With the rise of specialized crypto trading platforms, Bitunix and BingX have emerged as strong contenders—each with distinct strengths. Bitunix, launched in 2021, focuses on derivatives trading with high leverage and institutional-grade tools. In contrast, BingX, founded in 2018, offers a broader suite including spot, futures, and copy trading—appealing to both beginners and experienced users.

This comparison breaks down their features, fees, trading volumes, and more—so you can decide which exchange aligns best with your goals.

Bitunix vs BingX: Quick Feature Comparison Table

| Feature | Bitunix | BingX |

|---|---|---|

| Founded | 2021 | 2018 |

| Founders / HQ | Built by traditional finance + blockchain experts; registered in Saint Vincent and the Grenadines | Founded in 2018; registered in BVI with HQ in Singapore/Lithuania |

| Supported Coins / Pairs | ~700+ trading pairs; ~490 coins across spot and futures | Over 1,000 coins and more than 1,000 trading pairs |

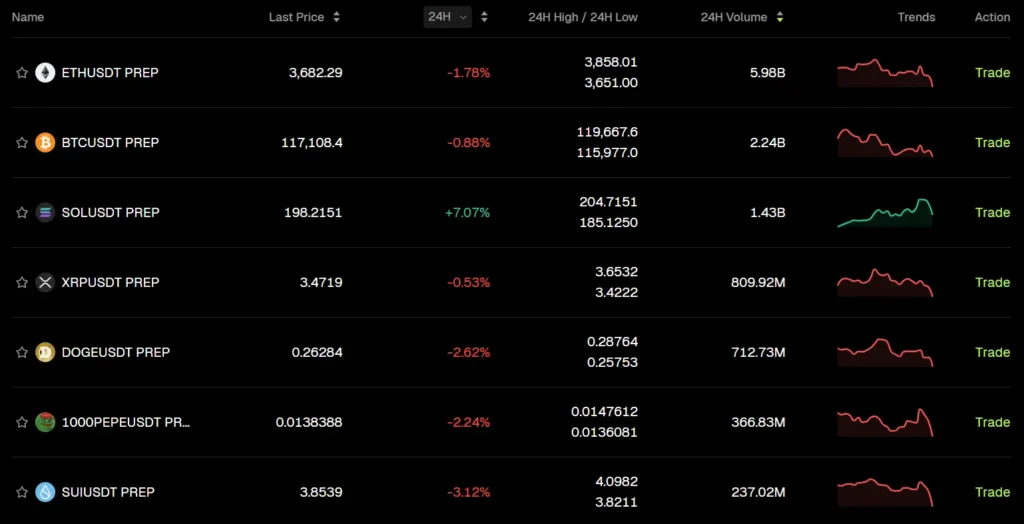

| 24h Trading Volume | Approximately $1.1 billion | Ranges from $600 million to $800 million |

| Leverage | Up to 125× | Up to 125× on BTC and ETH; up to 150× on select pairs |

| Spot Trading Fee | ~0.10% (maker/taker); lower with VIP tiers | 0.10% (maker/taker); discounts available with VIP status |

| Futures Trading Fee | 0.02% / 0.06% (maker/taker) | 0.02% / 0.05% (maker/taker); reduced rates for VIPs |

| Deposit / Withdrawal | Supports crypto and fiat via card; proof-of-reserves enabled | Crypto deposits, P2P trading, third-party fiat support |

| Security & Compliance | Cold storage, real-time reserve audits, MSB license in Canada | Cold wallets, insurance fund, regular audits, past reimbursements for hacks |

Bitunix vs BingX: Key Differences at a Glance

Bitunix and BingX serve different types of crypto traders with distinct approaches and priorities. Bitunix focuses heavily on derivatives trading, offering a clean and professional trading interface with fast execution and competitive leverage. It appeals mainly to users who are looking for simplicity, low fees, and a streamlined futures trading experience. The platform supports high leverage—up to 125x—and caters more to experienced traders and professionals seeking precision and speed.

On the other hand, BingX presents a much more diversified ecosystem. While it also offers derivatives trading with high leverage, its broader appeal lies in features like copy trading, social trading tools, and access to a vast selection of cryptocurrencies. It’s better suited for beginners, casual traders, and those interested in automated or assisted trading strategies. Its user-friendly mobile interface, combined with strong community features, makes it an ideal entry point for those new to crypto or looking to experiment with various trading products.

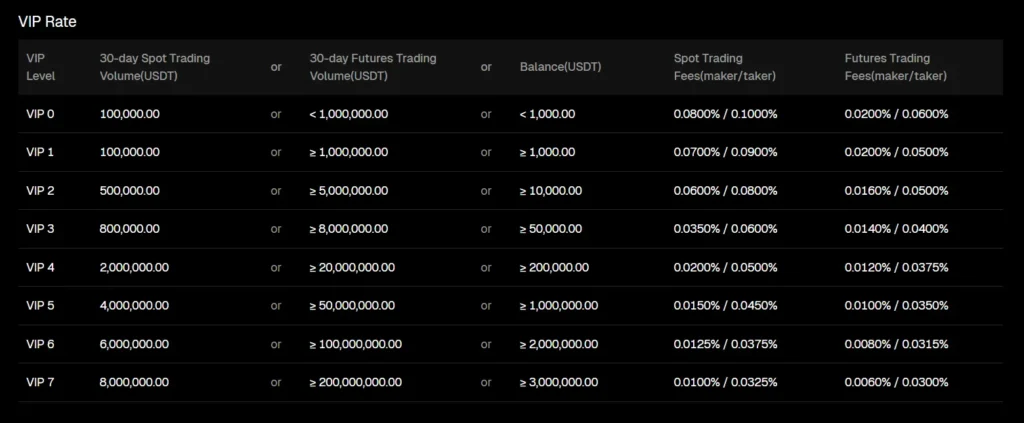

In terms of fees, both platforms are competitive. Bitunix charges low fees for both spot and futures trades, with further discounts for VIP users. BingX starts with similar fee structures but provides additional benefits through its tiered VIP program and promotions for high-volume traders.

Bitunix vs BingX: Platform Products and Services Overview

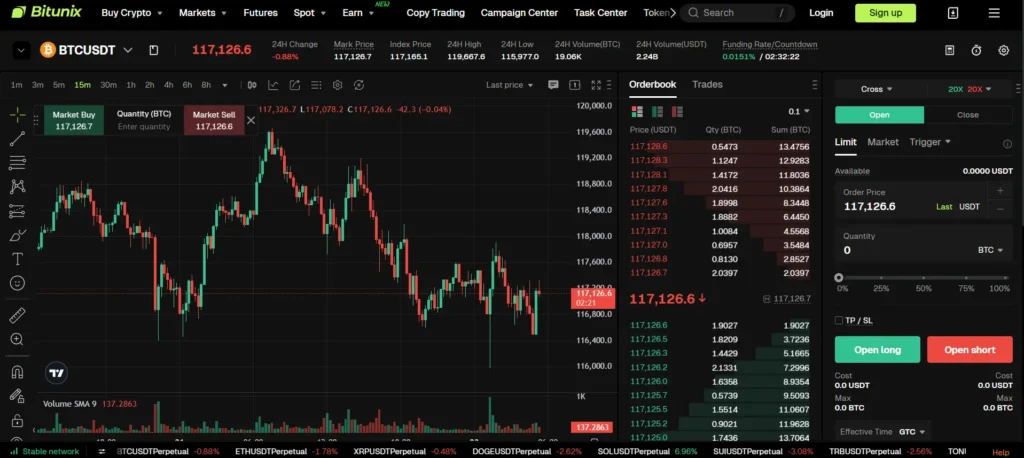

Bitunix is built around a core focus on derivatives trading. The platform specializes in perpetual contracts with high leverage, and it’s designed for traders who prioritize speed, low latency, and a minimalistic interface. Bitunix also offers basic spot trading and a copy trading feature where users can automatically mirror the strategies of experienced traders. While it doesn’t try to compete on the sheer number of products, it emphasizes performance, stability, and transparent operations.

BingX, by contrast, offers a much more extensive lineup of services. In addition to spot and derivatives trading, it features robust copy trading functionality, allowing users to follow top-performing traders and automatically replicate their trades. The platform also includes investment products like flexible and fixed-term staking, principal-protected products such as “Shark Fin,” and trading bots for those interested in automation. Its goal is to serve as an all-in-one trading hub, especially for users who prefer convenience and a wide array of tools in one place.

Bitunix vs BingX: Range of Tradable Contracts

Bitunix offers a robust selection of USDT-margined perpetual futures contracts covering a wide range of major and mid-cap cryptocurrencies. The platform is built to cater to traders looking for precision, high-speed execution, and competitive leverage. Most of its trading volume comes from these perpetual contracts, and the platform does not currently offer standard futures or exotic contract types. Its spot market is relatively smaller but still includes several high-volume trading pairs.

BingX, meanwhile, offers both perpetual and standard futures contracts, along with a rich assortment of spot trading pairs. It covers a broader array of digital assets, including many altcoins that are not available on Bitunix. This gives users more flexibility in how they choose to structure their portfolios or trading strategies. In addition to manual trading, BingX also supports copy trading for futures, allowing users to engage in derivatives markets without needing to manage every position themselves. The availability of grid bots and simulated trading options adds further depth to its contract offerings.

Bitunix vs BingX: Supported Cryptocurrencies and Trading Pairs

When it comes to supported cryptocurrencies, BingX clearly takes the lead in terms of variety. The platform offers access to a vast list of over a thousand coins and trading pairs, spanning major assets like Bitcoin and Ethereum to an extensive array of altcoins. This makes it a highly attractive choice for users looking to diversify their portfolios or capitalize on niche projects and tokens.

Bitunix, in contrast, keeps things more focused. While it supports a few hundred trading pairs, its core strength lies in high-liquidity pairs for both spot and derivatives markets. The platform is designed to serve traders who prioritize execution quality and stability, especially in popular pairs like BTC/USDT or ETH/USDT. If your trading strategy revolves around major cryptos and efficient order matching, Bitunix has what you need. However, if you prefer deep altcoin exposure or hunting for new tokens, BingX is the better option.

Bitunix vs BingX: Leverage and Margin Trading

Both Bitunix and BingX offer highly competitive leverage options, but there are some differences in how they approach margin trading. Bitunix provides up to 125x leverage on its futures products, with a clear interface that lets traders control position sizing, margin levels, and risk. It’s built for traders who are confident managing high-risk positions and want detailed control over their leverage settings.

BingX also offers leverage up to 125x on major pairs like BTC and ETH, with certain contracts allowing up to 150x—making it slightly more aggressive in terms of options. Where BingX stands out is its integration of copy trading into leveraged futures, which lowers the barrier to entry for less experienced users. Additionally, BingX offers margin control tools and liquidation warnings to help users manage risk, which is especially useful for beginners and intermediate traders.

Bitunix vs BingX: Trading Volume and Liquidity

Liquidity is a key factor in trading efficiency, and both exchanges perform well in this regard, though with different strengths. Bitunix regularly reports daily trading volumes exceeding $1 billion, primarily from its futures markets. Its deep order books in perpetual contracts help ensure smooth execution, minimal slippage, and reliable performance during volatile market conditions. This makes Bitunix an attractive choice for serious derivatives traders who rely on tight spreads and fast order matching.

BingX also boasts solid trading volumes, often ranging from $600 million to $800 million daily. While its futures volume is significant, BingX also benefits from high activity in its spot and copy trading markets. Liquidity on the platform is generally good across the board, but it may vary more than Bitunix depending on the asset being traded, especially among lesser-known altcoins.

Bitunix vs BingX: Fee Structure Comparison

Both Bitunix and BingX offer competitive fee structures, but they differ slightly in approach and flexibility. Bitunix keeps things straightforward, charging around 0.10% for spot trades and 0.02% for makers and 0.06% for takers in futures trading. These rates are already lower than industry averages, and users can unlock further discounts by advancing through VIP tiers based on trading volume.

BingX offers a similar baseline for spot trading, starting at 0.10% for both makers and takers. For futures, BingX provides even more attractive fees—0.02% for makers and 0.05% for takers. The platform also includes tier-based discounts and occasional promotional campaigns that can further reduce trading costs. Additionally, BingX rewards active users and high-volume traders with exclusive incentives like fee rebates, trading competitions, and loyalty programs.

While both exchanges are cost-effective, BingX stands out for its dynamic fee-reduction options and frequent community promotions. Bitunix, on the other hand, appeals to traders who value transparent, fixed low fees without much complexity.

Bitunix vs BingX: Deposits, Withdrawals, and Payment Methods

Bitunix supports a mix of crypto and fiat deposit methods, allowing users to fund their accounts via bank cards, Apple Pay, or third-party payment gateways. Withdrawals are processed quickly, and the platform provides a clear interface showing processing times and applicable network fees. Bitunix also supports proof-of-reserve systems to assure users of transparent asset backing.

BingX, while primarily crypto-based, also offers fiat onboarding through partnerships with third-party providers. Users can purchase crypto using credit cards, bank transfers, or P2P trading. However, fiat withdrawals are not supported natively on BingX—users must first convert assets to crypto before cashing out. Despite that, its crypto withdrawal processing is fast, typically completed within minutes to a couple of hours, depending on network congestion.

For users who prefer seamless fiat integration and quicker access to their funds, Bitunix may offer a slight edge. BingX, however, is more geared toward users already familiar with crypto and those comfortable using alternative payment methods like P2P.

Bitunix vs BingX: Native Exchange Tokens

While many top-tier exchanges have launched native tokens, neither Bitunix nor BingX currently operates with a widely adopted proprietary token like BNB or KCS. Bitunix does not have an exchange token in circulation as of now, which reflects its focus on being a lean, performance-driven derivatives platform without extra layers of tokenomics.

BingX has hinted at plans to introduce its own native token in the future, but as of now, it does not offer a utility token for fee discounts or staking benefits. Instead, the platform relies on VIP levels, volume-based rewards, and other promotional tools to drive user retention and loyalty.

For traders specifically looking for exchange tokens with staking rewards, fee reductions, or profit-sharing features, these platforms might not be the primary choice. However, the absence of native tokens also means a cleaner and more transparent fee model, with no pressure to hold a specific asset to access platform benefits.

Bitunix vs BingX: KYC Requirements and Account Limits

Both Bitunix and BingX offer flexible onboarding options, allowing users to explore their platforms with or without completing full KYC (Know Your Customer) verification. On Bitunix, users can begin trading with limited functionality without KYC, but higher withdrawal limits and access to certain features require identity verification. Once verified, users benefit from increased daily withdrawal caps, enhanced account security, and access to fiat-related services.

BingX follows a similar structure. New users can explore the platform and even conduct some basic trading without verification, but completing KYC unlocks higher withdrawal limits and advanced product features. The platform offers a tiered verification system, with each level providing progressively higher benefits such as increased limits and participation in special promotions.

For casual users or those concerned about privacy, both platforms provide enough flexibility to get started without immediate verification. However, traders planning to move larger volumes or engage with the full suite of services will eventually need to complete KYC to enjoy unrestricted access and maximum security.

Bitunix vs BingX: User Interface and Ease of Use

User experience is an area where both platforms shine, but they cater to slightly different audiences. Bitunix offers a clean, professional-grade trading interface that prioritizes performance and clarity. The platform is fast, minimal, and highly responsive, making it ideal for seasoned traders who want a distraction-free environment for executing trades. Its layout focuses on charts, order books, and key metrics, keeping things tight and efficient.

BingX, on the other hand, takes a more welcoming approach. Its interface is beginner-friendly and intuitive, with guided features that help new users navigate spot, futures, and copy trading easily. The mobile app is especially well-designed, offering access to core features with a few taps. For traders who enjoy exploring features like trading bots, social feeds, and copy strategies, BingX makes the experience seamless without overwhelming the user.

In essence, Bitunix is designed with professional efficiency in mind, while BingX focuses on accessibility, making it suitable for both newcomers and intermediate traders who want more than just execution speed.

Bitunix vs BingX: Order Types Supported

Both Bitunix and BingX offer a solid variety of order types to accommodate different trading styles, though Bitunix is more aligned with active futures traders who need precise execution tools. On Bitunix, users have access to standard order types like market, limit, and stop-limit orders, as well as more advanced settings like post-only and reduce-only. These tools allow for greater control over position entries and exits, which is essential in high-leverage futures trading.

BingX also provides market and limit orders across its trading interfaces, including copy trading and bot-driven orders. While its order book trading features are slightly less comprehensive than Bitunix in terms of pro-level execution options, it makes up for this with ease-of-use and automation features. For example, copy traders can follow strategies that include automatic stop-loss and take-profit levels without needing to manually input each trade.

Bitunix vs BingX: Security Features and Practices

Security is a critical aspect of any crypto exchange, and both Bitunix and BingX have implemented robust measures to protect user funds and data. Bitunix uses cold wallet storage to hold the vast majority of user assets offline, minimizing exposure to online threats. It also conducts regular proof-of-reserve audits to assure users of asset transparency. Two-factor authentication (2FA) is mandatory for withdrawals, and the platform includes anti-phishing features to prevent unauthorized access. Additionally, Bitunix holds regulatory licenses such as an MSB license in Canada, adding a layer of compliance and trust.

BingX also places strong emphasis on security. The exchange stores user funds in multi-signature cold wallets and has established a history of reimbursing users for security-related incidents in the past, which builds confidence within the community. Like Bitunix, it supports 2FA, anti-phishing codes, and IP whitelisting to help users safeguard their accounts. BingX also publishes regular updates on its operational practices and has implemented system risk controls to automatically detect and prevent abnormal trading behaviors.

In terms of reputation, both platforms have avoided major security breaches in recent years, and they continue to improve their internal protocols. Bitunix leans more toward regulatory transparency and traditional finance-grade controls, while BingX excels at community trust and proactive risk management.

Bitunix vs BingX: Insurance Funds

Insurance funds play a vital role in protecting users from unexpected losses during high-leverage trading, particularly in futures markets. Bitunix operates an internal insurance fund designed to cover shortfalls in extreme liquidation events. If a trader’s position is forcibly closed and their margin is insufficient to cover the loss, the insurance fund steps in to prevent systemic risk to other users. This ensures that profitable traders receive full payouts even in volatile market conditions.

BingX follows a similar model. It maintains an insurance fund that covers users during aggressive market swings, especially when losses exceed margin collateral. In some instances, BingX has gone a step further by voluntarily reimbursing users affected by technical glitches or outages, showcasing a user-first approach. The fund also supports fair liquidation pricing, helping to avoid unnecessary or premature liquidations that can wipe out traders’ balances.

Bitunix vs BingX: Customer Support

Customer support is another area where both Bitunix and BingX perform well, though they cater to different user expectations. Bitunix offers a responsive live chat feature on its platform, typically delivering fast replies during peak hours. In addition to live chat, it provides a detailed help center with tutorials, FAQs, and platform updates. Support tickets can also be submitted for more complex issues, and the response times are generally reasonable.

BingX places a strong emphasis on user engagement and community building. It offers multilingual customer support through live chat, support tickets, and an active presence on social media platforms like Telegram and Discord. The exchange frequently runs community events and responds quickly to user feedback, helping to create a more interactive and connected trading environment. Its help center is also comprehensive and includes video tutorials for beginners.

Bitunix vs BingX: Regulatory Compliance

Regulatory compliance is increasingly important in the crypto industry, especially as global scrutiny intensifies. Bitunix has taken steps to align with regulatory expectations by securing an MSB (Money Services Business) license in Canada and adhering to international AML (Anti-Money Laundering) and KYC standards. The platform is registered in Saint Vincent and the Grenadines, which provides it with operational flexibility while still maintaining a degree of transparency. While it does not yet hold licenses in major jurisdictions like the U.S. or EU, its efforts in securing foundational regulatory approvals reflect a commitment to compliance and trust-building.

BingX, on the other hand, is registered in the British Virgin Islands and has offices in regions such as Singapore and Lithuania. It complies with KYC/AML protocols and restricts access in jurisdictions with stringent regulatory requirements, including the United States. The platform operates under a risk-controlled model, using internal safeguards to monitor for suspicious activity and limit potential abuse. While BingX also lacks licenses in high-profile regulatory zones, it has earned a reputation for responsible operation, especially in the Asia-Pacific and European markets.

Both platforms operate in the gray areas typical of many global crypto exchanges. However, Bitunix leans slightly more toward regulatory alignment, while BingX focuses on internal governance and jurisdictional restrictions to manage compliance.

Conclusion

Choosing between Bitunix and BingX ultimately depends on your trading goals, experience level, and preferences.

If you’re a serious derivatives trader who values a clean, fast, and secure platform with transparent fees and strong execution, Bitunix is a great fit. Its focus on futures markets, high leverage, low trading fees, and institutional-grade security make it ideal for active traders who don’t need dozens of extra features.

On the other hand, if you’re a more casual trader—or someone who values variety, copy trading, and community features—BingX offers a more flexible and user-friendly experience. Its wide selection of cryptocurrencies, social trading tools, and passive income products make it an attractive choice for beginners and intermediate users alike.

For security-conscious users, both platforms offer strong protection with cold wallet storage and active monitoring. In terms of fees, they are competitive across the board, with small differences in futures maker/taker rates.