In the crowded landscape of crypto exchanges, Bitunix and Binance stand out for very different reasons. While Binance is known for its wide range of features and global dominance, Bitunix is quickly gaining traction with a sharper focus on simplicity and high-leverage derivatives trading.

Binance offers a full ecosystem—spot trading, futures, staking, and more—making it ideal for users looking for an all-in-one solution. Bitunix, in contrast, keeps things streamlined, catering to traders who value speed, clarity, and powerful trading tools without distractions.

This comparison breaks down their key differences across features, fees, supported assets, and overall user experience—so you can decide which platform aligns better with your trading goals.

Absolutely! Here’s the Quick Feature Comparison Table for Bitunix vs Binance, with all source links removed:

Bitunix vs Binance: Quick Feature Comparison Table

| Feature | Bitunix | Binance |

|---|---|---|

| Supported Coins | 400+ trading pairs including major and trending altcoins | 400+ coins with 1,500+ spot and futures pairs across a wide ecosystem |

| Trading Volume | Moderate and growing, primarily in derivatives | Extremely high daily trading volume; among the highest globally |

| Spot Fees (maker/taker) | 0.08% / 0.10%; reduced further with VIP tiers | 0.10% / 0.10%; discounts with BNB usage and higher volume |

| Futures Fees (maker/taker) | 0.02% / 0.06% base tier; drops with VIP levels | 0.02% / 0.04%; reduced with BNB and higher trading volumes |

| Leverage | Up to 125× on futures | Up to 125× on futures |

| Deposit / Withdrawal | Supports crypto and selected fiat methods; fees vary | Supports crypto, credit/debit cards, and P2P; withdrawal fees vary by asset |

| Security Measures | 2FA, insurance fund, standard protections | 2FA, insurance fund (SAFU), advanced risk management, and regulatory tools |

Bitunix vs Binance: Key Differences at a Glance

At first glance, both Bitunix and Binance offer competitive features, but they cater to different trader profiles. Binance is a comprehensive, high-liquidity exchange suited for users who want access to a full suite of financial tools—spot, futures, staking, launchpads, and even a native blockchain ecosystem. Bitunix, meanwhile, appeals to more focused, active traders—especially in the derivatives space—with its clean interface, fast execution, and lower entry barriers.

In terms of fees, both exchanges offer competitive rates, but Bitunix slightly edges out for futures traders at the base level. Binance compensates through flexible discounts using BNB and VIP tiers. Coin selection is also a major differentiator—Binance supports nearly every major and emerging token, while Bitunix focuses on popular and high-volume pairs.

If you’re a beginner or someone looking for multiple earning and trading avenues within one platform, Binance is more suited for you. On the other hand, if you prefer direct, high-leverage trading with fewer distractions, Bitunix may offer the leaner experience you’re looking for.

Bitunix vs Binance: Platform Products and Services Overview

Binance is much more than just a crypto exchange. It offers a comprehensive product ecosystem that includes spot and futures trading, staking, savings accounts, liquidity farming, launchpad tokens, dual investment products, and a decentralized wallet. Its goal is to be a one-stop shop for all things crypto, and it largely succeeds in doing so. Users can even participate in copy trading, use Binance Pay, or explore NFT marketplaces directly within the platform.

Bitunix, by contrast, keeps things more streamlined. It focuses heavily on crypto futures trading, with up to 125× leverage, and supports a smaller but sufficient set of spot trading pairs. Its user interface is clean and performance-oriented, with minimal learning curve. Bitunix is especially popular among mobile-first traders and those looking to execute fast trades without navigating a complex dashboard.

Bitunix vs Binance: Range of Tradable Contracts

When it comes to derivatives, both platforms offer perpetual contracts with high leverage, but the structure and user experience differ significantly.

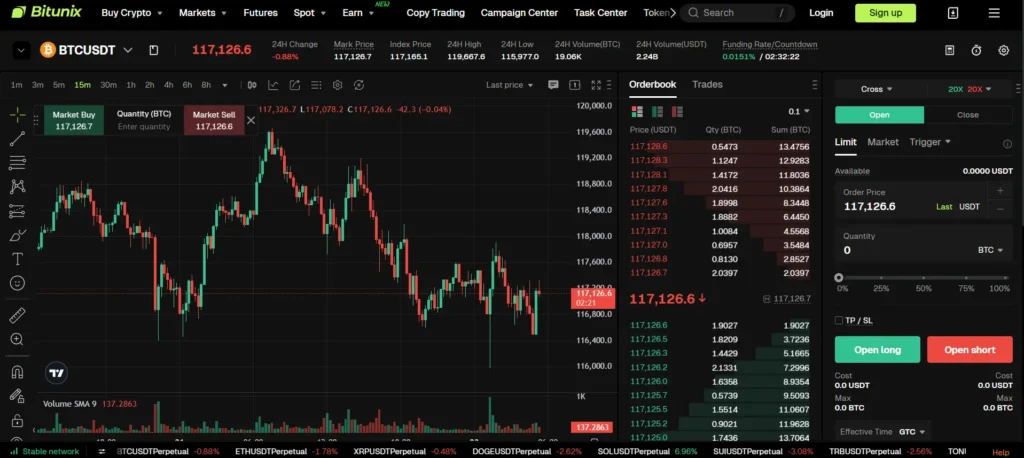

Bitunix offers USDT-margined perpetual contracts on major cryptocurrencies like BTC, ETH, and SOL, along with a few altcoins. The interface is optimized for precision and speed, especially on mobile. Its order execution is clean, and position management is simple—making it suitable for short-term and high-frequency traders.

Binance, in contrast, has one of the widest selections of tradable contracts in the industry. It supports both USDT- and coin-margined futures, options trading, leveraged tokens, and even quarterly delivery contracts. This wide variety gives professional traders more flexibility in terms of hedging, arbitrage, and advanced strategy execution.

In essence, Bitunix emphasizes accessibility and speed for leveraged trading, while Binance offers depth and variety for more sophisticated traders.

Bitunix vs Binance: Supported Cryptocurrencies and Trading Pairs

Both exchanges support a wide range of cryptocurrencies, but their focus differs.

Binance supports over 400 cryptocurrencies and offers more than 1,500 trading pairs across spot and futures markets. This includes major assets like BTC, ETH, and BNB, as well as a massive selection of altcoins, stablecoins, DeFi tokens, and newer project listings. Traders looking for access to niche tokens or early-stage coins will find Binance’s offering hard to beat.

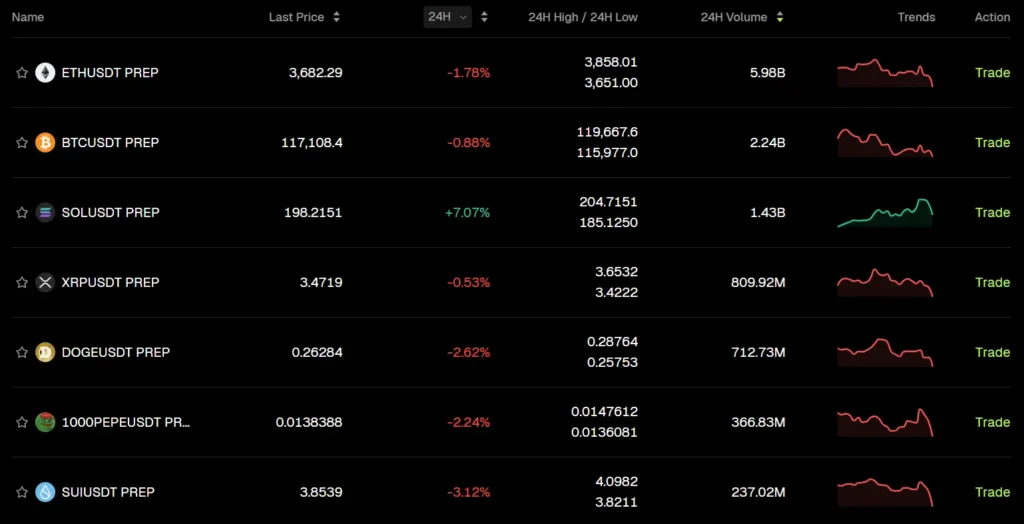

Bitunix, while more limited in scope, covers the essentials well. It offers around 400+ trading pairs with an emphasis on high-volume, high-demand tokens. This includes top cryptocurrencies like BTC, ETH, SOL, DOGE, and several trending altcoins. The selection is curated more tightly, focusing on liquidity and trade efficiency.

In short, Binance offers broader coverage and experimentation, while Bitunix keeps things focused on popular, liquid markets.

Bitunix vs Binance: Leverage and Margin Trading

Both platforms support high-leverage trading, with a maximum leverage of up to 125× on select perpetual contracts.

Bitunix offers straightforward leverage settings, ideal for traders who want to quickly adjust their position sizes without dealing with complicated margin settings. The platform is built for speed and execution simplicity, making it a solid choice for scalpers or intraday traders.

Binance, while also offering 125× leverage on major futures pairs, provides more advanced margin options. It supports both isolated and cross margin, along with a wide range of risk management tools like auto-deleveraging (ADL), margin call alerts, and tiered maintenance margins. This flexibility appeals more to professional and institutional traders who need fine-grained control over their risk exposure.

If you’re a casual or speed-oriented trader, Bitunix’s simplicity will suit you better. If you need control and complex strategies, Binance leads the way.

Bitunix vs Binance: Trading Volume and Liquidity

Liquidity is a critical factor for any trader, and here, Binance is in a league of its own.

Binance consistently ranks at the top in global trading volume for both spot and derivatives markets. This translates to tighter spreads, faster order execution, and minimal slippage even for large trades. Whether you’re trading Bitcoin or a low-cap altcoin, Binance’s liquidity depth provides confidence for execution at scale.

Bitunix, while growing, operates at a smaller scale. It offers solid liquidity on major pairs like BTC/USDT and ETH/USDT but may have thinner order books for lesser-known tokens. For most retail traders and mid-sized trades, Bitunix’s liquidity is sufficient, but high-volume traders may notice limitations during peak volatility.

Overall, Binance is the clear leader in liquidity, making it more suitable for high-frequency, institutional, or large-position traders.

Bitunix vs Binance: Fee Structure Comparison

Understanding trading fees is essential for any active trader. Both Bitunix and Binance offer competitive structures, but they vary slightly depending on user tier and token usage.

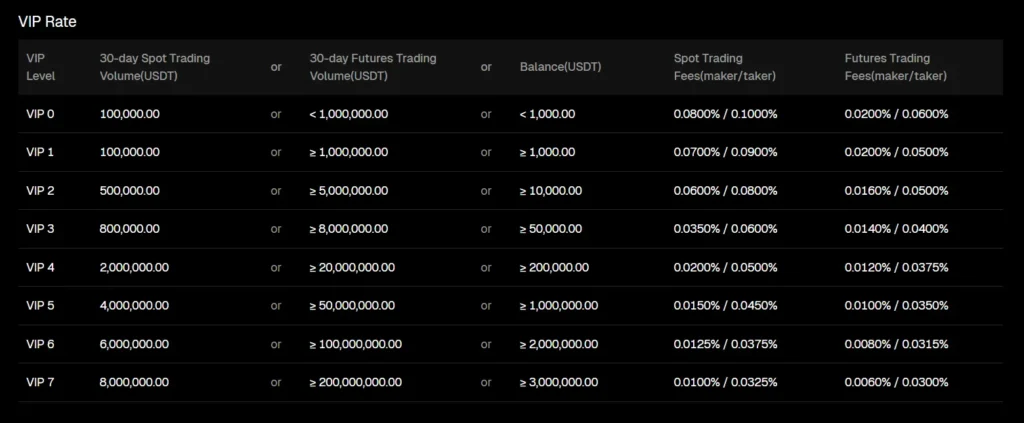

Bitunix starts with base fees of 0.08% (maker) / 0.10% (taker) on spot trades and 0.02% / 0.06% on futures. These fees reduce as you climb their VIP ladder based on trading volume and holdings. Bitunix does not have a native token to reduce fees but maintains relatively low baseline rates, especially attractive for new users.

Binance charges a standard 0.10% for both maker and taker on spot trading and 0.02% / 0.04% on futures. However, fees can drop significantly if users pay with BNB, the exchange’s native token, or reach higher VIP levels. Binance also offers periodic promotions with zero-fee trading on selected pairs.

While both platforms are cost-effective, Bitunix provides a simpler, low-fee model out of the box, while Binance rewards higher volume and BNB use with steeper discounts.

Bitunix vs Binance: Deposits, Withdrawals, and Payment Methods

The convenience and speed of funding your account can affect your trading readiness.

Bitunix supports both crypto deposits and select fiat methods, including third-party payment processors. Withdrawals are mostly crypto-based, with fees depending on network congestion and coin type. The platform supports common coins like USDT, BTC, and ETH for both funding and withdrawals.

Binance, being a global leader, offers a much wider range of options. Users can deposit via crypto, bank transfers, credit/debit cards, P2P trading, and regional payment gateways. Withdrawals are also available in fiat (in supported countries), and the platform shows transparent fees for every asset.

Binance clearly has the edge in terms of fiat flexibility, while Bitunix keeps it simple and crypto-centric.

Bitunix vs Binance: Native Exchange Tokens

Native tokens play a big role in reducing fees and offering added perks.

Binance has BNB (Binance Coin), one of the largest cryptocurrencies by market cap. Holding BNB unlocks multiple benefits: reduced trading fees, early access to token sales, staking rewards, and exclusive platform features. BNB is also deeply integrated across Binance’s ecosystem, including its blockchain (BNB Chain).

Bitunix, as of now, does not have a native utility token. Its fee structure is straightforward and does not rely on token-based incentives. This simplifies usage but may limit future discount or loyalty options compared to token-powered platforms like Binance.

Bitunix vs Binance: KYC Requirements and Account Limits

Know Your Customer (KYC) compliance impacts your trading limits and platform access. Both Bitunix and Binance enforce KYC, but their approaches differ in flexibility and scope.

Bitunix offers limited functionality without verification—you can browse, but cannot deposit, trade, or withdraw until you complete KYC. Once verified, users enjoy full platform access with reasonable withdrawal limits, typically aligned with industry standards.

Binance is more rigorous. Basic verification unlocks limited access, but full trading, fiat transactions, and high withdrawal limits require advanced KYC, including government ID and facial verification. Binance also enforces region-specific rules, especially in countries with tighter regulations.

Binance provides more detailed tiering and regional customization, while Bitunix keeps the process simple but mandatory from the start.

Bitunix vs Binance: User Interface and Ease of Use

The overall trading experience can be heavily influenced by design and usability—especially for mobile users and beginners.

Bitunix offers a minimalist and clean trading interface, prioritizing speed and simplicity. Whether on desktop or mobile, the experience is smooth and uncluttered, making it ideal for new traders or those focused mainly on futures trading. The mobile app is lightweight yet powerful, with a fast order flow and intuitive navigation.

Binance, while more feature-rich, can feel overwhelming to first-time users. The platform includes a basic and advanced mode, but with so many tools, widgets, and menus, there is a learning curve. However, once mastered, it’s extremely powerful. Binance’s mobile app is one of the most comprehensive in the market, allowing nearly all desktop features on the go.

If you want a lightweight, user-friendly setup with fast execution, Bitunix is the better choice. For traders who want depth and can manage complexity, Binance offers a complete toolkit.

Bitunix vs Binance: Order Types Supported

Order types determine how you execute trades and manage positions. Both platforms cover the basics, but Binance provides a broader range of options.

Bitunix supports core order types including:

-

Market Order

-

Limit Order

-

Stop-Market

-

Stop-Limit

This makes it suitable for most traders, particularly those focused on short-term futures strategies. The interface allows for quick order placements and modifications.

Binance supports all of the above plus more advanced order types, including:

-

OCO (One Cancels the Other)

-

Trailing Stop Orders

-

Iceberg Orders

-

Post-Only Orders

-

TWAP (via API or third-party bots)

Binance clearly provides more flexibility for strategy-driven and automated traders, while Bitunix focuses on speed and simplicity with core tools.

Bitunix vs Binance: Security Features and Practices

Security is a top concern for any crypto trader, and both Bitunix and Binance take it seriously—but at different scales.

Bitunix implements essential security practices such as 2-Factor Authentication (2FA), email/SMS verification, and cold wallet storage for the majority of user funds. It also maintains an internal insurance fund to protect users from extreme volatility events in futures trading. While Bitunix hasn’t faced any known major security incidents, it lacks publicly available third-party audits or transparency reports.

Binance, being a global leader, has a much more advanced and layered security infrastructure. It offers 2FA, anti-phishing codes, device management, whitelisted withdrawal addresses, and a SAFU (Secure Asset Fund for Users)—an emergency reserve used to reimburse users in the event of a breach. Binance has recovered from several attacks in the past, the most notable being a $40M hack in 2019, after which all affected users were reimbursed. The platform now undergoes regular audits and complies with global security standards.

Bitunix vs Binance: Insurance Funds

Insurance funds act as a safety net to prevent users from suffering unrecoverable losses due to extreme volatility or liquidation mismatches.

Bitunix maintains a dedicated insurance fund for its derivatives markets. This fund helps absorb unexpected losses from bankrupt positions and ensures fairness in high-leverage environments. While details are limited, the fund is automatically funded by a portion of liquidations.

Binance also operates a robust insurance mechanism through its SAFU and Futures Insurance Fund. The SAFU is funded from a percentage of trading fees and is used for platform-wide emergencies. Meanwhile, the insurance fund for futures prevents users from being negatively impacted by counterparty liquidations, especially during market crashes.

Overall, Binance provides more transparency and scale in its insurance coverage, while Bitunix offers a functional but less publicized layer of protection.

Bitunix vs Binance: Customer Support

Responsive customer service can make or break the trading experience, especially during volatile conditions.

Bitunix offers 24/7 support via live chat and email. Response times are generally fast, and the support team is known for being helpful in resolving issues related to deposits, withdrawals, and trading. The platform also includes a basic help center for FAQs and common troubleshooting.

Binance offers a more extensive support system with multi-language live chat, email ticketing, and a detailed knowledge base. While support quality has improved over time, high traffic can sometimes lead to slower response times. Binance also integrates AI-driven support bots for faster triaging of issues.

If you prefer human-first, fast responses, Bitunix offers a more direct experience. Binance’s system is more robust but may require more navigation and waiting time during peak hours.

Bitunix vs Binance: Regulatory Compliance

Regulation has become one of the most defining aspects of crypto exchanges, influencing how and where they operate.

Binance has faced intense regulatory scrutiny across multiple jurisdictions. It has exited several regions or adjusted services due to compliance challenges, but it has also taken steps to align with regulations—establishing regional entities, enhancing KYC protocols, and cooperating with financial authorities. Binance now operates under licenses in selected regions and is actively pursuing more formal compliance in others. However, the platform is still restricted in some countries.

Bitunix, being a newer platform, maintains a lower regulatory profile. It offers KYC verification and anti-money laundering (AML) procedures, but does not operate under major international regulatory licenses yet. While this gives it some flexibility in onboarding global users, it may also limit institutional adoption or fiat on-ramp partnerships in stricter jurisdictions.

In essence, Binance is actively working to comply with global standards, while Bitunix offers a lighter, more accessible structure, especially for users in regions with less restrictive policies.

Conclusion

Both Bitunix and Binance bring value to the table—but in different ways.

Choose Bitunix if you’re a derivatives-focused trader who values speed, simplicity, and low fees. The clean interface, high leverage, and no-frills experience make it ideal for active traders who want to get in and out of the market quickly without navigating complex tools.

Choose Binance if you want a feature-rich ecosystem, access to a wide range of coins, and tools for both beginners and professionals. It’s the better option for long-term users who want everything from staking to launchpads to institutional-level liquidity—all in one place.

When it comes to security and regulation, Binance has the edge with established systems and a proven track record. Bitunix, however, may appeal to those looking for less red tape and a faster onboarding process.

Ultimately, the right choice depends on your trading style:

-

For simplicity and speed → Go with Bitunix

-

For diversity and depth → Stick with Binance