In the ever-evolving world of cryptocurrency trading, choosing the right exchange can significantly impact your trading experience and profitability. With dozens of platforms offering a range of features, tools, and trading pairs, it’s crucial to identify which one best suits your needs. In this post, we compare two rising contenders in the crypto exchange arena: Blofin and BingX.

Both platforms have garnered attention for their user-friendly interfaces, growing user bases, and focus on derivatives and copy trading. However, their underlying philosophies, features, and market strategies differ in key areas. Whether you’re a seasoned trader looking for deep liquidity and advanced tools, or a beginner seeking simplicity and support, this comparison will help clarify which platform aligns better with your goals.

Quick Feature Comparison Table: Blofin vs BingX

| Feature | Blofin | BingX |

|---|---|---|

| Founding Year | 2022 | 2018 |

| Founders | Matt Lang (CEO) | Josh Lu (CEO) |

| Supported Coins | 150+ major and emerging assets | 500+ including major, altcoins, and tokens |

| 24h Trading Volume (Est.) | ~$300 million (primarily derivatives) | ~$800 million (spot & derivatives) |

| Trading Fees | Maker: 0.02%, Taker: 0.04% (VIP tiers available) | Maker: 0.045%, Taker: 0.075% (discounts via native token) |

| Leverage | Up to 150x on select contracts | Up to 150x on perpetual contracts |

| Deposit Methods | Crypto deposits only | Crypto, P2P fiat, and third-party fiat gateways |

| Withdrawal Methods | Crypto withdrawals | Crypto withdrawals, fiat via P2P (limited regions) |

| Security Measures | Multi-sig cold wallets, 24/7 risk monitoring, institutional-grade custody | Real-time risk control, multi-factor authentication, cold wallet storage |

Blofin vs BingX: Key Differences at a Glance

Blofin was founded in 2019 and launched its exchange platform in early 2023 with a clear focus on high-leverage derivatives trading. BingX, established in 2018, began as a derivatives platform as well but quickly evolved into a more versatile exchange offering spot trading, copy trading, and investment tools like grid bots and structured products.

Blofin caters primarily to experienced traders with over 350 USDT-margined futures contracts and leverage up to 150×. It emphasizes performance, speed, and pro-level tools such as demo accounts and trading bots. BingX, while also supporting up to 100× leverage on most contracts, is more beginner-friendly and includes a broader range of features designed for passive or semi-automated trading.

In terms of asset support, BingX lists over 750 spot cryptocurrencies, including many trending altcoins and meme tokens. Blofin, while more focused on derivatives, also supports a wide range of trading pairs but leans toward structured futures offerings rather than sheer volume.

When it comes to fees, both platforms offer competitive maker-taker structures with tiered discounts based on trading volume. BingX tends to have slightly lower spot fees, while Blofin shines in the futures segment with tight spreads and high liquidity.

Fiat support is another point of contrast. BingX offers both crypto and fiat deposits and withdrawals through multiple providers. Blofin supports fiat-to-crypto purchases but does not currently allow fiat withdrawals.

Overall, Blofin is best suited for high-frequency, leverage-focused traders, while BingX appeals to a broader user base looking for variety, ease of use, and passive income tools like copy trading.

Platform Products and Services Overview

Blofin is built with a strong emphasis on professional derivatives trading. It offers a comprehensive suite of features such as over 350 USDT-margined perpetual contracts, trading bots, demo trading, and copy-trading. The platform supports a Unified Trading Account (UTA) that allows seamless movement between spot and futures without manual transfers, making it ideal for strategy-driven traders who value efficiency and automation.

BingX takes a more diverse approach. It offers spot and futures trading, but its standout features include copy trading, grid bots, and structured investment tools under its “Wealth” section. Users can also access beginner-friendly tools, like simple margin modes and one-click copy trades, making the platform attractive to both new and passive traders.

Range of Tradable Contracts

Blofin specializes in USDT-margined perpetual futures, offering high leverage and a fast trading engine. Its contract structure revolves around perpetual swaps with both isolated and cross-margin options. Strategic tools such as automated trading bots and demo accounts further enhance its value for high-frequency traders.

BingX, while also strong in futures, provides both USDT- and coin-margined perpetuals as well as standard contracts with expiry dates. It supports up to 150× leverage on select pairs and includes execution features like TradingView charts, dual-price mechanisms, and zero-slippage protections. The platform’s focus is on giving traders more choice and control across varying levels of experience.

Supported Cryptocurrencies and Trading Pairs

Blofin offers a wide selection of futures and spot trading pairs, focusing on highly liquid markets and popular coins. Its listings are carefully curated to ensure deep liquidity and fast execution, making it suitable for traders who prefer consistency and reliability.

BingX, on the other hand, supports over 750 cryptocurrencies on its spot exchange, including trending altcoins, memecoins, and tokens from emerging projects. This makes it a better fit for users who want to diversify into niche assets or participate in early-stage token trading.

Leverage and Margin Trading

Blofin offers leverage up to 150× on select futures contracts, positioning itself as a platform for experienced and high-frequency traders. It provides both isolated and cross-margin options, allowing traders to manage risk according to their strategy. Risk controls such as auto-deleveraging (ADL) and liquidation indicators are in place to help mitigate losses during high volatility.

BingX also supports leverage up to 150× on specific markets, though most contracts are capped at 100×. The platform caters to both novice and pro traders with simplified margin modes and detailed leverage settings. It includes features like dual-price mechanisms and margin alerts to help users stay informed and protected from unexpected liquidations.

Trading Volume and Liquidity

Blofin has gained traction in the futures market with solid trading volumes, especially in high-leverage contracts. Its unified account structure and liquidity partnerships contribute to fast order execution with minimal slippage. The platform is built to support institutional-grade performance, which reflects in its growing liquidity footprint.

BingX enjoys strong daily trading volumes across spot and derivatives, supported by a large user base. Its liquidity is especially notable in USDT pairs and popular futures contracts. While not on the same level as the largest global exchanges, BingX consistently ranks among the top platforms in terms of retail activity and copy-trading volume.

Fee Structure Comparison

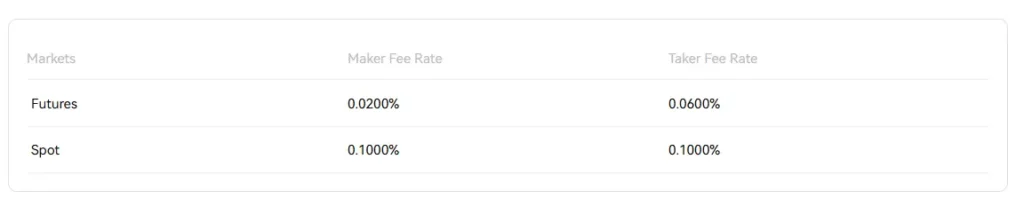

Blofin uses a tiered fee system based on trading volume, offering competitive maker and taker fees. For most users, the maker fee starts around 0.02% and the taker fee at 0.04% on futures. Spot trading fees are similarly low, and the platform offers discounts for high-volume traders or those holding its native token.

BingX offers some of the lowest entry-level fees in the market. Spot trading fees typically start at 0.1%, while futures trading fees begin at 0.02% for makers and 0.05% for takers. The platform also provides VIP tiers that reduce fees further, along with promotional discounts and zero-fee campaigns on selected pairs.

Deposits, Withdrawals, and Payment Methods

Blofin and BingX offer different levels of flexibility when it comes to funding your account and accessing your funds, especially in terms of fiat support and transaction options.

Blofin currently supports crypto-only deposits and withdrawals, with no fiat on-ramp or off-ramp options. All deposits are free, and withdrawal fees are asset-specific—set at fixed network rates to ensure transparency. Processing times are relatively quick, especially for major coins, and the platform uses multi-sig cold storage and risk monitoring to secure transactions. However, beginners may find the lack of fiat access limiting.

BingX, in contrast, offers a wide range of payment methods, including crypto deposits/withdrawals, P2P fiat trading, and third-party payment gateways like MoonPay or Banxa. This makes it much more accessible for users who want to buy crypto with local currency or cash out earnings. Withdrawal fees are reasonable and vary by asset, while P2P transactions may include minimal service fees or none at all depending on the method and region.

Native Exchange Tokens

While some major exchanges offer native tokens with added benefits, Blofin currently does not have a native utility token. It maintains a straightforward fee model without token-based discounts, which appeals to users who prefer simplicity and transparency without needing to manage another asset for benefits.

BingX, however, offers a native exchange token called BINGX Token, which provides various utilities within the platform. Users can enjoy fee discounts, exclusive campaign access, and potential rewards when holding or using the token during trades. Though not as widely integrated as larger tokens like KuCoin’s KCS or Bybit’s BYD, BingX’s token still enhances user engagement and incentivizes loyalty.

KYC Requirements and Account Limits

Both Blofin and BingX support trading without mandatory KYC for basic functionality, but verification unlocks higher withdrawal limits and additional features.

Blofin allows users to trade and deposit crypto without KYC, but withdrawals are limited until identity verification is completed. Once KYC is verified, users can enjoy full platform access and higher withdrawal limits, aligning with industry compliance standards.

BingX offers a tiered KYC structure, where basic trading and small withdrawals are allowed without verification. Completing Level 1 or Level 2 KYC increases daily withdrawal limits and access to P2P trading and fiat services.

User Interface and Ease of Use

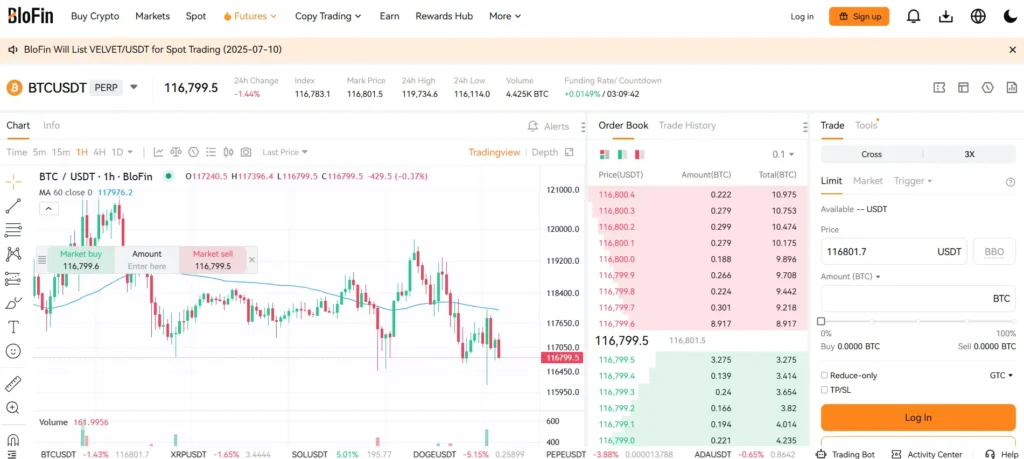

Blofin offers a clean, professional trading interface tailored for experienced traders. The web platform is fast and minimal, with an emphasis on real-time charting, advanced order controls, and seamless execution. The mobile app mirrors this pro-grade feel, though it may appear a bit technical for beginners who are new to trading.

BingX, in contrast, prioritizes user-friendliness and accessibility. Its interface—both on web and mobile—is visually intuitive, making it easy for new users to navigate spot, futures, and copy trading features. BingX also includes educational tooltips, beginner modes, and one-click copy trading, making it especially appealing for users with little or no prior experience.

Order Types Supported

Both Blofin and BingX support a solid range of order types, but Blofin leans more into advanced execution tools, while BingX keeps things simple for the average user.

Blofin supports:

-

Market orders

-

Limit orders

-

Stop-limit orders

-

Stop-market orders

-

Take-profit/Stop-loss triggers

-

Post-only and reduce-only options

BingX supports:

-

Market orders

-

Limit orders

-

Stop-loss and take-profit

-

Trailing stop (limited assets)

-

Copy trading auto-orders

Security Features and Practices

Both platforms take security seriously, though Blofin is especially vocal about its institutional-grade protections.

Blofin uses:

-

Cold wallet storage with multi-sig access

-

24/7 risk monitoring systems

-

Two-factor authentication (2FA)

-

Regular audits and internal compliance checks

BingX implements:

-

Cold and hot wallet segregation

-

2FA and anti-phishing codes

-

Real-time risk management

-

Manual review for large withdrawals

Neither platform has faced any major public security incidents as of now. Blofin’s positioning around institutional security suggests a more conservative, risk-mitigated architecture. BingX focuses on user-side protections and accessibility, making it secure yet approachable.

Insurance Funds

Both Blofin and BingX maintain insurance funds to protect users in extreme market conditions, especially during high-leverage trading where losses can exceed margin.

Blofin’s insurance fund is designed to cover losses from liquidations where the margin is insufficient to close the position, helping maintain system stability and prevent clawbacks. It operates similarly to institutional-grade derivatives platforms, focusing on ensuring fairness and execution integrity for professional traders.

BingX also has an insurance fund that supports losses in copy trading and futures, especially when volatile moves trigger slippage or liquidation risks. It serves as a safety net for retail users, particularly beginners who may not fully understand leveraged risks.

In both cases, the insurance fund acts as a risk buffer, but Blofin leans toward protecting larger, high-volume trades, while BingX uses it to support a broader retail user base.

Customer Support

Blofin and BingX both offer multi-channel customer support, but their approaches vary slightly in speed and accessibility.

Blofin provides support through:

-

24/7 live chat

-

Email ticketing

-

Help center with detailed FAQs

Its support is aimed at traders who may need technical assistance with execution or account-related issues, and response times are generally fast.

BingX also offers:

-

24/7 live chat

-

Email ticketing

-

AI chat assistant for quick resolutions

-

Telegram and social media support in select regions

BingX’s support system is more community-friendly and multilingual, making it better suited for new traders and international audiences.

Regulatory Compliance

Regulatory compliance is a growing concern in crypto trading, and both exchanges take steps to align with industry expectations, though their approaches differ.

Blofin is focused on maintaining a compliance-first reputation, with KYC verification and internal controls aligned with global financial standards. While not headquartered in a major regulatory jurisdiction, it structures its services to mirror institutional expectations.

BingX, meanwhile, is actively licensed in select jurisdictions, such as Lithuania and Australia, and works with regulators to stay compliant in regions where it operates. Its layered KYC, transaction monitoring, and fiat gateway compliance make it more retail-regulation ready.

Conclusion

Both Blofin and BingX are strong contenders in the crypto exchange space, but they cater to distinct trader profiles.

Blofin is best suited for professional and derivatives-focused traders who value low fees, deep liquidity on major pairs, advanced order types, and institutional-grade security. Its clean, execution-focused platform is ideal for those who prioritize performance and control in leveraged trading.

On the other hand, BingX is a great choice for beginners and casual traders, offering a user-friendly interface, wide coin selection, copy trading features, and multiple fiat on-ramp options. It excels in accessibility and education, making it easier for new users to get started and scale up gradually.

In terms of security, both platforms are reliable, with cold wallet storage and 2FA. Blofin leads in risk management and liquidation protection, while BingX offers broader tools for user protection and learning.

For fees, Blofin has the edge with ultra-low trading costs for derivatives. BingX charges slightly more but provides discounts through token use and referral programs, especially beneficial for active retail traders.

If you’re an experienced trader seeking speed, efficiency, and precision—Blofin is your go-to. If you’re a newcomer looking for flexibility, social trading, and a wide range of crypto assets—BingX is the better fit.