In the ever-expanding world of cryptocurrency trading, choosing the right exchange can significantly impact a trader’s experience, profitability, and security. Among the many platforms available, Binance has long been a dominant player, offering a comprehensive ecosystem of crypto products and services. Meanwhile, Weex, a newer yet rapidly growing exchange, has carved out its own niche by focusing on user-centric features, high-speed derivatives trading, and global accessibility.

This comparison aims to provide a detailed, unbiased analysis of Weex vs Binance, helping traders—whether beginners or seasoned professionals—understand the strengths and limitations of each platform. We’ll explore essential elements like trading fees, supported assets, leverage options, security, and much more to determine which exchange is better suited for different trading styles and needs.

Whether you’re considering switching platforms, diversifying your trading accounts, or just entering the crypto space, this guide will equip you with the knowledge to make an informed decision.

Weex vs Binance: Quick Feature Comparison Table

| Feature | Weex | Binance |

|---|---|---|

| Founding Year | 2018 | 2017 |

| Founders | Team with backgrounds in Citibank, Wall Street, and Google | Changpeng Zhao (CZ) and Yi He |

| Supported Coins | 930+ cryptocurrencies | 500+ cryptocurrencies |

| Trading Pairs | 1,000+ trading pairs (spot + derivatives) | 1,500+ trading pairs (global operations) |

| Average Daily Volume | ~$3.2 billion total; strong in derivatives | Highest global volume; billions daily in spot and derivatives |

| Trading Fees (Spot) | 0.1% maker / 0.1% taker | 0.1% base (can be reduced with BNB usage) |

| Trading Fees (Futures) | 0.02% maker / 0.06–0.08% taker | 0.02% maker / 0.05% taker |

| Maximum Leverage | Up to 200× | Up to 125× |

| Deposit Methods | Crypto deposits only; limited fiat options | Crypto, bank transfer, credit/debit card, P2P fiat on-ramps |

| Withdrawal Methods | Crypto withdrawals | Crypto and fiat withdrawals (where supported) |

| Security Measures | 1,000 BTC user protection fund, 2FA, cold wallets, proof of reserves | SAFU fund, cold wallets, 2FA, anti-phishing codes, strong regulatory audits |

Weex vs Binance: Key Differences at a Glance

Weex and Binance serve different types of traders. Weex is built for high-leverage, derivatives-focused users who prefer speed, flexibility, and fewer onboarding requirements. It offers up to 200× leverage and supports over 900 cryptocurrencies, making it attractive to active traders and altcoin enthusiasts. Binance, by contrast, is a full-service exchange offering everything from spot and futures to savings, staking, and fiat support. It caps leverage at 125× but provides broader services and deeper liquidity.

In terms of fees, both platforms are competitive. Weex charges 0.1% on spot and 0.02–0.08% on futures. Binance also starts at 0.1% but offers fee discounts through its BNB token and VIP tiers, making it more cost-effective for high-volume users.

Binance supports fiat deposits via bank transfers, cards, and P2P trading, while Weex is more crypto-native with limited fiat options but generous non-KYC withdrawal limits. Binance also has stronger regulatory infrastructure and a well-established SAFU insurance fund, while Weex focuses on cold storage and proof-of-reserves for user protection.

Overall, Weex suits high-risk traders looking for flexibility and leverage. Binance is ideal for users who want a more complete, secure, and fiat-integrated trading experience.

Weex vs Binance: Platform Products and Services Overview

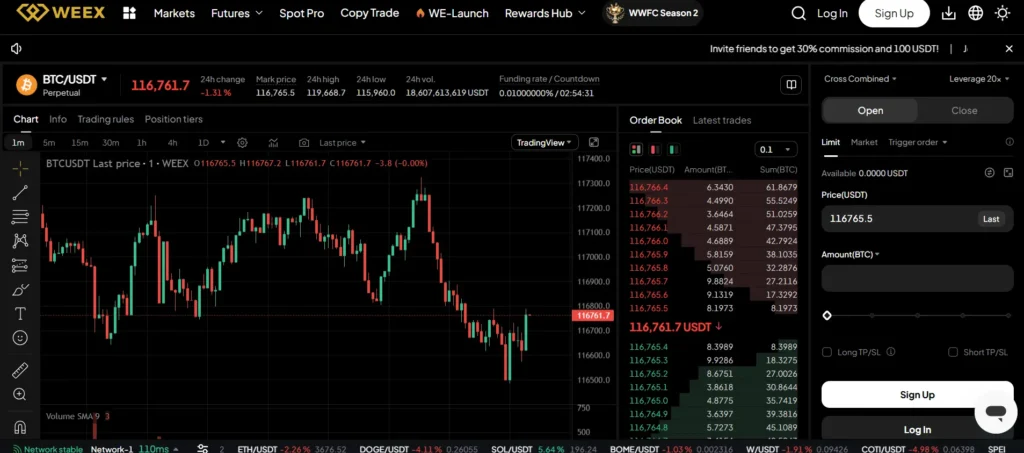

Weex is primarily known for its robust futures trading platform. It offers a focused suite of services including spot trading, high-leverage futures (up to 200×), OTC trading, and a unique copy trading feature that allows users to follow the strategies of top-performing traders. The platform is built with speed and performance in mind, featuring real-time charts, advanced order types, and responsive mobile apps.

Binance, on the other hand, is a full-fledged crypto ecosystem. Beyond spot and margin trading, it provides a wide range of services including perpetual and quarterly futures, crypto options, staking, savings, liquidity farming, and leveraged tokens. It also supports P2P trading, an NFT marketplace, a launchpad for new tokens, and its own blockchain ecosystem through Binance Smart Chain. Binance caters to both retail users and institutions, making it a one-stop shop for nearly every crypto-related need.

Weex vs Binance: Range of Tradable Contracts

Weex specializes in futures trading with a focus on simplicity and flexibility. It supports USDT-margined perpetual contracts, inverse contracts, and simulated paper trading environments. These contracts come with high leverage options, making them appealing to experienced traders who want to execute strategic positions quickly and efficiently.

Binance, in contrast, offers a broader variety of tradable derivatives. It includes USDT- and coin-margined perpetual contracts, quarterly futures, European-style options, and leveraged tokens. These instruments are suitable for different levels of trading experience, from institutional players managing large portfolios to retail users seeking simplified leveraged exposure. Binance’s product depth allows users to tailor their strategies with precision across multiple asset types.

Weex vs Binance: Supported Cryptocurrencies and Trading Pairs

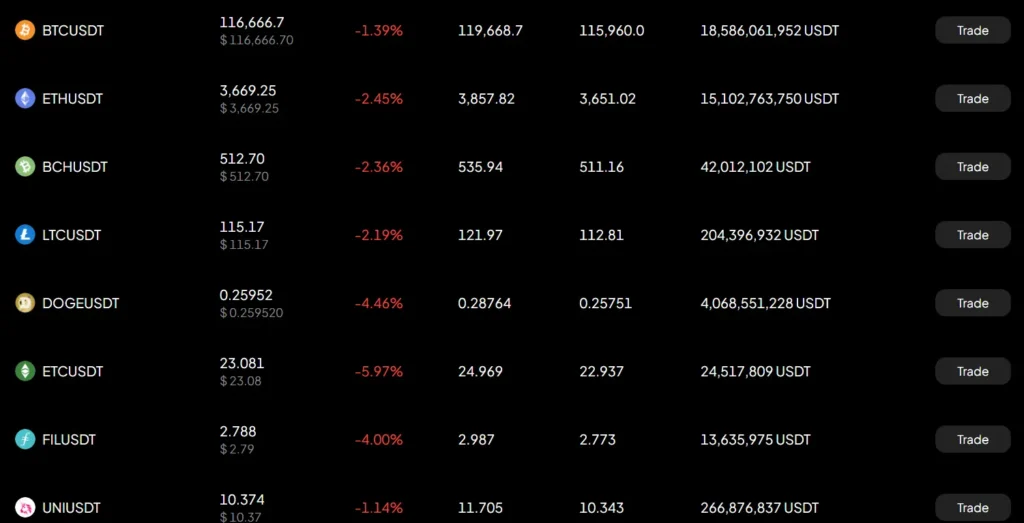

Weex supports an extensive range of cryptocurrencies, with over 1,000 coins and more than 1,500 trading pairs. It covers all major assets like Bitcoin, Ethereum, XRP, and Dogecoin, while also giving users access to a wide variety of emerging altcoins. This makes Weex particularly attractive to traders who focus on market diversity and new token opportunities.

Binance also offers a vast selection of digital assets, including over 500 cryptocurrencies and more than 1,500 trading pairs globally. Its listings span across spot, margin, and futures markets, and often include newly launched or trending coins. Additionally, Binance’s native BNB ecosystem adds another layer of functionality and token utility that enhances the trading experience.

Weex vs Binance: Leverage and Margin Trading

Weex offers some of the highest leverage in the industry, going up to 200× on certain futures contracts. This aggressive leverage structure is designed to attract experienced traders and speculators who are comfortable managing high levels of risk. The platform also provides advanced risk management tools like isolated and cross margin modes, along with built-in liquidation alerts and take-profit/stop-loss settings to help mitigate losses.

Binance, while slightly more conservative in its leverage offerings, still provides up to 125× on its futures products. Its margin trading is split into cross and isolated options, with clear tiered systems for risk control. Binance also offers robust margin account management, including auto-deleveraging, insurance funds, and comprehensive trading calculators. This structured approach appeals to both professional traders and those newer to using margin responsibly.

Weex vs Binance: Trading Volume and Liquidity

Binance dominates the crypto exchange landscape when it comes to trading volume. It consistently ranks as the largest exchange by daily spot and derivatives volume, often exceeding tens of billions of dollars in turnover. This high volume ensures deep liquidity across most trading pairs, reducing slippage and enabling faster order execution for both retail and institutional traders.

Weex, while smaller in comparison, has rapidly gained momentum—particularly in its futures markets. Its daily derivatives volume frequently crosses the billion-dollar mark, and the platform continues to expand its reach. Liquidity is generally strong on major trading pairs like BTC/USDT and ETH/USDT, though altcoin pairs may occasionally show thinner order books. For traders focused on speed and depth in high-leverage environments, Weex offers competitive execution.

Weex vs Binance: Fee Structure Comparison

Weex maintains a straightforward and transparent fee model. For spot trading, it charges a flat 0.1% fee for both maker and taker orders. In the futures segment, fees are typically 0.02% for makers and 0.06–0.08% for takers, depending on the contract and market conditions. The platform occasionally offers zero-fee promotions and fee discounts through its native token, making it a cost-effective choice for frequent traders.

Binance also uses a competitive fee structure, starting with 0.1% maker/taker fees on spot trades. However, traders can significantly reduce fees by holding and using BNB (Binance Coin) to pay for transactions, with discounts reaching up to 25%. On the derivatives side, Binance charges 0.02% for makers and 0.05% for takers, with further reductions available for VIP users based on their 30-day trading volume. This makes Binance especially attractive for high-frequency or institutional traders.

Weex vs Binance: Deposits, Withdrawals, and Payment Methods

Binance offers a comprehensive range of deposit and withdrawal options, making it one of the most accessible exchanges globally. Users can fund their accounts using cryptocurrencies, bank transfers, credit and debit cards, and peer-to-peer (P2P) methods. Binance supports over 50 fiat currencies for deposits and withdrawals, depending on the user’s region. Processing times are generally quick, especially for crypto transactions, and fiat transfers may take anywhere from a few minutes to a couple of business days. Binance also provides detailed fee transparency—crypto withdrawals have network-based fees, while fiat fees vary based on the method and currency used.

Weex, in contrast, operates with a more crypto-native approach. It supports deposits and withdrawals in a wide range of cryptocurrencies but offers limited fiat support compared to Binance. There is currently no direct support for credit/debit cards or bank transfers on most regions, although P2P trading is being expanded. One of Weex’s strengths is its fast withdrawal processing and high non-KYC withdrawal limits, which appeal to users who value privacy and efficiency. Fees are competitive, and the platform occasionally waives certain transaction charges during promotional events.

In summary, Binance excels in fiat accessibility and payment method diversity, making it ideal for users who need seamless integration between traditional finance and crypto. Weex, on the other hand, is best suited for crypto-first users who prioritize speed, privacy, and minimal friction in crypto transfers.

Weex vs Binance: Native Exchange Tokens

Binance has its native utility token, BNB (Binance Coin), which plays a central role in the platform’s ecosystem. Holding BNB allows users to receive trading fee discounts, participate in token sales on Binance Launchpad, and earn rewards through staking, liquidity farming, and more. BNB can also be used to pay for transaction fees, gift cards, and even travel bookings via Binance’s partner integrations. Over time, BNB has evolved from a fee-reduction token into a multi-utility asset within the Binance Smart Chain ecosystem.

Weex has its own native token, WXT, designed primarily to offer trading incentives and fee discounts. While not as developed or widely used as BNB, WXT provides benefits like reduced trading fees and exclusive promotions for holders. The token also ties into Weex’s reward systems, including referral bonuses and trading competitions. Although still in its early stages compared to BNB, WXT aims to grow its utility as Weex continues to expand.

Weex vs Binance: KYC Requirements and Account Limits

Binance enforces strict Know Your Customer (KYC) policies across most jurisdictions. Users must complete identity verification to access the full suite of features, including fiat deposits, spot trading beyond a small threshold, and high-volume withdrawals. The verification process typically requires a government-issued ID, a selfie, and sometimes proof of address. Daily withdrawal limits depend on the user’s verification level, with fully verified accounts able to withdraw up to 100 BTC or more.

Weex, by contrast, offers much more flexibility in terms of onboarding. Users can trade and withdraw crypto without completing full KYC, with limits reaching up to 500,000 USDT per day for non-verified accounts. For those who choose to verify, the limits increase further, with access to premium features and enhanced customer support. This more relaxed KYC model appeals to privacy-conscious traders, especially those who operate primarily in crypto without fiat involvement.

Weex vs Binance: User Interface and Ease of Use

Binance offers a highly polished and feature-rich interface tailored to both beginners and professionals. Its desktop and mobile platforms come with multiple view modes—basic, advanced, and professional—allowing users to customize the experience based on their skill level. Charting is powered by TradingView, and tools like real-time depth, margin calculators, and trade history are all accessible within a few clicks. Binance also offers in-app educational resources and tutorials to guide new users.

Weex focuses on speed and simplicity. Its interface is clean and minimalistic, making it easy for new users to start trading without a steep learning curve. The platform’s mobile app is especially well-designed, offering seamless navigation, fast order placement, and real-time updates. While it may lack some of the advanced analytics and multi-layered dashboards of Binance, it compensates by delivering a fast and efficient trading experience for users who prefer streamlined functionality.

Weex vs Binance: Order Types Supported

Binance supports a wide variety of order types suitable for all levels of traders. These include basic orders like market, limit, and stop-limit, as well as more advanced options such as stop-market, trailing stop, OCO (One Cancels the Other), and iceberg orders on certain markets. These tools give users high precision in entering and exiting trades, allowing for automated risk management and strategy execution. Binance’s futures platform also includes features like post-only, reduce-only, and time-in-force settings.

Weex, while more streamlined, still offers the essential order types most traders rely on. These include market, limit, and stop-limit orders, along with take-profit and stop-loss features that are tightly integrated into the trading interface. Although it lacks some of the more advanced conditional or algorithmic order types available on Binance, Weex compensates with simplicity and fast execution, which appeals to users who prioritize speed and ease of use over complex configurations.

Weex vs Binance: Security Features and Practices

Binance has built a strong reputation for its security infrastructure. It employs multiple layers of protection, including cold wallet storage, two-factor authentication (2FA), anti-phishing codes, IP/device whitelisting, and real-time withdrawal monitoring. Following a major security breach in 2019, Binance introduced its SAFU (Secure Asset Fund for Users), which sets aside a portion of trading fees to cover potential future losses due to security incidents.

Weex also prioritizes security and follows industry best practices. It uses cold wallet storage to safeguard the majority of user funds and enforces 2FA for account access and withdrawals. Weex stands out for maintaining a 1,000 BTC user protection fund as an internal safety mechanism in the event of unexpected losses or system failures. The platform also supports proof-of-reserves mechanisms to enhance transparency and user trust.

Weex vs Binance: Insurance Funds

Binance operates a dedicated insurance mechanism called SAFU (Secure Asset Fund for Users). A percentage of all trading fees collected by the exchange is allocated to this fund, which serves as an emergency pool to compensate users in the event of a hack or major system failure. The SAFU fund has been actively used in the past, demonstrating Binance’s commitment to user protection.

Weex has its own version of an insurance fund in the form of a 1,000 BTC protection reserve. While not branded like Binance’s SAFU, this reserve serves a similar purpose—acting as a financial buffer to cover unexpected incidents, including potential trading anomalies or platform security issues. This proactive approach helps reinforce user confidence, especially among high-volume traders who need an extra layer of safety.

Weex vs Binance: Customer Support

Binance offers a multi-layered customer support system that includes 24/7 live chat, a comprehensive help center, and a ticket-based system for more complex issues. The platform also provides educational materials, how-to guides, and a support bot to help users resolve common problems quickly. Binance has expanded its support services across multiple languages, catering to a global user base and maintaining a reputation for prompt responses.

Weex provides solid support, especially for an emerging exchange. It features live chat assistance and an online help center covering most operational topics. While the scope of available resources is not as extensive as Binance’s, Weex makes up for it with a more personalized support approach and relatively fast response times. As the platform continues to grow, its support infrastructure is also expanding to meet global demand.

Weex vs Binance: Regulatory Compliance

Binance operates under significant regulatory scrutiny and has taken steps in recent years to strengthen its compliance posture. It now enforces strict KYC and AML protocols, partners with third-party compliance tools, and adjusts offerings by region to comply with local laws. Binance has also acquired licenses or registrations in multiple jurisdictions, including France, Dubai, and Australia, and continues to work with regulators worldwide to maintain operational status in key markets.

Weex, while committed to user security and transparency, takes a more decentralized and privacy-friendly approach. The platform offers high withdrawal limits without mandatory KYC, making it attractive to privacy-focused users. However, this also means it operates with fewer regulatory disclosures compared to Binance. This model may suit traders in regions with relaxed crypto regulations but may not offer the same level of legal recourse in highly regulated markets.

Conclusion

When choosing between Weex and Binance, the right platform ultimately depends on your trading needs, risk tolerance, and desired feature set.

Weex stands out for its high-leverage futures trading, crypto-first experience, and relaxed KYC structure. It’s ideal for seasoned traders looking for fast execution, wide altcoin exposure, and privacy-friendly policies. The platform’s copy trading, clean interface, and growing list of supported tokens make it a strong option for aggressive derivatives traders.

Binance, on the other hand, remains the gold standard for a full-service exchange. It offers unparalleled liquidity, robust fiat support, deep product offerings across spot and derivatives, and a highly secure, regulated environment. Whether you’re a beginner exploring your first crypto purchase or an institutional trader managing large volumes, Binance provides the tools, trust, and scalability needed to operate confidently.