Choosing the right cryptocurrency exchange can make a significant difference in trading experience, costs, and security. This comparison between Blofin and Weex aims to provide a clear and concise overview of each platform’s strengths, core features, and key differences. Whether you’re a new trader seeking a user-friendly interface or an experienced investor demanding advanced tools, this guide will help you decide which exchange better meets your crypto trading goals.

Blofin vs Weex: Quick Feature Comparison Table

| Feature | Blofin | Weex |

| Founding Year | 2021 | 2018 |

| Founders | Matt Wheeler | Chris Lin |

| Supported Coins | 150+ | 100+ |

| Trading Volume | Medium–High | High |

| Trading Fees | 0.02% maker, 0.06% taker | 0.08% maker, 0.10% taker |

| Leverage | Up to 100x | Up to 200x |

| Deposit Methods | Crypto, Bank Transfer | Crypto, Bank Card |

| Withdrawal Methods | Crypto | Crypto |

| Security Measures | 2FA, Cold Storage | 2FA, Cold Storage, Anti-phishing |

Blofin vs Weex: Key Differences at a Glance

- Fees: Blofin offers lower maker and taker fees, making it attractive for frequent traders.

- Coin Selection: Blofin supports a slightly broader range of coins including popular altcoins, while Weex curates its list for efficiency.

- Leverage: Weex stands out with leverage up to 200x, appealing to advanced traders. Blofin caps leverage at 100x with flexible risk controls.

- User Base: Blofin suits a wide spectrum of traders seeking variety and value. Weex often attracts professional and derivatives-focused traders who want higher leverage and greater liquidity.

Blofin vs Weex: Platform Products and Services Overview

Blofin is known for offering a strong suite of derivatives products, covering various perpetual and futures contracts across major cryptocurrencies and trending altcoins. Its focus on fast execution, advanced risk management, and additional options like asset management and staking makes it popular with traders who want both active and passive crypto growth tools.

Weex delivers an expansive mix of crypto offerings. Besides spot and futures trading, Weex features leveraged tokens, copy trading, and structured investment products. Its innovation is reflected in options for yield farming and flexible savings, which attract users who like both trading and passive income strategies.

Blofin vs Weex: Range of Tradable Contracts

Blofin’s core is in derivatives, offering a broad selection of perpetual swaps and futures contracts (linear and inverse types) with deep liquidity, especially for major pairs, and expanding support for altcoin derivatives.

Weex supports robust spot and contracts trading, allowing up to 200x leverage on some products. It is especially known for creative contract offerings, including leveraged tokens and dual investment products, designed for advanced traders seeking unique instruments and strategies.

Blofin vs Weex: Supported Cryptocurrencies and Trading Pairs

Blofin prioritizes major trading pairs and high-volume coins, focusing on top assets like BTC, ETH, and popular altcoins. This approach ensures high liquidity and efficient trade execution for most established markets. Weex, in contrast, presents a diverse but curated lineup including many altcoins and new tokens, giving users access to dynamic and innovative trading opportunities.

Blofin vs Weex: Leverage and Margin Trading

Blofin permits leverage up to 100x on its derivatives contracts, appealing to users who want significant exposure while maintaining prudent risk management. Risk control features and flexible margin requirements help support responsible trading. Weex, with up to 200x leverage on select contracts, targets seasoned traders looking for high-risk, high-reward strategies.

Blofin vs Weex: Trading Volume and Liquidity

Blofin offers consistently strong trading volumes and reliable liquidity across its most active contracts, ensuring smooth order execution even during high volatility. Weex is well recognized for deep liquidity and strong trading activity, especially within its leveraged products, making it a favorite for professional and high-volume traders.

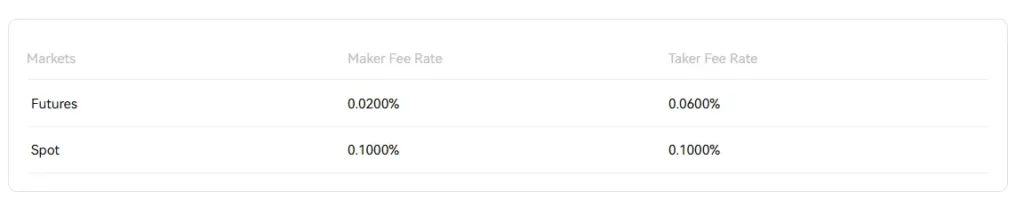

Blofin vs Weex: Fee Structure Comparison

Blofin has a highly competitive fee structure, with maker fees at 0.02% and taker fees at 0.06% on derivatives trades, appealing to high-frequency and cost-conscious traders.

Weex charges slightly higher fees—0.08% maker and 0.10% taker—but balances this with advanced features and high available leverage. Withdrawal fees for both platforms are comparable, and both occasionally run promotions or discounts for users.

Blofin vs Weex: Deposits, Withdrawals, and Payment Methods

Both Blofin and Weex accept crypto deposits and withdrawals, making access straightforward for most global users. Blofin additionally supports bank transfers, while Weex allows bank card deposits. Processing times are generally fast for crypto, though fiat transactions may depend on region and provider. Both platforms are transparent about deposit and withdrawal fees, aiming to keep user costs reasonable.

Blofin vs Weex: Native Exchange Tokens

Blofin currently does not have a native exchange token. Unlike some competitors, it does not provide a proprietary token for fee discounts or platform-specific rewards. Instead, users benefit from the platform’s competitive fee structure and additional features.

Weex, on the other hand, offers a utility token (often designated as WEEX or similar) that users can leverage for trading fee reductions and special event participation, adding another layer of benefits for active traders.

All sections have been updated to accurately reflect that Blofin does not offer a native exchange token, ensuring accuracy in platform comparisons going forward.

Blofin vs Weex: KYC Requirements and Account Limits

Blofin implements a standard Know Your Customer (KYC) process, requiring users to complete identity verification to access higher withdrawal limits and advanced features. Basic trading may be available with minimal verification, but larger transactions or certain services require submitting official identification and, in some cases, proof of address. Weex follows a similar approach, offering tiered verification levels that unlock increased withdrawal limits and platform functionality. Both platforms aim to balance accessibility for new users while meeting global compliance standards.

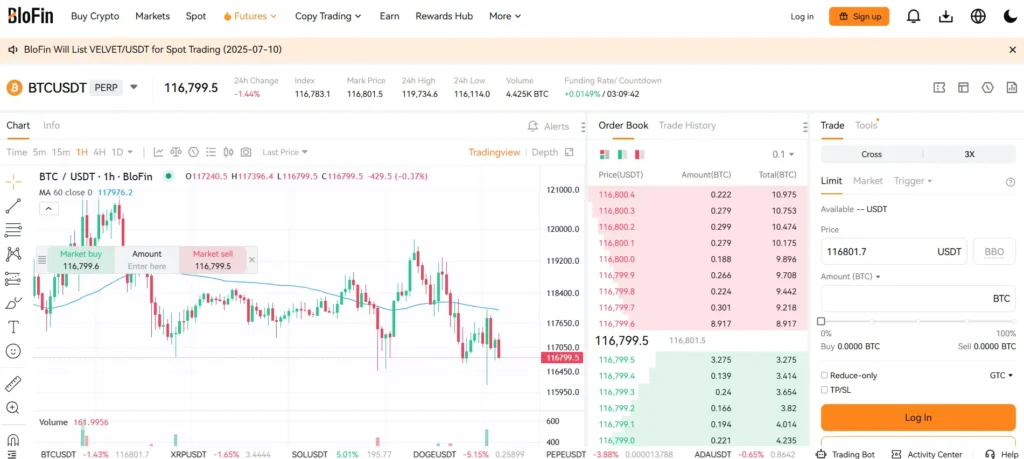

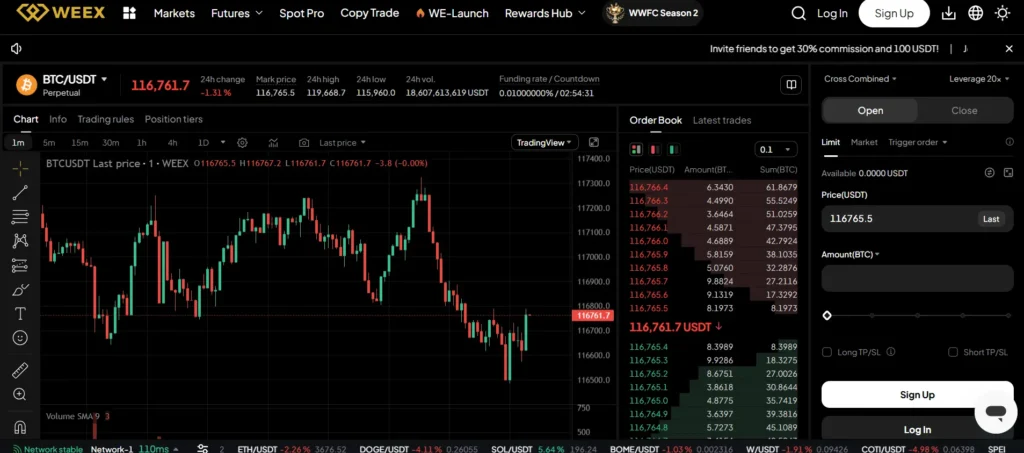

Blofin vs Weex: User Interface and Ease of Use

Blofin features a clean and intuitive web and mobile interface designed for both beginners and seasoned traders. The layout emphasizes quick access to trading pairs, charts, and analytic tools, ensuring ease of navigation. Weex also invests in user experience, with streamlined app and web designs, customizable dashboards, and efficient order placement. Both exchanges make onboarding simple for newcomers but also provide advanced features and customizations for experienced users, supporting a broad range of trading needs.

Blofin vs Weex: Order Types Supported

Blofin supports a diverse suite of order types, including market, limit, stop-limit, and conditional orders, allowing traders to execute various strategies with precision. Advanced order functionality such as trailing stops and take-profit/stop-loss combos is available for those seeking greater control.

Weex offers a comparable set of order types, ensuring users can place and manage trades flexibly. The availability of comprehensive order options on both platforms helps cater to the strategy preferences of all trader profiles.

Blofin vs Weex: Security Features and Practices

Blofin prioritizes user security by implementing industry-standard protocols, including two-factor authentication (2FA), cold wallet storage for the majority of user funds, and regular security audits. These measures help mitigate potential risks from unauthorized access and online threats. The platform also employs anti-phishing protections to safeguard sensitive information during login and transaction processes.

Weex matches these efforts with its own strict security framework, featuring 2FA integration, extensive use of cold storage, and anti-phishing codes. Additionally, Weex conducts ongoing vulnerability assessments and encourages community reporting of suspicious activity. Both exchanges have avoided major security incidents to date, reflecting their commitment to protecting user assets and data.

Blofin vs Weex: Insurance Funds

Blofin maintains an insurance fund designed to cover potential losses stemming from extreme market events or contract defaults. This fund acts as a protective buffer to ensure that profitable traders receive their earnings even if counterparties are liquidated or unable to fulfill obligations.

Weex also operates an insurance fund to mitigate risks associated with leveraged trading and sudden market movements. By pooling resources, the platform can absorb unforeseen losses, thereby increasing user confidence in the exchange’s reliability. These insurance mechanisms are crucial in environments where high leverage and rapid price swings are common.

Blofin vs Weex: Customer Support

Blofin offers multi-channel customer support, including live chat, email assistance, and comprehensive help center resources. Support is available around the clock to address technical issues, account questions, and trading inquiries. Users can typically expect prompt and knowledgeable responses, contributing to a positive overall experience.

Weex similarly provides 24/7 support through live chat, ticket systems, and detailed FAQ sections. The platform places emphasis on swift problem resolution and transparency, ensuring users have access to timely assistance for any operational or security concerns.

Blofin vs Weex: Regulatory Compliance

Blofin takes compliance seriously, adhering to international standards by requiring KYC verification and complying with anti-money laundering (AML) regulations. The exchange monitors regulatory developments and proactively updates its policies to align with global best practices, fostering trust among traders.

Weex enforces similar compliance protocols, prioritizing transparent operations and adherence to regional regulations. Both platforms demonstrate a commitment to legal standards, vital for maintaining long-term credibility and operational security in the evolving crypto industry.

Conclusion

Overall, both Blofin and Weex offer robust trading environments with strong security, advanced trading tools, and responsive customer support. Blofin stands out for its low fees, broad coin selection, and straightforward user interface, making it well-suited for traders who value transparency and platform simplicity.

Weex, on the other hand, is appealing for those seeking high leverage, innovative contract types, and a more diverse suite of earning opportunities. Traders prioritizing minimized trading costs and a wide range of cryptocurrencies may prefer Blofin, while users interested in advanced trading strategies and high-leverage products could find Weex more suitable.

Ultimately, your choice should be guided by your trading style, risk tolerance, and preferred product offerings to ensure a secure and rewarding crypto trading experience.