Bitunix vs Bybit: Feature-by-Feature Comparison

Written by Larry Jones

Hi, I'm Larry Jones, an Financial Management graduate from Franklin University, where I focused on Finance. With a deep passion for trading and investing, I've immersed myself in the dynamic world of financial markets. Currently, I dedicate my time to trading while also educating others about the exciting opportunities in cryptocurrencies. Through my experience and expertise, I aim to make complex financial concepts accessible to everyone. Whether you're a seasoned trader or new to the world of investing, my goal is to provide you with valuable insights and practical knowledge to help you navigate the world of cryptocurrencies with confidence.

Expert Reviewed

This article has been reviewed by crypto market experts at SCM to ensure all the content, sources, and claims adhere to the highest standards of accuracy and reliability.

Last Updated on December 2, 2025

In the rapidly evolving crypto exchange landscape, traders face abundant choices—from spot trading hubs to derivative-focused platforms. Two names gaining notable attention are Bitunix and Bybit. While both platforms offer derivatives trading, they serve different user needs with distinct approaches to design, product focus, and user experience.

The purpose of this comparison is to give your readers a clear, side-by-side look at what Bitunix and Bybit bring to the table—starting with their origins and target audiences, followed by a detailed breakdown of features, offerings, and strengths. Whether your readers are seasoned derivatives traders, spot-focused investors, or newcomers looking for easy-to-use platforms, this guide will help them identify which exchange aligns best with their strategies and goals.

In the sections that follow, we’ll start with a quick comparison of their founding details and major features, then delve deeper into trading fees, supported cryptocurrencies, leverage, security, tokens, user experience, and more. By the end, readers will have a well-rounded understanding of each exchange and an informed recommendation based on their trading profile.

Bitunix vs Bybit: Quick Feature Comparison Table

| Feature | Bitunix | Bybit |

|---|---|---|

| Founding Year & Founder | Launched in 2021. Founder details not publicly known. | Founded in 2018 by Ben Zhou. |

| Supported Coins | Supports 300–400 assets across spot, futures, and P2P trading. Includes major altcoins and niche tokens. | Offers thousands of trading pairs across spot and derivatives. Regularly adds new listings. |

| Average Daily Trading Volume | Over $5 billion in combined daily volume, especially strong in derivatives. | Spot volume around $7 billion; derivatives volume near $50 billion. One of the largest globally. |

| Trading Fees | Spot: ~0.01–0.08% maker/taker; Futures: ~0.006–0.06%. | Spot: 0.1% maker/taker at base level; Derivatives: 0.02% maker / 0.055% taker, with VIP discounts. |

| Max Leverage | Up to 125× on selected futures contracts. | Up to 100× leverage, mostly on BTC, ETH, and other major pairs. |

| Deposit / Withdrawal Methods | Supports crypto deposits across multiple chains (BTC, ETH, TRX, BSC, etc.). Also supports debit/credit cards, Apple Pay, and Google Pay. | Crypto deposits supported; fiat onramps available via third-party providers. Some minimums apply. |

| Security Measures | Regulated under FinCEN (US) and FINTRAC (Canada). Offers Proof of Reserves, 2FA, and cold wallet storage. | Employs multi-signature cold wallets, 2FA, Proof of Reserves, and maintains large emergency funds. |

Bitunix vs Bybit: Key Differences at a Glance

Bitunix and Bybit serve different segments of the crypto trading community, and the contrast becomes clear when looking at their core features. Bitunix positions itself as a beginner-friendly platform with simplified navigation, low fees, and support for copy trading. Its fee structure is slightly lower than Bybit’s at the base level, and it allows users to access up to 125× leverage on certain futures contracts. The coin selection on Bitunix is solid, covering around 300–400 assets, including many niche tokens.

Bybit, on the other hand, is tailored more toward professional and high-volume traders. It offers a wider range of spot and derivative pairs, robust trading infrastructure, and features like grid bots and institutional-grade APIs. The platform supports up to 100× leverage on major assets such as Bitcoin and Ethereum and provides a tiered fee structure with discounts for active traders. In terms of user base, Bybit attracts a more seasoned audience due to its comprehensive product suite and deep liquidity, while Bitunix appeals more to users looking for ease of use, copy-trading features, and flexible KYC policies.

Bitunix vs Bybit: Platform Products and Services Overview

Bybit has carved a niche for itself in the derivatives market, offering perpetual contracts, futures, and options trading. While it also supports spot trading, its main focus is on serving active traders with advanced tools. Features like grid trading, automated bots, dual asset investments, and an earn section for passive income make it particularly attractive to traders looking for depth and versatility. The platform also offers a launchpad for early access to token sales, VIP programs with fee discounts, and institutional-grade services.

Bitunix, by contrast, offers a streamlined experience focused on simplicity and accessibility. Its platform includes spot trading, perpetual contracts with high leverage, and an increasingly popular copy-trading feature that allows users to mirror the trades of successful investors. This makes it a strong choice for beginners or part-time traders who may not have the time or expertise to actively manage positions. Bitunix also supports fiat payments through credit/debit cards and mobile wallets, making onboarding easy. Additional features include a user rewards system, staking opportunities, and an educational hub to help new users understand the crypto landscape better.

Bitunix vs Bybit: Range of Tradable Contracts

The variety of contracts offered by each platform reflects their core philosophy. Bitunix provides access to both spot and perpetual futures contracts across a range of major and mid-tier cryptocurrencies. It includes flexible leverage options, often up to 125×, and supports copy-trading contracts, where users can follow the strategies of top-performing traders. This structure is designed to make complex trading strategies accessible to everyday users.

Bybit, in contrast, offers one of the most comprehensive derivatives suites in the industry. It features USDT- and coin-margined perpetuals, inverse futures, and even crypto options on select assets. Bybit also supports advanced trading strategies with the help of grid bots, API connectivity, and structured product tools. Its derivatives offerings are tailored to professional traders, institutional clients, and algo traders looking for precision and liquidity. The depth of Bybit’s contract offerings makes it particularly strong for those who trade across multiple timeframes or deploy systematic trading strategies.

Bitunix vs Bybit: Supported Cryptocurrencies and Trading Pairs

Bybit offers an extensive list of trading pairs, especially in the derivatives segment. While its spot market is growing, the platform mainly focuses on major cryptocurrencies like BTC, ETH, SOL, and other top altcoins for perpetual and futures contracts. Traders benefit from deep liquidity on these high-volume assets, making it ideal for large orders and active strategies.

Bitunix supports a slightly smaller but still diverse list of coins, ranging from blue-chip assets to emerging altcoins. It provides access to both spot and perpetual markets, with new listings appearing regularly. While it may not have the depth of Bybit, Bitunix does a good job catering to users looking for both mainstream and niche tokens under one roof.

Bitunix vs Bybit: Leverage and Margin Trading

Bitunix offers leverage up to 125× on select perpetual contracts, positioning itself as a high-leverage exchange for aggressive traders. It provides basic risk management tools like isolated and cross margin, along with simplified UI for margin adjustments—making it accessible even to newer users testing leveraged trades.

Bybit caps leverage at 100× for most major assets but integrates more advanced tools, including position builders, portfolio margining for institutions, and real-time risk indicators. This makes it a better fit for experienced traders who need granular control over their margin exposure and wish to scale their strategies with precision.

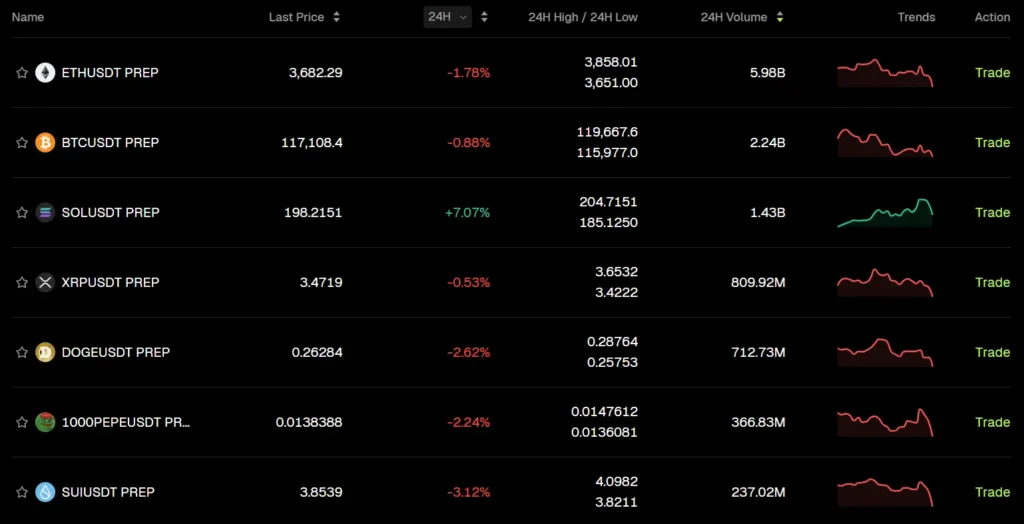

Bitunix vs Bybit: Trading Volume and Liquidity

Bybit is one of the top global exchanges in terms of daily trading volume, especially for derivatives. Its deep liquidity ensures tighter spreads and faster execution, which is critical for active and institutional traders. High trading volumes also make it more appealing for scalping and algorithmic strategies.

Bitunix, while growing fast, has comparatively lower volume. However, it still maintains sufficient liquidity for most retail traders and offers a smooth trading experience for mid-sized positions. For users trading less common altcoins or using copy-trading features, the current volume levels are generally more than adequate.

Bitunix vs Bybit: Fee Structure Comparison

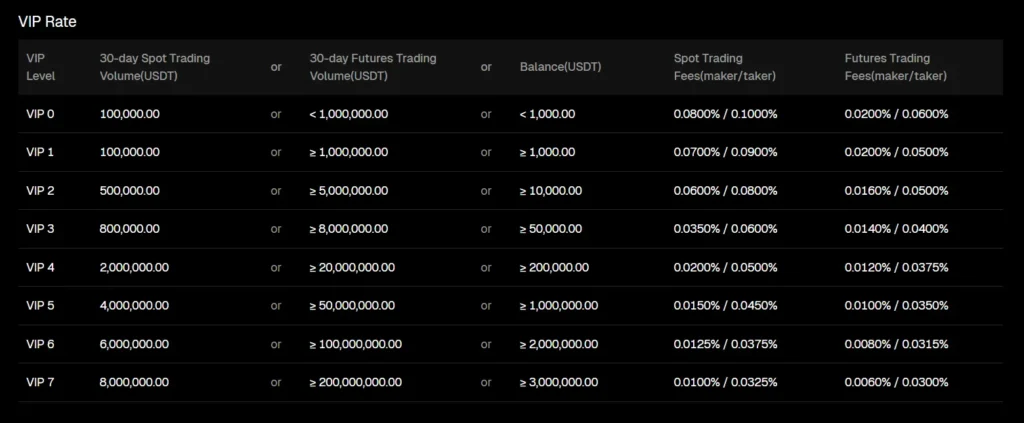

Bybit uses a tiered fee system based on trading volume and asset holdings. At the base level (VIP 0), spot trading fees are 0.1% for both makers and takers, while derivatives start at 0.02% (maker) and 0.055% (taker). Users can reduce these fees by increasing their 30-day trading volume or holding the platform’s native token.

Bitunix offers slightly lower entry-level fees. Spot trading starts around 0.08%, and futures go as low as 0.006% for makers. Like Bybit, Bitunix also uses a VIP structure to reward active users with reduced fees, though its tiers are simpler and more accessible for new traders. For low- to mid-volume users, Bitunix often ends up being more cost-effective.

Bitunix vs Bybit: Deposits, Withdrawals, and Payment Methods

Both platforms support crypto deposits across major chains like Bitcoin, Ethereum, and Tron. Bitunix also supports fiat deposits via debit/credit cards, Apple Pay, and Google Pay—offering a smoother onboarding for beginners. Withdrawal processing is fairly quick, though some delays can occur during high-demand periods.

Bybit supports crypto deposits and integrates with fiat on-ramp services through third-party providers. While it doesn’t offer as many direct fiat methods as Bitunix, it compensates with higher limits and faster execution for large withdrawals. Both platforms offer 24/7 crypto withdrawals with standard network fees, but only Bitunix supports card-based purchases directly.

Bitunix vs Bybit: Native Exchange Tokens

Bybit’s native token, $BIT (formerly associated with BitDAO), is used for staking, trading fee discounts, and governance participation. While it’s not mandatory to hold, users benefit from holding or staking it to unlock fee reductions and rewards.

Bitunix has its own native token as well—commonly used for unlocking trading discounts and reward programs within the platform. Though not as widely adopted or traded as $BIT, it functions effectively within the Bitunix ecosystem and offers perks like reduced fees, early access to features, and referral bonuses.

Bitunix vs Bybit: KYC Requirements and Account Limits

Bitunix offers flexible KYC policies. Users can trade and withdraw limited amounts without full verification, making it attractive to those who prioritize privacy or operate in restricted regions. Higher withdrawal limits and advanced features unlock with basic ID verification.

Bybit, while also allowing limited access without KYC, has gradually moved toward stricter compliance. Users must complete identity verification to unlock full functionality, including higher withdrawal limits and fiat transactions. For professional traders or those planning to scale, completing KYC is generally necessary on both platforms.

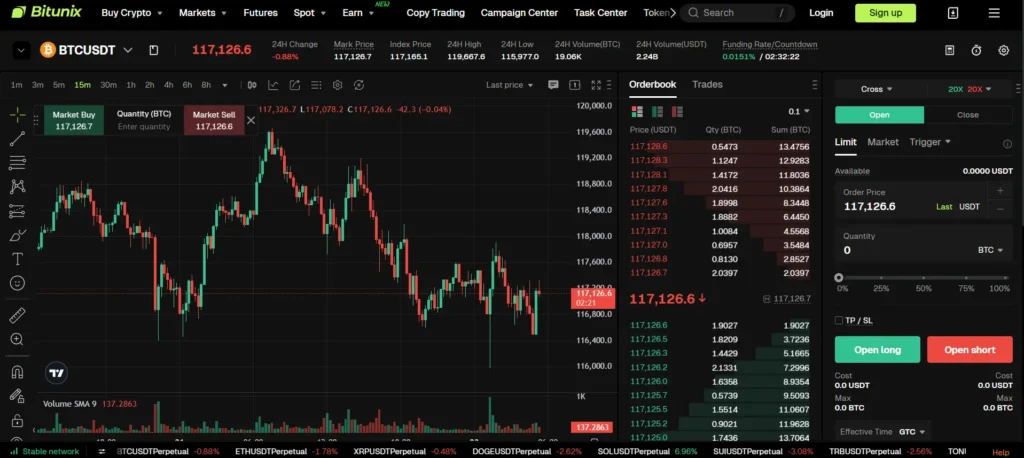

Bitunix vs Bybit: User Interface and Ease of Use

Bitunix emphasizes a clean, beginner-friendly interface. The dashboard is straightforward, with clear tabs for spot, futures, and copy trading. It’s optimized for ease of use, making it a great choice for new traders who don’t want to feel overwhelmed.

Bybit, while still user-friendly, leans toward a more feature-rich design. The platform includes advanced charting, multiple order panels, and integration with tools like TradingView. Experienced users will appreciate the depth, though absolute beginners may face a mild learning curve initially.

Bitunix vs Bybit: Order Types Supported

Bybit supports a wide range of order types including market, limit, conditional, post-only, and iceberg orders—designed for flexibility and precision in trade execution. It’s particularly suitable for traders running complex strategies or bots.

Bitunix covers the essential order types: market, limit, and stop orders. While it lacks the depth of advanced conditional tools, it makes up for it by keeping the interface simple and quick to navigate—especially beneficial for casual or copy traders.

Bitunix vs Bybit: Security Features and Practices

Security is a top priority for both exchanges. Bybit employs multi-signature cold wallets, two-factor authentication (2FA), and regular audits to ensure the safety of user assets. The platform also publishes proof-of-reserves and maintains strong internal controls to detect suspicious activity.

Bitunix follows similar standards, offering cold wallet storage for the majority of user funds, mandatory 2FA for withdrawals, and a real-time monitoring system for detecting anomalies. It is also registered with regulatory bodies like FinCEN and FINTRAC, adding a layer of credibility. While newer, Bitunix has made visible efforts to build user trust through transparency and licensing.

Bitunix vs Bybit: Insurance Funds

Both Bitunix and Bybit operate insurance funds to cover extreme market events and user losses during liquidation. Bybit’s insurance fund is more mature and better capitalized due to its long-standing presence and high trading volumes. It serves as a buffer to protect traders from negative balances in high-volatility environments.

Bitunix also maintains an insurance fund, though it is comparatively smaller. The fund is used to absorb the risk of auto-deleveraging and to protect users during rapid market moves. While less proven than Bybit’s, it demonstrates Bitunix’s intent to provide a secure trading environment for leveraged products.

Bitunix vs Bybit: Customer Support

Bybit provides 24/7 customer support via live chat, email, and a detailed help center. Its response times are generally fast, and the platform supports multiple languages, making it accessible to a global audience. VIP users often receive priority support and dedicated account managers.

Bitunix also offers 24/7 support through live chat and a support ticket system. Its help center includes tutorials and FAQs aimed at helping beginners. While the support infrastructure is not as extensive as Bybit’s, it is responsive and adequate for most retail user needs.

Bitunix vs Bybit: Regulatory Compliance

Bybit has made significant strides in aligning with global regulatory standards. It has relocated its headquarters to Dubai and actively seeks licenses in crypto-friendly jurisdictions. The platform has introduced stricter KYC policies and regional restrictions to comply with evolving global frameworks, particularly in Europe and Asia. These efforts have helped Bybit maintain its reputation as a trustworthy platform for institutional and retail traders alike.

Bitunix, although newer, has also focused on regulatory compliance. It is registered with FinCEN in the U.S. and FINTRAC in Canada, which helps it operate more transparently in key markets. Its KYC flexibility allows for broader user access, but the platform also enforces verification and AML procedures for higher tiers and larger withdrawals. While not as globally licensed as Bybit, Bitunix has established a solid foundation for future regulatory alignment.

Conclusion

Both Bitunix and Bybit offer strong trading platforms, but they cater to different types of users. Bybit is the clear winner for advanced and professional traders who need deep liquidity, a wide range of derivatives, and institutional-grade tools. Its robust infrastructure, advanced order types, and global presence make it ideal for high-frequency, leveraged, or large-scale trading strategies.

Bitunix, on the other hand, is better suited for beginners and casual traders. It offers an easy-to-navigate interface, lower starting fees, and helpful features like copy trading and fiat on-ramps. For users looking for a no-frills, efficient trading experience with flexible KYC options, Bitunix presents a compelling alternative.

In summary:

-

Choose Bybit if you’re an experienced trader needing depth, speed, and professional tools.

-

Choose Bitunix if you’re a beginner, a copy trader, or someone prioritizing simplicity and low costs.