Bybit vs Phemex: An In-Depth Comparative Analysis

Written by Stephen Wedge

Stephen Wedge, with over 15 years of experience in finance, holds a Master of Science in Finance from Vanderbilt University's Owen Graduate School of Management. He specializes in financial analysis, strategic investment planning, and has a keen interest in the world of cryptocurrencies. With a deep understanding of both traditional and digital financial markets, Stephen offers valuable expertise to investors seeking to navigate the complexities of crypto investments.

Expert Reviewed

This article has been reviewed by crypto market experts at SCM to ensure all the content, sources, and claims adhere to the highest standards of accuracy and reliability.

Last Updated on December 1, 2025

In the rapidly evolving world of cryptocurrency, traders constantly seek reliable and efficient exchanges.

Two platforms that frequently come under scrutiny are Bybit and Phemex. Both have carved out significant niches in the crypto exchange market, but how do they stack up against each other?

This article delves into an in-depth comparison of Bybit and Phemex, examining their origins, user base, trading options, fees, security measures, and customer support.

Choosing between the two can be challenging with Bybit’s impressive liquidity and Phemex’s commitment to trader growth.

Our comprehensive analysis aims to shed light on the nuances of each platform, helping traders make an informed decision in their quest for the optimal trading experience.

Bybit Vs Phemex: Comparative Table

When comparing Bybit and Phemex, two prominent cryptocurrency exchanges, you’ll find that both offer unique features tailored to your trading needs.

Below is a concise table that encapsulates their differences and similarities:

| Feature | Bybit | Phemex |

|---|---|---|

| Founded | March 2018 | November 2019 |

| Founder(s) | Ben Zhou | Jack Tao and eight former Morgan Stanley executives |

| Trading Fees | Maker: -0.025%, Taker: 0.075% | Maker: -0.025%, Taker: 0.075% |

| Withdrawal Fees | Dynamic, based on blockchain conditions | Lowest at $0.0005 BTC |

| Deposit Methods | Crypto only | Crypto, Credit Card, Bank Transfer |

| Supported Cryptos | Multiple, including BTC, ETH | Multiple, including BTC, ETH |

| Trading Types | Spot, Derivatives (Perpetual & Futures) | Spot, Derivatives (Perpetual & Futures) |

| Trading Volume | High, 3rd largest derivatives exchange | Not as high as Bybit, ranked 20th |

| User Scores | Generally positive | Generally positive |

| Security | 2FA, multi-signature, and cold storage options | 2FA, multi-signature, and cold storage options |

| Leverage | Up to 100x on select products | Up to 100x on chosen products |

| Sign up Bonus | 🔥 Get up to $5020 Sign up Bonus | – |

You should consider your trading style and requirements when choosing between Bybit and Phemex. Both platforms have established themselves as secure options with competitive fees and a range of cryptocurrencies.

Bybit is older and has a higher trading volume, while Phemex is a growing platform with a strong foundation in financial expertise brought by its founders.

Bybit Vs. Phemex: Products And Services

When exploring products and services on Bybit and Phemex, you’ll find that both exchanges cater to a gamut of crypto trading preferences, but there are nuances worth noting.

Bybit: At your disposal, Bybit presents a comprehensive suite of trading options.

You can participate in spot trading for many cryptocurrencies, taking advantage of low fees of 0.1%.

If you’re inclined towards crypto futures trading, Bybit facilitates this with up to 125x leverage, a feature that is appealing if you aim to maximize potential gains while managing risk.

Options and leveraged tokens further diversify your trading strategies. A distinguishing service is the NFT marketplace, which allows you to engage with non-fungible tokens.

Additionally, Bybit’s innovative trading bots can help automate and potentially enhance your trading experience.

| Bybit Offerings | Key Details |

|---|---|

| Spot Trading | Fee: 0.1% |

| Futures Trading | Up to 125x leverage, Fees: 0.01% for makers, 0.06% for takers |

| Options and Leveraged Tokens | Multiple strategies available |

| NFT Marketplace | Trade and explore digital art and collectibles |

| Trading Bots | Automate trading strategies |

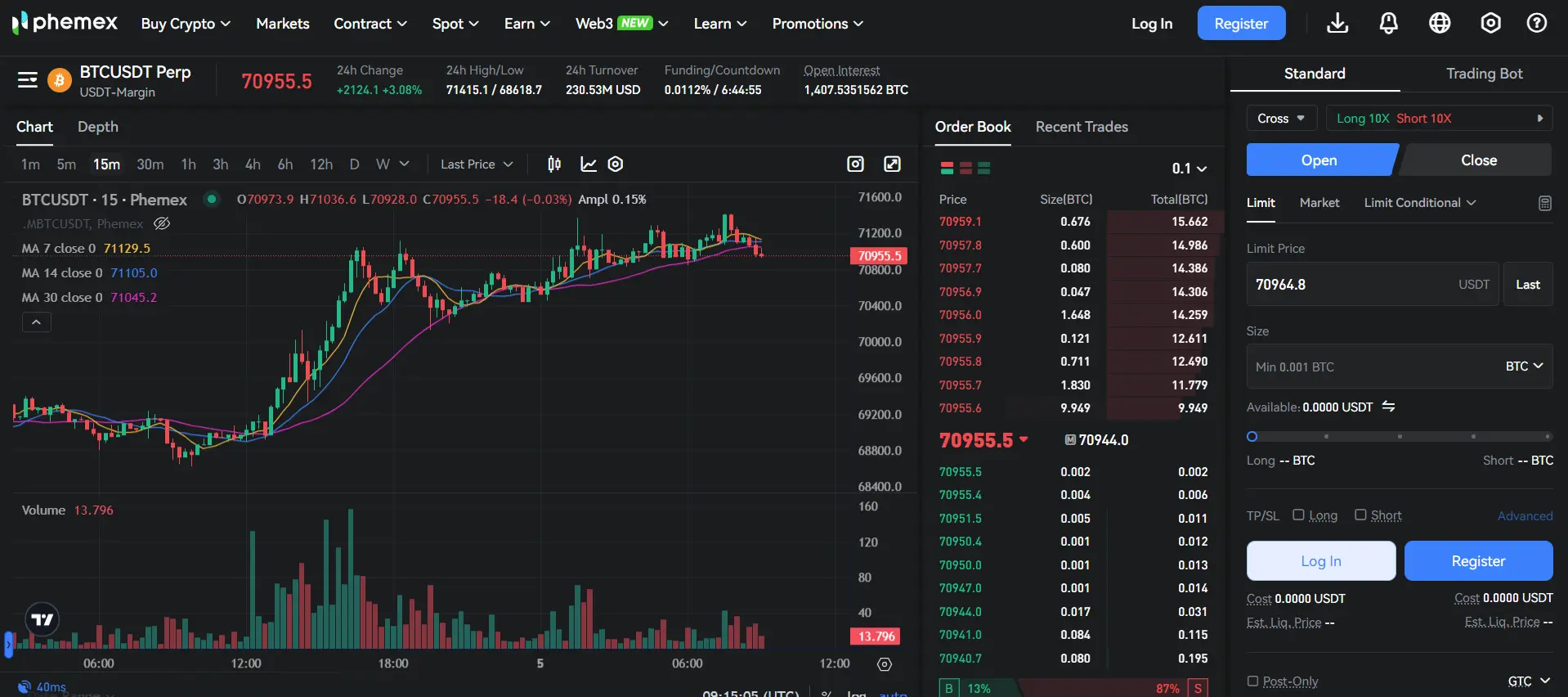

Phemex: Phemex may not boast the same level of variety but offers a robust trading experience. Your trading options are primarily spot and futures trading.

While NFTs and options trading aren’t directly advertised, Phemex supports an intuitive trading platform, ensuring a good user experience for beginners and seasoned traders.

Phemex’s leverage offerings are competitive, though for a different selection of products.

The fee structure aligns closely with industry standards, holding at 0.025% for makers and 0.075% for takers, which is harmonious with Bybit.

| Phemex Offerings | Key Details |

|---|---|

| Spot Trading | Competitive fees similar to Bybit |

| Futures Trading | Attractive leverage offerings, Fee structure: 0.025% maker, 0.075% taker |

Bybit broadens your horizons with a more diverse range of services, including NFTs and trading bots; Phemex focuses on core trading functionalities with a user-friendly platform.

Your preference for variety or simplicity can guide your choice between these platforms.

Bybit Vs. Phemex: Contract Types

Bybit and Phemex both offer diverse contract types suitable for different trading strategies. Understanding the specifics of each can significantly impact your trading experience.

Bybit Contract Types:

- Inverse Perpetual Contracts allow you to trade cryptocurrency contracts with the coin as collateral, effectively dealing in the asset’s native currency.

- Benefits: Direct exposure to cryptocurrency without converting to USD or another fiat currency.

- Drawbacks: Potential complexity for new traders who might not be familiar with the base currency.

- Linear Perpetual Contracts: These contracts are quoted and settled in USD, making them more accessible, especially for those new to crypto derivatives.

- Benefits: Simplified trading experience, as handling the underlying asset is unnecessary.

- Drawbacks: Less direct exposure to the asset can be a disadvantage if seeking to accumulate the cryptocurrency.

Phemex expands upon these offerings with additional products:

- Inverse Futures Contracts: A type of contract that locks in the sale price of an asset for future delivery presented in cryptocurrency.

- Benefits: Good for hedging against price movements.

- Drawbacks: This can be complex due to the fixed settlement date.

- USD-M Futures (USDT-Margined Futures): Similar to Linear Perpetual Contracts but with an expiration date, these are margined and settled in USDT.

- Benefits: Fixed expiration can benefit certain strategic plays.

- Drawbacks: Less flexibility compared to perpetual contracts.

- COIN-M Futures: These contracts are margined with the cryptocurrency in question and settled in the same cryptocurrency, similar to Inverse Perpetual Contracts.

- Benefits: Allows you to directly use your digital assets for trading without converting them to USDT.

- Drawbacks: Like in reverse perpetual contracts, inexperienced traders are complex.

Phemex does not offer options trading, which Bybit does, providing even more versatility for risk management and speculative strategies. With options, you have the right (but not the obligation) to buy or sell an asset at a predetermined price.

In comparing Bybit and Phemex, it’s essential to consider the type of contracts available and ensure they align with your trading goals and comfort with risk.

Each type provides tools for specific market conditions and risk profiles.

Bybit Vs. Phemex: Supported Cryptocurrencies

When selecting a cryptocurrency exchange for trading, one of the primary factors you consider is the range of supported cryptocurrencies. Bybit and Phemex vary significantly in this element.

Bybit supports a broader range of cryptocurrencies for trading. You will find over 359 cryptocurrencies and 500+ trading pairs, which include a wide variety of futures and leverage trading options. The most popular futures trading pairs that you might explore on Bybit include:

- BTC/USD

- ETH/USD

- XRP/USD

- EOS/USD

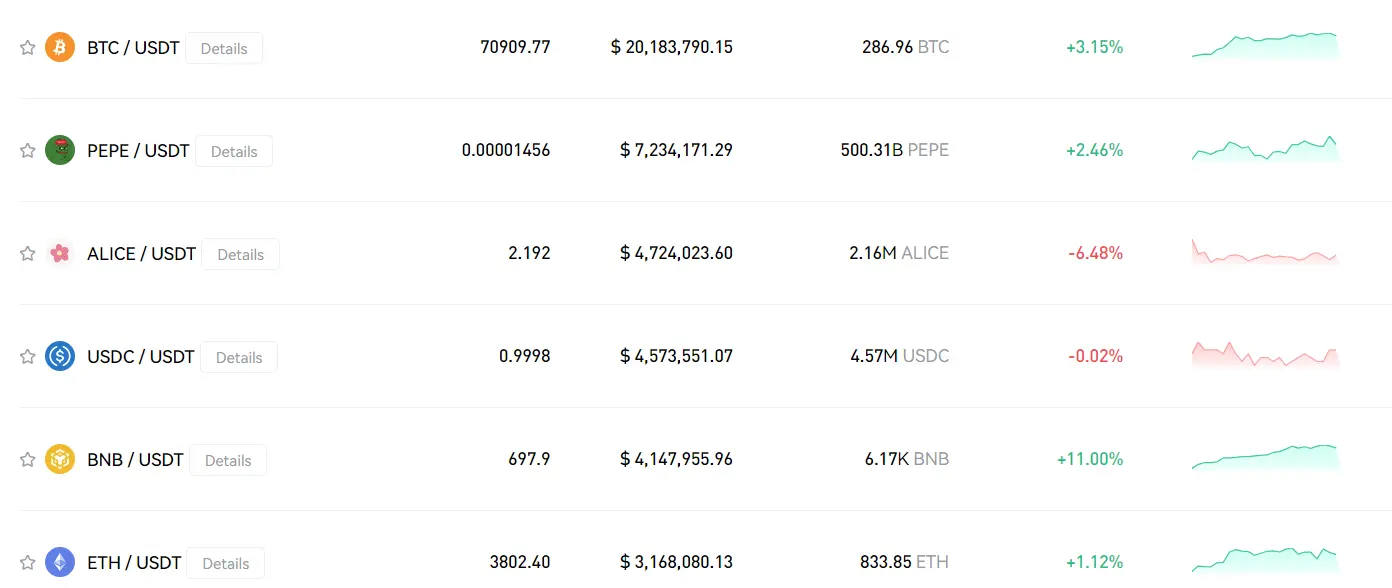

Phemex offers support for around 219 digital assets and 300+ trading pairs.

While the selection may be narrower than Bybit, Phemex still provides many cryptocurrencies for futures and leverage trades. Some of the top futures trading pairs available on Phemex consist of:

- BTC/USD

- ETH/USD

- LINK/USD

- XTZ/USD

Both platforms are continuously updating and expanding their offerings, striving to cater to the diverse needs of their trading communities.

Whether you prefer the extensive assortment of Bybit or the curated selection of Phemex, your choice may be influenced by your specific trading requirements and favorite cryptocurrencies.

Bybit Vs. Phemex: Leverage And Margin Trading

When trading cryptocurrencies, leverage allows you to control a more prominent position with less capital. Bybit and Phemex provide up to 100x leverage on specific assets, amplifying your potential returns and risks.

- Bybit:

- Offers leverage on perpetual and futures contracts with high liquidity and volume.

- Implements isolated and cross-margin trading, tailoring risks to your preferences.

- Liquidation risk is inherent with high leverage; thus, Bybit uses a dual price mechanism to avoid unfair liquidation.

- Phemex:

- Leverage is also available up to 100x, but predominantly for perpetual contracts.

- Isolated margin mode protects your total wallet balance by limiting risk to the individual position’s margin.

- Specific altcoin pairs have less trading volume than Bybit, which can impact liquidity.

Margin requirements on both platforms are in place to ensure sufficient collateral for a position.

Funding rates apply, which can significantly affect the cost of holding leveraged positions and vary depending on the market’s condition.

Remember, with increased leverage comes the increased risk of liquidation.

If the market moves against your position, you could quickly reach the liquidation price, where your trade is automatically closed, resulting in a loss.

Always consider risk management strategies when engaging in leverage and margin trading.

Bybit Vs. Phemex: Trading Volume

When choosing a cryptocurrency exchange, trading volume is a critical metric. It impacts the platform’s liquidity, affects the execution of trades, and plays a role in the slippage you might experience during volatile market conditions.

Bybit has emerged as one of the largest crypto derivatives exchanges. It boasts an impressive trading volume, ranking as the third-largest globally.

High trading volume often equates to enhanced liquidity and tighter spreads, leading to potentially better execution of your trades.

On the other hand, Phemex has seen a dip in rankings but maintains its position as an influential player in the cryptocurrency exchange space.

Previously ranking within the top echelons, Phemex currently holds the 20th position in daily trading volumes, according to CoinMarketCap.

Here’s a quick comparison:

| Exchange | Trading Volume Rank | Influence on Trading Efficiency |

|---|---|---|

| Bybit | 3rd | Higher volume leads to potentially reduced slippage and improved trade executions. |

| Phemex | 20th | Lower volume may result in increased slippage, affecting trade efficiency. |

These factors will shape your trading experience, and it’s worth examining data from sources like CoinMarketCap to understand each exchange’s liquidity and volume.

Remember, more volume can translate to a smoother trading journey for you.

Bybit Vs Phemex: Futures Trading Fees And Rewards

When trading futures on Bybit and Phemex, understanding the fee structure and the potential rewards is essential to manage costs and maximize profits.

Both platforms offer competitive fees and various rewards that can influence your trading strategies.

Bybit’s Fee Structure:

- Maker Fee: 0.01%

- Taker Fee: 0.06%

With Bybit, if you provide liquidity to the market, you’re charged a maker fee of 0.01%. Conversely, taking liquidity incurs a taker fee of 0.06%. For example, for a $10,000 trade as a maker, you pay $1, while as a taker, your fee is $6.

Phemex’s Fee Structure:

- Maker Fee: 0.01% for VIPs, varies based on VIP level and volume

- Taker Fee: Higher tiers may have different rates

Phemex adjusts its fees according to your VIP level and trading volume. Typically, the maker fee is also 0.01%, matching Bybit. However, more prominent traders can benefit from lower rates, incentivizing high-volume trading.

Reward Schemes:

Both platforms offer rewards, such as deposit bonuses and rebates. Bybit had a refund for market makers, which seems to have been discontinued.

Conversely, Phemex provides periodic promotions and social media bonuses that can enhance your trading capital.

When considering deposit and withdrawal fees, both platforms tend to waive deposit fees, with withdrawal fees differing based on network conditions and cryptocurrency types.

Monitoring any updates regarding fees and rewards is crucial since they can shift, affecting your trading decisions and bottom line.

Bybit Vs. Phemex: Deposits & Withdrawal Options

When examining the deposit and withdrawal options on Bybit and Phemex, you’ll find several considerations that influence your experience with each platform.

Both exchanges provide free deposits, meaning you can transfer funds into your trading account without incurring charges.

Supported Currencies:

Bybit and Phemex support a range of cryptocurrencies for deposit and withdrawal, including but not limited to Bitcoin (BTC), Ethereum (ETH), and XRP. It’s essential to check the latest list of supported currencies, as this can be subject to change.

Payment Methods:

- Bybit: Crypto deposits.

- Phemex: Crypto deposits.

Withdrawal fees:

- Bybit and Phemex charge a fee for withdrawing Bitcoin, set at 0.0005 BTC.

- The withdrawal fees on Phemex may vary for Ethereum and other currencies, such as 0.01 ETH for Ethereum withdrawals.

Withdrawal Processing Times:

Generally, both exchanges process withdrawals several times daily, ensuring your funds are transferred within a reasonable timeframe.

Minimum Deposit:

- Bybit: No minimum deposit requirement.

- Phemex: Requires a minimum deposit amount of 0.00000001 BTC.

While both platforms are designed to facilitate quick and cost-effective transactions, it is essential to consider the particular fee structures and minimum requirements that could affect your transfers.

These details will help you manage your funds efficiently as you engage in trading activities on Bybit or Phemex.

Bybit Vs. Phemex: Native Token Usage

Bybit and Phemex, as leading cryptocurrency exchanges, boast their native tokens that serve varied purposes within their ecosystems.

These tokens not only offer trading fee discounts but also provide additional utilities on their respective platforms.

Bybit utilizes its native token, BitDAO (BIT). As a holder, you can benefit from:

- Reduced trading fees: Possession of BIT tokens grants you discounts on trading fees, incentivizing more activity on the platform.

- Voting rights: Engage in Bybit’s governance decisions by voting on various proposals.

- Staking rewards: Earn rewards through staking your BIT tokens directly on Bybit.

| Bybit BitDAO (BIT) Usage | Description |

|---|---|

| Trading Fee Discounts | Discounts on fees for trading different cryptocurrency pairs. |

| Governance Participation | Ability to vote on Bybit ecosystem decisions. |

| Staking | Staking BIT for passive income through rewards. |

Phemex has introduced Phemex Coin (PHX), which you can utilize for:

- Membership benefits: Redeem PHX for premium memberships, unlocking zero-fee crypto spot trading.

- Trading fee discounts: Similar to Bybit, holding PHX can reduce trading expenses.

- Trading bonuses: PHX can offer bonuses that can be applied to trading activities.

| Phemex Coin (PHX) Usage | Description |

|---|---|

| Membership Access | Use PHX to attain premium memberships and additional platform benefits. |

| Fee Reductions | Leverage PHX for lower trading fees on the Phemex exchange. |

| Trading Bonuses | Apply PHX to receive bonuses enhancing your trading capital. |

Ensure to stay updated with each platform’s updates, as the utility and benefits of native tokens can evolve. Savvy use of these tokens can enhance your trading experience on Bybit and Phemex.

Bybit Vs. Phemex: KYC Requirements & KYC Limits

When evaluating Bybit and Phemex, you’ll find differences in their Know Your Customer (KYC) requirements, which could impact your trading experience.

Bybit:

- KYC: Mandatory

- Verification Levels: Typically involves submitting a government-issued ID, a selfie, and sometimes proof of address.

- Documents Required: Government ID and proof of residence.

- Procedures: Follow the on-screen prompts for document submissions and await verification approval.

Limits Based on KYC:

- Deposits: Unlimited.

- Withdrawals: Limited without KYC; upon verification, enhanced limits apply.

- Trading: Full access to trading features once KYC is completed.

Phemex:

- KYC: Optional

- Verification Levels: No initial document submission is required to begin trading, but higher withdrawal limits necessitate KYC completion.

- Documents Required (If KYC Completed): Government ID, facial recognition verification.

- Procedures: Optional KYC process with straightforward online steps; beneficial for increased limits.

Limits Based on KYC:

- Deposits: No limits even without KYC.

- Withdrawals: Capped daily withdrawal limit without KYC; significantly higher or no limits post-verification.

- Trading: Full access without KYC, with unrestricted withdrawals after KYC completion.

Bybit’s KYC procedures ensure a secure trading environment, while Phemex offers greater privacy with its optional KYC, allowing you to trade with fewer restrictions initially.

However, completing the KYC would be advantageous in fully enhancing your withdrawal capabilities on Phemex. Your choice between these platforms may hinge on your privacy preferences versus the convenience of the higher limits.

Bybit Vs. Phemex: User Experience

When trading on Bybit, you’re engaging with an exchange known for its ultra-fast trade execution. Bybit’s matching engine boasts an impressive capacity to handle 100,000 trades per second.

This speed can be a significant advantage in the fast-moving cryptocurrency market, where prices change in milliseconds. To know more, check this Bybit futures trading tutorial.

Phemex, while not matching Bybit’s execution speed, still offers a stable and responsive trading experience. Phemex emphasizes a clean and intuitive interface.

For you, this means more straightforward navigation and less time spent learning the platform’s intricacies when managing your trades.

On mobile, both Bybit and Phemex offer apps with full functionality.

Their clear and user-friendly interfaces make it convenient for you to trade on the go. Notifications and alerts can be set up quickly to inform you of market movements and account changes.

Moreover, both mobile applications ensure that features like your trade history, open positions, and account overview are easily accessible.

| Feature | Bybit | Phemex |

|---|---|---|

| Speed | 100,000 trades per second | Responsive but less than Bybit |

| Interface | Fast and efficient | User-friendly, clean design |

| Mobile | Full functionality, efficient | Full functionality, intuitive |

Both platforms emphasize security in their user experience design, incorporating features like two-factor authentication (2FA) to add layers of protection for your account.

This commonality is essential for peace of mind when dealing with digital assets.

Both platforms commit to providing a robust and secure trading experience, whether on desktop or mobile.

Bybit Vs. Phemex: Order Types

Bybit and Phemex offer various order types to cater to your trading strategies and risk management needs. Both exchanges support commonly used order types but differ in their flexibility in order execution.

- Market Orders: Both platforms allow you to execute orders instantly at the current market price. Your order is filled right away, enabling quick trading actions.

- Limit Orders: You can set the specific price for buying or selling an asset on either exchange. This gives you control over the execution price, although the trade is not guaranteed if the market doesn’t reach that price.

- Stop Orders: These orders are activated when a specific price is reached as a risk management tool to help you prevent significant losses.

- Conditional Orders:

- Bybit: Offers only three types — limit, market, and conditional orders.

- Phemex: Provides the same as Bybit but is more flexible, giving you varied options for tailoring your trades.

- Post-Only Orders: You ensure you’ll be a market maker, adding liquidity to the market and often qualifying for lower fees or rebates on Bybit and Phemex.

- Reduce-Only Orders: These orders ensure that your position size can only be reduced and not increased. They’re handy for risk management.

Here’s a brief comparison table:

| Feature | Bybit | Phemex |

|---|---|---|

| Market Orders | Available | Available |

| Limit Orders | Available | Available |

| Stop Orders | Available | Available |

| Conditional Orders | Limited | More Flexible |

| Post-Only Orders | Available | Available |

| Reduce-Only Orders | Available | Available |

The availability of these order types at Bybit and Phemex allows you to execute a broader range of trading strategies and better manage your positions.

Although the essential order types are present on both, Phemex offers more flexibility with its conditional orders.

Bybit vs Phemex: Security Measures & Reliability

Bybit and Phemex are cryptocurrency exchanges that take your security seriously. Both platforms implement robust measures to ensure the integrity of your funds and personal data.

Bybit

- Two-Factor Authentication (2FA): You have an additional layer of security through 2FA on every account.

- Cold Wallet Storage: For enhanced security, most of your assets are held in cold wallets.

- SSL Encryption protects your data by encrypting information transmitted between your device and its servers.

Phemex

- 2FA: Similar to Bybit, Phemex also offers 2FA for securing your user accounts.

- Cold Wallets: They utilize hierarchical deterministic cold wallets to safeguard your assets.

- Advanced Security Protocols: Multiple firewalls and strict authentication processes are in place for key actions on the exchange.

Both platforms prioritize your financial security and go to great lengths to protect your information from unauthorized access. There’s an emphasis on using cold storage to reduce the risks of online theft and hacking attempts.

In the past, cryptocurrency exchanges have faced various security threats. Bybit and Phemex have not been immune to this industry-wide issue.

However, incidents affecting these exchanges have been efficiently resolved without significant losses to user funds. This reflects their commitment to reliability and ability to respond effectively to potential security breaches.

Read More: Bitcoin & Crypto Futures Basis Trade & Carry Trade Explained

You must take personal cybersecurity measures, such as using strong, unique passwords and ensuring that your 2FA is enabled, to complement the security measures provided by the exchanges.

Bybit vs. Phemex: Insurance Fund

When comparing Bybit and Phemex, providing an insurance fund is critical for mitigating risks. These funds protect you against excessive losses during extreme market volatility.

Bybit offers an insurance fund to shield you against the negative balance issues arising from unfilled liquidation orders at a loss surpassing a trader’s margin.

Bybit’s insurance fund holds a significant amount, reflecting its commitment to user security. It is utilized to cover these deficits to ensure a stable trading environment. Here’s a simple breakdown:

- Protection: Covers losses due to market volatility or system failures.

- Current Balance: Approximately $32,639,158.

Phemex, on the other hand, does not currently offer a similar insurance fund. While this might suggest a gap in risk protection, it’s essential to acknowledge that Phemex has other measures in place for user security. Here’s what you should know:

- No insurance fund is available to cover trading losses.

- Other security measures are in place, although details are not specified.

Insurance Fund Table:

| Feature | Bybit | Phemex |

|---|---|---|

| Insurance Fund | Available | Not Available |

| Current Balance | ~$32,639,158 | N/A |

| Coverage | Market Volatility, System Failures | N/A |

In summary, your choice between Bybit and Phemex may hinge on the importance of insurance funds for added risk management. Bybit provides a financial bulwark against certain trading risks, while Phemex offers other unspecified safeguards.

Bybit vs Phemex: Customer Support

When selecting a cryptocurrency exchange, customer support is a vital factor. Both Bybit and Phemex provide robust support systems.

Your experience with either platform’s support might be similar, as they both focus on being accessible and helpful.

Bybit Customer Support Features

- 24/7 Support: You can get assistance at any hour of the day.

- Live Chat: Quick responses for urgent queries.

- Multilingual Support: Offers service in multiple languages.

- Email Communication: For less urgent, detailed inquiries.

- Social Media Assistance: Active on platforms like Telegram and Twitter.

Phemex Customer Support Features

- 24/7 Availability: Always ready to respond to your needs.

- Live Chat: Immediate support for pressing issues.

- Multiple Languages: Communicate in your preferred language.

- Email Option: Detailed support for complex problems.

- Telegram Group: A social media path for help.

Your choice between Bybit and Phemex may hinge on slight differences in their support services.

For instance, Bybit extends its social media presence to Twitter, which might offer you more convenience or preference in seeking help.

However, if your choice is influenced by the presence of a knowledge base for self-help, Phemex provides that option.

Here is a comparative snapshot to help you understand the offerings at a glance:

| Feature | Bybit | Phemex |

|---|---|---|

| Availability | 24/7 | 24/7 |

| Live Chat | Yes | Yes |

| Yes | Yes | |

| Languages | Multilingual | Multilingual |

| Social Media | Telegram, Twitter | Telegram |

Each platform aims to ensure that your experience is seamless and your issues are addressed timely. The choice may be due to individual preferences and the slight nuances in service provision.

Bybit vs. Phemex: Regulatory Compliance

In the cryptocurrency exchange landscape, regulatory compliance is crucial for the legitimacy and trustworthiness of platforms like Bybit and Phemex.

As you navigate these exchanges, it’s essential to understand how they align themselves with various legal standards.

Bybit has expanded globally, but not without facing regulatory hurdles. In certain jurisdictions, including the United States, Bybit has grappled with regulatory challenges.

Despite this, Bybit continues to operate in many countries, offering a suite of trading options. Their ability to adapt to complex regulatory environments shows their commitment to legal compliance.

On the other hand, Phemex may not have been embroiled in as many high-profile regulatory issues as Bybit. Still, as an exchange, it operates within the legal frameworks of the countries where it provides services.

Phemex’s approach emphasizes user security and ethical trading practices.

| Feature | Bybit | Phemex |

|---|---|---|

| Jurisdiction | Global with specific exclusions | Global |

| Challenges | Regulatory scrutiny in countries like the USA | Fewer publicized cases |

| User Security | Emphasizes security measures | Puts security and ethical trading first |

Neither Bybit nor Phemex currently displays specific licenses, audits, or certifications on their public platforms, which are common indicators of regulatory compliance.

Read More: Is Crypto Leverage Trading Halal or Haram?

Cryptocurrency regulations remain rapidly evolving, and exchanges consistently adapt to new standards. Bybit and Phemex are vested in maintaining compliance to protect your investments and continue their operations.

Remember, the cryptocurrency market is inherently diverse and dynamic, and your vigilance as a user in sticking to platforms that prioritize regulatory compliance is essential. It underscores a dedication to ensuring a secure and reliable trading environment.

Conclusion

When choosing between Bybit and Phemex, it’s essential to consider your specific trading needs.

Bybit might be the more suitable choice if you’re focused on:

- High liquidity, especially for BTC/USD pairs

- A large volume of daily trades

- Low fees, with derivatives trading fees of 0.01% for makers and 0.06% for takers

On the other hand, Phemex caters to:

- Traders looking for a platform with a rising average daily trading volume

- A wide array of trading pairs, including unique options like GOLD

Both platforms maintain competitive fees, with maker fees at 0.025% and taker fees at 0.075%.

However, with Bybit currently being the third-largest crypto derivatives exchange and Phemex positioned at the 20th spot per CoinMarketCap, your preference may lean towards Bybit if the platform’s size and liquidity are critical for your trading strategy.

It’s also noteworthy that both exchanges take security seriously, offering two-factor authentication (2FA) to safeguard your account.

It would be best if you based your choice on how the specifics of each platform align with your trading habits.

Evaluate the fee structures, available pairs, platform liquidity, and security features. Your decision should be informed by how these factors support your trading endeavors.

Compare Bybit and Phemex with other major exchanges