Choosing the right crypto exchange can make a big difference in your trading experience—whether you’re a beginner or a seasoned trader. In this post, we’re comparing Weex and Bybit, two fast-growing platforms that have caught the attention of crypto traders around the world.

Weex is a newer exchange gaining popularity for its clean interface, strong focus on derivatives, and simplified user experience—especially in Asia and emerging markets. Bybit, on the other hand, is a more established name known for deep liquidity, advanced trading tools, and a strong reputation in the crypto derivatives space.

This comparison will help you decide which platform fits your style better by breaking down their features, fees, supported coins, trading tools, and more. Whether you’re after high leverage, low fees, or an easy-to-use app, this guide will give you clarity.

Weex vs Bybit: Quick Feature Comparison Table

| Feature | Weex | Bybit |

|---|---|---|

| Founded | 2018 | 2018 |

| Founder(s) | Peter & Team (ex-Google, Citibank) | Ben Zhou |

| Headquarters | Singapore | Dubai |

| Supported Coins | 930+ | 650+ |

| Trading Pairs | 1,500+ (Spot + Futures) | 676+ (Spot), 670+ (Derivatives) |

| Daily Trading Volume | $3B–$50B (varies by pair/contract) | $5B–$36B (spot + derivatives) |

| Spot Trading Fees | 0.10% | 0.10% |

| Futures Fees (Maker/Taker) | 0.02% / 0.08% | –0.025% / 0.075% |

| Max Leverage | Up to 400× | Up to 100× (varies by asset) |

| Deposit Methods | Crypto, Bank cards, Alipay, PayPal | Crypto, Fiat via partners |

| Withdrawal Methods | Crypto withdrawals | Crypto withdrawals |

| Security Measures | Cold storage, 2FA, 1,000 BTC fund | Cold wallets, 2FA, Multi-sig |

Weex vs Bybit: Key Differences at a Glance

When comparing Weex and Bybit, the differences boil down to trading focus, target users, and ecosystem depth.

Bybit is a well-established platform known for its strong derivatives infrastructure, institutional-grade products, and wide international user base. It caters more to advanced and professional traders looking for tools like options, strategy builders, and deep liquidity. Bybit also supports a more diverse product suite—spot trading, futures, options, copy trading, launchpad, and earn programs—all integrated into a polished mobile and web interface.

Weex, on the other hand, is a rising star that’s building momentum by simplifying derivatives trading for a broader audience. It focuses heavily on contract trading with up to 400× leverage and offers a beginner-friendly experience through features like copy trading, a clean UI, and strong affiliate incentives. Its reach is growing especially fast in Asian markets and among traders looking for high leverage with less complexity.

In short:

-

Bybit is better suited for experienced traders and users looking for a full-featured ecosystem.

-

Weex is ideal for newer traders or affiliates seeking fast execution, high leverage, and simplicity.

Weex vs Bybit: Platform Products and Services Overview

Bybit is known for its robust suite of trading products. It started as a derivatives-focused exchange and has since expanded into spot trading, copy trading, options, NFT marketplaces, launchpads for token sales, and an earn section offering staking, dual asset mining, and savings. Bybit is clearly positioning itself as a full-stack crypto ecosystem—ideal for users who want more than just trading.

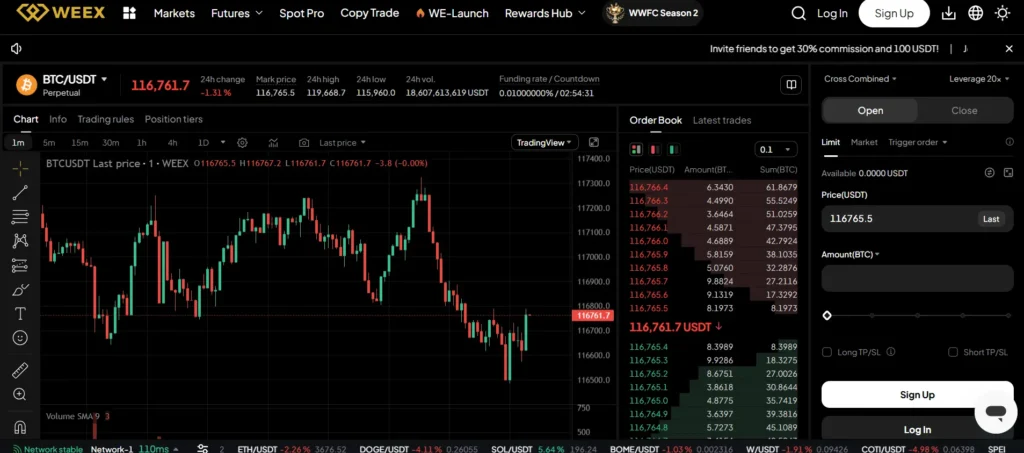

Weex, while newer, stays laser-focused on contract trading. Its key offerings include futures with ultra-high leverage (up to 400×), a growing spot market, and an intuitive copy trading system that allows users to follow top traders. The platform also offers simple onboarding and limited distractions—perfect for users who want to trade fast and efficiently without a steep learning curve.

Weex vs Bybit: Range of Tradable Contracts

Bybit offers a wide variety of contract types including USDT perpetuals, inverse perpetuals (BTC, ETH), and inverse futures. It also supports options trading for BTC and ETH, making it a more comprehensive platform for serious derivatives traders who require flexibility in hedging and speculation.

Weex, by contrast, keeps things streamlined. It focuses on USDT-margined perpetual contracts across hundreds of assets. While it doesn’t offer options or inverse contracts (yet), its contract trading interface is simple, fast, and mobile-optimized—targeting traders who want to go long or short without complexity.

If you’re looking for diversity and optionality, Bybit is the better choice. If you’re looking for speed and ease, Weex excels.

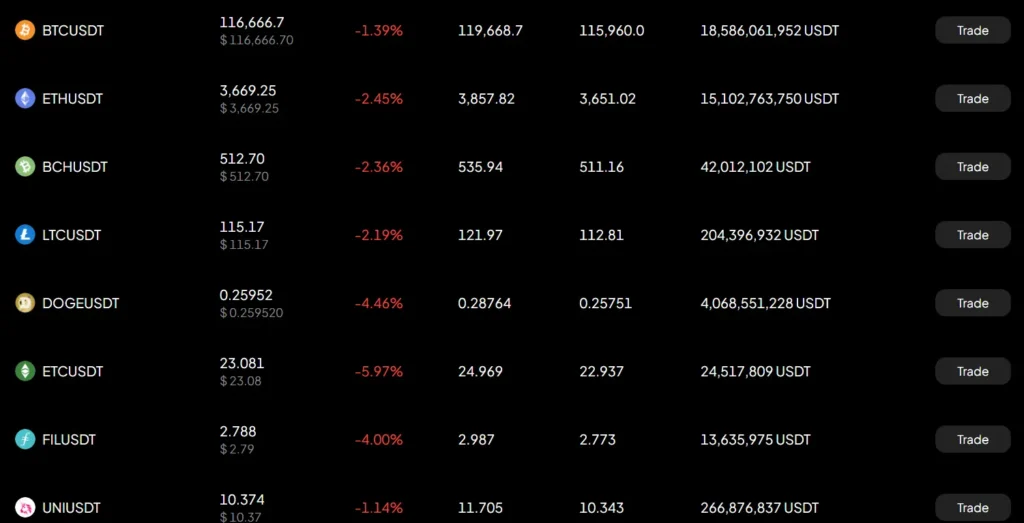

Weex vs Bybit: Supported Cryptocurrencies and Trading Pairs

When it comes to coin support, Weex has made impressive strides—offering over 930 cryptocurrencies and more than 1,500 trading pairs. This includes major tokens like BTC and ETH, as well as a wide array of altcoins and new listings. It’s especially attractive for traders looking to speculate on emerging tokens with high volatility.

Bybit also supports a strong lineup with around 650+ tokens across spot and futures. While it doesn’t match Weex in sheer volume, it focuses more on liquidity and quality—offering deeper books and faster order matching for popular pairs like BTC/USDT, ETH/USDT, and SOL/USDT.

For altcoin hunters and wide coverage, Weex takes the lead. For liquidity and execution on major pairs, Bybit wins.

Weex vs Bybit: Leverage and Margin Trading

Leverage is a key differentiator for traders seeking higher exposure with lower capital, and both Weex and Bybit offer compelling options.

Weex stands out by offering up to 400× leverage on certain perpetual contracts—among the highest in the industry. This is especially appealing to high-risk, high-reward traders. The platform keeps risk controls minimal to prioritize simplicity, although traders should exercise caution when using such high leverage.

Bybit, while slightly more conservative, still provides up to 100× leverage on its BTC and ETH contracts, and slightly lower for altcoins. Bybit also features advanced risk management tools, including isolated and cross margin modes, auto-deleveraging, and insurance funds—making it better suited for those who want precision and control.

If you’re an aggressive trader chasing high leverage, Weex might be your playground. But if you prefer structured margin systems and risk tools, Bybit is more dependable.

Weex vs Bybit: Trading Volume and Liquidity

Liquidity affects everything from slippage to execution speed—and both platforms perform well here, but in slightly different ways.

Bybit consistently ranks in the top 5 global exchanges by trading volume, frequently processing $10–30 billion in combined daily spot and derivatives volume. Its deep liquidity on major pairs ensures tight spreads and fast execution, which is critical for scalpers and institutional traders.

Weex, while newer, has rapidly scaled. On peak days, it reportedly clears $3–50 billion in volume across its spot and futures markets. However, the depth on smaller pairs can vary, and most liquidity is concentrated in major USDT pairs.

So, if you’re trading high-volume pairs or deploying larger capital, Bybit offers more consistency. For day-to-day leverage traders focused on trending pairs, Weex still delivers solid execution.

Weex vs Bybit: Fee Structure Comparison

Fees can eat into profits quickly—especially for frequent traders. Here’s how Weex and Bybit compare on this front:

Weex Fees

- Spot: 0.10% (maker & taker)

- Futures: 0.02% maker / 0.08% taker

- Discounts: Occasional zero-fee promotions on selected pairs

Bybit Fees

- Spot: 0.10% (maker & taker)

- Futures: –0.025% maker (rebate) / 0.075% taker

- Discounts: Fee reductions through VIP tiers and using Bybit Launchpad/earn products

If you’re looking to benefit from maker rebates or are a high-volume trader, Bybit is slightly more favorable. Weex remains competitive with lower taker fees and regular fee waivers.

Weex vs Bybit: Deposits, Withdrawals, and Payment Methods

Both Weex and Bybit support a variety of deposit and withdrawal options, though their approach to fiat differs slightly.

Weex allows crypto deposits and also supports fiat on-ramps through third-party payment providers. Users can fund accounts via bank cards, Google Pay, Apple Pay, PayPal, SEPA, and Alipay, depending on region. Withdrawal options are mostly crypto-based, with processing typically completed within a few hours.

Bybit, similarly, supports crypto deposits and fiat on-ramps via its integration with Banxa, MoonPay, and other services. Fiat deposits may include options like bank transfer and credit/debit cards, depending on location. Withdrawals are crypto-only and subject to batch processing a few times per day.

If you prefer broader fiat access and instant flexibility, Weex may be slightly more convenient. For seamless crypto operations, Bybit offers trusted infrastructure and transparency.

Weex vs Bybit: Native Exchange Tokens

Exchange tokens often provide benefits like fee discounts, staking rewards, or profit-sharing—and both Weex and Bybit are developing in this area.

Bybit is gradually rolling out its native token called BYD (still under development in 2024), which is expected to offer fee rebates, staking opportunities, and VIP program access. Until then, Bybit leans on other tokens (like BIT, their previous ecosystem token) and loyalty rewards for platform incentives.

Weex does not currently have a major utility token live in the market. However, they offer trading bonuses, referral earnings, and zero-fee campaigns to reward activity, and rumors of a token drop for early users have circulated—especially around its copy trading feature.

If you’re looking for an established token economy, Bybit has the edge—though Weex could surprise users with token rewards down the line.

Weex vs Bybit: KYC Requirements and Account Limits

Know Your Customer (KYC) requirements vary by exchange and affect what you can do without verification.

Weex offers a no-KYC experience for smaller withdrawals and trading, which appeals to privacy-focused users. However, higher limits and some fiat services require KYC submission, including government ID and facial verification.

Bybit has moved toward stricter compliance. Most key features—including withdrawals, derivatives trading, and staking—now require Level 1 KYC. Higher withdrawal limits and VIP tiers require Level 2 KYC with proof of address.

For users wanting anonymity or faster onboarding, Weex offers flexibility. For those prioritizing security and access to all features, Bybit is more comprehensive.

Weex vs Bybit: User Interface and Ease of Use

A clean, intuitive interface can make all the difference—especially for traders who need to act fast or manage multiple positions.

Weex takes a minimalist approach, offering a clutter-free dashboard that’s great for beginners and mobile-first users. The layout is streamlined, with easy access to futures, copy trading, and wallet functions. Their mobile app is especially well-optimized, making it ideal for traders on the go.

Bybit, while offering more features, maintains an efficient UI across web and mobile. The platform provides advanced charting tools, custom layouts, and seamless switching between spot, derivatives, and earn products. While the feature-rich dashboard may feel overwhelming to newcomers, it’s a powerhouse for experienced traders.

Weex vs Bybit: Order Types Supported

Order flexibility matters when managing market volatility or building strategies. Both platforms support the core order types but differ in advanced options.

Weex supports:

-

Market Order

-

Limit Order

-

Stop-Limit / Stop-Market

-

TP/SL (Take-Profit / Stop-Loss)

These are sufficient for basic to intermediate trading strategies.

Bybit offers all of the above, plus:

-

Conditional Orders

-

Post-Only / Reduce-Only Flags

-

Trailing Stop

-

One-Cancels-the-Other (OCO)

-

Strategy builder (advanced users)

If you’re into advanced trade automation or scalping tactics, Bybit clearly leads. For simpler setups and fast entries, Weex covers the basics well.

Weex vs Bybit: Security Features and Practices

Security is critical in crypto trading, and both platforms claim robust systems—but there are nuances.

Weex secures user assets using cold wallet storage, multi-signature authentication, 2FA, and maintains a 1,000 BTC protection fund to handle emergencies. While it’s still building reputation, no major hacks have been reported so far.

Bybit, being more established, uses multi-tier system architecture, cold storage for 100% of funds, real-time risk monitoring, and mandatory KYC for full access. However, it has faced scrutiny over withdrawal processes in the past—although no large-scale breaches have occurred.

Both platforms prioritize safety, but Bybit’s maturity and global compliance give it a slight edge for high-cap traders.

Weex vs Bybit: Insurance Funds

Insurance funds act as a safety net to protect traders from extreme volatility and counterparty risk—especially in high-leverage environments.

Weex maintains a 1,000 BTC protection fund to cover potential losses from sudden liquidation failures. This fund is designed to step in when user positions are force-liquidated below bankruptcy price and ensures users aren’t unfairly penalized during volatile swings.

Bybit also uses an insurance fund mechanism across all its perpetual contracts. It helps minimize auto-deleveraging (ADL) by covering losses when a liquidated position cannot be closed at the bankruptcy price. The fund is transparently tracked and varies by contract type and volume.

For users trading leveraged contracts, both platforms provide a reliable insurance buffer, though Bybit’s longer track record offers additional confidence for institutional traders.

Weex vs Bybit: Customer Support

Customer support can be the deciding factor when things go wrong. Here’s how Weex and Bybit handle user assistance.

Weex provides 24/7 customer support through live chat, in-app help centers, and email ticketing. The platform also features multi-language support, which is helpful for users across Asia, Europe, and Latin America.

Bybit is known for its responsive 24/7 live chat, a well-maintained Help Center, and active presence on Telegram, Twitter, and Discord. It also provides dedicated account managers for VIP users.

For quick resolutions and account management, Bybit has a more mature support infrastructure. Weex, however, covers all the basics effectively.

Weex vs Bybit: Regulatory Compliance

Compliance has become a critical factor in choosing an exchange—especially for traders in regulated regions.

Bybit has proactively adjusted to global regulatory pressure. It restricts access in certain jurisdictions (like the U.S., China) and enforces mandatory KYC for most trading activities. Bybit is also increasingly aligning with licensing frameworks in places like Dubai and Europe.

Weex, while less visible on the regulatory front, is registered in Singapore and supports KYC for users requiring fiat gateways. However, it maintains a more flexible stance on verification, making it popular in markets with stricter restrictions.

If you prioritize operating in a fully regulated environment with licensing clarity, Bybit is the safer bet. Weex, however, offers more accessibility for traders in less regulated or restricted regions.

Conclusion

Weex and Bybit both offer strong crypto trading platforms, but they serve different needs.

Weex is ideal for traders who want a straightforward, high-leverage trading experience with minimal friction. Its clean interface, easy onboarding, and strong focus on contract trading make it a solid choice for beginners and those trading on mobile.

Bybit, on the other hand, is a more comprehensive platform suited for advanced traders. With deep liquidity, advanced tools, and a broad product ecosystem—from options to staking—it’s better for users who want more control and a wider range of services.

If you want simplicity and speed, go with Weex. If you’re looking for features, stability, and long-term growth potential, Bybit is the better option.