The cryptocurrency exchange landscape is crowded, but not all platforms are created equal. In this post, we’re diving into a head‑to‑head comparison of Weex and MEXC—two fast-growing centralized exchanges. We’ll explore their histories, coin support, trading tools, fee structures, security systems, and overall fit for different types of traders. By the end, you’ll have a clear view of which platform aligns best with your needs—whether you’re into high-leverage futures trading or exploring the latest altcoin innovations.

Quick Feature Comparison of Weex vs MEXC:

| Feature | Weex | MEXC |

|---|---|---|

| Founded / Founders | 2018; built by a team of former Wall Street, Google, and tech veterans | 2018; corporate-led, headquartered in Seychelles |

| Supported Coins / Pairs | 900+ coins, 1,000+ trading pairs | 2,800+ coins, over 3,000 trading pairs |

| 24h Trading Volume | ~$3.5–4 billion | ~$6–7 billion, among the top 10 globally |

| Leverage | Up to 400× on futures | Up to 200×, with some instruments offering higher |

| Spot Trading Fees | Often 0% during promotions; standard ~0.1% | Flat 0.05% maker/taker fees |

| Futures Trading Fees | ~0.02% maker / 0.06% taker | 0% maker / 0.02% taker; discounts with native token |

| Deposit & Withdrawal | Supports credit/debit cards, bank transfers, and crypto; fast processing | Crypto deposits free; fiat support via third-party providers |

| Security Measures | Cold wallet storage, 2FA, advanced encryption, insurance fund for user protection | Multi-layered security, proof of reserves, insurance mechanisms |

Weex vs MEXC: Key Differences at a Glance

Weex and MEXC serve distinct trading needs despite being founded in the same year. Weex focuses on professional traders, offering up to 400× leverage on derivatives and competitive futures fees (~0.02% maker / 0.06% taker). It often promotes zero spot trading fees and provides deep liquidity, making it ideal for high-volume, high-leverage trading.

MEXC, on the other hand, appeals to retail users and altcoin hunters with over 2,800 listed coins and 3,000+ pairs. Its flat 0.05% spot trading fee and 0.02% futures taker fee are further reduced for MX token holders. It also ranks among the top global exchanges by volume and user base.

While MEXC emphasizes accessibility and variety, Weex stands out with its minimal slippage, fast execution, and relaxed KYC for lower tiers. In short, Weex suits high-frequency and leverage-driven traders, while MEXC is better for those exploring new tokens with low trading fees.

Weex vs MEXC: Platform Products and Services Overview

Weex and MEXC offer distinct product ecosystems tailored to their core user bases.

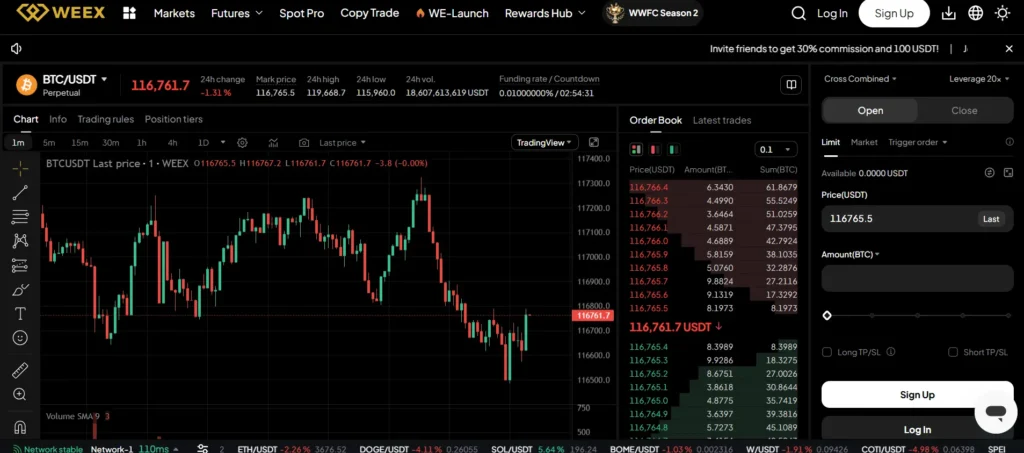

Weex positions itself primarily as a derivatives-focused platform, specializing in perpetual contracts and advanced leverage trading. The platform prioritizes low-latency execution and deep order books, making it a strong choice for professional traders. Key features include cross and isolated margin modes, multi-tier risk management, and access to real-time funding rates. Weex also integrates a professional trading terminal with tools like charting, order flow analysis, and advanced order types. Its user interface is streamlined for speed and clarity, especially suited for high-frequency and leverage-based strategies.

MEXC, meanwhile, offers a broader suite of products aimed at a wider audience. Beyond standard spot and futures trading, MEXC supports margin trading, copy trading, leveraged ETFs, staking, launchpads for new tokens, and structured earn products. The exchange also features grid trading bots and AI-driven trading strategies for beginners. Its versatility attracts users interested in more than just price speculation—those who seek passive income, token launches, or exposure to niche markets find MEXC especially appealing.

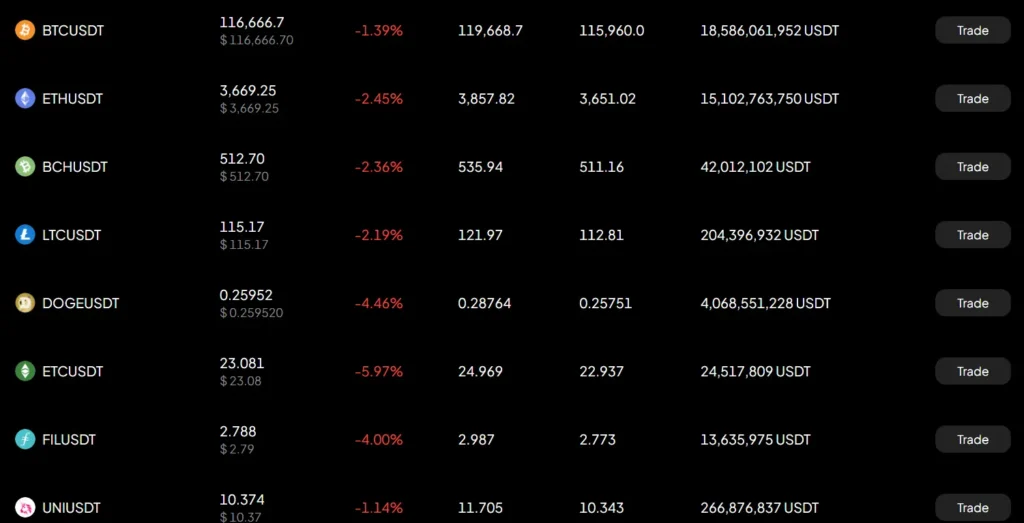

Weex vs MEXC: Range of Tradable Contracts

Weex maintains a tight, high-performance contract catalog, offering perpetual futures in major pairs like BTC/USDT, ETH/USDT, and select altcoins. The focus is on liquidity depth, execution speed, and transparency in contract specifications. Most contracts on Weex are settled in USDT, with linear structures that make PnL calculation simple. Its trading engine is optimized for minimal latency, which is critical for scalping and large-volume strategies.

MEXC offers a wider variety of contract types, including USDT-M and COIN-M perpetuals and quarterly futures. It supports hundreds of contract pairs, covering everything from large-cap coins to emerging tokens. MEXC also provides leveraged ETFs—products that offer exposure to 2x, 3x, or more of an asset’s daily movement without the need for margin or liquidation management. This variety gives MEXC an edge for retail traders looking for alternative ways to trade with leverage or hedge positions.

Weex vs MEXC: Supported Cryptocurrencies and Trading Pairs

MEXC is known for its massive listing diversity, supporting over 2,800 cryptocurrencies and 3,000+ trading pairs. This includes both mainstream assets and a constant stream of new tokens, often listed much earlier than on other major exchanges. It’s a go-to platform for altcoin enthusiasts and early adopters seeking exposure to emerging projects.

Weex, by contrast, focuses on quality over quantity. With support for around 900 coins, it prioritizes liquidity and stability over listing every new project. Its spot and futures offerings cover the most traded and demanded tokens in the market, making it ideal for traders who prefer reliable markets with tighter spreads and deeper books. While it doesn’t match MEXC’s breadth, Weex makes up for it with consistency and performance in core trading pairs.

Weex vs MEXC: Leverage and Margin Trading

Weex is designed with high-leverage traders in mind, offering up to 400× leverage on select futures contracts. This makes it attractive for professional traders and scalpers looking to maximize capital efficiency. Users can choose between isolated and cross margin modes, with real-time risk management tools that help mitigate liquidation risks. Weex also provides flexible margin adjustments, enabling traders to scale leverage up or down dynamically during open positions.

MEXC offers leverage of up to 200× on its derivatives platform, including USDT-M and COIN-M perpetual contracts. It supports both isolated and cross margin and has a more retail-oriented approach with built-in guidance and tutorials for less experienced users. MEXC also offers leveraged ETFs for traders who want exposure to leveraged positions without the complexity of margin and liquidation thresholds. While MEXC’s maximum leverage is lower than Weex, its risk management tools and educational support make it beginner-friendly.

Weex vs MEXC: Trading Volume and Liquidity

Liquidity and trading volume directly affect trade execution, especially for large positions. Weex, though lesser known among casual traders, maintains high liquidity in its futures markets, particularly for BTC, ETH, and other top-tier pairs. Its deep order books and tight spreads make it suitable for large-volume and high-frequency trading strategies. The platform focuses on fewer but more liquid contracts, ensuring minimal slippage even during volatile periods.

MEXC consistently ranks among the top exchanges by trading volume globally, driven by its massive user base and wide range of listed tokens. It offers strong liquidity across many altcoin pairs, which is rare even among large platforms. However, with so many assets listed, depth can vary significantly between pairs. That said, for most popular tokens, MEXC offers sufficient liquidity and low slippage, making it reliable for most trading styles.

Weex vs MEXC: Fee Structure Comparison

Weex employs a tiered fee model, where futures trading typically involves maker fees around 0.02% and taker fees near 0.06%. Spot trading fees may go as low as 0% during promotional periods, which appeals to high-frequency traders and arbitrageurs. The platform occasionally offers trading rebates or fee reductions for VIP users, though these promotions vary.

MEXC, in contrast, uses a simple and flat fee structure. Spot trades are charged 0.05% for both maker and taker orders, while futures trades come with 0% maker and around 0.02% taker fees. Users holding MX tokens get additional discounts on trading fees, which incentivizes long-term platform loyalty. This straightforward and transparent fee setup makes MEXC easy to understand and cost-effective, especially for everyday traders.

Weex vs MEXC: Deposits, Withdrawals, and Payment Methods

Weex supports a range of deposit and withdrawal options, including cryptocurrency transfers, credit/debit cards, bank transfers, and OTC trading. Crypto deposits are typically processed quickly, while fiat options depend on region and third-party providers. Withdrawal speeds are generally fast, especially for crypto, and the platform includes built-in security layers like withdrawal whitelists and 2FA verification.

MEXC also offers flexible payment methods, including free crypto deposits, bank transfers, P2P trading, and support for fiat via third-party gateways. It maintains a zero-fee policy for most crypto deposits and offers competitive withdrawal rates depending on the asset. Processing times are efficient, though fiat withdrawals may take longer depending on the provider and currency. MEXC’s strong P2P ecosystem makes it especially convenient for users in regions without direct banking support for crypto.

Weex vs MEXC: Native Exchange Tokens

MEXC uses MX Token as its native exchange utility token. Holding MX grants users trading fee discounts, access to token launchpads, and eligibility for exclusive airdrops. MX also plays a role in the exchange’s ecosystem development, including governance and staking. The more MX a user holds, the greater the benefits, especially in reducing trading costs.

Weex does not currently have a well-established native token comparable to MX. Instead, the platform focuses on delivering value through its trading infrastructure, low fees, and insurance-backed risk management. While a native token could be introduced in the future, Weex’s current model does not rely on token incentives, which may appeal to users who prioritize functionality over tokenomics.

Weex vs MEXC: KYC Requirements and Account Limits

Weex offers a flexible KYC structure. Basic trading and limited withdrawals are available without full verification, making it appealing to users who value privacy or need quick access. However, higher withdrawal limits and access to fiat services typically require identity verification, including submission of official documents and facial recognition.

MEXC, by contrast, enforces a tiered KYC system more prominently. Users can trade and deposit without KYC but must complete identity verification to unlock higher withdrawal limits and access features like P2P and fiat channels. Full verification includes government-issued ID checks and biometric confirmation. The platform’s KYC policies are designed to comply with global regulations and enhance platform security.

Weex vs MEXC: User Interface and Ease of Use

Weex delivers a clean and professional user interface that caters to both seasoned traders and high-frequency users. Its desktop and mobile platforms are optimized for speed and clarity, with easy access to charts, order books, and leverage controls. While minimalistic in design, the platform prioritizes execution efficiency and real-time responsiveness, which is ideal for traders focused on futures and fast-moving markets.

MEXC, on the other hand, offers a more feature-rich and user-friendly interface. It balances functionality with accessibility, making it suitable for both beginners and experienced traders. The mobile app is especially well-designed, offering quick access to spot, futures, ETFs, staking, and other tools from a single dashboard. Tooltips, tutorials, and an intuitive layout make onboarding smoother for new users compared to the more trading-intensive feel of Weex.

Weex vs MEXC: Order Types Supported

Weex supports all the standard order types needed for professional derivatives trading. These include market, limit, stop-limit, and conditional orders. Traders can also utilize post-only and reduce-only features, helping them execute precise strategies while managing risks effectively. The order system is built for speed, ensuring minimal latency for high-frequency strategies.

MEXC also provides a comprehensive set of order types, including market, limit, stop-limit, and trigger orders. For futures trading, it includes advanced functions like take-profit/stop-loss orders, trailing stops, and iceberg orders. These features cater to both casual spot traders and more advanced strategy-based traders. MEXC’s broader product range means more order tools are integrated across multiple products, not just derivatives.

Weex vs MEXC: Security Features and Practices

Security is a top priority for both platforms, but each takes a slightly different approach. Weex employs multi-layered security protocols, including cold wallet storage, multi-factor authentication, withdrawal address whitelisting, and an insurance fund to protect user funds in extreme cases. The platform has maintained a clean record with no major security incidents reported so far.

MEXC also takes security seriously, implementing features like two-factor authentication (2FA), cold and hot wallet segregation, and real-time monitoring systems. The exchange follows industry best practices and regularly conducts internal audits. While it has handled security threats in the past, MEXC has generally responded swiftly and transparently, helping maintain user confidence.

Weex vs MEXC: Insurance Funds

Weex maintains an exchange-backed insurance fund to protect user assets in cases of extreme market volatility or unforeseen liquidation events. This fund is specifically designed to cover negative balances and minimize the impact of auto-deleveraging for futures traders. By proactively securing user positions, Weex builds trust with high-leverage traders who require an added layer of financial protection.

MEXC also operates an insurance mechanism, primarily within its futures trading environment. While the details are less publicly emphasized compared to Weex, MEXC’s fund serves a similar purpose—protecting users from unexpected losses and ensuring the stability of its perpetual contracts. It contributes to overall user confidence, especially in high-volatility conditions.

Weex vs MEXC: Customer Support

Weex offers 24/7 multilingual customer support via live chat, email, and in-app support features. The response time is generally fast, and the platform has a strong reputation for resolving technical and trading-related queries efficiently. For advanced traders, Weex also offers account managers or priority support, depending on trading volume.

MEXC’s customer support is also available 24/7, with live chat and ticketing systems in place. It supports a wide range of languages and has an extensive help center for self-service support. The platform’s high user base sometimes leads to slightly longer response times, but most issues are resolved within a reasonable timeframe. Community support is also available through MEXC’s social channels and Telegram groups.

Weex vs MEXC: Regulatory Compliance

Weex operates with a compliance-light structure, allowing global access with limited restrictions in many regions. While this makes onboarding easier and faster, it also places some limitations in terms of fiat services and jurisdictional coverage. That said, Weex has been increasing its efforts to align with evolving regulatory expectations.

MEXC adopts a more formal compliance approach, implementing structured KYC verification, geofencing for restricted countries, and collaboration with third-party providers for fiat gateways. Though it is not regulated in major jurisdictions like the U.S., MEXC has shown consistent improvements in risk controls and compliance frameworks as part of its global expansion strategy.

Conclusion

Both Weex and MEXC are powerful exchanges, but they serve distinctly different trader profiles.

Weex is a strong choice for professional and high-frequency traders who prioritize deep liquidity, fast execution, and high-leverage derivatives. Its streamlined UI, insurance protections, and low-latency systems make it ideal for scalpers, futures specialists, and institutional users.

MEXC, by contrast, excels as a feature-rich, all-in-one platform for retail traders, altcoin explorers, and those seeking a diverse trading experience. With thousands of coins, low flat fees, leveraged ETFs, staking, and token launchpads, it’s a go-to hub for users looking to grow and diversify their portfolios.

If you’re a derivatives-first trader seeking performance and precision—Weex is the way to go. If you want access to the widest selection of coins, beginner-friendly tools, and a vibrant global community—MEXC is your best bet.