With dozens of crypto exchanges available today, choosing the right platform can be overwhelming. Bitunix and MEXC are two fast-growing exchanges that cater to traders looking for deep altcoin markets, derivatives, and high leverage.

While MEXC is known for its wide coin listings and strong global presence, Bitunix is gaining traction with its streamlined interface and focus on security and futures trading.

This comparison breaks down their key features—fees, leverage, supported coins, trading volume, user experience, and more—to help you decide which platform fits your trading style best.

Quick Feature Comparison: Bitunix vs MEXC

| Feature | Bitunix | MEXC |

|---|---|---|

| Founded | 2021, Saint Vincent & the Grenadines | 2018, Seychelles |

| Founders | Not publicly disclosed | Not publicly disclosed |

| Supported Coins | 300+ spot, 400+ perpetual contracts | 3,000+ spot listings, 600+ futures pairs |

| Daily Trading Volume | Over $5 billion | Around $6 billion (Top 10 globally) |

| Leverage | Up to 125× on futures | Up to 500× on futures |

| Trading Fees | Spot: ~0.08%/0.10% (maker/taker), Futures: ~0.02%/0.06% | Competitive; lower with MX token discounts |

| Deposit & Withdrawal | Crypto, fiat via Visa, Mastercard, Apple/Google Pay, P2P | Crypto & fiat, OTC & C2C support |

| Security | 2FA, Proof of Reserves, cold wallet storage, licensed in US & Canada | 2FA, cold storage, high trust security rating |

Bitunix vs MEXC: Key Differences at a Glance

Though Bitunix and MEXC both offer comprehensive crypto trading ecosystems, their core strengths and target audiences differ significantly.

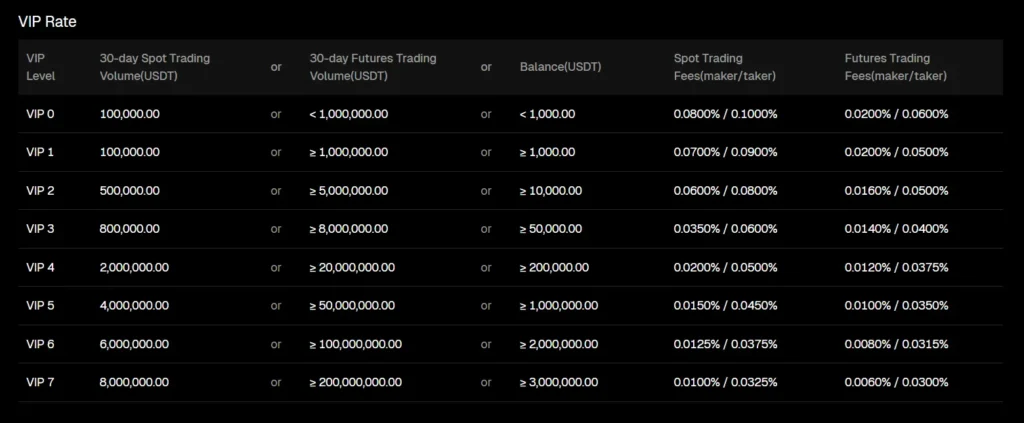

When it comes to fees, Bitunix stands out with its flat and competitive pricing model. Traders benefit from low maker and taker fees on both spot and futures markets, making it an attractive option for those who prioritize cost efficiency. MEXC, while slightly higher on base fees, provides attractive discounts to users who pay with its native MX token—beneficial for frequent traders looking to reduce costs over time.

In terms of coin selection, MEXC clearly leads the race with over 3,000 spot trading pairs and more than 600 derivatives contracts. It’s a go-to platform for traders seeking exposure to newly launched tokens and lesser-known altcoins. In contrast, Bitunix takes a more curated approach, offering around 300+ spot listings and 400+ futures contracts, focusing primarily on liquidity and trading reliability.

The leverage options also show a stark contrast. Bitunix allows users to trade with leverage up to 125× on select futures contracts, which is already considered high. However, MEXC pushes this further by offering up to 500× leverage—catering to high-risk, high-reward strategies used by experienced or aggressive traders.

From a user base and positioning perspective, Bitunix appeals more to semi-professional and professional traders who value security, a clean interface, and efficient contract execution. It also provides regulatory clarity with licenses in the US and Canada, and proof-of-reserves—a plus for safety-conscious users. On the other hand, MEXC caters to a broad global retail audience, especially those enthusiastic about exploring new altcoins and trading with high leverage.

Bitunix vs MEXC: Platform Products and Services Overview

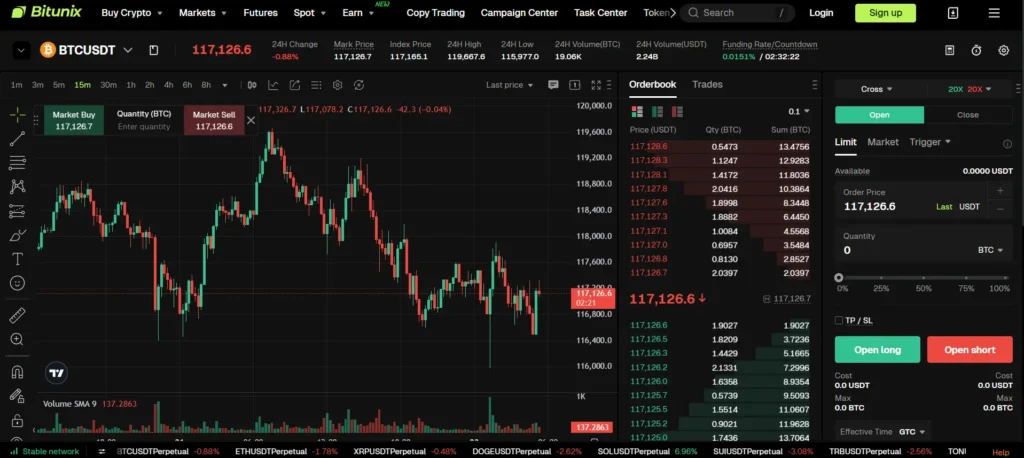

Bitunix is primarily a derivatives-focused exchange with a clean and intuitive interface, making it suitable for serious traders. It supports multi-chart layouts, TradingView integration, and copy-trading—allowing users to replicate strategies of top-performing traders. Bitunix also offers staking products, dual investments, and savings options for passive income. Fiat on-ramps via credit cards, Apple/Google Pay, and P2P transfers make it easy for users to enter the crypto market directly from fiat.

MEXC, on the other hand, provides a more diverse product ecosystem. Alongside spot and futures trading, it includes margin trading, leveraged ETFs, staking, launchpads for new tokens, and demo trading for futures. MEXC also supports copy-trading and caters to institutional users with features like sub-accounts, API access, and market maker tools. Its broader toolkit makes it more appealing to both retail and institutional participants.

Bitunix vs MEXC: Range of Tradable Contracts

Bitunix supports USDT-margined perpetual contracts, covering over 400 pairs including all major cryptocurrencies and select mid-cap altcoins. It offers leverage up to 125× with cross, isolated, and hedge margin modes. The platform avoids overcomplicating things—no coin-margined futures or options—making it focused and efficient for futures traders.

MEXC supports both USDT-margined and coin-margined perpetual contracts, offering a wider selection of instruments. Leverage can go up to 500× for select contracts. In addition to standard order types like limit, market, and stop-limit, MEXC provides an in-depth demo trading environment, helping users get familiar with futures strategies risk-free.

Bitunix vs MEXC: Supported Cryptocurrencies and Trading Pairs

Bitunix offers around 300 spot tokens and 400+ futures contracts, with a focus on high-liquidity assets such as BTC, ETH, SOL, DOT, and LINK. It maintains a curated approach to listings, emphasizing stability, liquidity, and fast execution rather than sheer volume.

MEXC is known for having one of the largest token selections in the industry, with over 3,000 spot listings and thousands of trading pairs. It supports a wide range of base pairs including USDT, BTC, ETH, and stablecoins. This extensive variety makes it a top choice for altcoin hunters and early adopters looking for new projects.

Bitunix vs MEXC: Leverage and Margin Trading

Bitunix offers leverage of up to 125× on futures contracts, which caters well to experienced derivatives traders. It supports both isolated and cross margin modes, along with a hedge mode that allows simultaneous long and short positions on the same contract—useful for managing complex strategies. The platform includes risk control tools like auto-deleveraging (ADL) and real-time margin monitoring to help traders manage their positions efficiently.

MEXC goes even further by offering leverage up to 500× on select futures contracts. While this allows for potentially massive gains, it also introduces significantly higher risk. MEXC also supports isolated and cross margin modes, and its platform includes features like forced liquidation warnings, insurance funds, and detailed margin breakdowns to protect users from extreme volatility. It’s designed for more aggressive traders comfortable with high-risk leverage trading.

Bitunix vs MEXC: Trading Volume and Liquidity

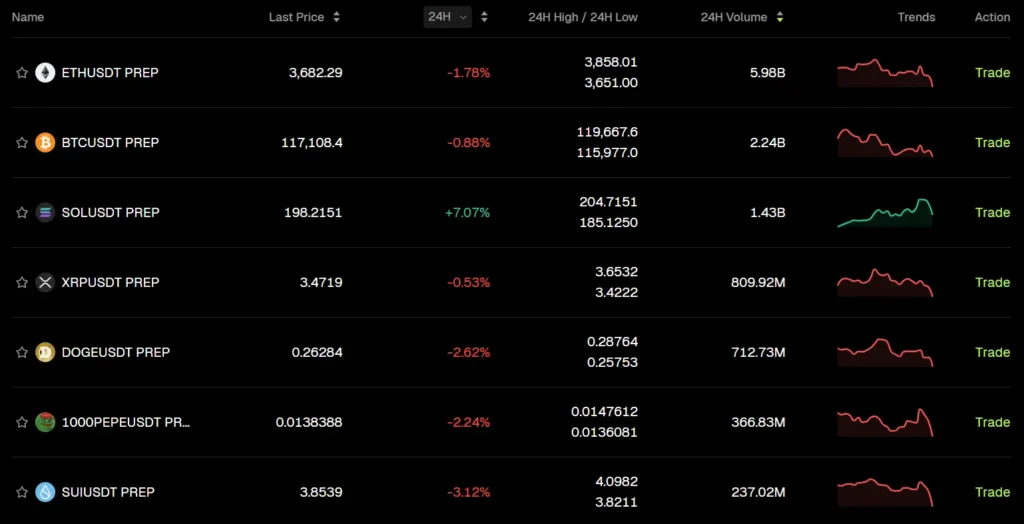

Bitunix has seen strong growth in trading volume, with daily volumes crossing the $5 billion mark, particularly in its futures markets. This ensures solid liquidity for major trading pairs and allows for quick execution without significant slippage. However, its spot market liquidity is more modest in comparison, reflecting its primary focus on derivatives.

MEXC consistently ranks among the top 10 global exchanges in terms of spot trading volume, often recording over $6 billion daily. Its deep liquidity across a wide range of altcoins ensures smoother trading even on less popular pairs. The combination of high trading activity and a vast user base enhances market depth and reduces slippage, which is crucial for scalpers and large-volume traders alike.

Bitunix vs MEXC: Fee Structure Comparison

Bitunix maintains a competitive and transparent fee model. For spot trading, fees are typically around 0.08% for makers and 0.10% for takers. On the futures side, fees are even lower, with 0.02% for makers and 0.06% for takers. There are no surprise charges, and the structure is flat across the board, which appeals to high-frequency and institutional traders.

MEXC also offers competitive fees but with more flexibility. Standard maker/taker fees on futures are around 0.02% and 0.06%, similar to Bitunix. However, MEXC users can reduce their fees significantly by using the native MX token. Additionally, spot trading fees start at 0.1% and can go lower based on trading volume and token holdings. This tiered structure benefits active traders and those participating in the MEXC ecosystem.

Bitunix vs MEXC: Deposits, Withdrawals, and Payment Methods

Bitunix offers a flexible range of deposit and withdrawal options. Users can deposit cryptocurrencies directly or use fiat payment methods through third-party gateways like Visa, Mastercard, Apple Pay, and Google Pay. Peer-to-peer (P2P) trading is also available for direct crypto purchases with local currencies. Withdrawals are processed quickly, typically within minutes, and fees vary based on the asset being transferred.

MEXC supports both crypto and fiat transactions as well. It offers a comprehensive fiat gateway, OTC desk, and P2P platform, allowing users to buy crypto with bank transfers, e-wallets, and cards in multiple currencies. Processing times for crypto withdrawals are generally fast, and like Bitunix, the withdrawal fees are asset-specific and adjusted according to network congestion.

Bitunix vs MEXC: Native Exchange Tokens

Bitunix does not currently have a native exchange token. This simplifies its fee structure and keeps the platform focused on performance and utility rather than token-based incentives. However, this also means users don’t benefit from additional fee discounts or rewards through token staking.

MEXC uses the MX Token as its native utility asset. Holding MX allows users to get trading fee discounts, participate in launchpad events, vote in governance polls, and earn staking rewards. The token plays a central role in user engagement and platform activity, rewarding loyalty and participation.

Bitunix vs MEXC: KYC Requirements and Account Limits

Bitunix provides a flexible KYC model. Users can trade and withdraw within basic limits without completing KYC, which makes onboarding fast and easy. However, to increase daily withdrawal limits and access all platform features, users are encouraged to complete identity verification.

MEXC enforces more standard KYC protocols. Users must complete at least Level 1 verification for higher deposit and withdrawal limits. Additional KYC tiers may be required for certain fiat services or higher-value transactions. The process includes identity document submission and face verification.

Bitunix vs MEXC: User Interface and Ease of Use

Bitunix offers a clean and professional trading interface that caters especially to futures traders. Its platform supports multi-chart layouts, advanced order book views, and TradingView integration, making it ideal for users who need deep technical analysis tools. Navigation is intuitive, and the mobile app provides a smooth trading experience with nearly all the features of the web platform.

MEXC provides a user-friendly interface suitable for both beginners and experienced traders. Its dashboard is customizable, with easy access to spot, futures, and ETF trading. The mobile app is robust and supports everything from trading to staking and KYC, offering a seamless experience. Beginners benefit from tooltips, a simple spot market layout, and access to demo trading for practice.

Bitunix vs MEXC: Order Types Supported

Bitunix supports essential order types needed for active futures trading. These include Market, Limit, Stop-Market, Stop-Limit, and advanced options like Post-Only and Time-in-Force settings. This gives professional traders the flexibility to fine-tune their entries and exits, especially in volatile markets.

MEXC offers a similarly wide range of order types for both spot and futures trading. Traders can use Market, Limit, Stop-Limit, Stop-Market, Trailing Stop, and Conditional Orders. The platform also allows grid trading bots, which can automate entries and exits based on price ranges—useful for passive trading strategies.

Bitunix vs MEXC: Security Features and Practices

Bitunix places strong emphasis on security. The platform uses cold wallet storage for the majority of user funds, offers two-factor authentication (2FA), and provides proof-of-reserves to maintain transparency. It also holds regulatory licenses in the US and Canada, adding another layer of credibility and compliance.

MEXC follows industry-standard security protocols, including cold storage, anti-phishing protection, 2FA, and withdrawal whitelisting. While the platform has not experienced any major security breaches, it regularly updates its systems and conducts internal audits to maintain safety. MEXC does not yet provide proof-of-reserves publicly but maintains a strong trust score among third-party analytics.

Overall, both platforms take security seriously, but Bitunix’s additional transparency with reserve data and regulatory compliance may appeal more to users who prioritize trust and accountability.

Bitunix vs MEXC: Insurance Funds

Bitunix maintains an insurance fund to cover losses arising from bankrupt liquidations in highly volatile market conditions. This helps ensure that traders are protected from auto-deleveraging events when counterparties default. The insurance fund is automatically funded through liquidation fees and is used to cover any shortfall that might occur during forced liquidations.

MEXC also operates an insurance fund for its perpetual futures contracts. It serves a similar purpose—protecting users from significant losses when a counterparty’s margin is insufficient to cover their losses. MEXC’s insurance mechanism helps prevent large-scale auto-deleveraging and ensures market stability during periods of extreme volatility.

In both cases, the presence of an insurance fund adds an important safety net for leveraged traders, particularly in fast-moving markets.

Bitunix vs MEXC: Customer Support

Bitunix offers 24/7 customer support through live chat and email. The response times are generally quick, and the platform also provides a detailed help center with guides and FAQs to assist users with common issues. Support is available in multiple languages, making it accessible to a global user base.

MEXC also provides round-the-clock support via live chat, support tickets, and email. In addition, it runs active Telegram and Discord communities where users can ask questions and get peer or moderator support. The knowledge base is extensive, covering everything from trading tutorials to KYC procedures.

Both platforms offer strong support infrastructure, but MEXC’s community-driven support channels give it an edge for users who prefer quick peer engagement or crowd-sourced help.

Bitunix vs MEXC: Regulatory Compliance

Bitunix is relatively transparent when it comes to regulatory positioning. It holds licenses in several jurisdictions, including the U.S. and Canada, and adheres to regulatory standards for KYC, AML, and user fund protection. This makes it more appealing to compliance-focused users and institutions.

MEXC, while headquartered offshore, complies with international KYC and AML norms and restricts access in certain regulated jurisdictions. It doesn’t publicly share as much detail about licenses but continues to operate globally without major regulatory red flags.

Conclusion

Bitunix and MEXC both offer strong crypto trading experiences but cater to different types of users. Bitunix is ideal for traders who value simplicity, security, and a professional derivatives environment. With regulatory licenses, proof-of-reserves, and low trading fees, it’s a solid choice for those focused on futures trading with confidence and clarity.

On the other hand, MEXC excels in variety. With thousands of listed tokens, high leverage (up to 500×), and features like staking, launchpads, and MX token benefits, it’s well-suited for altcoin enthusiasts and active retail traders who want access to new opportunities and flexible tools.

In summary, go with Bitunix if you prioritize a clean, secure, futures-focused platform. Choose MEXC if you want maximum coin exposure, community-driven features, and higher leverage options. The best platform depends on your trading goals and risk appetite.