Choosing the right crypto derivatives trading platform can be challenging, with options like Blofin and Bybit standing out for their features and user experience. Bybit is known for its global reach, deep liquidity, and advanced trading tools, while Blofin has gained traction for its security focus and transparency.

This comparison will break down the essential aspects of both platforms—including fees, leverage, supported assets, and user interface—to help you identify which exchange best fits your trading needs. Whether you are a beginner or experienced trader, understanding these differences is crucial to maximizing your trading potential.

Quick Feature Comparison Table: Blofin vs Bybit

| Feature | Blofin | Bybit |

| Founding Year | 2023 | 2018 |

| Supported Countries | 150+ (excludes US) | 195+ (excludes US, China, Singapore, UK, others) |

| Supported Coins | 250+ spot pairs, 350+ perpetual futures pairs, 400+ USDT-M futures | 650+ cryptocurrencies for spot, margin, futures, and options |

| Trading Products | Spot, Perpetual Futures, Copy Trading, Wealth Management, Demo Trading | Spot, Perpetual and Futures, Options, Margin, Copy Trading, Trading Bots, Gold/Forex/Commodities |

| Max Leverage | Up to 150x (futures) | Up to 100x (crypto futures), 500x (forex/commodities; varies by asset) |

| Account/KYC Requirements | No mandatory KYC for basic features; higher limits and features with verification | Tiered KYC; required for fiat and for larger withdrawal limits |

| Order Types | Market, Limit, Stop, Grid, Copy, Bot-trading | Market, Limit, Stop, Trailing, Conditional, Advanced order types, Copy, Grid, Bot-trading |

| Notable Features | Fast trading engine, institutional tools, copy trading, low-latency API, demo account | Wide product suite (options, bots, savings), Bybit Card, global education, VIP rewards |

Blofin vs Bybit: Key Differences at a Glance

Blofin and Bybit cater to different trader needs through a few standout features. Blofin, founded in 2023, focuses on institutional-grade trading speed, advanced security through partners like Fireblocks, and offers a streamlined experience with copy trading and demo accounts. By contrast, Bybit, established in 2018, stands out for its deep liquidity, vast selection of over 650 cryptocurrencies, and an extensive suite of trading products, including options and innovative trading bots.

Another key difference is in user access and KYC requirements. Blofin allows basic trading and withdrawals without mandatory verification, appealing to users who value privacy and flexibility, while Bybit uses a stricter, tiered KYC system, especially for fiat services and larger withdrawals. In terms of native tokens, Bybit offers the $BIT token with fee discounts and rewards, whereas Blofin does not have a native exchange token. Overall, Blofin is ideal for users focused on speed and security, while Bybit suits those seeking diversified trading features and high liquidity.

Platform Products and Services Overview

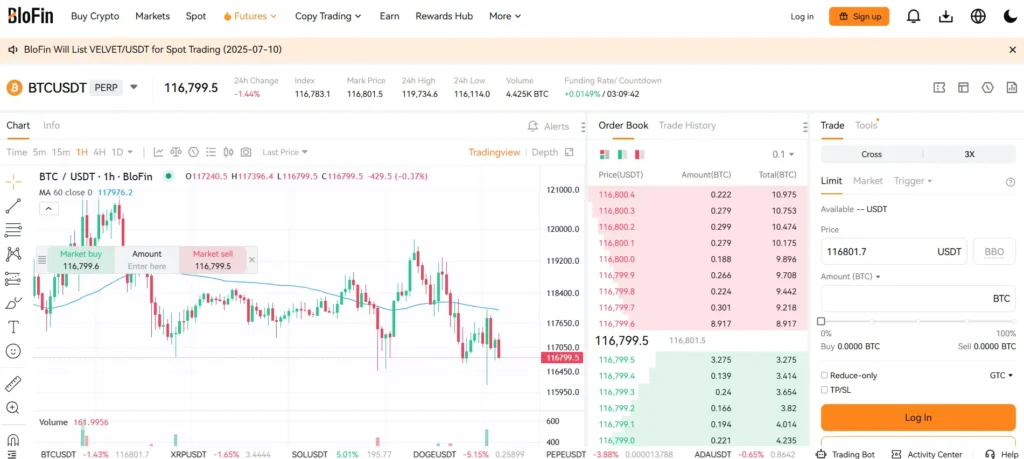

Blofin caters to traders seeking speed and simplicity, offering over 250 spot pairs and 350+ perpetual/USDT-M futures with high-speed execution. The platform features a user-friendly interface, institutional-grade security, proof-of-reserves transparency, demo accounts, and copy trading—making it suitable for both beginners and pros. Blofin also supports algorithmic and institutional traders with a low-latency API and growing wealth management tools.

Bybit offers a wide range of trading products, including spot, margin, futures, and crypto options across 650+ assets. It also features trading bots, copy trading, and advanced order types. Unique offerings include forex, commodities, a savings platform, token launchpad, and the Bybit Card for crypto-to-fiat spending. Bybit enhances user experience through education resources, a global VIP program, and robust app support.

Range of Tradable Contracts

Blofin offers 350+ USDT-M perpetual futures alongside spot trading, focusing on fast, consistent execution ideal for both retail and institutional traders. Copy trading and demo mode make derivatives more accessible to beginners.

Bybit provides one of the widest derivatives selections, including perpetuals, inverse futures, crypto options, and even select commodities and forex. Its advanced contract types cater to professional traders seeking flexible, multi-asset strategies.

Supported Cryptocurrencies and Trading Pairs

Blofin offers 250+ spot pairs and 350+ perpetual futures, covering major cryptocurrencies and trending altcoins. Its curated selection ensures high liquidity and smooth execution, making it ideal for traders seeking efficiency, stability, and reduced risk.

Bybit supports 650+ cryptocurrencies across spot, margin, futures, and options. Alongside top tokens like BTC and ETH, it frequently lists new and emerging altcoins, appealing to traders looking for variety and early access to market trends. Deep liquidity and broad asset coverage make Bybit ideal for those seeking exposure to both mainstream and niche assets.

Leverage and Margin Trading

Blofin offers leverage of up to 150x on its perpetual futures contracts, appealing to traders who want greater risk and return potential. Users can easily adjust leverage settings to fit their strategy, with built-in risk management features to minimize the chance of liquidation. The simple interface and fast execution support active management of leveraged positions, and copy trading lets beginners follow experienced high-leverage traders.

Bybit provides up to 100x leverage on crypto futures and even higher—up to 500x—on select forex and commodity markets. It supports both isolated and cross margin modes, giving traders flexibility in managing capital and exposure. Bybit also implements advanced risk controls, including auto-deleveraging and an insurance fund, to help protect users from large losses.

Trading Volume and Liquidity

Blofin has quickly built a reputation for strong liquidity and growing trading volume, especially in futures markets. Its deep order books and tight spreads make it reliable for both active and institutional traders. Bybit, however, remains one of the world’s top exchanges by volume, known for extremely deep liquidity across all major and minor crypto pairs. High trading volumes on Bybit ensure orders are filled quickly and with minimal slippage, even during periods of high volatility.

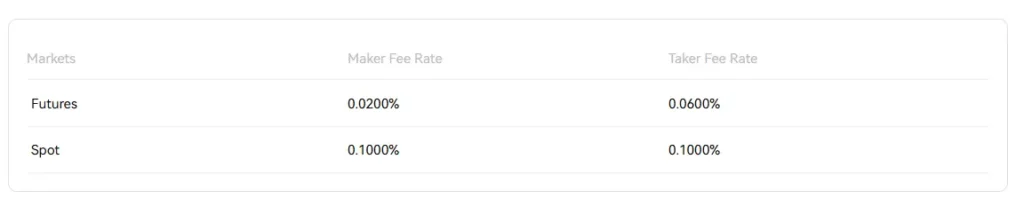

Fee Structure Comparison

Both Blofin and Bybit offer competitive, tiered fee structures. Standard spot trading fees on both platforms start at 0.10%, with futures trading typically at 0.02% maker and around 0.06% taker. VIP or high-volume traders can unlock much lower rates. Crypto deposits are free on both, while withdrawal fees depend on the asset’s network costs. Bybit extends discounted fees to more products, such as options, and often runs trading promotions, but overall, fee differences between the two are minor for most users.

Deposits, Withdrawals, and Payment Methods

Blofin focuses on easy cryptocurrency deposits and withdrawals, supporting a wide range of coins with straightforward wallet address generation and prompt crediting. Users can also access fiat on-ramps through third-party gateways and pay in over 85 currencies, though larger or fiat transactions may require verification. Withdrawal fees are limited to standard blockchain network charges, with no added platform fees.

Bybit provides even broader flexibility, allowing both crypto and fiat deposits and withdrawals. The platform supports numerous fiat payment channels, including bank transfers, cards, and popular digital wallets, though KYC is required for cashing out in fiat. Withdrawal fees are network-based, and higher verification levels increase daily limits and processing speeds.

Native Exchange Tokens

Blofin does not currently offer a native exchange token, focusing instead on core platform features and security.

Bybit, while not issuing its own proprietary coin, integrates closely with the $BIT token, which provides users with fee discounts, access to special promotions, and participation in related governance activities.

KYC Requirements and Account Limits

Blofin allows users to start trading with minimal friction. No mandatory KYC is required for basic access, including withdrawals up to a set daily limit (e.g., 20,000 USDT), making it appealing for users who value speed and privacy. However, completing KYC unlocks higher withdrawal limits, increased fiat transaction capabilities, and access to more platform features. The identity verification process enhances account security and is recommended for users with larger trading needs or who want to fully utilize the platform.

Bybit follows a tiered KYC structure. Users can deposit, trade, and withdraw limited amounts with a basic account, but full KYC is required for fiat transactions, higher withdrawal limits, and participation in advanced features like Launchpad events or P2P trading. Verification involves submitting standard identification documents and is generally quick and user-friendly. Bybit’s strong focus on regulatory compliance also means some jurisdictions may face restrictions or limited access based on local laws.

User Interface and Ease of Use

Blofin offers a clean, minimalist interface on both web and mobile, designed for easy navigation and fast performance. Demo trading and integrated copy trading make onboarding simple for beginners, while advanced users benefit from low-lag execution and efficient layout for managing trades and portfolios with ease.

Bybit provides a polished, feature-rich interface suitable for all trader levels. Its platforms include advanced charting, customizable workspaces, and rapid order entry. Educational guides, multi-language support, and a seamless web-to-app experience make it beginner-friendly, while pros enjoy powerful tools and dashboard flexibility.

Order Types Supported

Blofin offers a robust set of order types to suit a variety of trading strategies. These include standard market and limit orders, as well as stop orders for better risk control. Additionally, advanced features like grid and copy trading enable automation and portfolio diversification with minimal effort. Traders also have access to bot trading, allowing for algorithmic execution and hands-off strategies.

Bybit supports an even wider range of order types, including market, limit, and stop orders, along with trailing stop and conditional orders for more complex strategies. The platform also enables advanced order combinations and grid trading, making it suitable for both basic and sophisticated trading approaches. Copy trading and integrated trading bots round out the platform’s tools, catering to all user skill levels and trading styles.

Security Features and Practices

Security is a core focus for both exchanges. Blofin adopts institutional-grade safeguards, including Fireblocks custody for asset protection, regular monitoring for suspicious activity via Chainalysis, and transparent Merkle-tree proof of reserves. The bulk of user assets are kept in cold storage, and platform security is reinforced through industry partnerships and continuous system audits. These practices foster trust and demonstrate a deep commitment to protecting user funds and information.

Bybit also implements strong security protocols, favoring cold wallet storage for most assets and deploying multi-factor authentication to secure accounts. The exchange provides public proof-of-reserves to maintain transparency. Bybit’s track record for system uptime and responsiveness to potential threats has solidified its reputation as a secure environment for large-scale trading. Additional safeguards include anti-phishing codes, withdrawal whitelist options, and ongoing security assessments.

Insurance Funds

Blofin employs industry-standard insurance practices to help protect users against unexpected losses in the event of market volatility or rare platform incidents. Custodial partners like Fireblocks provide an additional layer of insurance for assets held on the platform, although Blofin does not currently operate a dedicated insurance fund specifically for user-covered contract losses.

Bybit operates a comprehensive insurance fund, particularly designed to support its derivatives markets. This fund covers auto-deleveraging risks and compensates traders in cases where large positions are liquidated but cannot be filled at the market price. The existence of a transparent, well-capitalized insurance fund helps instill confidence in users trading high-leverage products on Bybit, ensuring protection during especially volatile or extreme market events.

Customer Support

Blofin offers 24/7 live chat support directly on its platform, helping users with trading, deposits, and technical issues. A detailed help center provides guidance on common topics, making it easy for both beginners and experienced users to find quick solutions. The focus is on fast, clear, and accessible assistance.

Bybit also provides 24/7 live chat, along with a multilingual helpdesk and rich self-help resources including FAQs, guides, and video tutorials. Regional support teams and community managers enhance the experience for global users. Bybit is known for responsive, thorough support—especially on complex issues like account verification.

Regulatory Compliance

Blofin emphasizes security and compliance by using trusted partners like Fireblocks for custody, deploying blockchain analysis tools, and maintaining proof-of-reserves transparency. While basic features are accessible without KYC, advanced services require verification in line with global standards. The platform adapts access based on evolving regulations in its target markets.

Bybit takes a strong compliance-driven approach, enforcing KYC and limiting access where crypto trading is restricted. It actively seeks licenses and aligns with regulatory frameworks like MiCA in Europe. With proof-of-reserves and ongoing cooperation with authorities, Bybit aims to build long-term trust and regulatory readiness.

Conclusion

Both Blofin and Bybit are strong crypto trading platforms, but they cater to different types of users. Blofin is best suited for those who value a streamlined, privacy-friendly experience with no mandatory KYC for basic access. Its fast trade execution, intuitive interface, and emphasis on perpetual futures, copy trading, and demo accounts make it especially appealing to users focused on high-leverage strategies and ease of use.

In contrast, Bybit offers a more expansive trading ecosystem with deep liquidity, a wide variety of assets—including options and advanced derivatives—and comprehensive fiat support. Its straightforward KYC process unlocks higher limits and access to additional features, while its global reputation, educational content, and regional customer support make it a strong choice for users seeking reliability, regulatory alignment, and long-term platform depth.

Ultimately, the right choice depends on your individual trading needs—whether you prioritize speed, simplicity, and privacy, as with Blofin, or a full-featured, regulation-ready platform like Bybit.