In the rapidly evolving landscape of cryptocurrency trading, two rising platforms—Bitunix and Weex—have carved out distinctive positions for themselves. While they may not yet rival giants like Binance or Bybit in size, both exchanges are gaining traction for their unique features, product offerings, and focus on user experience.

This article provides a comprehensive, side-by-side comparison of Bitunix and Weex, evaluating everything from trading fees and leverage options to security practices and regulatory compliance. Whether you’re a high-leverage derivatives trader, a spot market enthusiast, or simply exploring new exchanges beyond the mainstream, understanding the strengths and differences of Bitunix vs Weex can help you choose the platform that best suits your trading style.

Let’s begin by breaking down the foundational features of both platforms in a quick comparison table.

Quick Feature Comparison: Bitunix vs Weex

| Feature | Bitunix | Weex |

|---|---|---|

| Founding Year / Founders | Launched around 2023–24; founded by a professional financial team | Founded in 2018 by Peter (CEO) and a team from Wall Street, Citibank, and Google |

| Supported Coins | 300+ cryptocurrencies including BTC, ETH, LTC, SHIB, DOGE, MATIC, ARB | Supports over 600 tokens including BTC, ETH, DOGE, XRP, SHIB, PEPE |

| Trading Volume | Average daily volume over $5 billion; ranked in top‑15 globally | Approximately $3 billion in 24‑hour trading volume |

| Trading Fees | Spot: 0.01–0.08%; Futures: 0.006–0.06% (tiered/VIP discounts) | Spot: 0%; Futures: Maker 0.02%, Taker 0.06%; discounts for WXT holders |

| Max Leverage | Up to 125× on USDT‑margined futures | Up to 200× leverage on futures contracts |

| Deposit / Withdrawal | Crypto deposits via multiple chains; fiat via card (Visa/Mastercard), Apple Pay, bank transfer; no fiat wallet support | Supports crypto deposits, credit/debit cards, bank transfers, OTC trades |

| Security Features | 1:1 reserve fund, 2FA, SSL encryption, risk controls for copy-trading; uses cold and hot wallets | Regulatory licenses in multiple countries, 2FA/MFA, cold storage, 1000 BTC insurance protection fund |

Bitunix vs Weex: Key Differences at a Glance

Bitunix and Weex cater to different types of traders despite both offering global crypto trading platforms. Bitunix is built for professional and high-volume traders who prioritize low fees, fast execution, and a clean, no-frills interface. In contrast, Weex appeals to retail traders with its broader selection of altcoins, higher leverage options, and user-friendly features.

Bitunix stands out with ultra-low trading fees—futures fees as low as 0.006%—making it ideal for cost-sensitive, active traders. Weex counters with zero spot fees and competitive futures rates, especially for users holding its native WXT token.

Weex supports over 600 tokens, including many trending altcoins and meme coins, while Bitunix keeps its focus tighter with around 300 core assets, primarily large-cap and stablecoin pairs. In terms of leverage, Bitunix offers up to 125×, while Weex goes higher with 200×, attracting more aggressive traders.

Bitunix vs Weex: Platform Products and Services Overview

Bitunix focuses primarily on derivatives trading, offering a professional suite of perpetual futures contracts with competitive leverage and low fees. The platform emphasizes speed and efficiency, catering to serious traders looking for minimal slippage and robust risk controls. Bitunix also supports spot trading, but it’s clearly positioned as a derivatives-first platform. Additional features include copy trading for beginners and a tiered VIP program that rewards high-volume users with fee discounts and faster service.

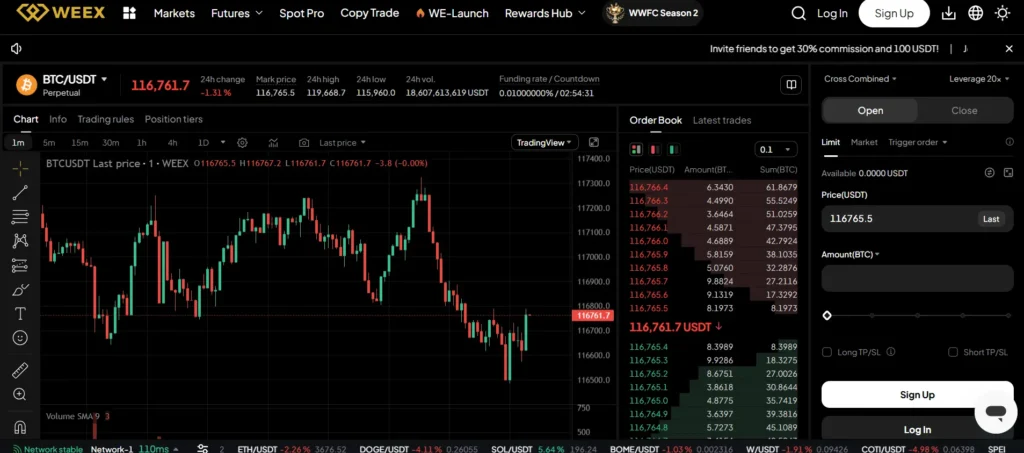

Weex, meanwhile, takes a more diverse approach. While it also offers futures trading with up to 200× leverage, it balances this with a wide selection of spot trading options, launchpad events, and demo trading for new users. Weex provides a broader ecosystem aimed at retail users—combining a gamified experience, staking rewards, referral bonuses, and a built-in wallet system. It also supports social trading features and aims to make crypto trading more approachable for non-professional users.

Bitunix vs Weex: Range of Tradable Contracts

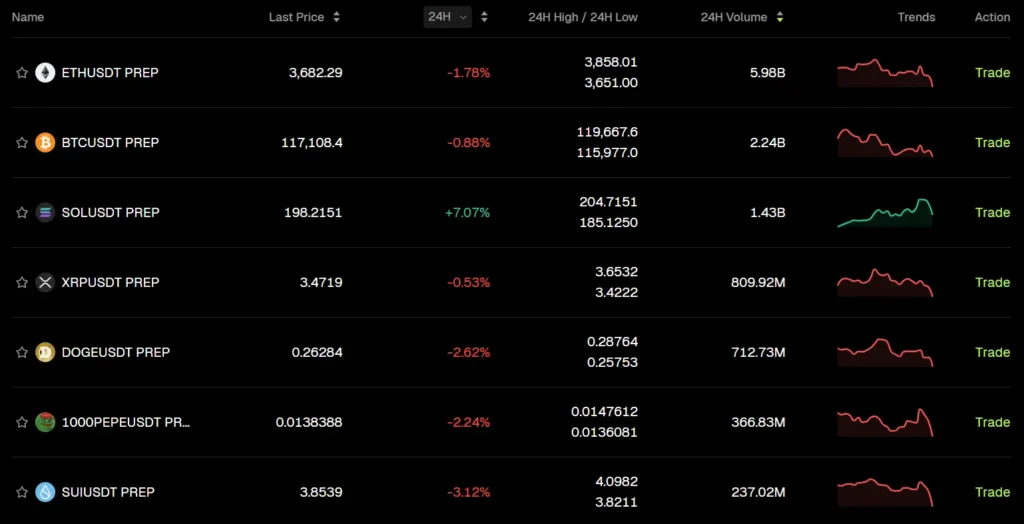

When it comes to tradable contracts, Bitunix keeps its product range streamlined and professional. It offers USDT-margined perpetual contracts on major assets like BTC, ETH, and a few top altcoins. These contracts are structured for high-speed execution, with risk controls designed to prevent extreme losses. The platform’s goal is not to overwhelm users with hundreds of exotic pairs but to provide deep liquidity and efficient access to high-demand derivatives.

Weex, on the other hand, provides a more extensive range of futures contracts, including both USDT- and coin-margined contracts. Its catalog includes high-volatility altcoins, meme tokens, and newer listings, allowing traders to speculate on a much broader universe. This makes Weex more suitable for short-term traders looking to capitalize on fast-moving altcoin markets, whereas Bitunix serves those focused on blue-chip asset speculation and stable derivatives performance.

Bitunix vs Weex: Supported Cryptocurrencies and Trading Pairs

In terms of supported assets, Weex offers a significantly broader selection. With over 600 cryptocurrencies and trading pairs, the platform is well-suited for altcoin traders and users who want exposure to trending tokens like PEPE, SHIBA, and other micro-caps. The inclusion of meme coins, lesser-known tokens, and regional projects helps Weex capture a younger, retail-driven audience.

Bitunix supports around 300 cryptocurrencies, with a focus on high-liquidity trading pairs. The platform is more selective, favoring top-tier assets like BTC, ETH, BNB, and stablecoins such as USDT and USDC. This ensures tighter spreads, lower risk of slippage, and better support for leveraged positions. If you’re looking to trade major pairs with consistent liquidity, Bitunix provides a solid environment for that.

Bitunix vs Weex: Leverage and Margin Trading

Bitunix offers leverage of up to 125× on its futures contracts, primarily for BTC/USDT and ETH/USDT pairs. The platform emphasizes responsible risk management with features like adjustable margin modes (cross and isolated), liquidation price alerts, and real-time risk metrics. These tools help traders manage their exposure more effectively, making Bitunix ideal for those who take a strategic, professional approach to leverage.

Weex, by contrast, pushes leverage higher—up to 200×—and supports it across a wider variety of contracts, including meme coins and lower-liquidity assets. This makes it attractive for more aggressive traders or scalpers who want to maximize gains from small price movements. However, the higher leverage and broader asset base also introduce greater volatility and risk, making Weex better suited for experienced users who understand leverage intricacies.

Bitunix vs Weex: Trading Volume and Liquidity

Bitunix consistently reports daily trading volumes of over $5 billion, placing it among the top exchanges globally in terms of derivatives activity. This strong volume ensures high liquidity for major contracts like BTC/USDT, which translates to better order execution and lower slippage. For institutional or high-frequency traders, this level of depth is critical for maintaining performance in fast-moving markets.

Weex, meanwhile, sees a daily trading volume of around $3 billion, which is impressive for a retail-focused platform. While its liquidity for top pairs is solid, users trading smaller altcoins may notice slightly wider spreads and less order book depth compared to Bitunix. Still, for retail users trading typical sizes, Weex offers sufficient liquidity for most use cases, especially in trending altcoin pairs.

Bitunix vs Weex: Fee Structure Comparison

When it comes to fees, both platforms are highly competitive, but they take different approaches.

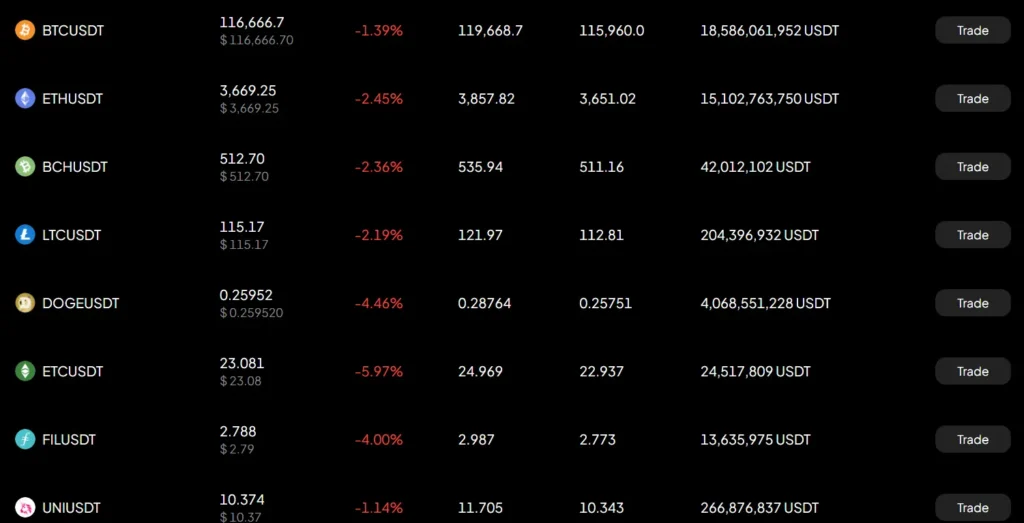

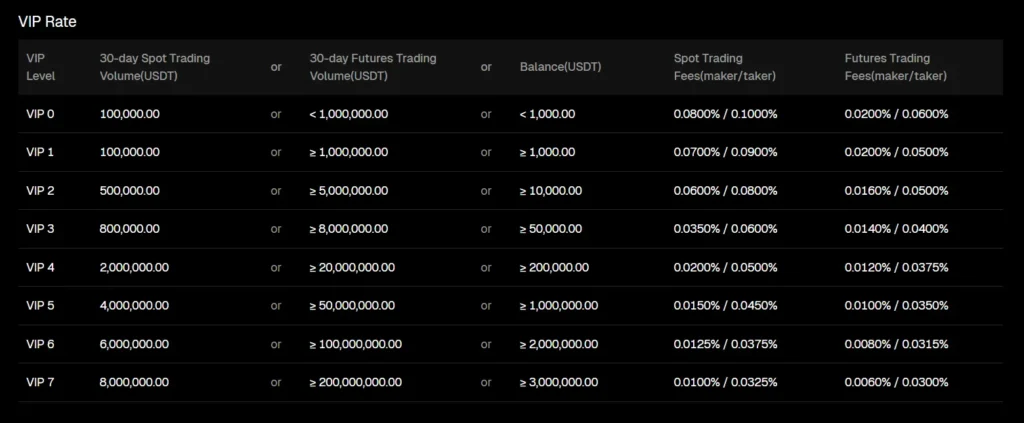

Bitunix uses a tiered fee structure, starting as low as 0.01% for spot and 0.006% for futures makers, with deeper discounts available for high-volume traders or VIP accounts. There are no deposit fees, and withdrawal fees vary by asset but remain reasonable. This makes Bitunix one of the most cost-effective platforms for active traders.

Weex attracts users with zero spot trading fees, a major advantage for casual and retail traders. For futures trading, it charges 0.02% maker and 0.06% taker by default, with fee reductions for users who hold the native WXT token. Withdrawal fees are asset-specific, but the platform occasionally offers promotions with fee waivers or bonuses for referrals.

In short, Bitunix is built for fee-sensitive, high-frequency traders who value predictable, low-cost execution. Weex is optimized for casual users and altcoin traders who want minimal entry barriers and enjoy fee-free spot activity.

Bitunix vs Weex: Deposits, Withdrawals, and Payment Methods

Bitunix supports crypto deposits across multiple blockchains, including Bitcoin, Ethereum, Tron, and others. Fiat support is limited but available through third-party providers like credit/debit cards, Apple Pay, and select bank transfer options. Withdrawals are processed quickly, with standard on-chain confirmation times, and the platform maintains competitive withdrawal fees based on network load. However, direct fiat wallets or peer-to-peer (P2P) systems are not a primary focus for Bitunix, reinforcing its orientation toward crypto-native users.

Weex offers a broader variety of on-ramp and off-ramp methods. Users can deposit crypto directly or use payment methods like credit cards, bank transfers, and even OTC (Over-the-Counter) services for large-volume fiat transactions. The platform is also known for occasional deposit bonuses or gas fee rebates to incentivize new users. Withdrawal processing times are fast, and the user interface provides clear fee estimates before confirmation. Overall, Weex is more fiat-friendly, which can be a strong plus for traders new to crypto.

Bitunix vs Weex: Native Exchange Tokens

Bitunix has yet to launch a dedicated native token, but there is speculation it may introduce one in the near future to enhance its loyalty or VIP program. As of now, discounts and trading perks are linked directly to trading volume or VIP tiers rather than token holdings. This gives Bitunix a more traditional, performance-based reward structure.

Weex, on the other hand, features its own token called WXT, which functions as a utility token across the platform. WXT holders benefit from discounted futures trading fees, exclusive staking products, and participation in token launch events. The token is integrated into Weex’s user reward programs, making it central to the exchange’s ecosystem and a key incentive mechanism for regular users.

Bitunix vs Weex: KYC Requirements and Account Limits

Bitunix adopts a flexible approach to Know Your Customer (KYC) requirements. Users can begin trading with basic access—typically with limited withdrawal capabilities (around 2 BTC daily)—but higher-tier verification unlocks increased limits, participation in special features like copy trading, and enhanced security settings. Full KYC involves providing identification documents and may take a few hours to verify.

Weex enforces tiered KYC levels more rigorously, especially for fiat transactions and higher leverage access. Basic accounts allow limited trading and withdrawals, while advanced verification is required for features like fiat on-ramps, OTC trading, and higher withdrawal thresholds (up to 100 BTC per day). The process is straightforward, with document upload and selfie verification steps, and support is generally responsive during the verification process.

Bitunix vs Weex: User Interface and Ease of Use

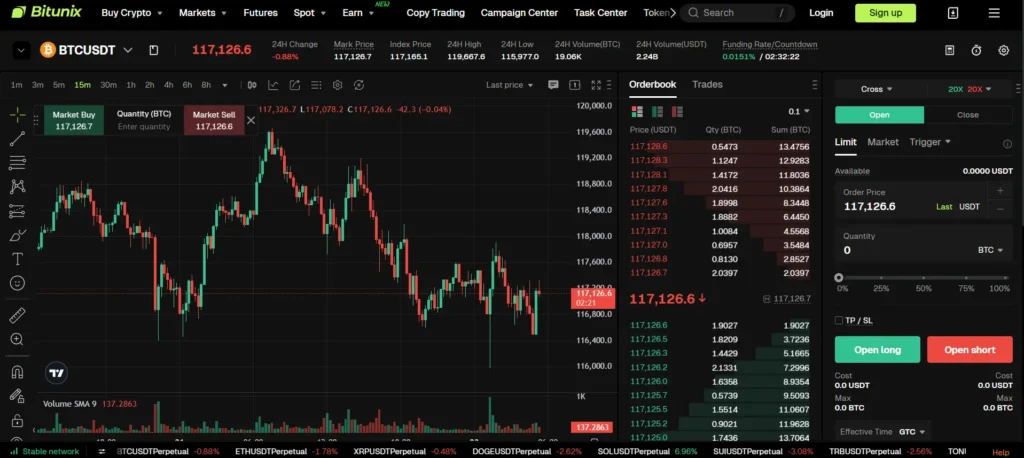

Bitunix offers a clean, minimalist trading interface that appeals to professionals and intermediate-level traders. The web platform is fast, with a focus on charting tools, order book visibility, and one-click order execution. Its mobile app mirrors this simplicity, offering a reliable and distraction-free experience. The platform avoids overwhelming users with excessive features, making it ideal for those who value precision and speed in trading.

Weex, in contrast, leans toward a more interactive and retail-friendly design. The interface is colorful, intuitive, and packed with features such as demo trading, trading competitions, and educational prompts. The mobile app is highly rated, offering full access to spot, futures, staking, and rewards dashboards. It’s built to keep users engaged, particularly those new to crypto or exploring a wide variety of tokens and tools. For first-time traders or altcoin enthusiasts, Weex offers a more accessible and guided experience.

Bitunix vs Weex: Order Types Supported

Bitunix provides a robust range of essential order types for both spot and derivatives markets. These include limit, market, stop-limit, and stop-market orders, along with conditional orders and post-only options for advanced users. This selection gives traders flexibility in managing entries, exits, and risk. Bitunix emphasizes execution speed and accuracy, making it well-suited for algorithmic and high-frequency trading strategies.

Weex supports all standard order types as well, including limit, market, and stop orders, along with trailing stop-loss and trigger orders in the futures section. The user interface for setting up advanced orders is beginner-friendly, often accompanied by tooltips and tutorials. While both exchanges support the same fundamental types, Weex provides more onboarding help, while Bitunix favors a fast, clutter-free setup for seasoned traders.

Bitunix vs Weex: Security Features and Practices

Security is a top priority for both platforms, though each approaches it slightly differently.

Bitunix maintains a 1:1 asset reserve policy, ensuring that all user assets are fully backed. It uses a combination of cold and hot wallets, though detailed transparency reports are limited. Two-factor authentication (2FA) is mandatory for withdrawals and account changes, and SSL encryption protects all platform interactions. Additional safeguards include anti-phishing codes and trading password features for key actions.

Weex adopts a more visible security framework, backed by licenses in the U.S., Canada, and Australia, as well as a 1,000 BTC insurance fund to cover unexpected losses or incidents. It uses a multi-signature cold wallet system, and users are encouraged to enable 2FA and MFA (multi-factor authentication). Weex’s public compliance documentation and visible reserve practices enhance trust, particularly for users wary of unregulated platforms.

Bitunix vs Weex: Insurance Funds

Bitunix does not currently operate a public-facing insurance fund but maintains a 1:1 asset reserve policy and internal risk controls to protect against insolvency or major liquidation events. While this suggests a strong internal treasury strategy, the lack of a dedicated and transparent insurance pool may be a concern for traders looking for guaranteed loss protection in extreme scenarios.

Weex, in contrast, offers a clear advantage with its 1,000 BTC insurance fund. This reserve is publicly acknowledged and is designed to cover unexpected losses, especially in the event of contract defaults or platform-side issues. This provides an extra layer of confidence for leveraged traders who are exposed to volatile price swings. The existence of such a fund places Weex among the more proactive exchanges when it comes to trader protection.

Bitunix vs Weex: Customer Support

Bitunix provides 24/7 customer support via live chat, email, and an extensive help center with detailed documentation and video guides. While response times are generally fast, Bitunix prioritizes efficiency over personalization. VIP clients receive faster support response as part of the loyalty tier program. The support team is known to be professional, though ticket resolution for more complex issues may take a few hours.

Weex also offers round-the-clock support, including live chat, email, and ticketing. What sets Weex apart is its stronger focus on onboarding and retail user education—frequent pop-ups, guides, and support tips are built into the interface. The platform also provides support in multiple languages, especially for Asian markets, reflecting its geographically diversified user base. Response time is typically quick, and support is well integrated with the mobile experience.

Bitunix vs Weex: Regulatory Compliance

Bitunix takes a lean approach to compliance, operating in multiple regions without aggressively marketing regulatory licenses. It enforces standard KYC/AML protocols and claims to follow international best practices but hasn’t published a full list of country-specific licenses. This approach suits crypto-native users who prefer fewer restrictions, though it may raise concerns for institutional traders requiring higher transparency.

Weex, on the other hand, emphasizes its regulatory legitimacy. The platform holds Money Services Business (MSB) licenses in the U.S., Canada, and Australia, and operates with enhanced legal frameworks in Asia. This gives it a clear edge in compliance visibility. The licensing allows Weex to provide fiat on-ramps more confidently and builds trust with users seeking a legally transparent and internationally recognized exchange.

Conclusion

If you’re a professional or high-frequency trader seeking low fees, fast execution, and a clean, derivatives-focused platform, Bitunix is the better fit. It offers deep liquidity, tiered trading incentives, and a no-frills environment ideal for serious crypto traders.

If you’re a retail trader, altcoin explorer, or someone looking for an all-in-one experience with fiat support, higher leverage, and a broader asset range, Weex delivers more flexibility and user-friendly features.

Both platforms are secure and rapidly growing—but your choice should depend on whether you prioritize performance and simplicity (Bitunix) or variety and ease of access (Weex).