In the ever-evolving world of crypto trading, choosing the right exchange can significantly impact your trading experience and outcomes. With hundreds of platforms available, Blofin and MEXC stand out as two dynamic contenders offering advanced features, diverse asset selections, and competitive fees. This comparison dives deep into their core functionalities, strengths, and trade-offs to help traders—whether beginners or professionals—make an informed decision on which exchange best suits their needs.

Quick Feature Comparison Table: Blofin vs MEXC

Feature |

Blofin | MEXC |

|---|---|---|

| Founded | 2022 | 2018 |

| Founder(s) | Matt (CEO) – ex-Huobi exec | John Chen (CEO) |

| Supported Coins | 200+ cryptocurrencies | 1,700+ cryptocurrencies |

| Daily Trading Volume | ~$400 million (mainly derivatives) | $2–3 billion (spot & derivatives combined) |

| Trading Fees | Maker: 0.01% / Taker: 0.06% (Futures) | Maker: 0.1% / Taker: 0.1% (Spot) |

| Max Leverage | Up to 150x (for select contracts) | Up to 200x (on perpetuals) |

| Deposit Methods | Crypto only | Crypto, P2P fiat, third-party gateways |

| Withdrawal Methods | Crypto only | Crypto only (no direct fiat withdrawal) |

| KYC Requirements | Mandatory for trading | Optional up to 30 BTC daily withdrawal |

| Security Measures | Cold storage, 2FA, Anti-DDoS | Cold storage, 2FA, anti-phishing code |

| Insurance Fund | Yes, for derivatives protection | Yes, for futures liquidation risks |

Blofin vs MEXC: Key Differences at a Glance

Blofin is a relatively new but focused exchange primarily designed for derivatives traders. Its institutional-grade infrastructure, high-leverage options, and advanced analytics tools cater to serious futures traders. MEXC, on the other hand, is a more established, all-rounded exchange known for its massive coin selection, accessibility, and beginner-friendly interface.

Key differences include:

- Coin Selection: MEXC supports over 1,700 coins, ideal for altcoin hunters. Blofin focuses on ~200 highly liquid assets for derivatives.

- User Base: MEXC caters to a wide audience—from retail investors to pro traders. Blofin primarily targets experienced traders and institutions.

- Fee Structures: Blofin offers lower fees for derivatives trading, while MEXC charges standard spot fees but often runs fee discounts for newcomers.

Blofin vs MEXC: Platform Products and Services Overview

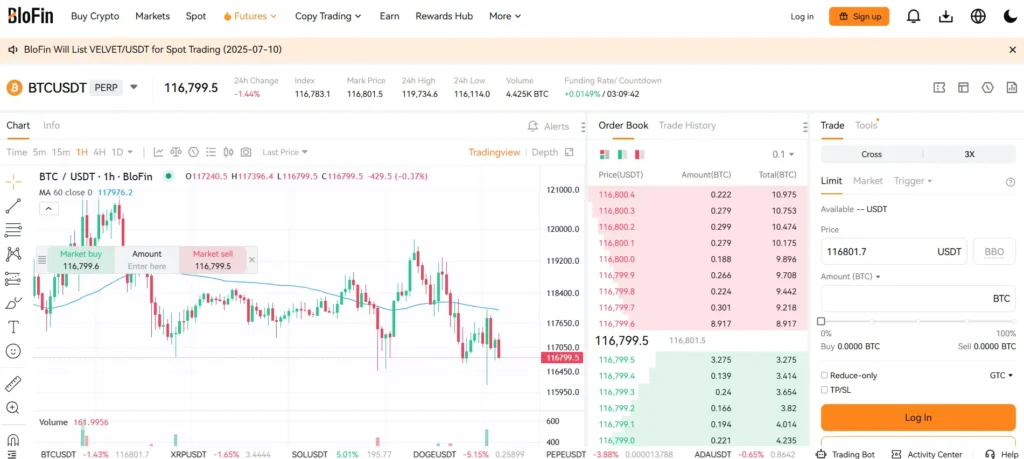

Blofin offers a tightly focused set of services tailored specifically for derivatives traders. The platform excels in USDT-margined perpetual futures with high leverage options and deep liquidity. It emphasizes a professional-grade trading environment equipped with advanced analytics, robust risk controls, and portfolio margin support—features that appeal especially to institutional and high-frequency traders. The minimalistic interface and technical depth are designed to prioritize speed and performance over breadth.

In contrast, MEXC positions itself as a multi-functional trading ecosystem. Beyond spot and futures trading, it supports a wide range of services like leveraged ETFs, copy trading, grid trading bots, staking, and access to token launches through Launchpad and Kickstarter. This makes MEXC a more versatile platform suitable for a broad user base, including beginners, altcoin enthusiasts, and passive income seekers.

Blofin vs MEXC: Range of Tradable Contracts

Blofin focuses on offering a refined list of USDT-margined perpetual contracts for major cryptocurrencies such as BTC, ETH, SOL, and a select set of trending altcoins. While its contract offerings are fewer in number, the platform emphasizes execution quality, low latency, and narrow spreads—attributes that attract professional traders and institutions seeking stable environments for high-volume trading.

MEXC, on the other hand, offers a significantly wider range of tradable contracts, including both USDT-M and Coin-M perpetuals, as well as leveraged tokens (ETFs) and futures contracts for many small-cap and emerging tokens. This diversity allows traders to experiment with new assets and trading styles, offering flexibility for those seeking opportunities beyond blue-chip cryptocurrencies. Overall, Blofin prioritizes precision and stability, while MEXC thrives on variety and reach.

Blofin vs MEXC: Supported Cryptocurrencies and Trading Pairs

MEXC is widely known for its extensive coin listing, supporting over 1,700 cryptocurrencies and thousands of trading pairs. From major assets like BTC and ETH to low-cap altcoins and emerging tokens, MEXC serves as a go-to platform for altcoin enthusiasts and early-stage investors. The platform frequently adds new tokens soon after their launch, which appeals to high-risk, high-reward traders.

Blofin, by contrast, adopts a more curated approach. It supports around 200+ cryptocurrencies, focusing on highly liquid and established assets. This narrower selection ensures that liquidity is deep and order execution is fast and reliable—crucial factors in derivatives trading. Traders on Blofin will mostly find major pairs suited for perpetual contracts rather than speculative altcoins.

Blofin vs MEXC: Leverage and Margin Trading

Both exchanges offer competitive leverage, but their approach and risk frameworks differ.

Blofin provides up to 150x leverage on select perpetual futures contracts. It’s designed for seasoned traders comfortable with high-risk, high-reward strategies. Blofin also features portfolio margining for users with large balances, optimizing capital efficiency while applying strict risk controls and auto-deleveraging to reduce systemic risk.

MEXC, on the other hand, offers up to 200x leverage on perpetual contracts, although such high leverage is only available on major pairs. It also supports cross and isolated margin modes across spot and futures markets. While MEXC’s broader leverage offerings are attractive, it may lack some of the institutional-level risk tools available on Blofin.

Blofin vs MEXC: Trading Volume and Liquidity

When it comes to trading volume, MEXC consistently ranks among the top 10 global exchanges, with daily volumes exceeding $2 billion across spot and derivatives. Its large user base and deep order books, particularly for popular altcoins, ensure decent liquidity even for lesser-known tokens.

Blofin, while smaller in scale, has carved out a niche in derivatives trading. With a daily derivatives volume of ~$400 million, the platform focuses on providing deep liquidity on a select few high-demand contracts. Its strength lies in execution speed, order book stability, and minimal slippage during volatile market conditions.

In short, MEXC is the winner in overall volume and coin breadth, while Blofin excels in liquidity quality and infrastructure for high-frequency derivatives trading.

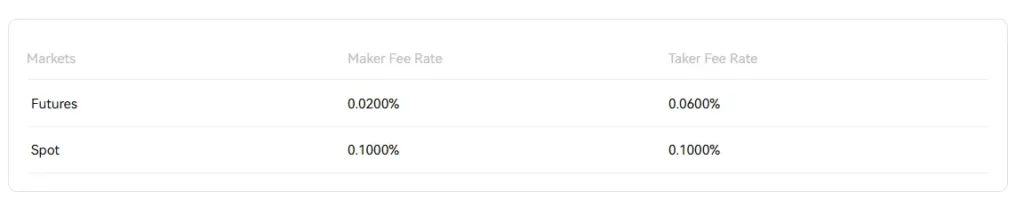

Blofin vs MEXC: Fee Structure Comparison

Both Blofin and MEXC offer competitive fee models, but they cater to slightly different user needs.

Blofin keeps things simple and appealing for high-volume derivatives traders. It charges 0.01% maker and 0.06% taker fees on perpetual futures, making it one of the more cost-effective platforms for professional traders. There are no spot trading services as of now, and deposit fees are zero. Withdrawal fees vary by asset but remain in line with industry standards.

MEXC, on the other hand, follows a standardized 0.1% maker/taker fee for spot trading and 0.02% maker / 0.06% taker for futures. It also frequently offers trading fee rebates, zero-fee trading events, and VIP tiers for high-volume traders. MEXC charges no deposit fees and maintains reasonable withdrawal fees depending on the asset.

Blofin vs MEXC: Deposits, Withdrawals, and Payment Methods

Blofin currently supports only crypto-based deposits and withdrawals. It does not provide fiat gateways or P2P options. This focused setup works well for users who are already integrated into the crypto ecosystem but can be limiting for newcomers looking to deposit fiat via UPI, cards, or bank transfers.

MEXC, in contrast, offers multiple on-ramps for users. It supports:

-

Crypto deposits/withdrawals

-

Fiat purchases via third-party providers (Visa, Mastercard, Banxa, etc.)

-

P2P trading for INR and other major currencies

Although MEXC does not support direct fiat withdrawals to bank accounts, users can sell crypto via P2P or off-ramp via a third-party service.

Blofin vs MEXC: Native Exchange Tokens

As of now, Blofin does not have a native exchange token, which is unusual in the industry but reflects its focused, professional-grade positioning. This also means no token-based fee discounts or staking benefits are offered.

MEXC issues the MX Token, a utility token that can be used for:

-

Fee discounts on trading

-

Staking for rewards

-

Participation in Launchpad/Kickstarter

-

Voting for new listings

MX holders also enjoy exclusive access to airdrops and other incentives, making it a value-add for frequent users.

Blofin vs MEXC: KYC Requirements and Account Limits

KYC policies on both platforms reflect their core priorities—compliance and access.

Blofin enforces mandatory KYC for all users. Without completing identity verification, users cannot deposit, trade, or withdraw. This strict policy aligns with Blofin’s institutional-grade positioning and its focus on regulatory alignment and user safety.

MEXC, on the other hand, offers more flexibility. Basic accounts without KYC can:

-

Deposit and trade

-

Withdraw up to 30 BTC per day

For larger withdrawals or participation in fiat-related services, full identity verification (KYC) is required.

Blofin vs MEXC: User Interface and Ease of Use

Blofin features a clean, fast, and performance-optimized interface designed primarily for derivatives traders. Its dashboard focuses on depth charts, order book visibility, and multi-screen layout. The interface appeals more to intermediate and advanced users familiar with leveraged trading environments.

MEXC, by contrast, strikes a balance between functionality and user-friendliness. Its mobile and desktop platforms are highly navigable, with clearly labeled tabs, easy asset search, and customizable layouts. The app is particularly well-suited for beginners exploring spot markets, copy trading, or token launches.

Overall:

-

Blofin = Best for professionals and derivatives-focused traders

-

MEXC = Best for beginners, casual users, and altcoin enthusiasts

Blofin vs MEXC: Order Types Supported

A key distinction between the two exchanges is the range and depth of order types supported.

Blofin includes:

-

Market Order

-

Limit Order

-

Trigger Order (Stop-limit/Stop-market)

-

Post-Only & Reduce-Only options

These are essential for active traders who need precision in volatile conditions.

MEXC supports:

-

Market & Limit Orders

-

Stop-Limit/Stop-Market

-

Iceberg Orders

-

OCO (One-Cancels-the-Other)

-

Grid Bot Automation (via built-in bots)

While both exchanges offer the basics, MEXC adds automation and strategy-based orders, making it suitable for users looking for semi-passive trading tools or DCA/grid strategies.

Blofin vs MEXC: Security Features and Practices

Security is a critical aspect of any exchange, and both Blofin and MEXC implement industry-standard measures—though their emphasis varies.

Blofin puts strong focus on institutional-grade security. Key features include:

-

Cold wallet storage for over 95% of user funds

-

Multi-signature wallet access

-

Two-Factor Authentication (2FA)

-

Anti-DDoS protections

-

Advanced risk control engine to prevent forced liquidations and market manipulation

There have been no known major security breaches reported on Blofin as of mid-2025.

MEXC also provides a robust security framework:

-

2FA, email & SMS verification

-

Cold wallet fund storage

-

Anti-phishing code for email communication

-

Real-time risk monitoring systems

While MEXC hasn’t suffered from high-profile hacks, its wide user base and asset range mean users should remain vigilant and always enable all protective features.

Blofin vs MEXC: Insurance Funds

Both exchanges maintain insurance funds to protect users in cases of extreme market volatility or contract bankruptcies.

-

Blofin’s Insurance Fund is focused solely on its derivatives platform. It is funded by liquidation penalties and helps cover losses when a position is force-liquidated below bankruptcy price. This ensures smoother operation during sharp price moves and reduces clawback risks.

-

MEXC also uses an insurance fund system for its futures trading. In addition, it implements Auto-Deleveraging (ADL) to limit systemic risk when the insurance fund is insufficient. MEXC’s structure helps minimize loss-sharing across traders during periods of abnormal volatility.

For both platforms, these funds are an extra layer of protection—but they’re not substitutes for personal risk management.

Blofin vs MEXC: Customer Support

Good support makes a big difference, especially during market stress. Here’s how the platforms compare:

Blofin offers:

-

24/7 live chat support

-

Email ticketing system

-

In-platform help center with basic FAQs

While responsive, Blofin’s support channels are more focused on trading-related technical issues than general account queries.

MEXC provides a broader customer support experience, including:

-

24/7 live chat

-

Email and ticketing support

-

Active Telegram communities in multiple languages

-

Extensive help docs and tutorials

MEXC’s larger team and multilingual presence make it more accessible for everyday users, especially beginners navigating account setup or fiat transactions.

Blofin vs MEXC: Regulatory Compliance

Regulatory stance is becoming increasingly crucial as global scrutiny over crypto exchanges intensifies.

Blofin positions itself as a compliance-forward exchange, especially as it targets institutional traders. It mandates KYC for all users, adheres to anti-money laundering (AML) policies, and has stated its intent to align with future regulatory frameworks in major jurisdictions. While not headquartered in a major Western country, its operations reflect a drive toward long-term compliance and legitimacy.

MEXC, while globally accessible, operates more like a non-restrictive offshore exchange. KYC is optional for most basic features, and the platform has historically catered to users in regions with looser regulations. However, MEXC has recently started stepping up compliance for certain fiat services and regional partners, signaling a potential shift toward a more regulated stance over time.

Conclusion

When comparing Blofin vs MEXC, the choice comes down to trader profile and purpose.

-

Choose Blofin if you’re an advanced or institutional trader focused on derivatives, precision execution, and high-leverage strategies. It offers low fees, a professional interface, and a security-first approach. However, its lack of spot trading, fiat on-ramps, and altcoin support may be limiting for casual users.

-

Choose MEXC if you’re a general crypto enthusiast, beginner, or altcoin investor looking for a wide selection of tokens, flexible KYC, and multiple trading products (including spot, futures, ETFs, bots, and staking). MEXC offers more accessibility and product diversity, making it ideal for broad use cases.

Final Verdict:

-

Blofin = Best for serious traders and futures-focused professionals

-

MEXC = Best for casual users, altcoin hunters, and those looking for a full-service platform

No matter which you choose, both exchanges are secure, feature-rich, and offer unique strengths depending on your trading style.