In the ever-evolving world of crypto trading, choosing the right exchange can make all the difference. This post compares Bitunix and Bitget, two rising platforms that cater to both new and experienced traders. While Bitunix is a newer player gaining attention for its clean interface, solid security, and leverage options, Bitget has established itself as a global leader known for its advanced copy-trading features and deep liquidity.

Whether you’re looking for low fees, a wide selection of assets, or powerful derivatives tools, understanding how these two platforms stack up will help you decide which one fits your trading goals best. Let’s dive in.

Bitunix vs Bitget: Quick Feature Comparison

| Feature | Bitunix | Bitget |

|---|---|---|

| Founded | 2021 | 2018 |

| Headquarters | Saint Vincent and the Grenadines | Seychelles |

| Founders | Team from finance & blockchain | Not publicly disclosed |

| Supported Coins | 300+ tokens, 500+ trading pairs | 800+ tokens, 900+ trading pairs |

| Trading Volume | Moderate, growing rapidly | High, among top global exchanges |

| Trading Fees | Spot: 0.08% maker / 0.10% takerFutures: 0.02% maker / 0.06% taker | Spot: 0.10% maker/takerFutures: 0.02% maker / 0.06% taker |

| Maximum Leverage | Up to 125× | Up to 125× |

| Deposit/Withdrawal | Crypto only; third-party fiat on-ramps | Crypto, P2P, card, and bank transfer support |

| Security Measures | Cold wallet storage, 1:1 PoR, 2FA | 1:1 PoR, $300M Protection Fund, 2FA |

Bitunix vs Bitget: Key Differences at a Glance

At first glance, both Bitunix and Bitget offer a solid trading experience, but they cater to slightly different trader profiles. Bitunix is more streamlined and appeals to traders who want a no-frills, efficient platform with high leverage and fast order execution. Its interface is clean, making it beginner-friendly, while still offering the core functionalities that futures traders need.

Bitget, on the other hand, is a more feature-rich platform that’s ideal for both retail and professional traders. It stands out with its popular copy-trading system, diverse product suite, and advanced order types. Bitget also maintains deeper liquidity across spot and derivatives markets, making it more suitable for high-frequency or institutional-grade traders.

When it comes to fees, both exchanges offer competitive rates on spot and futures trading. However, Bitget provides more fee reduction options through its native token and VIP tiers. In terms of coin selection, Bitget has a broader offering, making it the better choice for altcoin enthusiasts.

Bitunix vs Bitget: Platform Products and Services Overview

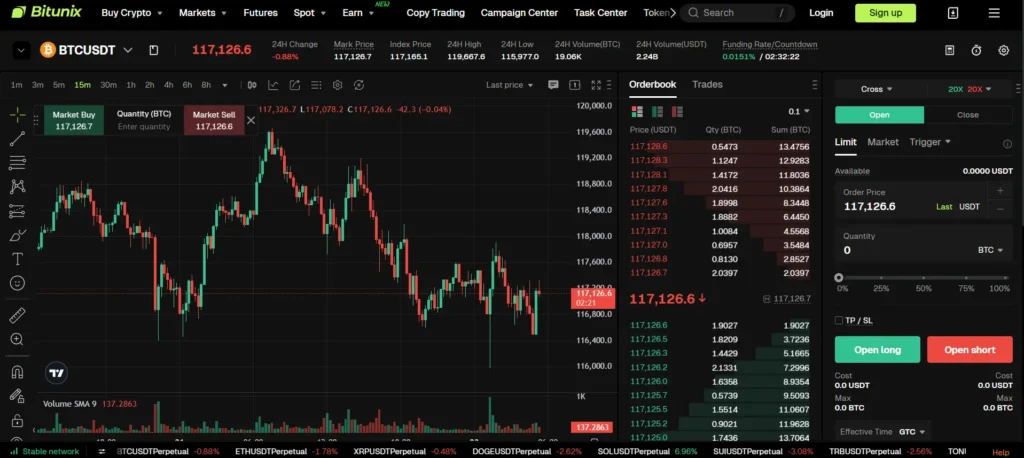

Bitunix keeps things lean with a focus on derivatives trading, offering perpetual futures contracts with leverage up to 125x. The platform also supports spot trading and integrates TradingView charting tools directly into its interface for better technical analysis. While it doesn’t have a wide array of extra products, Bitunix provides a stable and efficient trading environment, especially for futures traders.

Bitget, on the other hand, offers a broader ecosystem. It includes spot and futures trading, structured investment products like launchpads and dual investments, and a standout copy-trading platform that allows users to follow top-performing traders. Bitget also runs regular promotions, trading competitions, and educational content through its academy. It’s built for traders who want more than just buying and selling.

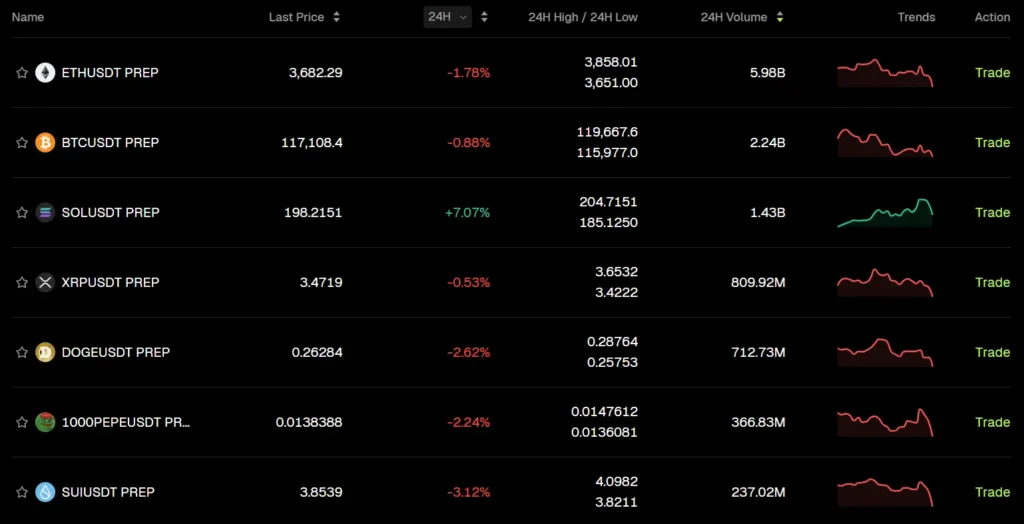

Bitunix vs Bitget: Range of Tradable Contracts

Bitunix focuses mainly on USDT-margined perpetual contracts, offering a streamlined list of popular pairs like BTC/USDT, ETH/USDT, and a few top altcoins. It keeps the range limited but fast and efficient, aimed at traders who focus on major crypto assets with leverage.

Bitget provides a more diverse set of derivatives. It offers both USDT-margined and coin-margined futures contracts, along with innovative products like grid trading bots and copy trading strategies in the futures segment. For traders looking to experiment with different contract types or automate strategies, Bitget offers much more flexibility.

Bitunix vs Bitget: Supported Cryptocurrencies and Trading Pairs

Bitunix supports over 300 cryptocurrencies across spot and futures markets, with a strong emphasis on high-volume and trending assets. Its selection is enough for most traders, especially those focused on top-tier coins and major perpetual contracts.

Bitget goes further, listing over 800 tokens with a huge number of trading pairs. It covers everything from blue-chip assets like BTC and ETH to newly launched altcoins, meme coins, and DeFi tokens. For users who want exposure to the latest tokens or are seeking high-risk, high-reward plays, Bitget offers significantly more variety.

Bitunix vs Bitget: Leverage and Margin Trading

Both Bitunix and Bitget offer leverage up to 125x on select futures contracts, making them attractive platforms for high-risk, high-reward trading. Bitunix keeps things simple, offering high leverage on popular pairs with straightforward margin requirements, making it suitable for experienced futures traders who prefer a clean, fast interface.

Bitget offers more robust risk management tools alongside its leveraged products. Users can choose between isolated and cross margin modes, and the platform provides detailed liquidation data, insurance fund coverage, and adjustable leverage settings per trade. These features make Bitget better suited for active traders managing multiple positions with more sophisticated strategies.

Bitunix vs Bitget: Trading Volume and Liquidity

Bitunix has seen steady growth in trading volume, especially in futures markets. While not yet among the top-tier exchanges by global volume, it offers decent liquidity on major trading pairs, ensuring smooth execution for retail traders.

Bitget, by contrast, ranks among the top global exchanges by trading volume—often exceeding $10 billion in daily derivatives volume. Its deep liquidity ensures tight spreads and efficient order fills even for large trades. For traders who value execution speed and minimal slippage, especially on high-leverage positions, Bitget clearly holds the advantage.

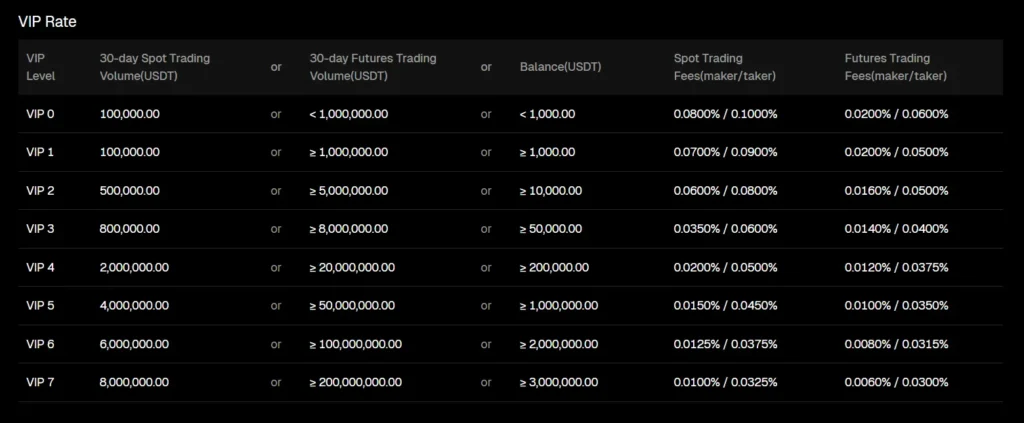

Bitunix vs Bitget: Fee Structure Comparison

Bitunix keeps its fee structure competitive, charging 0.08% (maker) and 0.10% (taker) on spot trades, and 0.02% / 0.06% on futures. Traders can reduce these fees further by moving up VIP tiers based on trading volume or holding specific balances.

Bitget has a similar base structure with 0.10% (maker/taker) for spot and 0.02% / 0.06% for futures, but users can lower their fees using its native token BGB or by joining the VIP program. The platform also offers occasional zero-fee trading events and referral-based rewards, giving active traders more chances to save.

Overall, both exchanges are competitive, but Bitget provides slightly more flexibility and promotional opportunities for fee savings.

Bitunix vs Bitget: Deposits, Withdrawals, and Payment Methods

Bitunix supports crypto-only deposits and withdrawals. Users can purchase crypto using third-party fiat gateways like credit/debit cards, but there are no native fiat on-ramp or P2P systems. Withdrawals are processed quickly and typically subject to standard network fees, with strong security checks in place.

Bitget, in contrast, offers a wide range of options. Along with crypto deposits, it supports fiat on-ramps via P2P trading, bank transfers, and credit/debit card purchases through integrated partners. Withdrawals are flexible and efficient, and the platform provides clear fee structures for each asset. For users needing fiat access or multiple payment channels, Bitget is clearly more versatile.

Bitunix vs Bitget: Native Exchange Tokens

Bitunix does not currently have a native exchange token, which simplifies its ecosystem but also means fewer opportunities for internal fee discounts or platform-based incentives.

Bitget offers the BGB token, which provides multiple benefits including trading fee discounts, staking rewards, and access to launchpad events. Holding BGB also helps users qualify for higher VIP tiers. This token-based utility system makes Bitget more attractive for long-term users who want to maximize savings and platform engagement.

Bitunix vs Bitget: KYC Requirements and Account Limits

Bitunix allows users to begin trading with minimal verification, although daily withdrawal limits are capped for non-KYC accounts. Full KYC unlocks higher limits and access to promotions and referral bonuses. The process is standard—requiring government-issued ID and facial verification.

Bitget also provides tiered KYC levels. Basic accounts can deposit and trade, but withdrawals are limited. Completing KYC increases withdrawal limits and unlocks features like P2P trading and higher fiat transaction limits. The platform is compliant with multiple jurisdictions and adheres to global AML standards, making it more robust in regulatory coverage.

Bitunix vs Bitget: User Interface and Ease of Use

Bitunix offers a clean, lightweight interface designed for speed and simplicity. Its layout is intuitive, with TradingView integration, quick access to futures markets, and minimal distractions—making it ideal for beginners or traders who value a focused experience. The mobile app is also streamlined, offering essential trading functions without overwhelming the user.

Bitget provides a more feature-rich interface with customizable dashboards, multiple market views, advanced charting, and direct access to copy-trading and staking features. While slightly more complex for new users, experienced traders will appreciate the depth of tools and smooth navigation across both web and mobile platforms.

Bitunix vs Bitget: Order Types Supported

Bitunix supports the most essential order types such as market, limit, and trigger orders. These are sufficient for straightforward trading strategies, especially in the futures market. The platform does not currently offer advanced algorithmic orders, which keeps things simple but might limit options for pro traders.

Bitget, on the other hand, includes a wider range of order types including market, limit, stop-limit, stop-market, trailing stop, post-only, and iceberg orders. This flexibility allows traders to automate strategies, manage risk more precisely, and operate in volatile markets with more control. For those who need complex execution options, Bitget stands out.

Bitunix vs Bitget: Security Features and Practices

Both exchanges place a strong emphasis on user security. Bitunix implements cold wallet storage, two-factor authentication (2FA), and real-time risk control systems. It also maintains a Proof-of-Reserves (PoR) system to ensure asset backing on a 1:1 basis.

Bitget matches these standards and adds extra layers, including a $300 million Protection Fund, multi-signature wallets, and regulatory registrations as a Virtual Asset Service Provider (VASP) in several jurisdictions. Bitget’s broader security infrastructure and public commitment to user protection give it an edge in this category.

Bitunix vs Bitget: Insurance Funds

Bitunix offers a risk-management framework that includes liquidations and margin call protections, but it doesn’t maintain a publicly disclosed insurance fund. Instead, the platform relies on real-time monitoring, risk control systems, and standard margin protocols to manage systemic risk.

Bitget maintains a dedicated $300 million Protection Fund, which is designed to safeguard user assets in extreme market conditions or unexpected platform issues. The fund is transparently tracked and adds an extra layer of confidence for high-volume traders or users concerned about asset safety during market volatility.

Bitunix vs Bitget: Customer Support

Bitunix provides 24/7 customer support through live chat and email. The response time is relatively quick for most issues, and the support team is known for being professional and helpful. The platform also includes an FAQ section and help center to guide users through common problems.

Bitget also offers round-the-clock support, but with additional channels like ticketing systems, a more extensive knowledge base, and multilingual support. It has a strong community presence across Telegram, Discord, and other platforms—helpful for users who want peer support or regional guidance. Overall, Bitget offers a more robust and accessible support ecosystem.

Bitunix vs Bitget: Regulatory Compliance

Bitunix operates under a regulatory framework from Saint Vincent and the Grenadines, and holds a Money Services Business (MSB) license in the U.S., offering a basic level of legitimacy. However, it still operates in a gray zone compared to more heavily regulated platforms.

Bitget goes further with compliance. It is registered as a Virtual Asset Service Provider (VASP) in multiple jurisdictions and actively engages with regulators to ensure user safety and operational transparency. This makes Bitget a stronger choice for users who prioritize compliance and long-term platform stability.

Conclusion

Both Bitunix and Bitget offer strong features for crypto traders, but they serve slightly different audiences.

Bitunix is a solid choice if you’re looking for a clean, fast, and focused trading experience. It’s ideal for traders who want straightforward access to perpetual contracts with high leverage and minimal distractions. Its intuitive design and competitive fees make it a good entry point for beginners stepping into futures trading.

Bitget, on the other hand, is better suited for users who want a complete trading ecosystem. From its deep liquidity and wide asset coverage to advanced tools, copy trading, fiat integrations, and regulatory standing—it’s built for traders who demand more functionality and flexibility. Its native token, insurance fund, and support infrastructure make it a strong long-term platform.