction limits and fees.

Weex vs BingX: Native Exchange Tokens

Weex features its native token, WXT, which serves multiple purposes within the ecosystem. Users holding WXT benefit from trading fee discounts, participation in promotional campaigns, and access to VIP-tier benefits. The token is integrated into the platform’s loyalty and incentive structure, encouraging long-term engagement from active users.

On the other hand, BingX does not currently offer a native exchange token. Instead, it focuses on a performance-based VIP system where users unlock fee reductions and exclusive perks by maintaining high monthly trading volumes. While the lack of a native token may limit speculative opportunities, it simplifies the platform’s economy and aligns user benefits directly with their trading activity.

Weex vs BingX: KYC Requirements and Account Limits

Weex follows a flexible KYC (Know Your Customer) policy. Users can access basic trading features and limited withdrawals without completing full verification. However, to unlock higher withdrawal limits and advanced features like fiat deposits or higher leverage, completing identity verification is mandatory. The KYC process involves uploading government-issued ID and facial recognition checks, which typically get processed within a few hours.

BingX, in contrast, encourages users to complete KYC from the start. While some basic trading functionality is accessible without verification, users must complete KYC to increase withdrawal limits, use copy trading features, and access fiat on-ramp services. BingX uses a tiered system—unverified accounts have low daily limits, while verified accounts can enjoy higher transaction thresholds and additional security. Overall, BingX places more emphasis on compliance, especially for users trading in regulated regions.

Weex vs BingX: User Interface and Ease of Use

Weex offers a clean and performance-optimized interface for both web and mobile users. The layout is intuitive, featuring fast chart rendering, customizable trading dashboards, and seamless navigation between spot, futures, and copy trading sections. The mobile app mirrors the desktop experience closely, with fast load times and responsive controls, making it suitable for active traders on the go.

BingX’s user interface is particularly beginner-friendly. Its platform is designed to simplify the trading process, especially for users new to crypto or social trading. Features like one-click copy trading, simplified order entry, and clear chart indicators make it easy to navigate. The mobile app is polished and includes helpful onboarding tutorials. For users who prefer clarity over complexity, BingX is one of the most accessible platforms on the market.

Weex vs BingX: Order Types Supported

Weex supports a wide variety of order types suited for professional traders. These include market, limit, stop-limit, and stop-market orders across both spot and futures. Advanced traders can also access post-only, reduce-only, and trigger orders, allowing for more nuanced risk management and execution strategies. This variety makes Weex a strong choice for high-frequency and algorithmic traders.

BingX offers the essential order types needed for most users: market, limit, and stop orders are supported on both spot and futures markets. While it doesn’t offer as many advanced order options as Weex, BingX integrates its order system closely with its copy trading functionality, allowing followers to mirror the order types used by pro traders. For the average user, BingX’s order features are more than sufficient and easy to manage.

Weex vs BingX: Security Features and Practices

Security is a core focus for Weex, which employs a multi-layered approach to protect user funds and data. The platform uses cold wallet storage for the majority of assets, 2FA (two-factor authentication), withdrawal address whitelisting, and multi-signature wallet systems. Additionally, Weex maintains a 1,000 BTC insurance fund to cover extreme market events or platform incidents, which adds an extra layer of trust.

BingX also places a strong emphasis on platform security. It conducts regular security audits, uses cold storage for most digital assets, and offers standard user protection tools like 2FA, biometric login, and email verification. BingX recently introduced passkey login options to strengthen account safety further. While both platforms have solid security frameworks, Weex’s additional insurance fund gives it a slight edge in terms of crisis protection.

Weex vs BingX: Insurance Funds

Weex stands out by offering a dedicated insurance fund backed by 1,000 BTC. This reserve is designed to protect users in case of unexpected events such as platform breaches, liquidity issues, or mass liquidations during volatile market conditions. The existence of such a large fund signals Weex’s commitment to safeguarding user assets, especially for futures traders operating with high leverage.

BingX, while not offering a public insurance fund of this scale, employs strict internal risk controls and maintains full asset reserves. It also conducts regular security audits and enforces protocols like auto-deleveraging and margin controls to minimize systemic risks. While it lacks a high-profile insurance reserve like Weex, its operational safeguards still provide confidence for everyday users.

Weex vs BingX: Customer Support

Weex provides 24/7 customer support through live chat and a ticketing system. Response times are generally fast, and the support team is known for being technically competent, especially for resolving trading and withdrawal-related queries. In addition to human support, Weex has a well-maintained help center with guides and FAQs covering most platform features.

BingX also offers round-the-clock support via live chat, email, and in-app contact forms. It places strong emphasis on user education, with a resource-rich help section, beginner tutorials, and video walkthroughs. BingX’s support system is particularly helpful for new traders navigating copy trading or social trading features for the first time.

Weex vs BingX: Regulatory Compliance

Weex operates with a more flexible regulatory posture, targeting users in crypto-friendly jurisdictions. While it follows industry-standard KYC and AML procedures, it does not hold licenses from major financial regulators, focusing instead on platform security and transparency through measures like proof of reserves and insurance coverage.

BingX adopts a more compliance-forward strategy. It is registered in multiple jurisdictions and complies with global regulatory standards for user verification, asset segregation, and data protection. For users in more regulated regions such as Europe or the US, BingX may feel more reassuring due to its visible adherence to local laws and transparent operational practices.

Conclusion

Choosing between Weex and BingX ultimately depends on your trading goals and experience level.

Weex is best suited for experienced traders who value low fees, ultra-high leverage, and access to a wide variety of assets. Its advanced order types, performance-optimized interface, and protective features like a 1,000 BTC insurance fund make it ideal for professionals and high-frequency traders.

BingX, on the other hand, is a strong choice for beginners and social traders. Its user-friendly design, strong educational resources, and copy trading features create a low-barrier entry point for users new to crypto. With good compliance practices and solid security, it offers peace of mind for risk-conscious investors.

If you’re looking for depth, speed, and aggressive trading tools, go with Weex. If you’re starting out or want to learn by following seasoned traders, BingX is the better fit.