Choosing the right cryptocurrency trading platform is critical for anyone seeking security, convenience, and a robust trading experience. BloFin and Binance are both prominent names in the digital asset space, each offering distinctive advantages to users worldwide. BloFin has earned attention for its institutional-grade security, seamless trading speed, and privacy-oriented features, making it ideal for those who value efficiency and straightforward access. Binance, as the world’s largest crypto exchange by volume, is renowned for its expansive range of coins, comprehensive suite of products, and deep global liquidity.

In this comparison, we will explore the fundamental differences between BloFin and Binance—including their asset selection, trading tools, user experience, KYC policies, and support services—to help you determine which platform best matches your priorities, whether you’re a newcomer or a seasoned cryptocurrency trader.

BloFin vs Binance: Quick Feature Comparison

| Feature | BloFin | Binance |

|---|---|---|

| Founded | 2019 | 2017 |

| Supported Coins | 500+ | 350+ |

| Main Offerings | Spot, Futures, Copy Trading, Earn | Spot, Futures, Options, Staking |

| Maximum Leverage | Up to 150x | Up to 100x |

| Copy Trading | Yes | Yes |

| Trading Fees | From 0.10% | From 0.10% (lower with BNB) |

| Fiat Support | 85+ currencies | 80+ currencies |

| Demo Trading | Yes | No |

| KYC Required? | Not always (limits apply) | Usually required |

| NFT Marketplace | No | Yes |

| Availability | 150+ countries (excl. US) | 180+ countries |

BloFin vs Binance: Key Differences at a Glance

Binance, as the world’s largest crypto exchange, offers a broader product range and is available in more countries compared to BloFin. While BloFin supports a wider selection of cryptocurrencies (over 500), Binance still maintains greater global reach and liquidity.

For traders interested in leverage and practice, BloFin offers higher futures leverage (up to 150x) and even includes a demo trading feature, which Binance does not provide. Both platforms offer copy trading, but it’s a more highlighted feature on BloFin.

KYC requirements also differ: BloFin lets users trade with limited identity checks up to a certain withdrawal limit, whereas Binance typically requires KYC for full access. Lastly, only Binance has its own NFT marketplace, while BloFin is focused strictly on trading and does not support NFTs.

BloFin vs Binance: Platform Products and Services Overview

BloFin is a streamlined crypto trading platform focusing on spot and futures markets, supporting over 500 cryptocurrencies. It highlights copy trading—users can mirror the strategies of experienced traders—and offers demo trading so newcomers can practice without risk. BloFin also makes it easy to purchase cryptocurrencies using more than 85 fiat currencies, and provides API support for advanced traders. The platform emphasizes digital asset security and supports user education with dedicated resources and real-time support.

Binance offers a broad range of products, positioning itself as the world’s largest crypto exchange. Users have access to spot trading, futures, options, and margin trading with leverage. Binance stands out with its passive income features like staking and flexible savings, as well as its Launchpad for early project investments. The platform also supports NFT trading in a dedicated marketplace and operates its own blockchain for DeFi and dApp development. Binance puts a strong focus on security and ease of use, with a comprehensive interface, feature-rich apps, and a wealth of educational materials for users at all levels.

BloFin vs Binance: Range of Tradable Contracts

BloFin offers a wide selection of tradable contracts, primarily focusing on spot and futures trading. The platform supports over 530 futures pairs, letting users access a broad spectrum of cryptocurrencies in both linear (USDT-margined) and inverse contracts. Traders on BloFin can find perpetual contracts for major cryptocurrencies like Bitcoin, Ethereum, and a large number of altcoins, catering to both mainstream and niche trading interests. The extensive futures offerings allow for flexible trading strategies with varying leverage options, making BloFin a strong choice for active derivatives traders.

Binance provides one of the most comprehensive ranges of tradable contracts in the industry. Users can access spot trading, perpetual and delivery futures, options contracts, and leveraged tokens. Binance features hundreds of futures pairs, covering all leading cryptocurrencies and many emerging tokens. The platform also offers various contract types, including both USDT-margined and coin-margined options, as well as unique instruments such as leveraged tokens and options for advanced strategies. This robust selection helps accommodate everyone from beginners to experienced traders seeking diverse derivatives and hedging products.

BloFin vs Binance: Supported Cryptocurrencies and Trading Pairs

BloFin gives traders access to a broad range of digital assets, supporting over 500 cryptocurrencies for spot trading and more than 530 futures pairs. This ensures coverage of all major coins like BTC, ETH, and SOL, along with a diverse array of trending altcoins and stablecoins. Most trading pairs on BloFin are USDT-margined, especially in the futures market, which simplifies portfolio management for active traders.

Binance also offers one of the industry’s most extensive selections, with over 350 cryptocurrencies available for spot trading. Its platform goes further in the variety of trading pairs, providing thousands of combinations for spot, margin, and derivatives markets. Binance’s broad pair selection includes both crypto-to-crypto and fiat-to-crypto options, supporting robust trading strategies and high market accessibility for users globally.

BloFin vs Binance: Leverage and Margin Trading

BloFin is recognized for its high-leverage offerings, providing up to 150x leverage on major futures contracts like BTC/USDT and ETH/USDT. The platform supports both isolated and cross margin modes, giving traders flexibility and control over their risk exposure. Margin features are centered on derivatives trading, as BloFin does not currently offer margin or lending services in the spot market.

On Binance, leverage options are comprehensive and cover both futures and margin trading. Traders can access up to 125x leverage on top futures pairs and up to 20x leverage for cross margin trading in the spot market. Binance’s margin and leverage settings can be adjusted per trading pair and user profile, allowing for tailored risk management across its diverse selection of contracts.

BloFin vs Binance: Trading Volume and Liquidity

BloFin has quickly established itself as a major global player in trading volume and liquidity, consistently ranking among the top exchanges for futures market depth. Its daily trading volume frequently surpasses $200 million, with especially strong liquidity on leading cryptocurrencies such as BTC and ETH. Several recent industry benchmarks have placed BloFin in the top tier for low slippage and deep order books, making it attractive for high-frequency and institutional trading.

Binance remains the clear leader in global trading volume and liquidity, regularly posting daily volumes in the tens of billions of dollars. Its deep liquidity is unmatched across most supported pairs and contract types, ensuring that even large orders are executed quickly and with minimal price impact. For traders who prioritize liquidity, Binance is widely considered the market standard.

BloFin vs Binance: Fee Structure Comparison

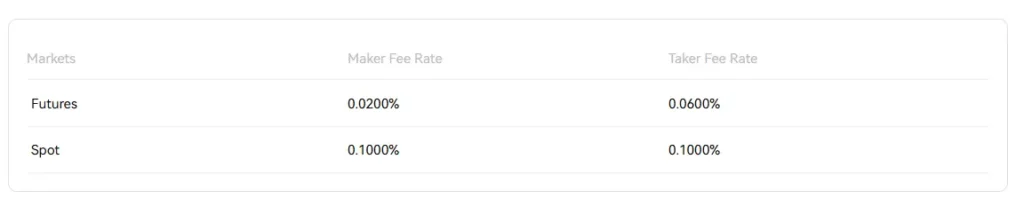

Both BloFin and Binance operate on a transparent, tiered fee system, but there are subtle differences in their approach and discounts. For spot trading, BloFin charges a standard fee of 0.10% for both makers and takers, and its futures fees are competitively set at 0.02% for maker trades and 0.06% for taker trades. Binance matches the 0.10% maker/taker fee for spot trades, but distinguishes itself by offering a 25% discount if users pay their trading fees with BNB, its native token.

On Binance, futures fees generally start at 0.02% for makers and 0.04% for takers. Both platforms reduce trading fees further for high-volume or VIP users. It’s important to note that, in addition to trading fees, users on both exchanges may encounter deposit and withdrawal charges depending on payment method and cryptocurrency network used. Overall, both BloFin and Binance offer competitive fee structures, but Binance’s native token discounts and broader volume-based incentives provide potential for greater savings, especially for active traders.

BloFin vs Binance: Deposits, Withdrawals, and Payment Methods

BloFin supports only crypto deposits and withdrawals, offering fast processing with no platform fees—only blockchain network fees apply. Fiat-to-crypto conversion is handled via third-party processors (e.g., cards, digital wallets), which may include additional service charges. BloFin doesn’t support fiat withdrawals; users must transfer crypto to another platform to cash out.

Binance provides far more flexibility, supporting both crypto and fiat deposits via bank transfers, cards, P2P, and more. It also enables fiat withdrawals in many regions, with fees depending on method and currency. Crypto withdrawals incur standard network fees. Overall, Binance offers greater global payment versatility.

BloFin vs Binance: Native Exchange Tokens

BloFin lacks a dedicated native token tied to its fee or rewards system. While it may support third-party tokens, there’s no proprietary asset offering trading discounts or exclusive benefits.

Binance, by contrast, integrates its BNB token deeply into the platform. BNB holders enjoy trading fee discounts, access to token launches, and special staking products. Regular token burns and ecosystem growth further enhance BNB’s value, giving Binance a clear edge in native token utility.

BloFin vs Binance: KYC Requirements and Account Limits

BloFin allows users to trade and withdraw up to a specific daily limit without completing full KYC (Know Your Customer) verification, providing quick account setup for those who prefer more anonymity or want to get started right away. However, daily withdrawal caps apply to non-verified users, and larger transactions or enhanced features require formal identity verification.

In contrast, Binance typically requires KYC for most users to unlock full platform features, including higher withdrawal ceilings, fiat deposits, and advanced trading products. Non-verified Binance accounts are subject to significant trading and withdrawal restrictions, making full verification necessary for regular or advanced usage.

BloFin vs Binance: User Interface and Ease of Use

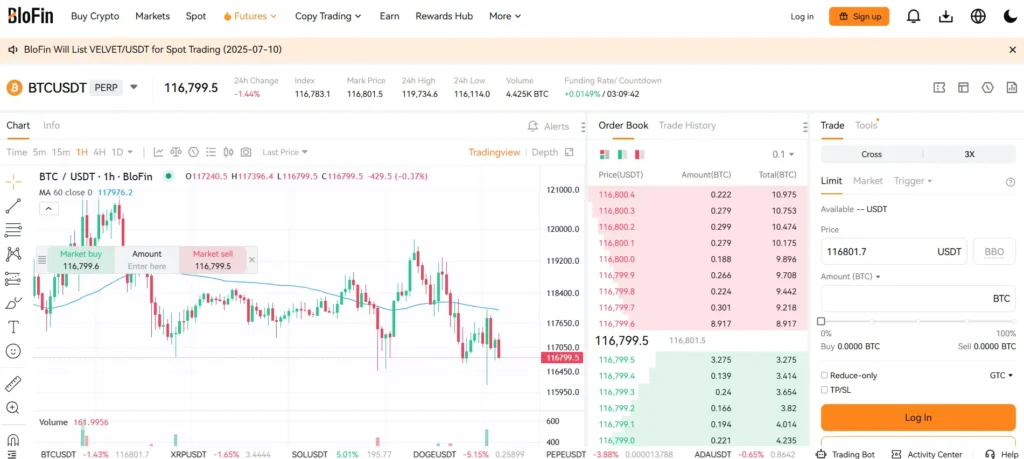

BloFin offers a clean, user-friendly interface that appeals to both beginners and experienced traders. Its platform is streamlined to reduce complexity, with intuitive navigation, straightforward order screens, and clear portfolio management tools. The presence of a dedicated demo trading section is particularly helpful for those new to crypto trading. Both web and mobile interfaces are designed for simplicity and quick access to major features.

Binance provides a more comprehensive and feature-rich interface, which may feel complex to absolute beginners but offers enormous flexibility and customization for advanced users. Its dashboard allows for easy switching between standard and advanced trading views, featuring real-time charts, analytics tools, and detailed order management. Despite the breadth of functions, Binance maintains a logical layout and provides educational guides and tooltips to help users get comfortable with the platform.

BloFin vs Binance: Order Types Supported

BloFin supports essential order types—market, limit, and stop orders—across its spot and futures markets, offering sufficient functionality for most retail and professional trading strategies. The platform’s focus remains on reliability and speed for its core order types, contributing to a straightforward trading experience.

Binance, with its emphasis on versatility, goes further by offering a variety of advanced order types. Besides market, limit, and stop-limit orders, Binance supports stop-market, OCO (One Cancels the Other), trailing stop, and post-only orders, among others. This wide range of order types enables users to execute complex strategies and manage risk more precisely, appealing to day traders, professionals, and algorithmic traders alike.

BloFin vs Binance: Security Features and Practices

BloFin places a strong emphasis on asset security by using advanced technologies such as multi-signature wallets, cold storage, and real-time monitoring tools. The platform partners with institutional custodians to reduce the risk of hacks or unauthorized access. Two-factor authentication (2FA) is available for user accounts, and regular security audits are conducted to identify and address vulnerabilities.

Binance is widely regarded for its robust security infrastructure, which includes multi-layered cold and hot wallet storage, SAFU (Secure Asset Fund for Users) as an emergency reserve, and continuous real-time risk monitoring. Binance enforces rigorous account protection through 2FA, withdrawal whitelists, anti-phishing code options, and proactive platform-wide security assessments. Regular penetration tests and industry collaborations further enhance its defense mechanisms.

BloFin vs Binance: Insurance Funds

BloFin safeguards user interests through dedicated insurance funds that help cover losses in case of platform breaches or major system failures affecting user balances. These reserves are designed to protect futures traders from unexpected systemic events, ensuring users are compensated in extraordinary circumstances.

Binance offers its well-known SAFU fund, which allocates a portion of trading fees to an emergency insurance reserve. This fund is used to compensate users in the rare event of a security breach or loss. The SAFU mechanism is considered a major contributor to Binance’s reputation for user protection in the crypto sector.

BloFin vs Binance: Customer Support

BloFin provides multi-channel customer support, including 24/7 live chat, email assistance, and a detailed FAQ section. New users can benefit from a friendly demo environment and educational resources, while experienced traders have access to support teams for account or technical inquiries.

Binance also delivers comprehensive customer support, with 24/7 multilingual live chat, ticket-based help, and an extensive knowledge base and help center. Binance invests in customer education through tutorials, regular updates, and community channels, ensuring traders at all levels receive timely assistance and clear communication.

BloFin vs Binance: Regulatory Compliance

BloFin enforces basic AML and KYC procedures, offering limited access without full verification but restricting trading volumes and withdrawals. This balances accessibility with compliance, though it may not suit users in tightly regulated regions.

Binance follows stricter global standards, requiring KYC for most users and adapting to regional laws. It restricts access in heavily regulated markets and works closely with financial authorities, making it a more robust option for compliant, cross-border trading.

Conclusion

Both BloFin and Binance deliver reputable platforms with unique strengths: BloFin stands out for its user-friendly experience, high leverage for futures, and quick onboarding with flexible KYC requirements. It suits traders seeking simplicity, advanced copy trading, and the ability to trade without initial full verification.

Binance, however, remains the benchmark for versatility, liquidity, and regulatory coverage. Its deep product suite, strong security, and robust compliance make it the ideal choice for serious traders, institutions, and those who need reliable fiat gateways and regional support.

For new users or those wanting straightforward trading with minimal barriers, BloFin is a solid pick. For most active, volume, or globally minded traders seeking the widest array of products and regulatory assurance, Binance is the recommended platform.