Crypto Exchange Statistics in 2025

Written by Ayanika Das

Ayanika is an experienced content writer with a background in Hotel Management and a master's in hospitality administration from IHM Calcutta. With her expertise in content creation and copywriting, Ayanika has collaborated with numerous companies across various sectors. She's currently focusing on the crypto and investment sectors and crafting in-depth pieces about different aspects of the crypto space.

Expert Reviewed

This article has been reviewed by crypto market experts at SCM to ensure all the content, sources, and claims adhere to the highest standards of accuracy and reliability.

Last Updated on June 23, 2025

Buying, selling, and trading cryptocurrencies without a crypto exchange is nearly unthinkable today. These platforms are the backbone of the digital finance ecosystem, driving a rapidly growing global market.

For both beginners and experienced traders, understanding how these platforms work and the trends shaping them is essential.

We’ve gathered the most important data and trends to help you grasp the current state of the crypto exchange market.

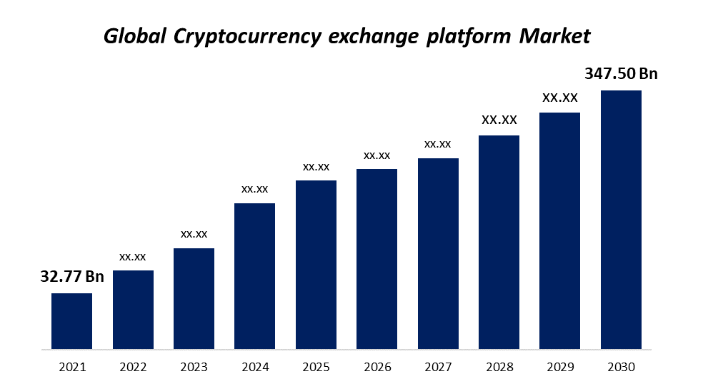

Crypto Trading Exchange Market Size

Over the past five years, the demand for crypto exchanges has increased. As per the 2021 reports, the crypto trading platform market held 35% of global cryptocurrency market share.

In 2021, the market size of crypto trading platforms was $32.77 billion. Although the exact market size for 2022 is not known, estimates suggest it was around $36.5 billion.

If you compare the market size for 2021 and the estimated figure for 2022, you’ll see that the market size has increased by 11.38%.

The precise market size for 2024 is currently unavailable, but previous reports indicate that experts anticipated an annual growth rate of 30.08%, projecting the market size to reach approximately $345.50 billion by 2030.

These data sets only confirm the growing demand for crypto exchanges.

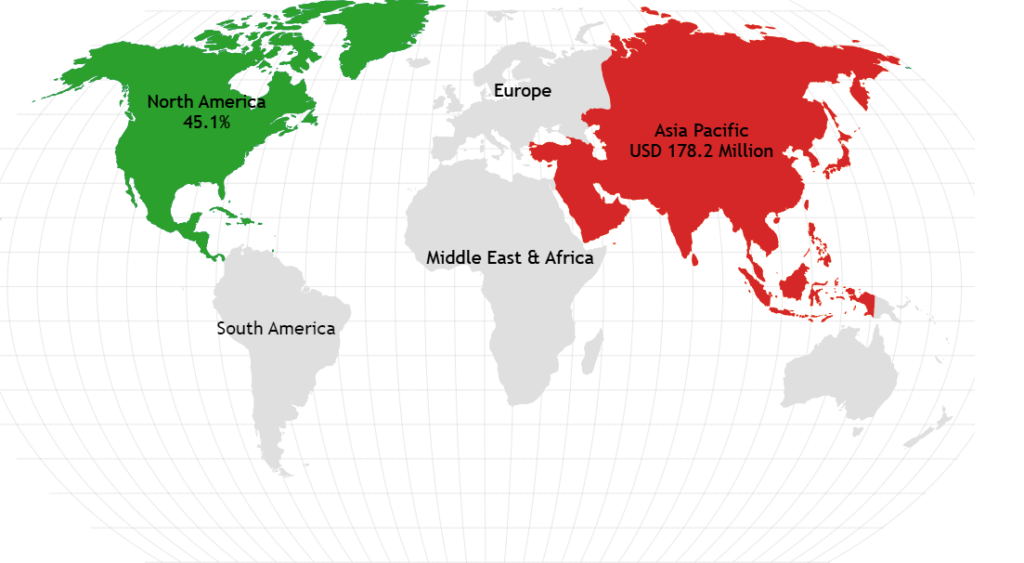

Global Distribution of Crypto Exchange Market

Crypto exchanges operate worldwide, experiencing varying levels of demand across different countries.

The valuation and market size of crypto exchanges vary from country to country. According to the 2021 report, North America has the largest cryptocurrency exchange market, with a share of about 30.35%.

The market crypto exchange revenue in 2021 was around $9.94 billion.

This growth is primarily attributed to the presence of some of the most prominent exchange players in the region, like Kraken, Coinbase, Crypto.com, etc.

Aside from North America, trends indicate that the Asia-Pacific region is emerging as the next significant crypto exchange market.

From 2021 to 2030, the Asia-Pacific market will experience the highest compound annual growth rate (CAGR).

Reports suggest that the Asia Pacific is estimated to reach $178.2 million.

Experts attribute this growth to the increasing acceptance of cryptocurrencies in major countries like China and India, driving the expansion of crypto trading platforms in the Asia-Pacific region.

Crypto Exchange Uptime & Downtime Statistics

Uptime is the time an exchange is operational and available for customers. Meanwhile, downtime is the opposite,i.e., it’s the duration during which the exchange’s services temporarily remain unavailable.

ZB.com had the highest downtime throughout 2023.The total downtime it faced last year was three days. At the same time, Bittrex reported the highest uptime among all the exchanges. In 2023, Bittrex maintained 100% uptime.

However, Coincheck replaced Bittrex in 2024.As of now, till June 2024, it is the highest uptime record at 100%. There have been changes in the downtime record as well. OKEx reported the highest downtime for about 9 hours till June 2024.

Order Speed Of Crypto Exchanges

How fast a crypto exchange is processing your buying or selling order is called the order speed of that exchange. Even the slightest variation in the order speed can make a difference for the traders indulging in high-frequency trading.

From the data collected, we have found 5 exchanges with the lowest order time execution stats.

| Deribit | The average order time delay for Deribit was 6.1 milliseconds. Almost 89.6 % of orders on the exchange were executed within 10 milliseconds, and no order took more than 1 second. |

| Coinbase | Coinbase has an average order time delay of about 33.0 milliseconds, and the exchange can execute 0.2% of its orders within 10 milliseconds. However, about 0.1% of orders take longer than 1 second. |

| Binance | The average order time delay for Binance is 37.2 milliseconds, with about 1.1% of orders taking more than 1 second for execution. And about 0.1% of orders on the exchange get executed within 10 milliseconds. |

| Bitfinex | Bitfinax recorded an average order time delay of 156 milliseconds. About 1.5% of the exchange’s orders take more than 1 second to process. However, Bitfinex couldn’t execute any order within 10 milliseconds. |

| Bitmex | This comes last with an average order delay time of 1.11 seconds. Even though the exchange boasts of executing 13.4% of all its orders within ten milliseconds, it still takes more than 1 second to perform 20.8% of exchange orders. |

Most Downloaded Crypto Exchange Apps

Binance leads the charts as the most downloaded crypto exchange app. In the first quarter of 2024, approximately 3,150 Binance apps were downloaded. To date, the total number of downloads has surpassed 25,000.

After Binance, Crypto.com took second on the list with 678 downloads in June 2024. The total number of downloads of the Crypto.com app in 2024 is close to 15.

As of June 2024, Bitpanda reported a total download of 593. In 2024, the total number of Bitpanda apps exceeded 14K.

DEX & CEX Comparison

A DEX (decentralized exchange) offers users more freedom and flexibility compared to a CEX (centralized exchange), making it traditionally more appealing. However, by November 2023, the market share based on trading volume showed that CEXs held 5%, while DEXs accounted for just 3%.

This data suggests a shift in user preference or behavior, indicating that despite the perceived advantages of DEXs, centralized exchanges still dominate in trading volume.

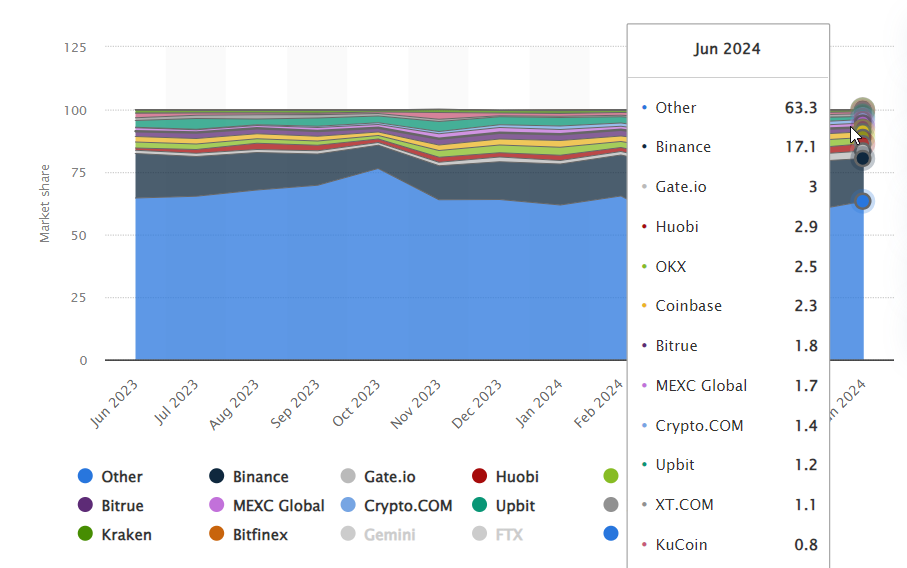

Popular Crypto Exchanges Market Share

Binance leads the crypto exchange market with a commanding 17.1% share based on total trading volume. Following Binance, Gate.io holds a 3% market share, while Huobi closely trails with 2.9%. These figures highlight Binance’s dominant position in the industry, significantly outpacing its competitors.

Crypto Exchange With Best Consumer Ratings

In 2022, Binance had the highest overall customer experience rating of 70.7. Next on the list were Coinbase and Crypto.com, with ratings of 55.1 and 53.7.

Crypto Exchange Fee Structures Comparison

Platforms have a different fee structure for various trading options. The fees usually differ for spot, derivatives trading, and withdrawal.

For this comparison, we are considering the spot trading fees only.

If you check out all the available spot trading fees of crypto exchanges, you’ll find that Binance has the lowest spot trading fee structure operating on the maker-and-taker fee model.

Binance’s makers’ fee ranges between 0.075% – 0%, while the taker fee falls between 0.075 % – 0.05%.

On the other hand, Kraken has the highest spot trading fees among the famous top exchanges. Spot trading fees on Kraken are based on the similar maker and taker fee.

There is an upper limit of 0.26% and a lower limit of 0.1% for the maker’s fees and 0.16% and 0% for the taker’s fees.

Crypto Exchange Statistics

- The Kraken crypto exchange has a 90% client satisfaction score. (Source – karken.com)

- There are more than 100 crypto venture capital firms. (Source – Fortunly)

- From March 2020, the global cryptocurrency market has surged by 900%. (Source – Fortunly)

- One crypto transaction requires the energy equivalent to 1.5 million Visa transactions. (Source – Fortunly)

- The trading volume of the top 10 cryptocurrency exchanges constitutes more than 80% of the market’s total trading volume. (Source – Fortunly)

- The total market capitalization of cryptocurrencies worldwide amounts to $2.21 trillion. (Source – Binance)

- Over 50 crypto unicorns and startups are valued at over $1 billion. (Source – failory.com)

- There are 1,492 active crypto exchanges globally, encompassing centralized and decentralized platforms. (Source – coinweb.com)

- As of 2024, the total daily trading volume in the crypto market is $116.61 billion. (Source – finrax.com)

- Kraken offers margin trading with leverage up to 5x. (Source – Kraken.com)