Choosing the right crypto exchange can significantly impact your trading success—especially when you’re dealing with leverage, fees, and liquidity. In this post, we’ll dive deep into a head-to-head comparison between Blofin and Bitget, two rapidly growing platforms in the crypto derivatives space. Whether you’re a seasoned trader or just starting out, this guide will help you understand how these exchanges stack up across features, fees, supported assets, and more—so you can decide which platform fits your strategy best.

Quick Feature Comparison Table: Blofin vs Bitget

Here’s a snapshot of how Blofin and Bitget compare across key metrics:

| Feature | Blofin | Bitget |

|---|---|---|

| Founding Year | 2022 | 2018 |

| Founders | Matt Bell | Sandra Lou |

| Supported Coins | 300+ | 550+ |

| Average Daily Trading Volume | ~$600 million | ~$10 billion |

| Trading Fees (Spot) | Maker: 0.01% / Taker: 0.05% | Maker: 0.1% / Taker: 0.1% |

| Max Leverage | Up to 150x | Up to 125x |

| Deposit Methods | Crypto only | Crypto, P2P, Fiat gateways |

| Withdrawal Methods | Crypto only | Crypto |

| Security Measures | Multi-sig, Cold Wallets, 2FA | Cold Wallets, 2FA, Bitget Protection Fund |

Blofin vs Bitget: Key Differences at a Glance

Blofin and Bitget both cater to crypto traders, but they serve distinct user profiles and offer differentiated experiences:

- Fees: Blofin is ultra-competitive with its low maker-taker fees, especially on futures. Bitget, while slightly pricier, often runs fee discount campaigns for active users.

- Coin Selection: Bitget offers a broader range of tokens and altcoins, appealing to spot traders and altcoin enthusiasts. Blofin, meanwhile, focuses on quality listings with an emphasis on derivative contracts.

- Leverage: Blofin edges ahead with up to 150x leverage, appealing to aggressive futures traders. Bitget provides up to 125x, balancing risk and exposure.

- User Base: Bitget has a significantly larger global user base and trading volume, making it a better choice for traders who prioritize liquidity and market depth.

Blofin vs Bitget: Platform Products and Services Overview

Blofin focuses primarily on crypto derivatives trading, offering an institutional-grade trading engine, ultra-low latency, and a clean interface. It’s tailored for serious traders looking to take advantage of deep liquidity and advanced risk management tools.

Bitget, while strong in derivatives, offers a more diversified suite of services:

- Spot trading with 500+ coins

- Copy trading, ideal for beginners

- Launchpad and staking programs

- Bitget Earn for passive income

This makes Bitget a more rounded platform for users seeking both active trading and yield-generating options.

Blofin vs Bitget: Range of Tradable Contracts

Blofin and Bitget both offer USDT-margined perpetual contracts, but their scope and strategy differ:

- Blofin offers a focused selection of popular perpetuals with up to 150x leverage, prioritizing performance and speed over quantity. It’s a trader-focused ecosystem with fewer distractions.

- Bitget, on the other hand, supports USDT, Coin-margined, and USDC contracts, catering to a wider user base. It offers linear and inverse contracts across a broader selection of crypto pairs, supporting more trading styles.

Bitget’s diverse contract offerings give traders more flexibility, while Blofin’s streamlined set-up favors high-frequency, professional trading strategies.

Blofin vs Bitget: Supported Cryptocurrencies and Trading Pairs

- Blofin supports over 300 cryptocurrencies, but its primary focus is on major trading pairs like BTC/USDT, ETH/USDT, and a curated set of high-volume altcoins for futures trading. This ensures low slippage and tight spreads on its most-traded pairs.

- Bitget boasts over 550 coins and thousands of trading pairs. From trending meme coins to lesser-known DeFi tokens, the platform offers something for every altcoin hunter.

If your priority is access to a wide variety of coins for spot trading or long-tail investments, Bitget stands out. If you prefer precision and efficiency in a limited set of high-liquidity markets, Blofin is a better fit.

Blofin vs Bitget: Leverage and Margin Trading

Blofin offers up to 150x leverage on selected futures pairs, appealing to high-risk, high-reward strategies. Its platform is optimized for fast execution and includes basic risk management tools like auto-deleveraging and position limits.

Bitget allows up to 125x leverage, with a more comprehensive margin system, including cross and isolated margin modes, risk tiers, and real-time liquidation alerts. It’s more beginner-friendly while still offering flexibility for pros.

Blofin vs Bitget: Trading Volume and Liquidity

Bitget consistently ranks among the top 5 derivatives exchanges globally, with daily volumes exceeding $10 billion. This ensures high liquidity, tighter spreads, and minimal slippage.

Blofin, though newer, is gaining traction with a growing user base and $500–600 million daily trading volume. While not as deep as Bitget’s, its liquidity is concentrated in major pairs, ensuring solid execution for high-volume trades.

Blofin vs Bitget: Fee Structure Comparison

| Fee Type | Blofin | Bitget |

|---|---|---|

| Spot Trading | Maker: 0.01%, Taker: 0.05% | Maker/Taker: 0.1% |

| Futures Trading | Maker: 0.01%, Taker: 0.05% | Maker: 0.02%, Taker: 0.06% |

| Withdrawal Fees | Varies by asset | Varies by asset |

| Discounts | Volume-based | Volume-based, BGB token use |

Blofin leads in raw fee competitiveness, especially for high-frequency traders. Bitget offers more discount flexibility via loyalty programs and its native token (BGB).

Blofin vs Bitget: Deposits, Withdrawals, and Payment Methods

- Blofin supports crypto-only deposits and withdrawals, with no fiat integration. Withdrawals are fast and secured via multi-sig and 2FA.

- Bitget offers more flexibility: crypto deposits, P2P trading, and fiat gateways (Visa/Mastercard, bank transfers in select regions), making onboarding easier for beginners.

| Platform | Crypto | Fiat Deposit | Fiat Withdrawal | P2P Support |

|---|---|---|---|---|

| Blofin | ✔️ | ❌ | ❌ | ❌ |

| Bitget | ✔️ | ✔️ (via gateways & P2P) | ❌ (crypto only) | ✔️ |

Blofin vs Bitget: Native Exchange Tokens

- Blofin is yet to launch a native token.

- Bitget has BGB, which offers:

- Fee discounts

- Token staking

- Exclusive launchpad access

- Potential airdrops

BGB adds utility and benefits for active Bitget users, giving the platform a loyalty edge.

Blofin vs Bitget: KYC Requirements and Account Limits

- Blofin allows limited trading without KYC, but higher withdrawal limits and full features require identity verification.

- Bitget offers tiered KYC, unlocking:

- Higher withdrawal limits

- Access to fiat services

- Participation in advanced features

| KYC Level | Blofin Daily Limit | Bitget Daily Limit |

|---|---|---|

| No KYC | ~$10,000 | ~$20,000 |

| Full KYC | Up to $1M | Up to $2M |

Both platforms are flexible, but Bitget’s wider fiat integration makes KYC more essential for full functionality.

Blofin vs Bitget: User Interface and Ease of Use

When it comes to user experience, both Blofin and Bitget have distinct design philosophies.

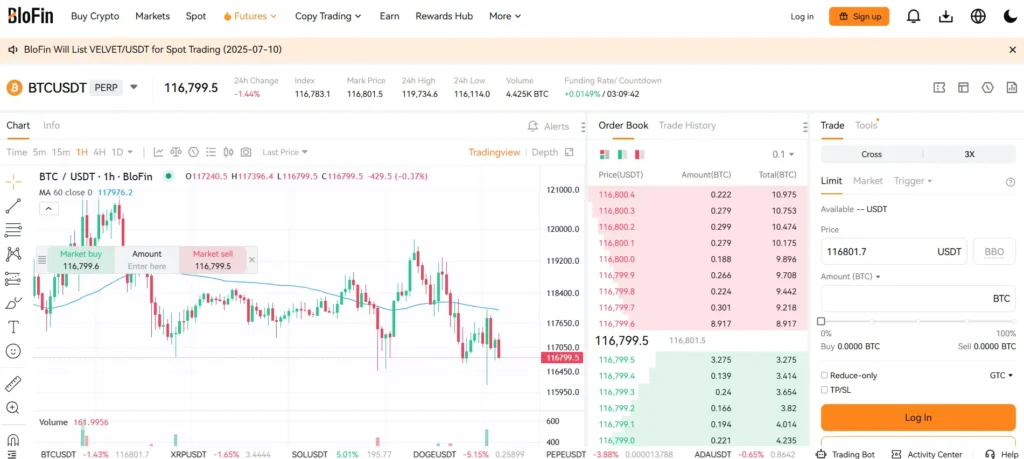

Blofin features a sleek, minimalist interface that emphasizes performance and speed. It’s clearly built with professional traders in mind—offering quick access to charts, order books, and trading panels without clutter. Its trading view is highly responsive, with a dark theme and modular layout. However, it lacks educational pop-ups or beginner guidance, which may pose a learning curve for new users.

Bitget, on the other hand, caters to a wider range of traders. Its interface supports both basic and advanced modes, allowing users to toggle between simplified spot trading or a full-featured futures dashboard. Bitget also provides copy trading interfaces, tutorials, and tooltips, making it much more accessible for beginners. The mobile app is intuitive, regularly updated, and integrates all major platform features—spot, futures, copy trading, and staking—in a single place.

Blofin vs Bitget: Order Types Supported

Order types are essential tools for risk management and trading flexibility, and the two platforms differ significantly in this area.

Blofin supports the fundamental order types needed for derivatives trading:

-

Market orders (instant execution at best price)

-

Limit orders (set a desired entry/exit price)

-

Stop-loss and take-profit orders

However, it does not currently offer more advanced order strategies like Trailing Stop or One Cancels the Other (OCO). This limits complex trade automation, which may be a downside for experienced traders who use layered or conditional setups.

Bitget, in contrast, provides a full suite of order types, including:

-

OCO (One Cancels the Other) – useful for setting a stop-loss and take-profit simultaneously.

-

Trailing Stop – automatically adjusts the stop price as the market moves in your favor.

-

Post-only, Fill-or-Kill, and Immediate-or-Cancel – giving fine control over how orders are placed and filled.

For users who rely heavily on order precision and risk automation, Bitget offers more depth and flexibility.

Blofin vs Bitget: Security Features and Practices

Security is non-negotiable in crypto trading, and both platforms employ strong foundational safeguards.

Blofin utilizes standard institutional-grade protections such as:

-

Cold wallet storage: The majority of funds are held offline to prevent external breaches.

-

Two-Factor Authentication (2FA): Required for logins and withdrawals.

-

Multi-signature authorization: Reduces internal fraud risk.

However, Blofin is a relatively new platform and does not yet publish a security transparency report or have a track record of handling major incidents. That said, it has shown no known breaches or downtime since launch, which is a promising sign.

Bitget has a more mature security infrastructure, including:

-

Cold wallet storage with real-time risk monitoring

-

$300 million Protection Fund to cover losses from unexpected security failures or black swan events

-

Bug bounty programs and regular security audits

-

Mandatory KYC for higher access levels, reducing fraud

With a proven history of no major security breaches and proactive communication around user protection, Bitget earns a higher level of trust—especially for large-volume traders.

Blofin vs Bitget: Insurance Funds

Insurance funds are a key risk management tool for derivatives platforms. Blofin currently does not publicly advertise a dedicated insurance fund, though it employs protective measures like auto-deleveraging to limit systemic risk.

Bitget, however, has a well-established $300 million Protection Fund. This fund is designed to cover unexpected losses from extreme market volatility, exchange errors, or hacks—ensuring user positions are protected even in worst-case scenarios. The transparency and size of Bitget’s fund offer added confidence for high-leverage traders.

Blofin vs Bitget: Customer Support

Customer service plays a crucial role, especially when managing funds or resolving trade issues. Blofin provides support through email, live chat, and ticketing, though response times may vary depending on the issue and time zone. The support is functional but relatively basic.

Bitget offers 24/7 live chat support, a structured help center, and even community-based support via Telegram and social platforms. Its ticketing system is responsive, and high-tier users often receive faster, more personalized help. Bitget’s broader infrastructure ensures quicker resolutions for urgent issues.

Blofin vs Bitget: Regulatory Compliance

Blofin is a newer exchange and currently operates with limited regulatory disclosures. It focuses on offshore jurisdictions with flexible frameworks for derivatives trading, which is common for newer platforms in early growth phases.

Bitget has made visible efforts in strengthening compliance, including obtaining licenses in regions like Lithuania and Canada and adhering to international KYC/AML standards. Its growing compliance profile and transparency align with its global expansion goals and help build trust with institutional and retail traders alike.

Conclusion

Both Blofin and Bitget are strong contenders in the crypto derivatives space, but they serve different trader profiles.

If you’re a professional or high-frequency trader who values speed, simplicity, and ultra-low fees, Blofin is a solid choice. Its clean interface, up to 150x leverage, and tight spreads make it ideal for focused futures trading with minimal distractions.

On the other hand, Bitget is better suited for a broader audience, including beginners and intermediate traders. With a diverse range of coins, advanced order types, robust copy trading features, and strong customer support, Bitget offers a complete trading ecosystem. Its $300M Protection Fund and regulatory progress add extra layers of trust.

Final recommendation:

Choose Blofin if you’re a pro trader looking for speed and precision in a lightweight environment.

Choose Bitget if you want a feature-rich platform with better support, asset variety, and long-term user protections.

Ultimately, the best platform depends on your trading goals, risk appetite, and experience level.